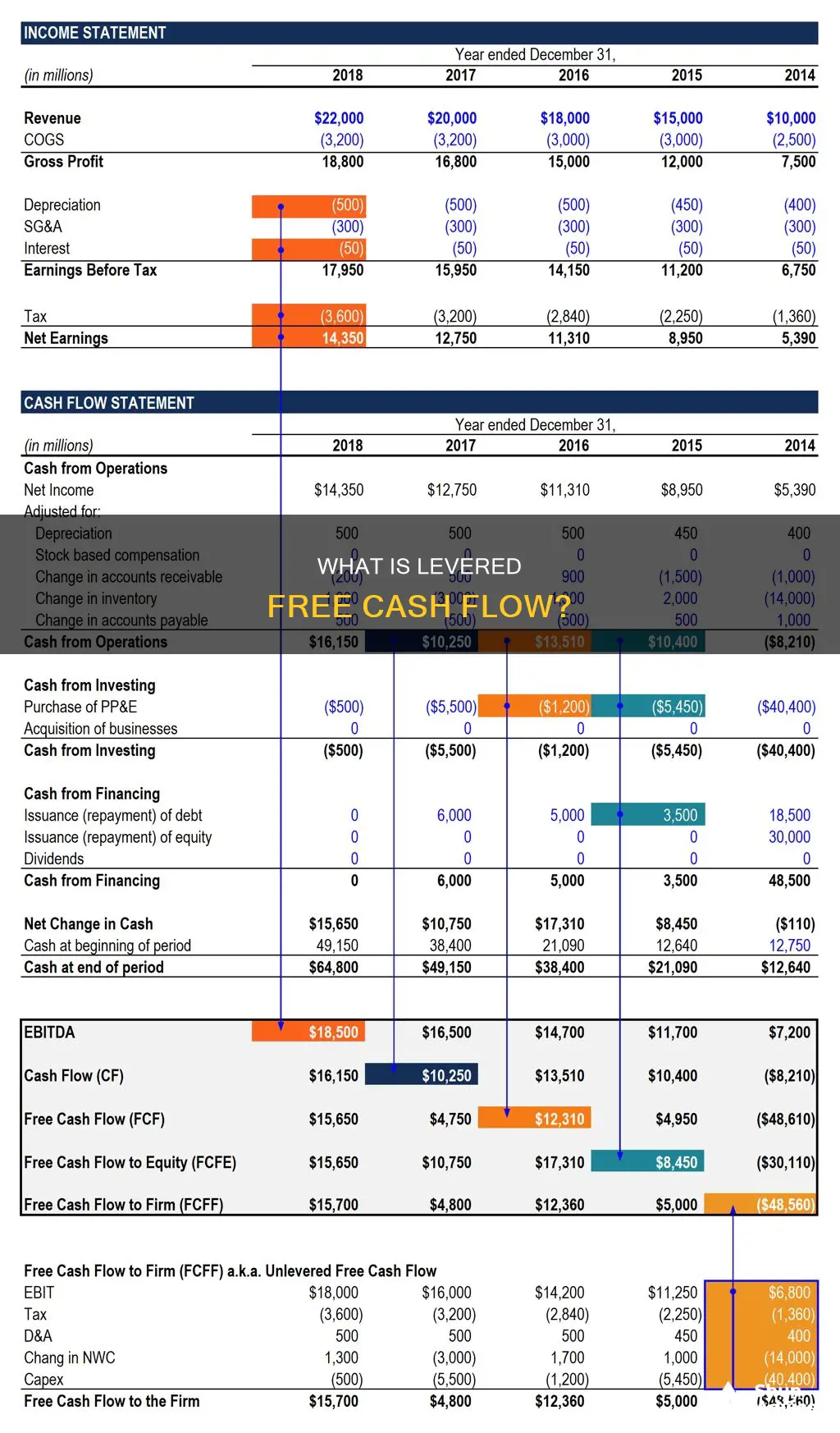

Levered free cash flow (LFCF) is the amount of money a company has left after paying all its financial obligations, including interest and debt payments. It is the cash available to equity shareholders after all expenses and commitments have been met. LFCF is calculated as Operating Cash Flow minus Capital Expenditures and Debt Repayments. This metric is critical for investors as it provides a clearer picture of a company's financial health and its ability to pay dividends, reinvest in the business, or pay down debt. A high LFCF indicates more discretionary cash and greater capacity to take on debt, while a low LFCF suggests reduced debt capacity and higher credit risk.

| Characteristics | Values |

|---|---|

| Definition | Levered Free Cash Flow (LFCF) is the residual cash belonging to only equity holders after deducting operating costs, reinvestments, and financial obligations. |

| Calculation | LFCF = Operating Cash Flow − Capital Expenditures − Debt Repayments |

| Importance | LFCF is important because it provides a clearer picture of a company's financial health and its ability to generate cash to pay dividends, reinvest in the business, or pay down debt. |

| Interpretation | A high LFCF indicates more discretionary cash, a greater capacity to take on debt, and lower credit risk. A low LFCF suggests the opposite. A negative LFCF does not automatically signal a company's failure and may be strategic if it is temporary. |

What You'll Learn

- Levered free cash flow (LFCF) is the money left over after a company has paid all its financial obligations

- LFCF is the amount of cash a company has after paying debts, while unlevered free cash flow (UFCF) is the money before debt payments

- LFCF is critical for investors and analysts as it provides a clearer picture of a company's financial health

- LFCF can be used in various ways by a company, including paying dividends, repurchasing shares, or reinvesting in business operations

- LFCF is calculated as: LFCF = Operating Cash Flow − Capital Expenditures − Debt Repayments

Levered free cash flow (LFCF) is the money left over after a company has paid all its financial obligations

Levered Free Cash Flow (LFCF) is a financial metric that indicates the money remaining or available to a company after it has fulfilled its financial obligations, such as interest and debt payments. LFCF is calculated as the company's operating cash flow minus capital expenditures and debt repayments.

LFCF is crucial because it reflects a company's ability to meet its financial commitments and its capacity to generate cash for shareholder returns and future growth initiatives. A positive LFCF indicates that a company has cash available after paying its debts, which can be utilised for dividend payments, share buybacks, or business reinvestments.

LFCF is a critical indicator for investors as it provides insights into a company's profitability and financial health. A high LFCF suggests a company has more discretionary cash, a greater capacity to take on debt, and a lower credit risk. Conversely, a low LFCF implies reduced cash availability, decreased ability to take on debt, and higher credit risk.

It is important to note that a negative LFCF does not necessarily imply a company's failure. It may indicate substantial capital investments with returns expected in the future. As long as the company can secure the necessary funding to sustain operations until these investments become profitable, a temporary period of negative LFCF can be manageable.

LFCF is often compared to Unlevered Free Cash Flow (UFCF), which is the cash available to a company before making debt payments. LFCF is generally considered more important for investors as it reflects the cash available for business expansion and shareholder returns.

Investing Without Cash: Strategies for Success

You may want to see also

LFCF is the amount of cash a company has after paying debts, while unlevered free cash flow (UFCF) is the money before debt payments

Levered Free Cash Flow (LFCF) is a financial metric that measures the amount of cash a company has available after it has met its financial obligations, such as interest and debt payments. LFCF is the amount of cash that a company has after paying its debts. It is the money left over after all of a company's bills are paid.

LFCF is calculated as:

> LFCF = Operating Cash Flow − Capital Expenditures − Debt Repayments

Operating Cash Flow (OCF) is the cash generated from the company’s core business operations. Capital Expenditures (CapEx) are the funds used by a company to acquire or upgrade physical assets such as property, industrial buildings, or equipment. Debt Repayments include both the interest and the principal payments made on the company’s debt.

LFCF is important because it is the amount of cash that a company can use to pay dividends and make investments in the business. It is also a vital financial metric that provides valuable insights into a company’s cash flow after accounting for debt payments. LFCF can be used in various strategic ways by a company, such as paying dividends to shareholders, repurchasing shares, or reinvesting in business operations to drive future growth.

Unlevered Free Cash Flow (UFCF), on the other hand, is the cash available to a company before making any debt payments. UFCF is the money a company has before accounting for its financial obligations. It is calculated as:

> UFCF = EBITDA − CapEx − Working Capital − Taxes

UFCF is of interest to investors because it indicates how much cash a business has to expand. However, it does not provide the whole picture of a company's financial health because it does not take into consideration debt and other obligations.

Recording Cash Investments: A Quickbooks Guide

You may want to see also

LFCF is critical for investors and analysts as it provides a clearer picture of a company's financial health

Levered Free Cash Flow (LFCF) is a financial metric that measures the amount of cash a company has available after it has met its financial obligations, such as interest and debt payments.

LFCF is essential because it accounts for a company's debt obligations, unlike unlevered free cash flow, which does not consider debt. By including interest payments and principal repayments, LFCF gives a more accurate representation of the cash available to equity shareholders. This metric helps investors understand whether a company can meet its financial commitments and still have cash left over for future growth and shareholder returns.

The level of LFCF has significant implications for a company's financial health. A high LFCF indicates more discretionary cash, a greater capacity to take on debt, and lower credit risk. Companies with high LFCF are better positioned to invest in growth opportunities and weather economic downturns. Conversely, a low LFCF suggests less discretionary cash, reduced debt capacity, and higher credit risk. These companies may face challenges in meeting financial obligations and funding new investments.

LFCF can be used in various strategic ways by a company. It can be directed towards paying dividends to shareholders, repurchasing shares, or reinvesting in business operations to drive future growth. These decisions reflect the company's priorities and financial strategy.

E*Trade Cash Balance Program: Investing Strategies for Beginners

You may want to see also

LFCF can be used in various ways by a company, including paying dividends, repurchasing shares, or reinvesting in business operations

Levered Free Cash Flow (LFCF) is a financial metric that measures the amount of cash a company has available after it has met its financial obligations, such as interest and debt payments. This figure is crucial for investors and analysts as it provides insights into a company's financial health and its ability to generate cash for various purposes.

LFCF can be used in several ways by a company:

Paying Dividends

LFCF can be used to pay dividends to shareholders. This is a common way to return cash to shareholders and is often a priority for investors. Dividends are usually paid out of the company's profits and can be distributed in the form of cash or stock.

Repurchasing Shares

Companies may also use LFCF to repurchase their own shares from the market. This can be done to return cash to shareholders, as well as to increase the value of the remaining shares by reducing the supply in the market. Share repurchases can also be used to improve financial ratios and increase earnings per share.

Reinvesting in Business Operations

LFCF can be directed towards reinvesting in the business to drive future growth. This may include investing in new projects, research and development, or upgrading equipment and technology. Reinvesting in the business can help the company expand its operations, improve efficiency, and stay competitive in the market.

Reducing Existing Debt

Companies may also use LFCF to reduce their existing debt. By making additional debt repayments, companies can improve their financial stability, reduce interest expenses, and lower their credit risk. Lower debt levels can also improve a company's credit rating and make it easier to obtain financing in the future.

Investing in New Opportunities

LFCF can be used to invest in new opportunities, such as acquiring other businesses, expanding into new markets, or launching new products. These investments can help the company diversify its revenue streams, increase its market share, and drive long-term growth.

The use of LFCF reflects a company's financial strategy and priorities. A company with positive LFCF is generally seen as financially healthy and well-positioned to invest in growth opportunities or weather economic downturns.

Understanding Cash Flow from Sales of Investments

You may want to see also

LFCF is calculated as: LFCF = Operating Cash Flow − Capital Expenditures − Debt Repayments

Levered Free Cash Flow (LFCF) is a financial metric that measures the amount of cash a company has available after it has met its financial obligations, such as interest and debt payments. This metric is calculated using the following formula:

LFCF = Operating Cash Flow − Capital Expenditures − Debt Repayments

Here, Operating Cash Flow (OCF) refers to the cash generated from the company's core business operations. It is important to note that OCF is different from net income, as it includes non-cash expenses such as depreciation and amortization.

Capital Expenditures (CapEx) refer to the funds used by a company to acquire or upgrade physical assets like property, industrial buildings, or equipment. These expenditures are crucial for the company's growth and maintenance of its operations.

Debt Repayments include both the interest and principal payments made on the company's debt obligations. By considering these repayments, the LFCF metric provides a more accurate representation of the cash available to equity shareholders.

LFCF is a critical indicator for investors and analysts as it offers insights into a company's financial health, profitability, and ability to meet financial commitments. A positive LFCF indicates that a company is capable of paying its debts, expanding its business, and rewarding shareholders. On the other hand, a negative LFCF suggests that a company may need to raise additional funds or make strategic investments to improve its financial position.

Cashing Out MoneyLion Investments: A Step-by-Step Guide

You may want to see also

Frequently asked questions

Levered free cash flow (LFCF) is the amount of money a company has left after paying all its financial obligations, such as interest and debt payments.

Levered free cash flow is the amount of cash a company has after paying debts, while unlevered free cash flow (UFCF) is the cash before debt payments are made.

LFCF is important because it accounts for a company's debt obligations, unlike UFCF. By including interest payments and principal repayments, LFCF gives a more accurate representation of the cash available to equity shareholders.

The formula for calculating LFCF is: LFCF = Operating Cash Flow − Capital Expenditures − Debt Repayments.