Cash flow from investing activities is one of the three sections of a company's cash flow statement, alongside cash flow from operations and cash flow from financing activities. It tracks the cash inflow and outflow from investing activities, such as purchasing and selling investments, as well as earnings from investments. Investing activities include the purchase of physical assets, investments in securities, or the sale of securities or assets. Cash trading, which is the buying or selling of securities using cash funds held in a brokerage or clearing account, is considered an investing activity.

What You'll Learn

- Cash flow from investing activities is a section of a company's cash flow statement

- Investing activities include the purchase and sale of physical assets, securities, or other businesses

- Cash trading refers to the purchase and sale of securities using cash on hand

- Cash flow statements complement the balance sheet and income statement

- Cash flow statements are useful for creditors and investors

Cash flow from investing activities is a section of a company's cash flow statement

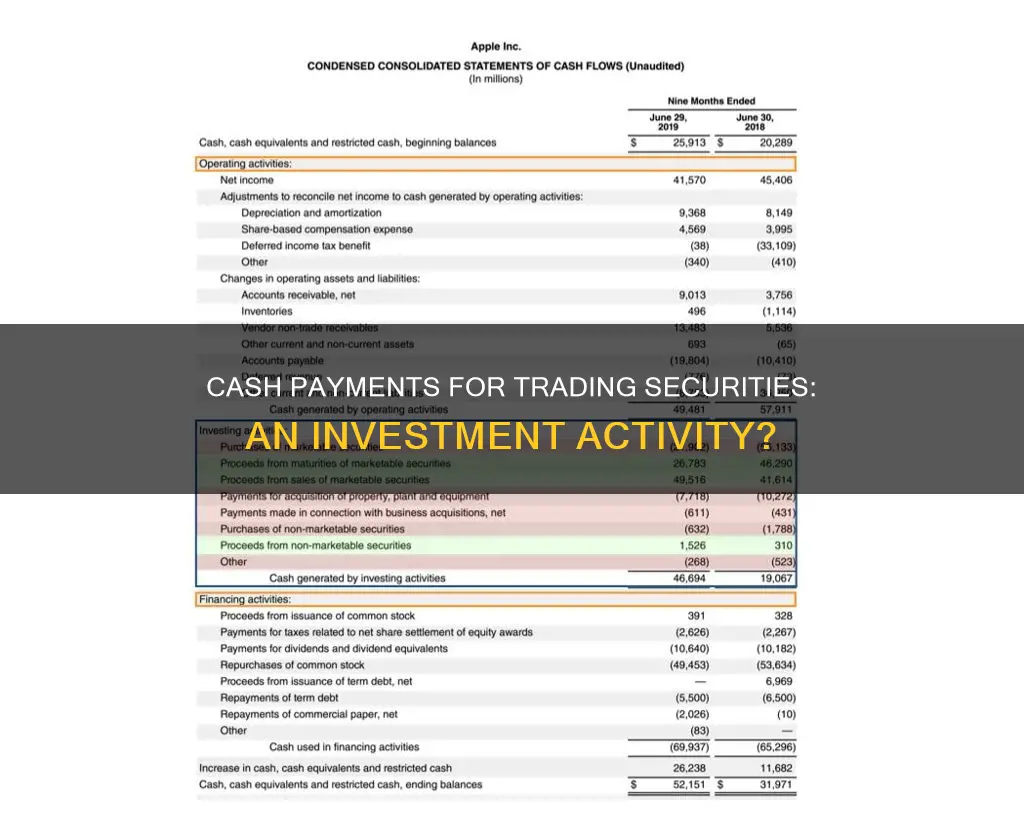

Cash flow from investing activities (CFI) is indeed a section of a company's cash flow statement. It details the cash generated by or spent on investment activities over a specific period.

The cash flow statement bridges the gap between the income statement and the balance sheet by showing how much cash is generated or spent on operating, investing, and financing activities. Investing activities include the purchase of physical assets, investments in securities, or the sale of securities or assets.

Some examples of investing activities are:

- Purchase of property, plant, and equipment (PP&E), also known as capital expenditures

- Proceeds from the sale of PP&E

- Acquisitions of other businesses or companies

- Proceeds from the sale of other businesses (divestitures)

- Purchases of marketable securities (i.e. stocks, bonds, etc.)

- Proceeds from the sale of marketable securities

Positive vs Negative Cash Flow

The cash flow from investing activities can be either positive or negative. Positive cash flow is generated by sales of investment securities or assets, while negative cash flow is the cash spent on long-term assets, lending, or marketable securities.

However, negative cash flow from investing activities is not always a bad sign. It could indicate that the company is investing in long-term growth and health, such as research and development. For example, a company with negative cash flow from investing activities may be investing heavily in plant and equipment to grow its business, which could lead to significant long-term gains if managed well.

Calculating Cash Flow from Investing Activities

To calculate the net cash flow from investing activities, one must consider the sum of all cash inflows and outflows. For example, a company spends $30 billion on capital expenditures and $5 billion on investments while also receiving $3 billion from the sale of investments. The net cash flow from investing activities would be -$33 billion.

Importance of Cash Flow from Investing Activities

Cash flow from investing activities is crucial as it shows how a company is allocating cash for the long term. It provides insight into whether the company is investing in fixed assets, short-term marketable securities, or other long-term development activities that are essential for the company's health and continued operations.

Unlocking Cash Flow: Investing Activities for Positive Change

You may want to see also

Investing activities include the purchase and sale of physical assets, securities, or other businesses

Investing activities are a crucial aspect of a company's financial strategy, encompassing a range of transactions that involve the purchase and sale of various assets and investments. These activities are typically reported in the investing activities section of a company's cash flow statement, providing valuable insights into its investment gains and losses over a specific period.

Types of Investing Activities

Investing activities can be broadly categorised into the following:

- Purchase of Physical Assets: This includes the acquisition of long-term physical assets such as property, plant, and equipment (PP&E). These assets are expected to be utilised for an extended period and are often referred to as capital expenditures.

- Investments in Securities: Investing activities also involve the purchase of marketable securities such as stocks, bonds, and other financial instruments. These investments can be made with the intention of generating income or improving the company's financial health.

- Sale of Securities or Assets: This includes the sale of previously acquired securities or physical assets. Such sales can result in positive cash flow, even if the sale price is lower than the initial purchase price, as they bring cash into the company.

- Acquisition of Other Businesses: Investing activities also encompass the acquisition of other companies or businesses. This can be a significant strategy for growth and expansion.

- Proceeds from the Sale of Businesses: When a company sells a portion or all of its business, it can result in a positive cash flow from the proceeds of the sale.

Understanding Cash Flow from Investing Activities

The cash flow statement is a critical financial report that outlines a company's sources and usage of cash during a specific period. It is one of the three main financial statements, alongside the balance sheet and income statement. The cash flow statement is particularly important for understanding a company's financial health and can indicate whether a company is investing in its long-term growth.

Negative cash flow from investing activities does not necessarily indicate poor performance. Instead, it may suggest that the company is investing in research, development, or other long-term initiatives that are crucial for its sustainability and future success. Therefore, it is essential to analyse the cash flow statement alongside the balance sheet and income statement to gain a comprehensive understanding of the company's financial position.

Cash Investment Strategies: Your Guide to Profitable Opportunities

You may want to see also

Cash trading refers to the purchase and sale of securities using cash on hand

Cash trading requires that all transactions are paid for by funds available in the account at the time of settlement. The settlement date is the day when the transaction is deemed to be completed, and the buyer must make full payment. Stock trades placed in cash accounts settle within one business day or T+1. The settlement process involves transferring the securities to the buyer's account and the cash into the seller's account.

Most brokers offer cash trading accounts as a default option. These accounts are much simpler to open and maintain than margin accounts because there is no margin provided. Cash trading is generally considered safer than margin trading because it does not involve the use of borrowed capital or leverage.

The downside of cash trading is that there is less upside potential due to the lack of leverage. Cash accounts also require funds to settle before they can be used again, which can take several days at some brokerages.

Cash Flow Notes: A Smart Investment Strategy

You may want to see also

Cash flow statements complement the balance sheet and income statement

A cash flow statement is one of the three main financial statements that a business uses, the other two being the balance sheet and the income statement. The cash flow statement complements the balance sheet and the income statement by showing how much cash is generated or spent on operating, investing, and financing activities for a specific period.

The income statement is not prepared on a cash basis. This means that accounting principles such as revenue recognition, matching, and accruals can make the income statement very different from the cash flow statement. It is the creation of the balance sheet through accounting principles that leads to the rise of the cash flow statement.

Net income from the bottom of the income statement links to the balance sheet and the cash flow statement. On the balance sheet, it feeds into retained earnings, and on the cash flow statement, it is the starting point for the cash from operations section.

The cash flow statement paints a picture of how a company's operations are running, where its money comes from, and how it is being spent. It helps creditors and investors determine the liquidity of a company and its ability to pay its debts and fund its expenses.

The main components of the cash flow statement are:

- Cash flow from operating activities

- Cash flow from investing activities

- Cash flow from financing activities

The cash flow statement is linked to the income statement by net profit or net loss, which is usually the first line item of a cash flow statement, used to calculate cash flow from operations.

Invest Hard Cash: Strategies for Smart Financial Growth

You may want to see also

Cash flow statements are useful for creditors and investors

A company's cash flow statement is a crucial financial document that provides insight into its financial health and operational efficiency. It is particularly useful for creditors and investors, helping them make informed decisions.

The cash flow statement summarises the inflow and outflow of cash, indicating how well a company manages its cash position and its ability to pay debts and fund expenses. It is one of the three main financial statements, alongside the balance sheet and income statement.

Understanding the Cash Flow Statement

The cash flow statement is divided into three main sections: operating activities, investing activities, and financing activities.

Operating Activities

This section reflects the cash flow generated from a company's core business operations, including receipts from sales of goods and services, payments to suppliers, salary and wage payments, and other operating expenses. It provides insight into how much cash is generated from the company's products or services.

Investing Activities

Investing activities include any sources and uses of cash from a company's investments. It covers purchases or sales of assets, loans, mergers and acquisitions (M&A), and changes in equipment, assets, or investments. This section is particularly important for creditors and investors as it indicates how the company allocates cash for the long term and its investment strategies.

Financing Activities

Financing activities encompass the sources and use of cash from investors, banks, and shareholders. It includes cash received from issuing stocks or debt, as well as cash paid to shareholders in the form of dividends or stock repurchases. This section is crucial for creditors as it reflects the company's ability to meet its debt obligations.

Benefits for Creditors and Investors

The cash flow statement is beneficial for creditors and investors in several ways:

- Liquidity Assessment: Creditors can assess a company's liquidity or the amount of cash available to fund operating expenses and pay down debts.

- Financial Health Evaluation: Investors can evaluate a company's financial health and stability, making better-informed investment decisions.

- Analysis of Investment Strategies: The statement provides insights into a company's investment strategies, including purchases of fixed assets, investments in securities, and acquisitions of other businesses.

- Understanding Cash Allocation: Creditors and investors can understand how a company allocates its cash across different activities, including long-term investments and debt repayment.

- Identifying Growth Opportunities: Positive cash flow from operating activities that exceed net income indicates a company's ability to reinvest in its operations and fund growth initiatives.

- Comparing with Other Financial Statements: By comparing the cash flow statement with the income statement and balance sheet, creditors and investors can gain a comprehensive understanding of the company's financial performance and health.

In summary, the cash flow statement is a powerful tool for creditors and investors to assess a company's financial health, liquidity, and investment strategies. It provides valuable insights that help make informed decisions about credit extensions and investments.

Transferring Cash to Fidelity Investments: A Step-by-Step Guide

You may want to see also

Frequently asked questions

Cash flow from investing activities (CFI) is a section of a company's cash flow statement that shows the cash generated by or spent on investment activities.

Investing activities include the purchase of physical assets, investments in securities, or the sale of securities or assets.

There is no singular formula for calculating CFI, but a generally accepted formula is: Cash flow from investing activities = CapEx/purchase of non-current assets + marketable securities + business acquisitions - divestitures.

Cash trading involves buying or selling securities using cash funds held in a brokerage or clearing account, whereas margin trading uses borrowed capital for the purchase and sale of securities.