LendingClub is a digital marketplace bank in the US that connects borrowers with investors. It offers a range of financial products and services, including personal loans, auto refinancing, and business loans. With approximately 5 million members and $90 billion in personal loans, LendingClub is the leading digital marketplace bank in the country. The company was founded in 2007 and has since helped over 4 million members reach their financial goals. LendingClub offers investors access to consumer credit, which includes personal loans, credit cards, auto loans, student loans, and mortgages. The company provides a variety of structures for investors to access consumer credit, including purchasing a pool of loans or actively selecting loans through its electronic marketplace, LCX. LendingClub also offers a high-yield savings account and a Rewards Checking account with cash-back rewards.

| Characteristics | Values |

|---|---|

| Number of members | 4 million+ |

| Amount of personal loans | $90 billion+ |

| Year founded | 2007 |

| Number of unique attributes | 2,000+ |

| Number of cells of proprietary data | 150 billion+ |

| Number of repayment events | Tens of millions |

| Years of proprietary data | 15+ |

| Number of banks partnered with | 60+ |

| Number of asset managers partnered with | Dozens |

| Number of hedge funds partnered with | Not specified |

What You'll Learn

LendingClub's acquisition of Radius Bank

On February 1, 2021, LendingClub Bank, N.A., finalised its acquisition of Radius Bancorp and its wholly-owned subsidiary, Radius Bank. The deal, worth $185 million, marked the first time a US fintech company had acquired a bank.

LendingClub, a fintech company that pioneered personal loans made online, sought to gain access to a stable and cheaper source of funding by acquiring a US bank. The acquisition of Radius Bancorp, a Boston-based online bank with about $1.4 billion in assets, provided LendingClub with this opportunity.

The merger created the only full-spectrum financial technology (fintech) marketplace bank and the first public US neobank. LendingClub's award-winning, branchless digital banking platform now offers a wide range of financial products and services, including convenient features such as check deposit, bill pay, card management, and a personal financial management dashboard.

The acquisition of Radius Bank was a significant step for LendingClub, allowing the company to diversify its earnings, reduce costs, and provide new and innovative financial solutions to consumers across the lending and deposit spectrum.

G Fund: A Safe and Secure Investment Option

You may want to see also

LendingClub's high-yield savings account

LendingClub is a digital marketplace bank that offers a range of financial products and services, including its High-Yield Savings account. This account provides customers with a competitive interest rate, allowing them to earn more on their savings.

The High-Yield Savings account from LendingClub offers a variable Annual Percentage Yield (APY) that is significantly higher than the national average. As of October 2024, the APY for this account was 5.15%, with a standard rate of 4.30% APY. To unlock the higher LevelUp Rate, account holders need to deposit a minimum of $250 per month. This rate is applied to the full balance of the account. However, it is important to note that the interest rates are subject to change at the bank's discretion.

LendingClub provides a LevelUp Savings account, which is a type of high-yield savings account that rewards customers with a higher interest rate when they make deposits of at least $250 per statement cycle. The First Evaluation Period for this account starts after the first two statement cycles, allowing customers to set up their deposits.

LendingClub also offers a Founder Savings account exclusively for its Notes investors, with a market-leading APY of 4.31% as of October 25, 2024. This account is no longer available to new customers as of August 22, 2024.

The company has been in business since 2007 and has established itself as the leading digital marketplace bank in the U.S., serving approximately 5 million members and providing over $90 billion in personal loans. LendingClub's business model focuses on keeping costs low by operating without physical branch locations, allowing them to pass the savings on to their customers in the form of competitive interest rates.

Maximizing Investment Funds: Strategies for Financial Success

You may want to see also

LendingClub's LC™ Marketplace Platform

The platform offers a range of loan options, including debt consolidation loans, personal loans, and patient solutions loans. With fixed rates and monthly repayment plans, members can choose a loan amount of up to $40,000. LendingClub also provides auto loan refinancing, with no origination fees or prepayment penalties.

Additionally, the company has a strong track record of data-driven credit modelling, utilising 2,000+ unique attributes and 150B+ cells of proprietary data from tens of millions of repayment events over 15+ years. This comprehensive data analysis ensures that loans are lent to reliable borrowers, resulting in better outcomes for investors.

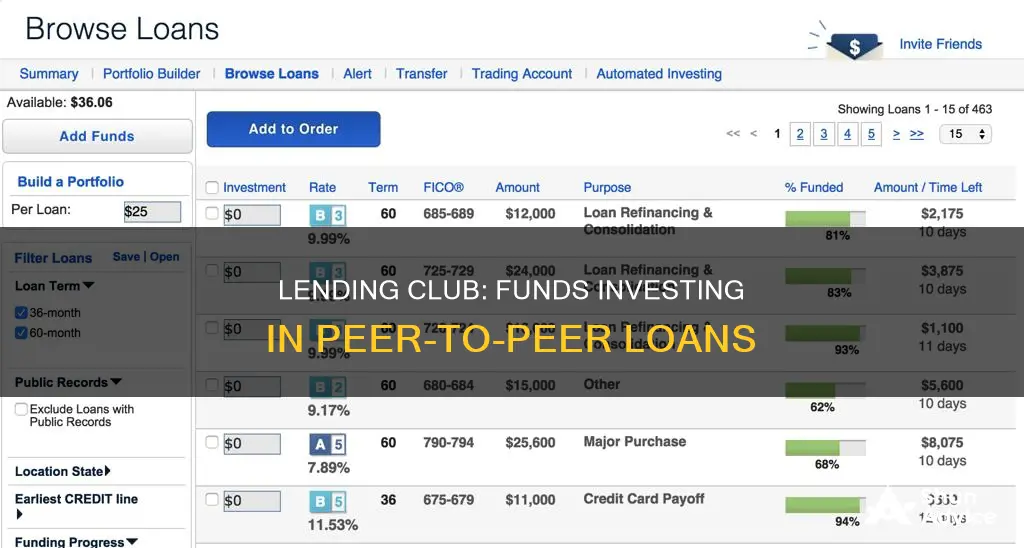

LendingClub provides multiple platforms for investors to purchase loans, offering flexibility in terms of passive or active investment, bulk or individual loan purchases, and whole loans or securities. The company's electronic marketplace, LCX, allows investors to build customised portfolios by filtering through specific credit attributes, benefiting from API-driven purchasing, dynamic pricing, and improved liquidity.

Unlock Real Estate Investing Using Retirement Funds

You may want to see also

LendingClub's auto loan refinancing

LendingClub auto loan refinancing allows members to save over $2,500 on average by paying off their existing car loan and refinancing into a new one. This can be done by securing a lower interest rate or reducing monthly payments by adjusting the length of the loan term. LendingClub auto refinancing is available for vehicles that are 10 years old or newer, with 120,000 miles or fewer, and for personal use only. The existing auto loan must have a balance of between $4,000 and $55,000, and at least 24 months of payments remaining.

LendingClub is a digital marketplace bank that connects borrowers with investors. It was founded in 2007 and is headquartered in San Francisco, California. The company has no brick-and-mortar locations, which helps keep costs low and allows it to pass savings back to customers in the form of great interest rates. LendingClub offers a range of financial products and services, including personal loans, auto refinancing, patient solutions, business loans, and institutional investing.

Global Investment Funds: Three Key Sources Explained

You may want to see also

LendingClub's personal loans

LendingClub is the leading digital marketplace bank in the U.S., connecting borrowers with investors since 2007. Their LC™ Marketplace Platform has helped more than 4.8 million members get over $90 billion in personal loans so they can save money, pay down debt, and take control of their financial future.

LendingClub offers personal loans of up to $40,000 with competitive fixed rates and a monthly repayment plan to fit within your budget. The ability to choose a loan amount of up to $40,000 means that you can borrow money for almost any purpose. Personal loans typically have a fixed term, a fixed interest rate, and a regular monthly payment schedule. Collateral is usually not required, and personal loans typically have lower interest rates than most credit cards.

One of the key benefits of LendingClub's personal loans is that checking your rate won't impact your credit score. They use a soft credit pull, so a hard credit inquiry that could impact your score will only occur if you continue with your loan and your money is sent. Additionally, their superior products and services are built to help you reach financial wellness, including their award-winning checking account, Rewards Checking, which offers 1% cash back, ATM rebates, and more.

With approximately 5 million members and $90 billion in personal loans, LendingClub is a trusted and reliable choice for those seeking personal loans.

Retirement Fund Investment: Choosing the Right Option

You may want to see also

Frequently asked questions

LendingClub is the leading digital marketplace bank in the U.S., connecting borrowers with investors since 2007. Their LC™ Marketplace Platform has helped more than 4.8 million members get over $90 billion in personal loans so they can save money, pay down debt, and take control of their financial future.

LendingClub offers a full suite of award-winning checking and saving products with benefits designed to meet your financial goals. Whether it's their cash-back Rewards Checking account or their High-Yield Savings and CD accounts with competitive rates, they have the right products to help you make the most of your money.

Personal loans with LendingClub come with fixed rates and a monthly repayment plan to fit within your budget. There are no origination fees or prepayment penalties, and checking your rate will not impact your credit score.

LendingClub offers multiple platforms that allow investors the flexibility to purchase loans on a passive or active basis, in bulk or as individual loans, and as whole loans or securities. Investors can build a portfolio on LCX, LendingClub's proprietary electronic marketplace, by filtering through specific credit attributes.