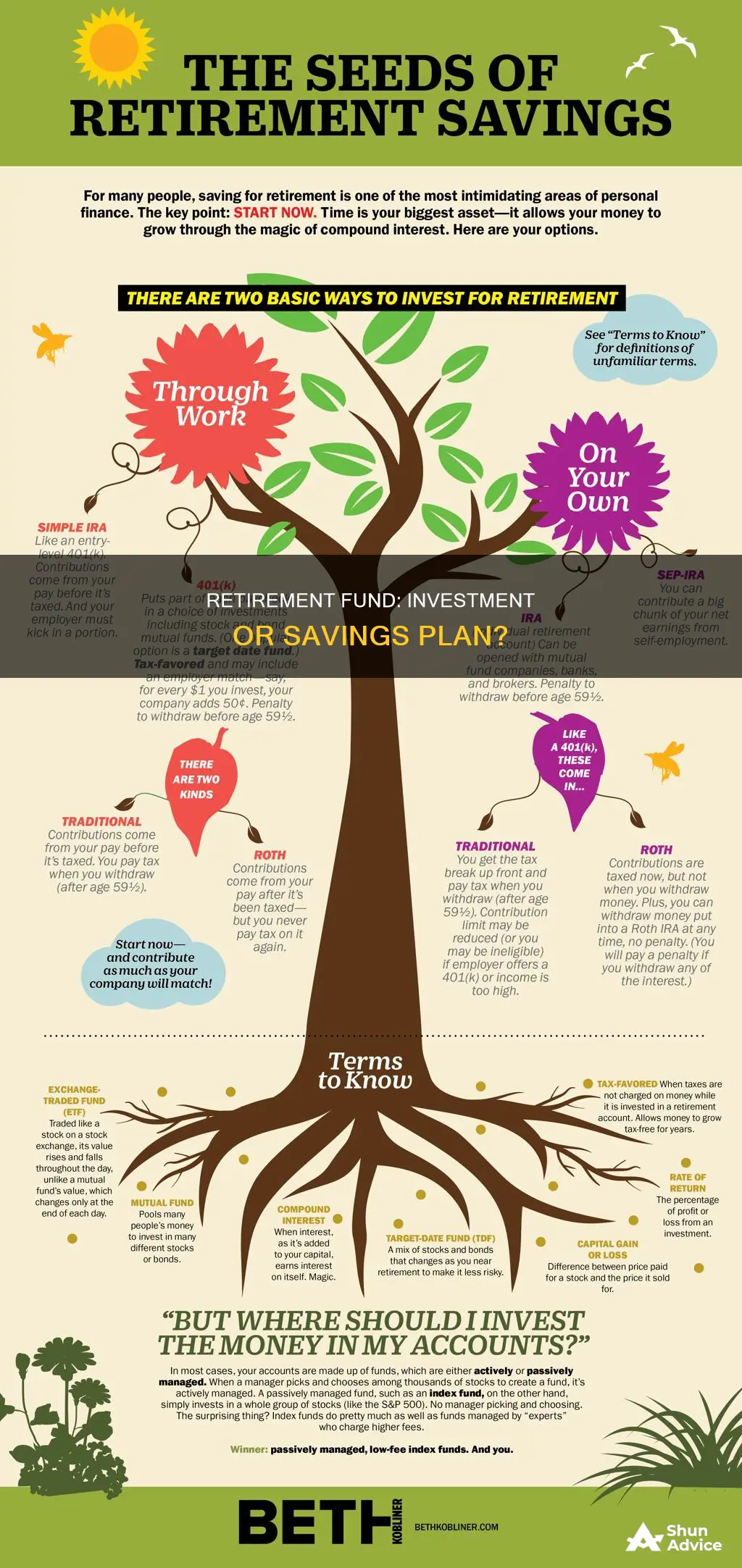

Retirement funds are a form of investment, and there are several types of retirement plans to choose from. These include 401(k) plans, IRAs, and 403(b) plans, each with its own set of advantages and tax implications. For example, 401(k) plans allow employees to contribute pre-tax wages, while Roth IRAs offer tax advantages on withdrawals in retirement. Ultimately, the best investment strategy for retirement will depend on individual circumstances, such as age, income, and retirement goals. It's important to start saving early and consistently to take advantage of compounding, and to maximise any employer contributions or matches.

| Characteristics | Values |

|---|---|

| Purpose | To save for retirement |

| Control | You control how much you contribute and where to direct contributions |

| Tax advantages | Tax breaks, tax-deferred or tax-exempt growth |

| Fees | Variety of fees that impact overall performance |

| Contribution limits | Annual contribution limits set by IRS, which are periodically increased due to inflation |

| Catch-up contributions | Participants aged 50+ can make catch-up contributions beyond basic limits |

| Matching contributions | Many plans offer matching contributions |

| Automatic features | Automatic enrollment into a pre-selected investment fund is increasingly common |

What You'll Learn

Tax advantages of retirement funds

Retirement funds are a type of investment, and there are several tax advantages to saving for retirement.

The government and many businesses offer incentives to save, such as IRA or 401(k) accounts, which allow account holders to accumulate savings tax-free for many years.

Tax-Deferred Accounts

The most common tax-deferred retirement accounts are traditional IRAs and 401(k) plans. With these accounts, you get an upfront tax deduction for contributions you make, and your money grows untouched by taxes. However, you will pay taxes on withdrawals at your ordinary income rate when you retire.

Tax-Exempt Accounts

Popular tax-exempt retirement accounts include Roth IRAs and Roth 401(k)s. With these accounts, you use money that you've already paid taxes on to make contributions, and your withdrawals are tax-free. Since contributions are made with after-tax dollars, there is no immediate tax advantage. The primary benefit of the tax-exempt structure is that investment returns can be withdrawn entirely tax-free.

Lowering Taxable Income

Contributions to tax-deferred accounts lower your taxable income in the year you make them. For example, if your taxable income is $50,000 and you contribute $3,000 to a tax-deferred account, you would pay tax on only $47,000.

Tax Breaks

Traditional 401(k) contributions reduce your taxable income in the year that you make them. Additionally, your 401(k) earnings accrue on a tax-deferred basis, meaning the dividends and capital gains that accumulate are not subject to tax until you begin withdrawals.

Employer Matching

Some employers offer to match the amount you contribute to your 401(k) plan, which can help you grow your nest egg faster. Employer contributions amount to free money, and most financial advisors would encourage taking advantage of this opportunity.

Hedge Fund Tax Havens: Investing Secrets for the Rich

You may want to see also

Choosing a brokerage firm

When choosing a brokerage firm, it is important to select one that aligns with your needs and goals. Here are some key factors to consider:

- Fees and minimums: Brokerage firms typically charge fees for their services, so it is essential to understand their fee structure. Look for firms that offer low or no fees and minimums to open an account. This can help you maximize your savings and avoid unnecessary costs.

- Range of investment options: Different brokerage firms offer different investment choices, such as mutual funds, exchange-traded funds (ETFs), stocks, bonds, and certificates of deposit (CDs). Choose a firm that provides a wide range of investment options to diversify your portfolio and meet your specific investment goals.

- Transparency and reputation: Opt for well-known brokerage firms that are transparent about their fees and services. Larger, national firms often have a good reputation and a wide selection of investment options. They may also be able to offer additional services, such as personal investment advisors, as your needs evolve.

- Customer service and support: Consider the level of customer service and support provided by the brokerage firm. Look for firms that offer dedicated advisors, educational resources, and easy access to their team through various communication channels.

- Retirement planning tools: If you are specifically saving for retirement, choose a brokerage firm that offers retirement planning tools and resources. These tools can help you make informed decisions about your retirement savings and investments.

- Security and protection: Ensure that the brokerage firm you choose has strict security measures in place to protect your personal and financial information. Read their terms and conditions carefully to understand how they handle your data and what protections they offer.

- User-friendliness and accessibility: Opt for a brokerage firm that offers a user-friendly platform or app, making it convenient for you to manage your investments and track your progress. Consider the ease of use, accessibility, and functionality of their tools and services.

- Performance and reviews: Research the performance track record of the brokerage firm and the investments they offer. Look for firms with a strong reputation and positive reviews from clients and industry experts.

Remember, taking the time to select the right brokerage firm is crucial, as switching firms frequently can result in reduced savings due to transfer fees. Focus on finding a firm that aligns with your investment goals, offers a diverse range of investment options, and provides excellent customer support.

Social Security Funds: Risky Business or Smart Investing?

You may want to see also

Retirement fund investment options

Defined Contribution Plans

Defined contribution (DC) plans include 401(k)s, 403(b)s, and 457(b)s. These plans allow employees to contribute a portion of their wages on a pre-tax or after-tax basis, depending on the specific plan. The main advantage of these plans is their tax advantages, which allow investments to grow tax-free until retirement. Additionally, many employers offer matching contributions, providing employees with "free money" for their retirement savings. However, early withdrawals from these plans may result in additional taxes and penalties.

Traditional Pensions

Traditional pensions, or defined benefit (DB) plans, are fully funded by employers and provide a fixed monthly benefit to retirees. While these plans offer the advantage of guaranteed income for life, they are becoming less common due to the significant cost to employers.

Guaranteed Income Annuities (GIAs)

GIAs are not typically offered by employers, but individuals can purchase them to create their own pensions. GIAs offer the advantage of guaranteed income for a certain period or for life. However, they may lock individuals into a strategy that cannot be changed.

Individual Retirement Accounts (IRAs)

IRAs are tax-advantaged retirement plans offered by the US government. There are several types of IRAs, including traditional IRAs, Roth IRAs, spousal IRAs, rollover IRAs, SEP IRAs, and SIMPLE IRAs. Each type has its own unique features and eligibility requirements. IRAs offer a wide range of investment options and tax benefits, but early withdrawals may result in additional taxes and penalties.

Stock and Bond Investments

Investing in stocks and bonds can be a way to generate income and growth in a retirement portfolio. Stocks offer the potential for higher returns but come with higher risk. Bonds are generally considered lower-risk investments but may have lower returns.

High-Yield Savings Accounts and Certificates of Deposit (CDs)

High-yield savings accounts and CDs can provide a safe place to park cash with modest returns. CDs have a fixed interest rate for a specific term, and early withdrawal may result in penalties.

When considering retirement fund investment options, it is important to evaluate your financial goals, risk tolerance, and time horizon. Consulting with a financial professional can help you determine the most appropriate strategies and options for your specific circumstances.

Baron Funds: A Guide to Investing in Their Success

You may want to see also

Employer-matched contributions

The specifics of employer-matched contributions vary. While some companies match contributions dollar-for-dollar up to a certain percentage of an employee's salary, others may match a percentage of an employee's contribution up to a specific portion of their total salary. In some cases, employers may elect to match employee contributions up to a certain dollar amount, regardless of compensation. The average employer match is 4.6%, with the most common formula being $0.50 per dollar on the first 6% of compensation.

It's important to note that employer-matched contributions may be subject to a vesting period, which refers to the number of years an employee must work before they are legally entitled to the money contributed by their employer. If an employee leaves the company before the vesting period ends, they will lose their right to claim any matching contribution funds in which they are not yet fully vested.

To benefit from employer-matched contributions, employees typically need to participate in the company's retirement plan and contribute a certain amount from their salary. The more an employee contributes, up to the plan's match limit, the more they will receive in matching contributions. It is recommended that employees contribute enough to receive the maximum matching contribution from their employer.

Hedge Funds: Investing in Your Business and You

You may want to see also

Early withdrawals

However, there are some exceptions to this 10% additional tax. These include:

- Unreimbursed medical bills that exceed 10% of adjusted gross income.

- Total and permanent disability of the participant.

- Health insurance premiums, if the individual is unemployed for 12 weeks.

- Qualified higher education expenses.

- Buying a first home.

- Qualified birth or adoption expenses.

- Domestic abuse victim distribution.

- Disaster recovery distribution.

- Emergency personal expenses.

- Unemployed health insurance.

It is important to note that while these exceptions waive the 10% penalty, regular income tax will still need to be paid on the withdrawal.

Additionally, it is recommended to avoid early withdrawals from retirement funds whenever possible. Instead, it is advised to build an emergency fund, take advantage of promotional credit card offers, seek financial support from friends and family, or explore other loan options such as personal loans or a portfolio line of credit.

L&T Emerging Business Fund: A Smart Investment Strategy

You may want to see also

Frequently asked questions

A retirement fund is a financial plan that allows individuals to save and invest money for their retirement years. It offers various tax benefits and investment options, such as stocks, bonds, mutual funds, and real estate. The goal is to build a nest egg that will provide financial security during retirement.

Retirement funds offer tax advantages, such as tax-deductible contributions, tax-deferred growth, or tax-free withdrawals. They also provide control over contributions and investment choices, ensuring individuals can tailor their plans to their needs. Additionally, many employer-sponsored plans offer matching contributions, further boosting retirement savings.

When choosing a retirement fund, consider the available tax benefits, contribution limits, fees, and investment options. It's essential to understand your personal financial goals and seek advice from tax and financial professionals. Additionally, employer-sponsored plans, like 401(k) or 403(b), are a great starting point due to their convenience and potential employer matching.