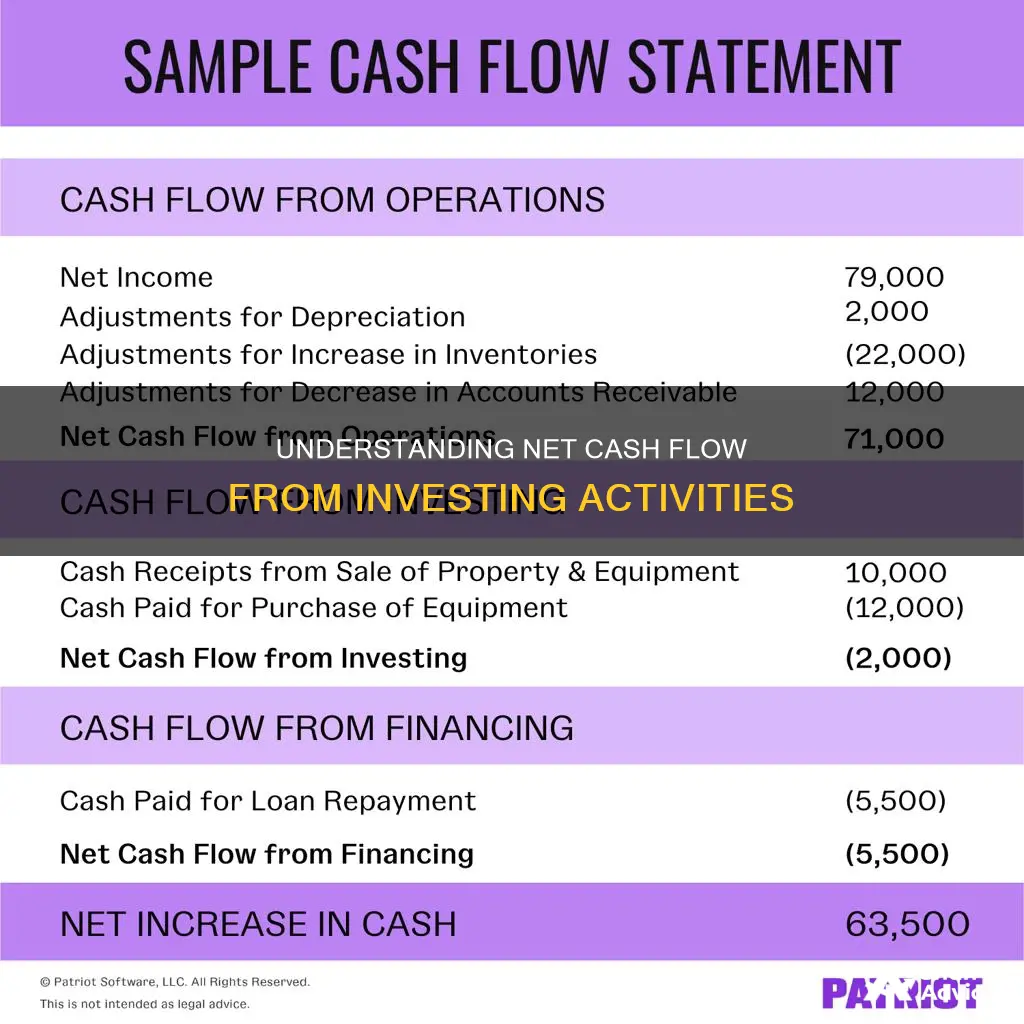

Net cash flow is a profitability metric that represents the amount of money produced or lost by a business during a given period. It is calculated by subtracting total cash outflows from total inflows related to investing activities to find the net cash flow. This can be done by adding up all cash inflows and outflows related to investing activities, with inflows typically including proceeds from asset sales and outflows including purchases of investments.

The cash flow statement is one of the three financial reports that a company generates in an accounting period, with the other two being the balance sheet and the income statement. The cash flow statement is divided into three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

Cash flow from investing activities is an important section of the cash flow statement as it displays how much money has been used in or generated from making investments during a specific time period. This includes purchases of long-term assets (such as property, plant, and equipment), acquisitions of other businesses, and investments in marketable securities (stocks and bonds).

| Characteristics | Values |

|---|---|

| Definition | Cash flow from investing activities (CFI) |

| Type of statement | Financial statement |

| Purpose | Reports how much cash has been generated or spent from various investment-related activities in a specific period |

| Types of activities | Purchases of physical assets, investments in securities, sales of securities or assets, capital expenditures, lending money, and the sale of investment securities |

| Calculation | Subtract total cash outflows from total inflows related to investing activities to find the net cash flow |

| Sections | Cash Flow from Operating Activities, Cash Flow from Investing Activities, Cash Flow from Financing Activities |

| Formula | Net Cash Flow = Net Cash Flow from Operating Activities + Net Cash Flow from Financial Activities + Net Cash Flow from Investing Activities |

What You'll Learn

Capital Expenditure

CapEx is distinct from operating expenses (OpEx) in terms of frequency, predictability, and tax treatment. While OpEx encompasses shorter-term expenses necessary for the day-to-day operations of a business, CapEx occurs less frequently and is less predictable. Additionally, CapEx is not directly tax-deductible but can indirectly reduce taxes through depreciation.

When examining a company's cash flow statement, CapEx is typically the largest cash outflow within the investing activities section. This is because CapEx involves the purchase of long-term fixed assets, which are essential for the company's operations and future growth. Examples of CapEx include the acquisition of land, vehicles, buildings, heavy machinery, equipment, and technology.

Calculating CapEx can be done using data from a company's income statement and balance sheet. By analysing the depreciation expense and the change in property, plant, and equipment (PPE) values over a specific period, one can determine the company's CapEx for that period.

In summary, CapEx is a critical metric for understanding a company's investment in its fixed assets and its ability to generate cash flow for future investments. It plays a significant role in evaluating a company's financial health and growth prospects.

Understanding Cash Flow: Investing Activities Explained

You may want to see also

Long-term Investments

The objective of long-term investments is not to sell the investments in a short period but to hold them to meet future needs. They generate a steady amount of regular income in interest or dividends, which can be used to fund routine operations. Long-term investments are listed on the asset side of the balance sheet under non-current assets.

The specific method of accounting for a particular long-term investment is largely governed by the intent of the investment. Investments may be acquired for their cash flow yields, to establish influence or control, or for other reasons. For instance, a company owning less than 20% of the outstanding stock of another company and having no significant influence uses the cost method, while a company with 20-50% ownership or significant influence employs the equity method.

Cash App Investment Options: Where to Put Your Money

You may want to see also

Business Acquisitions

When it comes to business acquisitions, the cash flow statement is an important document to refer to. This statement shows the sources and uses of a company's cash, both incoming and outgoing. It is comprised of three sections: Cash Flow from Operations (CFO), Cash Flow from Investing (CFI), and Cash Flow from Financing Activities (CFF).

The CFI section is particularly relevant for business acquisitions, as it reports the cash inflows and outflows resulting from investment activities, including the acquisition and disposal of long-term assets such as property, plant, and equipment, as well as investments in marketable securities.

When a company acquires another business, the cash flow statement will show a negative cash flow from investing activities, indicating that the company has spent money on acquiring another company. This is a common growth strategy for companies, as it allows them to become larger and strengthen their competitive position in the industry.

The amount of cash spent on acquisitions can be calculated by looking at the "Acquisitions, Net of Cash Acquired" line on the Cash Flow Statement. This line measures the net amount of cash spent on acquiring other companies. For example, if a company's Cash Flow Statement shows $500 million for "Acquisitions, Net of Cash Acquired", it means the company used $500 million in cash to buy other companies.

It is important to note that the cash flow statement only considers cash going into and out of a business. Therefore, when calculating the net cash flow from investing activities, it is crucial to consider only the cash inflows and outflows related to these activities. This includes proceeds from asset sales, dividends received, and interest earned on investments, as well as purchases of property, plant, equipment, and investments.

Investing: Negative Cash Flow's Impact and Insights

You may want to see also

Proceeds from the sale of assets

When a company sells a long-term asset, the amount of money received is referred to as the proceeds. If the amount received is greater than the book value or carrying value of the asset at the time of the sale, the difference is considered a gain on the sale. On the other hand, if the amount received is less than the book value, the difference is considered a loss on the sale.

For example, if a company sells one of its company cars for $10,000, and the car's book value at the time of the sale is $6,000, the company will have proceeds of $10,000 and a gain on the sale of $4,000.

The proceeds from the sale of a long-term asset are reported as a positive amount in the investing activities section of the statement of cash flows. This is an important component of a company's cash flow statement as it provides insights into the company's investment performance and capital allocation decisions.

The cash flow statement also includes information on the purchase of physical assets, investments in securities, and other investing activities. It is important to note that negative cash flow from investing activities does not always indicate poor financial health. It could mean that the company is investing in assets, research, or other long-term development activities that are crucial for its health and continued operations.

Understanding the Relationship Between Cash and Investments

You may want to see also

Loans and collection of loans

Loans and the collection of loans are a key part of understanding net cash flow from investing activities. This is a crucial metric for understanding a company's financial health and investment performance. Loans and loan collections are classified as investing activities because they involve sources and uses of cash from a company's investments.

Loans made to vendors or received from customers are included in this category. This also includes any payments related to mergers and acquisitions (M&A). Loans can be a significant source of cash inflow for a company, especially when they are repaid with interest. When calculating net cash flow, the principal amount of the loan is considered, as interest payments are classified as operating activities.

The collection of loans is an important component of cash inflows from investing activities. This includes the proceeds from loans made to third parties and the collection of loans made by the entity. For example, if a company lends money to another business and receives regular repayments, the principal amount received would be considered an investing activity.

It is important to note that only loans made to external parties are considered investing activities. Loans made to employees or other internal parties are not included in this category. Additionally, loans that are directly related to a company's day-to-day business operations, such as those in the trading portfolio or an investment company, are classified as operating activities.

When analyzing net cash flow from investing activities, it is crucial to consider both the cash outflow from loans made and the cash inflow from the collection of those loans. This provides a comprehensive understanding of the company's investment activities and their impact on cash flow.

Angel Investment Cash Flow Statement Strategies

You may want to see also