Quicken is a powerful tool for managing your investments and growing your net worth. It offers a comprehensive view of your portfolio, allowing you to track and plan your investments, monitor accounts, and stay ahead with stock watch lists and real-time quotes. With Quicken, you can see all your accounts and investments across every financial institution in one place, making it easier to assess your true risk level, allocations, and performance. The software also provides valuable insights into your portfolio's performance, helping you make informed decisions with confidence. Quicken's tax-related features, such as tracking individual buy/sell transactions and cost basis, further simplify the process of investing and ensure you stay on top of your financial goals.

What You'll Learn

Tracking investments across multiple brokerages

Quicken allows you to monitor all your investment accounts, from all your brokerages and retirement plans, with the convenience of a single, combined view. This includes tracking both liquid and retirement holdings, such as brokerage, 401(k)s, IRAs, options, bonds, ETFs, mutual funds, and more.

To track investments across multiple brokerages, you will have a separate investing account in Quicken for each real-world brokerage account. In each account, you will have the securities you hold. The Investing Portfolio screen allows you to switch between viewing your investments broken down by account and security, and viewing by security only. You can also view the value of holdings, performance metrics, and realised gains, grouped in whichever way you want. You can look at each account individually, grouped by type (e.g. retirement and non-retirement accounts), or all together.

You can enter your dividend reinvestments and monthly purchases manually, or if the brokerages you use are supported in Quicken, you can set them up to download automatically. Even if you don't set up automatic downloads, Quicken will still pull in price updates for each security so you don't have to enter that information manually.

If you hold publicly traded securities in a brokerage account that doesn't permit automatic connections, you can manually enter your buy/sell transactions. Quicken will update your position and continue to download security prices each time you refresh the software or app, so you can see your portfolio's current value.

If you hold investments in partnerships and private equities that aren't publicly traded, you can add these too. You will have to keep track of them manually, but Quicken gives you a way to add them yourself so you can still see everything at once.

Direct Investing: Strategies for Personal Finance Success

You may want to see also

Monitoring all accounts at once

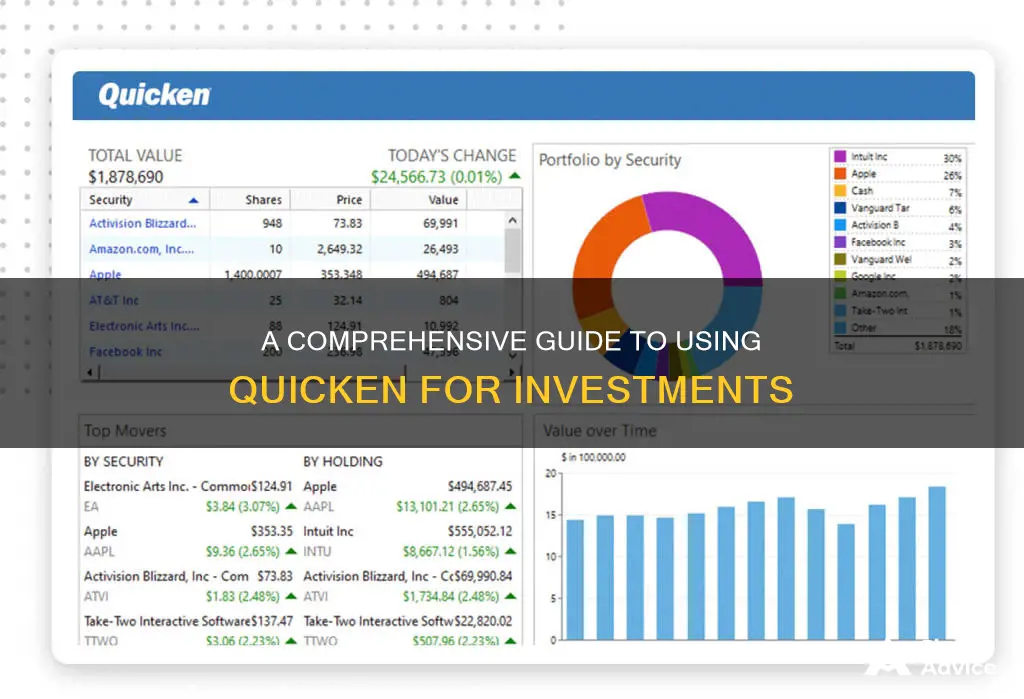

One of the most useful features of Quicken is the ability to monitor all of your investment accounts at once. This is done through the Portfolio View, which lists every security in your Quicken investment accounts. You can use the Portfolio toolbar to control your investment experiences. For example, you can use the "Date as of" function to see what your holdings looked like on a particular date, or the "group selector" to choose how you want to review your holdings.

The Quicken portfolio provides an overview of investing performance using various standard views such as portfolio value, performance, and realized gains. At the top of the portfolio view is a chart of the market value over time for the account or group of accounts. You can see the market value over different periods of time, including the value for the beginning of the year to the present, the value over the course of the previous year, and the value over 3, 5, and 10 years.

Quicken also allows you to see all your accounts across every financial institution in a single dashboard. This makes it easier to see your true risk level, allocations, and performance.

Investing Excess Cash in Shares: An Investment Activity?

You may want to see also

Customising your portfolio view

Quicken allows you to customise your portfolio view in a variety of ways. Firstly, you can group your portfolios by type, brokerage, or asset class (e.g. domestic bonds, large-cap stock). Alternatively, you can create new "buckets" to group your holdings in a way that is unique to you. For example, you could compare the performance of your blue-chip holdings with your tech stocks or cryptocurrencies. Or, you could separate the stocks you've set aside for your children from your own portfolio.

In the Investing Portfolio screen, you can switch between viewing your investments broken down by account and security, or just by security. You can also switch between viewing the value of holdings, performance metrics, and realised gains, grouped in whichever way you want. You can look at each account individually, grouped by type (e.g. retirement and non-retirement accounts), or all together. You can also drill down to see this information at the individual lot level. Quicken will pull in price updates for each security so you don't have to enter that information manually.

Quicken is fully customisable, so you can track your investments in a way that makes the most sense for your situation.

How Investments Can Drain Your Cash Reserves

You may want to see also

Understanding your true market returns

Quicken allows you to run IRR (Internal Rate of Return) and ROI (Return on Investment) performance reports to see how your investments have performed over time. These reports enable you to compare the performance of different funds or to run reports on all your investments together.

IRR calculates the annual profit an investment delivers as a percentage of the investment's value at the start of the year. For example, if you buy an investment for $100, the investment pays $10 in dividends at the end of the year, and then you sell the investment for $95, your IRR is 5%. There are two steps to making this calculation:

- Calculate the annual profit by combining the $10 of dividends with the $5 capital loss (calculated as $95 − $100) for a result of $5 of annual profit.

- Divide the $5 of annual profit by the $100 investment value at the start of the year. $5 ÷ $100 equals 5%, which is the IRR.

IRR can be a useful tool for quantifying the performance of a stock you've purchased and of your investment portfolio as a whole. This is particularly true for individual stocks and brokerage accounts because you often don't know how your stock picks, your broker's picks, and your portfolio have performed relative to the market as a whole and relative to other investments.

However, IRR is not without its flaws. Quicken calculates a daily IRR and then multiplies this percentage by the number of days in a year to get an equivalent annual IRR. This can present problems in the case of publicly-traded securities because a short-term percentage change in a security's market value—even if modest—can annualize to a very large positive or negative number. For example, if you buy a stock for $10 and ⅛ and the next day the stock drops to $10, the annual return using these two pieces of information is -98.9%.

To minimize the problems of annualizing short-term percentage changes, refrain from measuring IRRs for only short periods of time. An annualized daily return can be misleading.

Quicken also allows you to see the precise impact of fees, dividends, and cash infusions on your investments.

A Windfall's Wise Investment: Strategies for Sudden Cash

You may want to see also

Planning for tax implications

Quicken's advanced tax reporting features can help you understand how your income and expenses are affecting your taxes and ensure you're taking advantage of all the deductions and credits you qualify for.

Quicken's Tax Implications view in the Quicken Portfolio can help you decide whether to sell a short-term holding or wait until it becomes a long-term holding, which would be subject to a smaller tax liability. For example, if you sell a lot purchased less than a year ago, it would be taxed at the short-term capital gains tax rate. However, if you hold the stock until the end of the short-term holding period and then sell it, it would be taxed at the lower long-term capital gains tax rate.

The Capital Gains Estimator in Quicken Classic for Mac helps users assess the tax implications of selling investments, including capital gains taxes. This tool allows you to review your portfolio, estimate taxes owed, and make informed decisions on which shares to sell for optimal financial outcomes. It calculates three key figures: Gross Proceeds, Taxes Owed, and Net Proceeds. Gross Proceeds is the total amount you would receive from selling the selected number of shares. Taxes Owed are calculated based on your selected tax rates (federal, state, and any applicable net investment income tax). Net Proceeds is the final amount you will receive after taxes are deducted from your gross proceeds.

The estimator also provides a Summary View, which includes the total short-term and long-term gains/losses and an overall gain/loss figure, combining both short-term and long-term gains/losses. This allows you to quickly assess the tax impact of your sales and adjust your strategy as needed.

Additionally, you can use the Capital Gains Estimator to set up different scenarios to compare proposed sales. You can integrate the estimator with your tax data and tax rates from the Quicken Tax Planner to determine the overall tax impact before and after the sales. This will help you calculate your approximate gross and net proceeds from proposed sales and determine whether proposed sales would move you into a higher tax bracket.

Quicken also allows you to track your individual buy/sell transactions and specify lots for those transactions, so you can track the cost basis of your positions and see your realised and unrealised gains. This information can be easily exported to tax preparation software like TurboTax.

Cash Payments for Trading Securities: An Investment Activity?

You may want to see also

Frequently asked questions

Quicken allows you to set up your investment accounts and then automatically track your holdings, update prices, record transactions, and report on gains and losses. You can also use the Morningstar X-Ray tool to uncover concentrated positions and hit your diversification targets.

In Quicken, you'll have a separate investing account for each real-world brokerage account. In the Investing Portfolio screen, you can easily switch between viewing your investments broken down by account and security, or just by security. You can also view the value of holdings, performance metrics, and realized gains, grouped in whichever way you want.

Yes, Quicken lets you monitor all your investment accounts at once, from all your brokerages and retirement plans, with the convenience of a single, combined view.