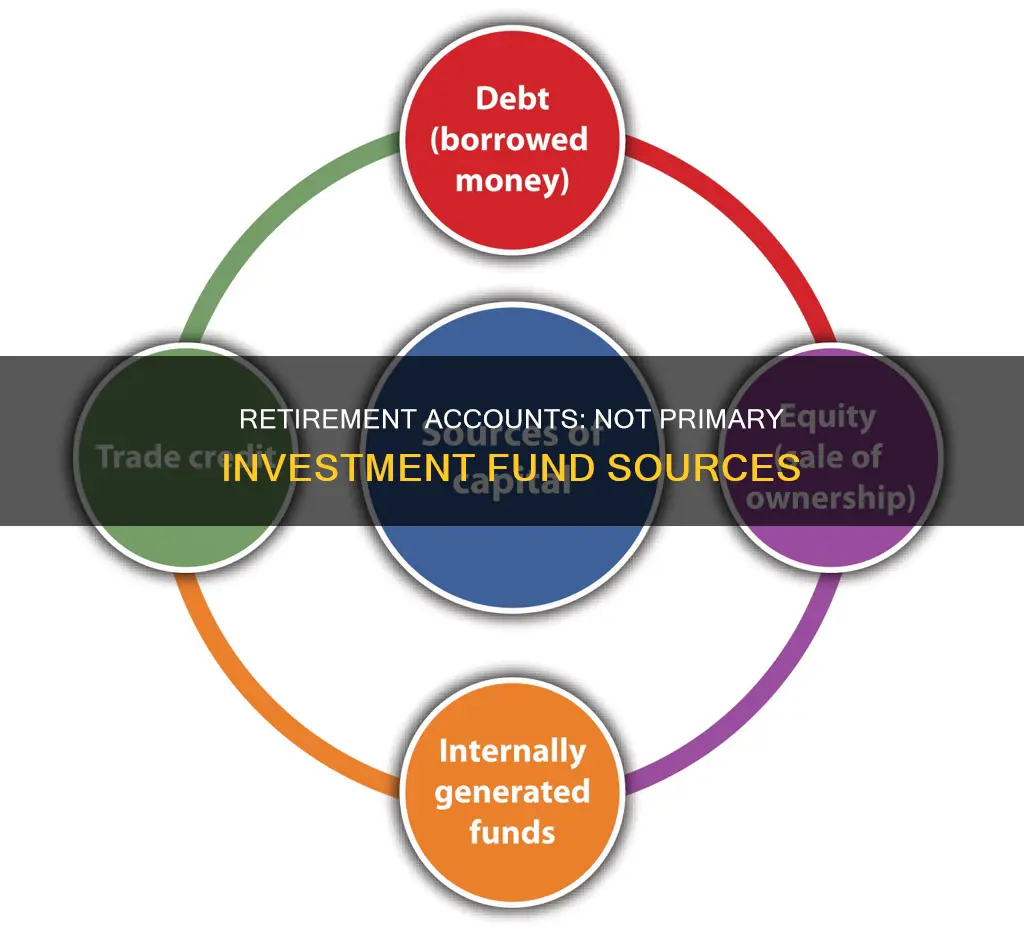

Sources of funding are essential for companies to grow their business. Funding can be raised for short-term or long-term purposes, and companies can obtain funds through various legitimate channels. The main sources of finance are retained earnings, debt capital, and equity capital. Companies can also raise funds through other channels such as crowdfunding, donations, or government grants and subsidies. However, it is important to note that businesses must ensure their customers are not using transactions to launder money gained through illegal activities. This is to comply with anti-money laundering legislation.

| Characteristics | Values |

|---|---|

| Salary | 37% |

| Stimulus Payments | 29.4% |

| Gifts | 19.1% |

| Inheritance | 14.2% |

| Retained Earnings | N/A |

| Debt Capital | N/A |

| Equity Capital | N/A |

What You'll Learn

Salary

However, it is important to note that salary can be a source of investment funds for individuals who have a significant amount of disposable income or those who are able to save and invest a portion of their salary consistently over time. In this case, salary can provide a steady stream of investment capital, which can be used to purchase stocks, bonds, or other financial instruments.

Additionally, salary can also be a primary source of investment funds for individuals with a high income or those in certain professions, such as finance or business ownership. In these cases, a large portion of their salary may be allocated towards investments, either personally or through their company.

It is worth noting that salary is generally considered "earned income", which is money earned by actively working for it. This is in contrast to passive income, which is money earned without actively working, such as rental income or royalties. While salary may not be the primary source of investment funds for most people, it can still play a significant role in building wealth and financial security when used effectively.

In summary, while salary may not be the primary source of investment funds for most individuals, it can still be a significant contributor to their overall financial portfolio and investment strategy, especially when combined with other sources of income and smart financial planning.

Hedge Fund Memos: Where to Access and Read

You may want to see also

Stimulus payments

The first round of stimulus payments, authorised by the CARES Act, was issued in March 2020. Individuals received $1,200, and an additional $500 was provided per child. This initial round of payments totalled $814 billion in financial relief.

The second round, authorised by the Consolidated Appropriations Act, was distributed in December 2020. Each income tax filer received $600, with an additional $600 provided per child.

The third round, part of the American Rescue Plan Act, was issued in March 2021. This time, each income tax filer received $1,400, and the same amount was provided per child.

It is important to note that eligibility for these stimulus payments was based on income, tax filing status, and the number of dependents. Additionally, the payments were not subject to income tax, and individuals who did not receive a payment or received an incorrect amount could claim the missing funds when filing their 2020 tax returns.

While stimulus payments provided much-needed financial support, there were challenges in ensuring that the payments reached all eligible individuals. Non-filers, first-time filers, mixed immigrant status families, and those experiencing homelessness faced difficulties in receiving timely payments. To address this, the IRS and Treasury were advised to improve their outreach efforts and collaborate more effectively to ensure that eligible individuals received the economic relief they needed.

Best Direct Mutual Fund Investment Apps: Your Guide

You may want to see also

Gifts

Firstly, it is important to note that if you are pursuing a conventional bank loan, gift funds cannot be used to purchase a property that is solely for investment purposes. This includes cash gifts or gifts of equity. This is a guideline set by federally backed Freddie Mac and Fannie Mae. However, there are no laws preventing the use of gift funds for the purchase of an investment property if you are not using a conventional loan.

If you obtain a conventional bank loan, gift funds can be used to purchase a primary or secondary residence, even if you are only planning to reside in the property part-time. In this case, most banks will allow you to use gift funds alongside a mortgage loan. But if you are not going to live in the property, banks will typically require that all the cash going towards a mortgage down payment is your own money.

If you are using gift funds to support the purchase of an investment property outright, there are no explicit rules against this, but you will need to abide by the tax rules surrounding gift limits. If the gift is under the annual gift tax exclusion amount, you may be able to use gift funds to help purchase an investment property. For 2024, the annual gift tax exclusion amount is $18,000 for an individual and $36,000 for a married couple filing jointly. Gifts that exceed this amount will be taxed, and this is the responsibility of the donor, not the recipient.

When using gift funds to finance a property purchase, there is specific documentation that will be required. This includes:

- Proof of Funds: The donor may need to provide proof of the source of the gift funds, such as bank statements showing the funds available in their account.

- Gift Letter: A formal statement from the donor confirming the amount of the gift, their relationship to the borrower, and that the funds are a gift and not a loan. The letter should also include the property address, the purpose of the gift, and both the donor's and recipient's contact information.

- Relationship Verification: Documentation to verify the relationship between the donor and the borrower, such as birth certificates or marriage certificates.

- Gift Transfer Documentation: Evidence of the transfer of funds from the donor's account to the borrower's account, such as copies of checks or wire transfer records.

- Donor's Identification: A copy of the donor's government-issued identification.

- Borrower's Acceptance: A written statement from the borrower confirming their acceptance of the gift funds.

In addition to the above, it is important to note that cash donors are liable to pay the IRS gift tax on any amount over $17,000 per person, per year. This is separate from the annual gift tax exclusion amount.

ETF and Index Funds: A Beginner's Guide to Investing

You may want to see also

Inheritance

Understanding Inheritance

Managing an Inheritance

If you are in the position of receiving an inheritance, it is important to carefully consider your options and seek professional advice if needed. Here are some key steps to managing an inheritance:

- Understand the assets: Before making any decisions, take the time to understand the full extent of the inheritance. This may include various types of assets, and it can take time to track down and divide these assets among multiple heirs.

- Seek professional advice: Depending on the complexity of the inheritance and your own financial knowledge, consider seeking guidance from a financial planner or tax professional. They can help you navigate tax implications and make informed investment decisions.

- Understand tax implications: Inheritances may have tax consequences, especially for certain types of assets. For example, securities, retirement accounts, and real estate can trigger tax obligations. It is important to understand these implications before making any major financial decisions.

- Make informed investment decisions: Inheritance can provide an opportunity to invest in a diversified portfolio or boost your contributions to retirement or education savings plans. Consider your financial goals and risk tolerance when making investment decisions.

- Pay off debts: Using inheritance money to pay off high-interest debts, such as credit card debt or student loans, can be a wise financial decision. This can help improve your overall financial health and reduce the burden of debt.

- Don't rush into decisions: Inheritance can be a life-changing event, and it is important not to rush into any hasty decisions. Take the time to grieve and process the situation before making any major financial moves.

Documentation and Proof of Inheritance

When dealing with inheritance, it is important to maintain proper documentation. This includes wills, court papers, probate documents, bank statements, and other relevant records. These documents may be required for tax purposes, legal proceedings, or even applying for certain programs, such as the EB-5 visa program in the United States. It is essential to work closely with legal and financial professionals to ensure compliance with any applicable laws and regulations.

Asia's 1997 Financial Crisis: Why Foreign Investment Poured In

You may want to see also

Personal savings

However, most entrepreneurs do not have the personal resources to provide all of their initial financing, so they must borrow money from external sources. This can include taking out a loan or mortgage on a private property, or borrowing from friends and family. Credit cards are also a common source of finance for small businesses, as they provide access to a free credit period.

Another advantage of using personal savings to fund a business is easy access to those funds. There are no loan applications to complete, no lenders to visit, no paperwork to prepare, and no interest to pay.

Gold Fund Investment: Timing is Everything

You may want to see also

Frequently asked questions

Entrepreneurs typically use their own personal savings to fund their business ventures. However, personal savings are often not enough to cover all expenses, so other sources of funding are used in conjunction with personal savings.

Angel investing, venture capital, bank loans, and crowdfunding are all common sources of funding for entrepreneurs.

Angel investing involves a private investor or investment firm providing large sums of money to an entrepreneur to start their business. This funding may be in exchange for stock shares or the entrepreneur may be required to pay back the funding with interest.

Venture capital is similar to angel investing but typically involves smaller investments and is targeted towards early-stage businesses.

Companies can raise capital through retained earnings, debt capital, and equity capital. Retained earnings refer to the profits generated by the company that are reinvested into the business. Debt capital involves borrowing money from lenders or issuing corporate debt. Equity capital involves selling ownership stakes to investors in exchange for funding.