The UK's withdrawal from the European Union, or Brexit, has had a chilling effect on inward investment. The UK is the only sovereign country to have left the EU, and the process of leaving formally began on 29 March 2017, when then-Prime Minister Theresa May triggered Article 50 of the Lisbon Treaty. The UK had been a member state of the EU or its predecessor since 1 January 1973.

The majority of economists believe that Brexit has harmed the UK's economy and reduced its real per capita income in the long term. A 2022 study from research firm Resolution Foundation found that Brexit had reduced the openness and competitiveness of the British economy. The London Mayor's Office also released a report in January 2024, citing an independent report by Cambridge Econometrics that London has almost 300,000 fewer jobs, and nationwide, two million fewer jobs as a direct consequence of Brexit.

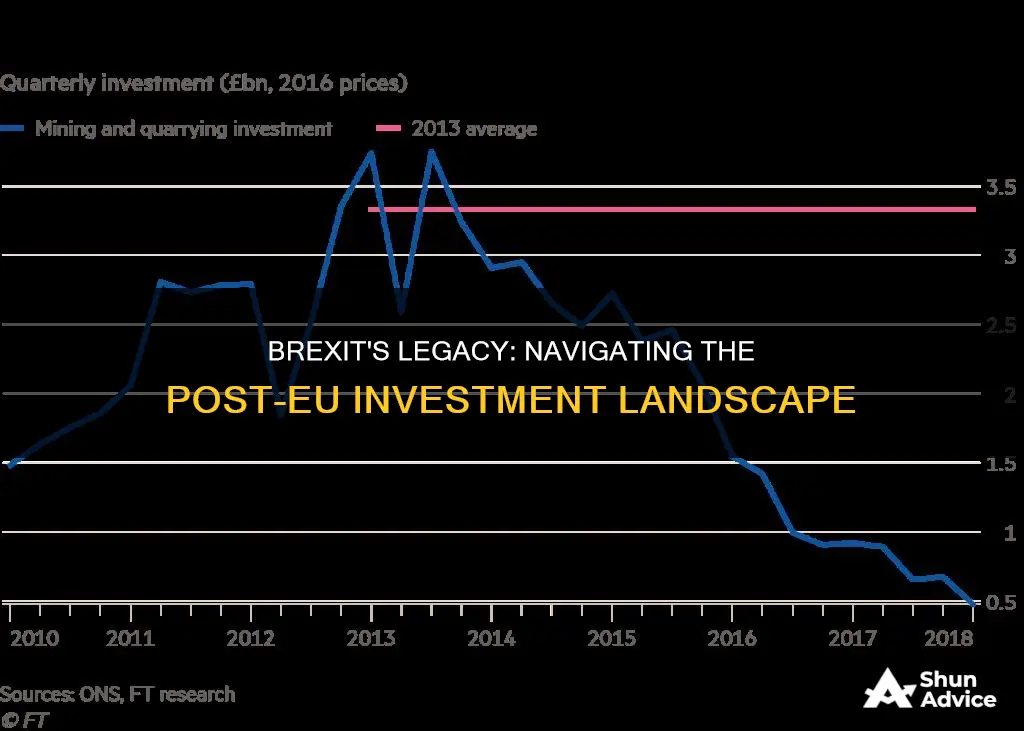

In the years following the referendum, business investment in the UK was essentially flat. It then took a sharp hit during the Covid-19 pandemic and has slowly recovered, only just regaining its pre-pandemic level at the end of 2022. Analytical approaches suggest that business investment has been subdued partly due to the effects of Brexit, reducing the size of the economy and future growth.

The impact of Brexit on the UK stock market is also notable. Since the UK public voted to leave the EU in the 2016 referendum, UK equities have significantly underperformed every year since. The depressed asset prices over the past few years have made UK equities one of the cheapest stock markets of any developed nation, making it an interesting prospect for investors.

The impact of Brexit on the UK economy and investment landscape is complex and multifaceted, with a range of factors influencing the country's future prospects.

| Characteristics | Values |

|---|---|

| Impact on the UK economy | The UK economy has been harmed in the long term, with reduced real per capita income, a large decline in immigration from the European Economic Area (EEA) to the UK, and challenges for higher education and academic research. |

| Impact on business investment | Business investment was flat in the years after the referendum, then took a sharp hit during the Covid-19 pandemic, and has since recovered slowly. Analytical approaches suggest that Brexit has contributed to subdued business investment, reducing the size of the economy and future growth. |

| Impact on trade | The UK's trade is worse off, with one-third of exports to the EU now facing tariffs or high trade barriers. |

| Impact on financial markets | The UK stock market surged higher immediately after the referendum result, but the FTSE 100 fell by 3% by the close of trading. The pound sterling fell to its lowest level against the US dollar since 1985. |

| Impact on companies | Many companies have shifted assets, offices, or business operations out of the UK and into continental Europe and Ireland. |

| Impact on financial institutions | The UK financial service industry may lose up to 35,000 jobs, and the Treasury may lose £5 billion in tax revenue annually. |

| Impact on asset management companies | The UK's withdrawal from the EU means that EU law and the Court of Justice of the European Union no longer have primacy over British laws. |

| Impact on foreign direct investment | The UK remains an attractive prospect for foreign direct investment, with the potential for less regulation and more control over trade policy. |

What You'll Learn

Impact on the UK stock market

The UK stock market has been significantly impacted by Brexit. When the London Stock Exchange opened on 24 June 2016, the FTSE 100 fell from 6338.10 to 5806.13 in the first ten minutes of trading. However, by 1 July, the FTSE 100 had risen above pre-referendum levels, reaching a ten-month high. This represented the index's largest single-week rise since 2011.

The impact of Brexit on the UK stock market has been complex and multifaceted. On the one hand, the uncertainty surrounding the UK's future relationship with the EU has led to increased volatility and impacted investor confidence. On the other hand, the depreciation of the pound has made UK equities more attractive to foreign investors, as many multinational companies listed on the FTSE 100 generate a large portion of their profits in US dollars.

In the years following the referendum, business investment in the UK remained flat and then took a sharp hit during the Covid-19 pandemic. It has since recovered slowly, only just regaining its pre-pandemic level at the end of 2022. Analytical approaches suggest that Brexit has been a factor in subdued business investment, reducing the size of the economy and future growth.

The impact of Brexit on the UK stock market has also varied across industries. For example, aerospace and defence firms, pharmaceutical companies, and professional services companies have seen boosts in their share prices due to the weaker pound. In contrast, the financial services industry has faced challenges due to the loss of "passporting" rights, which allowed financial products to be sold across the EU without additional approvals.

Overall, the UK stock market has experienced a mix of positive and negative effects due to Brexit, with the long-term impact still uncertain.

Investing for Freedom: Early Retirement Strategies

You may want to see also

The effect on the pound

The pound has had a rough time since the Brexit referendum in 2016, with its value declining sharply against the dollar and other currencies. This decline reflected a generally negative outlook among international investors for the UK's economic prospects outside the EU. The pound's weakness has made imports and holidays more expensive for UK residents, while making exports more competitive.

The exchange rate of the pound against other leading currencies has fallen significantly since the Brexit vote, with sterling experiencing its largest fall within a single day in 30 years. This was driven by expectations of increased trade friction between the UK and the EU, as well as increased uncertainty and persistent political instability. Financial institutions sold sterling-denominated assets, driving down the value of the pound relative to other currencies.

The long-term impact of Brexit on the pound is expected to be negative, with less trade between the UK and the EU leading to reduced demand for the currency. The UK's departure from the EU has also undermined international investors' belief in the UK as a stable and trustworthy economy, which is likely to affect the pound over time.

The pound's value is influenced by a range of factors, including interest rates, money-printing, and the UK's current account deficit. A weaker pound can benefit some companies, such as exporters, but hurt others, such as importers. Overall, the Brexit deal is likely to put downward pressure on the pound, affecting the cost of living in the UK and the competitiveness of British exports.

In summary, Brexit has had a significant negative impact on the pound, and this trend is expected to continue in the coming years, affecting the UK economy and the purchasing power of its residents.

AMC Stock: Invest or Avoid?

You may want to see also

Business investment

Brexit has had a notable impact on business investment in the UK, which is crucial for economic growth. In the years following the 2016 referendum, business investment remained flat and then took a sharp downturn during the Covid-19 pandemic, only recently recovering to pre-pandemic levels. Analytical approaches suggest that Brexit has contributed to subdued business investment, reducing the size of the economy and future growth prospects.

The Office for National Statistics (ONS) defines business investment as covering investments by businesses in buildings, structures, ICT equipment, machinery, vehicles, software, research and development, and other smaller categories. It is essential for capital accumulation within firms and plays a significant role in economic growth.

The growth of business investment fell sharply from mid-2016 onwards, right after the Brexit referendum. This slowdown in investment growth appears to cut across industries, indicating a likely relationship with Brexit. The UK's business services industry, including transport, ICT services, finance, and professional services, experienced the sharpest slowdown.

The relatively low level of business investment in the UK predated Brexit, but both aggregate data and survey evidence strongly suggest that Brexit is at least partially responsible for the poor performance since 2016. Investment may be around 10% lower than it would have been without Brexit, translating to a reduction in productivity and output of over 1% of GDP.

The impact of Brexit on business investment is complex and multifaceted. Uncertainty surrounding Brexit, including issues like the Northern Ireland Protocol, has likely deterred spending and investment. The introduction of new rules, paperwork, and checks on goods has created challenges for companies trading with the EU, potentially discouraging investment.

Additionally, Brexit has impacted the UK's participation in global supply chains, and the end of free movement has restricted labour supply, affecting specific sectors and the flexibility of the labour market. These factors have contributed to the subdued business investment environment in the UK following Brexit.

Social Security: Opting In or Out?

You may want to see also

The impact on trade

Brexit has had a chilling effect on UK trade and investment. The UK officially left the EU on 31 January 2020, following a referendum held on 23 June 2016. The UK is the only sovereign country to have left the EU.

The UK's trade with the EU has been adversely affected by Brexit. A 2022 study from the Resolution Foundation found that Brexit had reduced the openness and competitiveness of the British economy. The UK government's Office of Budget Responsibility calculated in October 2021 that Brexit would cost 4% of GDP per annum over the long term.

The UK's trade with the rest of the world has also been impacted. A 2019 analysis found that British firms substantially increased offshoring to the EU after the Brexit referendum, while European firms reduced new investments in the UK.

The impact of Brexit on trade is felt unevenly across sectors. For example, the UK's financial services industry, which is world-leading, is particularly vulnerable because it relies on "passporting" agreements with the EU. A 2016 report by the City of London Corporation estimated that the UK's financial services industry might lose up to 35,000 jobs as a result of Brexit.

The impact of Brexit on trade is also felt unevenly across the UK. Scotland and Northern Ireland, which both returned majorities for remaining in the EU, have been particularly affected. Scotland's First Minister, Nicola Sturgeon, requested a referendum be held before the UK's withdrawal, but this was rejected by the British Prime Minister.

The impact of Brexit on trade is complex and ongoing. While some sectors and regions have been adversely affected, others have benefited. For example, multinationals listed on the FTSE 100 saw earnings rise as a result of a softer pound. A weaker currency was also a boon for the tourism, energy, and service industries.

Jio: India's Digital Revolution

You may want to see also

The effect on the UK's attractiveness to foreign direct investment

The UK's departure from the European Union has had a chilling effect on inward investment. The UK is no longer a shareholder in the European Investment Bank, and European experts have argued that the long-term economic prospects of the UK remain high in terms of country attractiveness and foreign direct investment. The UK has historically been a major recipient of foreign direct investment, with the second-largest stock of inward investment in the world in 2014, amounting to just over £1 trillion, or almost 7% of the global total. This was more than double the 3% accounted for by Germany and France. On a per capita basis, the UK is the clear front-runner among major economies, with a stock of FDI around three times larger than the level in other major European economies and 50% larger than in the US.

However, the Brexit vote and subsequent departure from the EU have led to a significant decline in foreign direct investment into the UK. A 2019 analysis found that British firms substantially increased offshoring to the EU, while European firms reduced new investments in the UK. The UK government's own Brexit analysis, leaked in January 2018, showed that British economic growth would be stunted by 2-8% over 15 years following Brexit. The UK has also lost its position as Europe's largest stock market, with Euronext becoming the largest in 2021.

The impact of Brexit on the UK's attractiveness to foreign direct investment is complex and multifaceted. On the one hand, the UK's departure from the EU has removed barriers to investment from countries outside the EU, particularly those with whom the UK can now negotiate free trade agreements. On the other hand, the loss of access to the EU single market and customs union, as well as the uncertainty surrounding the future relationship between the UK and the EU, have made the UK a less attractive investment destination for some businesses.

The impact of Brexit on foreign direct investment into the UK is likely to continue to evolve as the future relationship between the UK and the EU becomes clearer. In the short term, it is expected that foreign direct investment into the UK will continue to be impacted by the uncertainty surrounding the UK's future relationship with the EU. In the long term, the UK may be able to attract more investment from countries outside the EU, particularly if it can negotiate favourable free trade agreements. However, it is also possible that the loss of access to the EU single market and customs union could outweigh the benefits of new trade deals, resulting in a net decline in foreign direct investment into the UK.

Startups: Invest or Avoid?

You may want to see also

Frequently asked questions

The UK stock market has underperformed other major indexes since the Brexit vote. However, the depressed asset prices have made UK equities one of the cheapest stock markets of any developed nation, which may present long-term opportunities for investors.

Foreign direct investment (FDI) in the UK may decrease due to Brexit. The UK has been a major recipient of FDI, with the second-largest stock of inward investment in the world in 2014. However, Brexit-related uncertainty may deter foreign investors, and the UK's attractiveness as an investment destination may diminish outside of the EU.

Business investment in the UK has been subdued since the Brexit referendum, and this has likely reduced the size of the economy and future growth. A range of analytical approaches suggest that Brexit is a contributing factor to this slowdown.

The financial services industry in the UK, particularly in London, may be significantly impacted by Brexit. The loss of "passporting" rights, which allow financial firms to operate across the EU, could result in job losses and a reduction in tax revenue for the UK government.

Most economists believe that Brexit has harmed the UK economy and reduced its real per capita income in the long term. Brexit has contributed to a decline in investment, employment, and international trade. The UK's trade, financial services, and academic sectors are among those facing the most significant challenges.