The weighted average cost of capital (WACC) is a key financial metric used by both investors and companies to assess investment opportunities and the overall financial health of a business. WACC measures the average cost of raising funds from various sources, including equity and debt, and is calculated by multiplying the cost of each capital source by its relevant weight and then adding the results together. This results in a single figure that represents the average cost of raising capital.

WACC is an important tool for investors as it helps them evaluate whether a business is a good investment opportunity. It represents the minimum rate of return that a company must achieve to produce value for its investors. If a company's return is lower than its WACC, it indicates that the company is shedding value and may be an unfavourable investment.

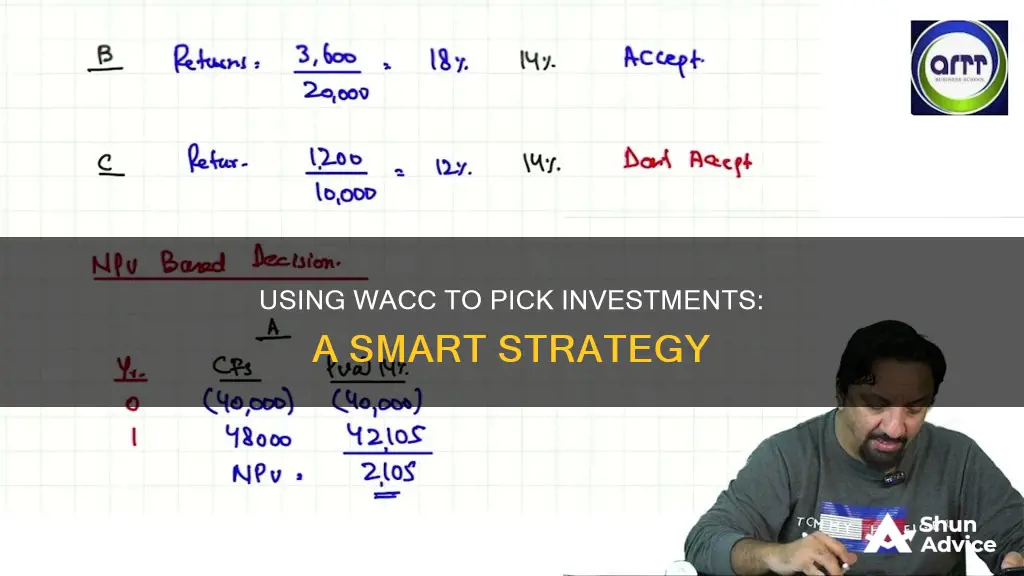

For businesses, WACC can be used to assess the benefits of different investment opportunities, such as business expansions or new projects. By comparing the expected return of a project with its WACC, businesses can determine whether an investment is worth pursuing. If the expected return is higher than the WACC, the investment is likely to increase the company's value.

While WACC is a valuable tool, it has some limitations. It assumes that the capital structure and the costs of equity and debt remain constant, which may not be realistic in a dynamic market. Additionally, WACC may not capture the specific risks and return characteristics of individual projects or acquisitions. Nevertheless, WACC remains a crucial metric for making informed investment decisions and evaluating the financial health of a company.

| Characteristics | Values |

|---|---|

| Purpose | To determine the cost of each part of a company's capital structure based on the proportion of equity, debt and preferred stock it has. |

| Formula | WACC = (E/V x Re) + (D/V x Rd x (1-Tc)) |

| Components | E = market value of the company's equity; D = market value of the company's debt; V = total value of capital (equity plus debt); Re = cost of equity; Rd = cost of debt; Tc = corporate tax rate |

| Use | To evaluate investment opportunities, as WACC is considered to represent the firm's opportunity cost of capital. |

| Interpretation | A higher WACC indicates a riskier investment, while a lower WACC tends to correlate with more stable investments. |

What You'll Learn

Calculating WACC

The Weighted Average Cost of Capital (WACC) is a key financial metric that helps investors and companies make informed decisions about investments, financing, and business opportunities. It represents the blended cost of capital across all sources, including common shares, preferred shares, and debt. The calculation of WACC involves determining the cost of each capital source and its relevant weight, then summing them up to find the total cost of capital. Here is a step-by-step guide to calculating WACC:

Step 1: Identify the Components of WACC

The WACC formula consists of several components, including:

- Market value of the company's equity (E)

- Market value of the company's debt (D)

- Total market value of the company's financing (V)

- Cost of equity (Re)

- Cost of debt (Rd)

- Corporate tax rate (T)

Step 2: Determine the Market Values of Equity and Debt

To calculate WACC, you need to find the market values of the company's equity and debt. These values can be obtained from the company's financial statements or by referring to the market capitalisation for publicly traded companies.

Step 3: Calculate the Proportions of Equity and Debt

The proportions of equity and debt in the company's capital structure are calculated by dividing the market value of each component by the total market value of the company's financing. These proportions are represented as E/V and D/V, respectively. Ensure that the sum of these proportions equals 1 to verify your calculations.

Step 4: Determine the Cost of Equity (Re)

Calculating the cost of equity can be challenging since share capital does not have an explicit cost. A commonly accepted method for determining Re is the Capital Asset Pricing Model (CAPM):

> Re = Rf + β(Rm - Rf)

Where:

- Rf is the risk-free rate (e.g., the interest rate on government bonds)

- Β is the equity beta, measuring the volatility of the company's share price relative to the market

- Rm is the market rate or the annual return of the stock market

Step 5: Determine the Cost of Debt (Rd)

The cost of debt is typically calculated as the yield to maturity on the company's existing debt. For publicly traded companies, this information is readily available. For private companies, you can estimate the cost of debt based on credit ratings from agencies like Moody's or S&P Global and add a relevant spread over risk-free assets.

Step 6: Adjust the Cost of Debt for Tax Effects

As interest payments on debt are tax-deductible, the net cost of debt is calculated as the interest paid minus the tax savings due to the tax-deductible interest payments. Therefore, the after-tax cost of debt is Rd x (1 - corporate tax rate).

Step 7: Calculate WACC

Finally, you can calculate the WACC by substituting the values obtained in the previous steps into the WACC formula:

> WACC = (E/V x Re) + (D/V x Rd x (1 - T))

This formula weighs the cost of equity and debt by their respective proportions in the company's capital structure and provides the average cost of capital for the company.

Example Calculation

Let's consider a company with $1 million in debt financing and $4 million in equity financing, with a total capital of $5 million. Assume a cost of equity of 10%, a cost of debt of 5%, and a corporate tax rate of 25%.

- E/V = $4,000,000 / $5,000,000 = 0.8

- D/V = $1,000,000 / $5,000,000 = 0.2

- Weighted cost of equity = 0.8 x 0.10 = 0.08

- Weighted cost of debt = (0.2 x 0.05) x (1 - 0.25) = 0.0075

- WACC = 0.08 + 0.0075 = 0.0875 = 8.75%

So, the WACC for this company is 8.75%, representing the average cost of attracting investors and the expected return given its financial strength and risk profile.

Cash App Investing: Dividends and Your Money

You may want to see also

Cost of equity

The cost of equity is the rate of return a company pays out to equity investors. Companies use it to assess the relative attractiveness of investments, including internal projects and external acquisition opportunities.

The cost of equity is calculated using the Capital Asset Pricing Model (CAPM), which equates rates of return to volatility (risk vs reward). The formula for the cost of equity is:

> Re = Rf + β × (Rm − Rf)

- Rf = risk-free rate (e.g. the yield of a government bond)

- Β = equity beta (a measure of a stock's volatility relative to the market)

- Rm = annual return of the stock market

The risk-free rate is the return expected from a risk-free investment, such as government bonds or U.S. Treasury bills. Beta measures how a company's stock price typically responds to market changes. A beta of 1 means the company moves in line with the market.

The cost of equity is an implied or opportunity cost of capital. It is the rate of return an investor requires to compensate for the risk of investing in a stock.

Compared to the cost of debt, the cost of equity is more challenging to estimate. Companies raise equity capital and pay a cost in the form of dilution. Equity investors expect a return but, unlike debt, there is no clearly defined cash flow pattern.

The cost of equity is often higher than the cost of debt. Equity investors are compensated more because equity is riskier than debt. Debtholders are paid before equity investors, guaranteed payments, and their debt is often secured by specific assets of the firm.

The cost of equity can be used to determine the relative cost of an investment if the firm doesn't possess debt. The weighted average cost of capital (WACC) is used instead for a firm with debt.

Big Data Strategies for Fundamental Investing Success

You may want to see also

Cost of debt

The cost of debt is a crucial component of the weighted average cost of capital (WACC) formula, which is used to evaluate investment opportunities and guide financing choices. It reflects the return that a company provides to its debtholders and creditors, compensating them for the risk of lending to the company.

Calculating the cost of debt is generally more straightforward than determining the cost of equity because observable interest rates play a significant role in quantifying it. The cost of debt reflects both the company's default risk and the prevailing market interest rates.

There are two common approaches to estimating the cost of debt:

- Yield to Maturity (YTM): This method involves examining the current YTM of a company's debt in the market. It is suitable for publicly traded companies with simple capital structures, such as those without multiple tranches of debt with varying interest rates.

- Credit Rating: This approach is useful for private companies without observable market data. It involves looking at the company's credit rating from agencies like S&P, Moody's, or Fitch. Based on this rating, a yield spread over US treasuries is determined and added to the risk-free rate to find the cost of debt.

When using the YTM or credit rating approach is not feasible, analysts can estimate a rating for the company by considering its leverage ratios, particularly its interest coverage ratio. A higher ratio indicates a safer borrower, which influences the yield spread.

It is important to note that the true cost of debt is represented by the formula: After-Tax Cost of Debt = Cost of Debt x (1 - Tax Rate). This takes into account the tax benefits associated with interest expense deductions.

By incorporating the cost of debt into the WACC calculation, companies can make informed decisions about their capital structure, investment opportunities, and overall financial strategy.

Cash Investments: Low Noise, High Returns

You may want to see also

WACC as a hurdle rate

The weighted average cost of capital (WACC) is a key financial metric used to assess the viability of investment projects and opportunities. It serves as a hurdle rate, representing the minimum return a company must achieve to satisfy its investors and creditors.

WACC is calculated by taking into account the relative weights of each component of a company's capital structure, including debt and various forms of equity. The formula for WACC is:

> WACC = (E/V x Re) + (D/V x Rd x (1-Tc))

Where:

- E = market value of the company's equity

- D = market value of the company's debt

- V = total value of capital (equity + debt)

- Re = cost of equity (required rate of return)

- Rd = cost of debt (yield to maturity on existing debt)

- Tc = corporate tax rate

By comparing the expected return of an investment project to the company's WACC, businesses can determine whether the project is worth pursuing. If the expected return is higher than the WACC, the investment is likely to create value for the company and its stakeholders.

For example, if a company has a WACC of 10% and is considering an investment project with an expected return of 15%, the project would be considered favourable as it exceeds the company's hurdle rate.

WACC is a valuable tool for financial analysts and investors when evaluating potential investments and acquisitions. It provides a single metric that captures the average cost of a company's capital sources, helping to inform investment decisions and assess the potential for profitability.

However, it is important to note that WACC has some limitations. It assumes a constant capital structure and costs of equity and debt, which may not hold true in dynamic market conditions. Additionally, WACC may not fully capture project-specific risks and uncertainties, and it relies heavily on historical data, assuming that past trends will continue in the future.

Investment Strategies: Cash Flow-Agnostic Criteria

You may want to see also

WACC as a discount rate

The weighted average cost of capital (WACC) is a key financial metric that measures a company's average after-tax cost of capital from various sources, including common stock, preferred stock, bonds, and other forms of debt. It is an important tool for both investors and companies in evaluating investment opportunities and assessing a company's financial health and potential for growth.

WACC serves as a discount rate for future cash flows in discounted cash flow (DCF) analysis. It is used to calculate the net present value (NPV) of future cash flows, which indicates whether a project or acquisition is profitable. A positive NPV means the project adds value, while a negative NPV means it destroys value. WACC is also used as a hurdle rate to assess the desirability of a project or acquisition. If an investment opportunity has an internal rate of return (IRR) lower than the WACC, it is generally not considered a good investment.

The WACC formula takes into account the relative weights of each component of the capital structure, including debt and equity. The formula is as follows:

WACC = (E/V x Re) + (D/V x Rd x (1-Tc))

Where:

- E = Market value of the company's equity

- D = Market value of the company's debt

- V = Total value of capital (equity + debt)

- Re = Cost of equity (required rate of return)

- Rd = Cost of debt (yield to maturity on existing debt)

- Tc = Corporate tax rate

By using WACC as a discount rate, investors and companies can make informed decisions about investment opportunities. It helps determine whether an investment will generate sufficient returns to compensate for the cost of capital and meet the expectations of lenders and shareholders.

It is important to note that WACC has some limitations. It assumes a constant capital structure and cost of capital, which may not hold true in dynamic market conditions. Additionally, WACC may not capture project-specific risks and returns, and it may overlook non-financial factors that influence investment decisions. Therefore, it should be used in conjunction with other financial metrics to make comprehensive investment decisions.

Cash and Sweep Investment: Maximizing Your Money

You may want to see also

Frequently asked questions

WACC stands for Weighted Average Cost of Capital. It is a key financial metric that companies and investors use to evaluate a company's finances and potential for profitability.

WACC is calculated by taking the weighted average of the costs of equity and debt, based on their proportion in a company's capital structure. The cost of equity reflects the return expected by shareholders, while the cost of debt reflects the interest rate charged by lenders.

WACC is used as a minimum hurdle rate of return that a company must achieve to satisfy its investors and creditors. If a company's return is higher than its WACC, it is creating value, and the investment is likely worthwhile. Conversely, if the return is lower than the WACC, the company is shedding value, and the investment may not be a good choice.