Investing in the stock market can be a great way to grow your money, but it's important to understand the tax implications. Any profits made from investments are generally subject to tax, with the exception of trading within certain tax-efficient products like Individual Savings Accounts (ISAs) or Self-Invested Personal Pensions (SIPPs). The amount of tax you pay will depend on factors such as your personal tax situation, the type of investment, and the amount of profit made. Understanding these factors is crucial before making any investment decisions.

When investing, you'll receive income through dividends or interest payments. Dividend income is taxed at different rates depending on your tax bracket, and you may need to pay income tax on interest payments. Additionally, capital gains made when selling investments that have increased in value may be subject to Capital Gains Tax (CGT). It's important to note that tax rates and regulations can change over time, so staying informed is essential.

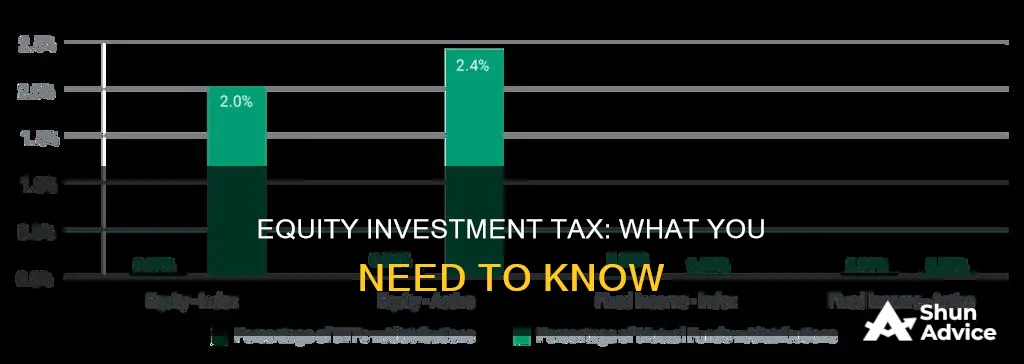

To reduce taxes on investment income and gains, you can utilise various allowances and tax-efficient products. Understanding the tax implications of your equity investments is crucial for effective financial planning and maximising your returns.

| Characteristics | Values |

|---|---|

| Are equity investments taxable? | Yes |

| What is the name of the tax on equity investments? | Capital Gains Tax (CGT) |

| What is the CGT allowance for the 2024/25 tax year? | £3,000 |

| Are there any investments that are not subject to CGT? | Shares put into an Individual Savings Account (ISA) or a self-invested personal pension (SIPP) |

| Are there any other taxes to consider when investing in equities? | Dividend tax, Stamp Duty, Stamp Duty Reserve Tax (SDRT) |

| Are there any tax implications for business owners? | Yes, there may be tax implications for business owners on the investments themselves as well as impact on IHT relief and CGT relief. |

Capital Gains Tax (CGT) on profits

Capital gains tax is a tax imposed on the sale of an asset. It is only due after an investment is sold. Capital gains taxes apply to capital assets, including stocks, bonds, digital assets like cryptocurrencies and NFTs, jewelry, coin collections, and real estate.

The tax rate on capital gains depends on the holding period of the asset, the taxpayer's income level, and the nature of the asset sold. Capital gains can be subject to either short-term or long-term tax rates, depending on how long the asset was owned.

Short-term capital gains tax is applied to profits from selling an asset held for less than a year. It is taxed at the same rate as ordinary income, such as wages from employment. The short-term capital gains tax rate for the 2024-2025 tax brackets is 10%, 12%, 22%, 24%, 32%, 35%, or 37%.

Long-term capital gains tax is applied to assets held for more than a year. The long-term capital gains tax rates are 0%, 15%, or 20%, depending on the income level and filing status of the taxpayer. These rates are typically lower than the ordinary income tax rate.

For the 2024 tax year, individual filers won't pay any capital gains tax if their total taxable income is $47,025 or below. They will pay 15% on capital gains if their income is $47,026 to $518,900. Above this income level, the rate increases to 20%.

For the 2025 tax year, individual filers won't pay any capital gains tax if their total taxable income is $48,350 or less. The rate increases to 15% on capital gains if their income is $48,351 to $533,400. Above that income level, the rate climbs to 20%.

It is important to note that capital gains taxes are only due when the asset is sold, not during the period when it is held. Additionally, capital gains taxes do not apply to unrealized gains, which are returns on investments that have not been sold.

To calculate capital gains tax, subtract the original cost of the asset from the total sale price. This difference is the taxable gain.

Certain investments are exempt from capital gains tax. For example, in the UK, you do not usually need to pay tax if you give shares as a gift to your spouse, civil partner, or a charity. Additionally, you do not pay CGT on certain assets, including UK government gilts, Premium Bonds, and Qualifying Corporate Bonds.

UK Private Equity: A Guide to Getting Started

You may want to see also

Dividend tax

Dividends are shares of a company's profits that are distributed to shareholders. Dividend tax is usually applied to this income.

For tax purposes, there are two kinds of dividends: qualified and nonqualified. Qualified dividends are taxed at lower rates than nonqualified dividends. The tax rate on qualified dividends is 0%, 15%, or 20%, depending on taxable income and filing status. Nonqualified dividends are taxed as income at rates up to 37%.

The tax rate on dividend income also depends on the recipient's income tax band. For instance, in the UK, if your total income for the year, including earnings from employment, pensions, benefits, savings, and investments, is up to £17,570, you can earn up to £11,570 in tax-free savings interest. If you earn between £17,571 and £100,000, your Personal Savings Allowance (PSA) determines how much savings interest you can earn tax-free.

In the US, individuals earning over $44,625 or married couples filing jointly who earn $89,250 pay a minimum of a 15% tax on capital gains for the 2023 tax year. For the 2024 tax year, the tax rate on qualified dividends is a maximum of 20% for individuals with a taxable income of over $47,025 or $94,050 for married couples filing jointly.

Inflation's Impact on Equity Investments: What You Need to Know

You may want to see also

Stamp duty

When you buy shares, you may have to pay stamp duty. The rate at which stamp duty is charged depends on how you buy your shares.

If you use a stock transfer form, also known as a paper transfer form, and the transaction is over £1,000, you’ll pay stamp duty at a rate of 0.5% (rounded up to the nearest £5). You must send a copy of your stock transfer form to the Stamp Office within 30 days of it being signed and dated.

If you buy your shares electronically through the computerised register of shares and shareowners system (CREST), you’ll pay Stamp Duty Reserve Tax (SDRT). It is charged at 0.5% and automatically deducted when you buy the shares.

You must also pay SDRT if you buy shares outside CREST, known as ‘off-market’ transactions.

Investment Management: Competitive or Cutthroat?

You may want to see also

Income tax

Ordinary Income Tax

Ordinary income tax is owed on your equity in the tax years during which you acquire shares. For example, if you acquire restricted stock, you will be taxed on the fair market value of the shares on the vesting date.

Capital Gains Tax

Capital gains tax comes into play when you sell your shares. Capital gains are the profits realised from selling shares. Capital gains tax depends on the type of equity you hold and how long you stayed invested in the stocks.

If you sell an equity share listed on a recognised stock exchange within one year of purchasing it, you will pay short-term capital gains tax. These are taxed at a flat rate of 15%.

If you sell a listed equity share after one year from the date of purchase, you will pay long-term capital gains tax. Long-term capital gains in excess of a certain amount are taxed at a rate of 10% without the benefit of indexation.

Other Types of Income

Aside from capital gains, dividend income is another type of income that you may receive from equity investments. Dividend income is paid out by companies to their shareholders as a reward for investing in their stock. Dividend income is also taxable and should be considered when investing in equities.

India's Future: Investing in Petro?

You may want to see also

Inheritance tax

In the United States, there is no federal inheritance tax. However, certain states have their own laws regarding inheritance tax. As of 2024, only six states impose an inheritance tax: Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania. The taxation of an inheritance depends on the state in which the deceased lived or owned property, the value of the inheritance, and the beneficiary's relationship to the deceased.

The amount of inheritance tax owed varies and depends on several factors, including the value of the assets inherited and the relationship between the deceased and the heir. Each state has different thresholds and tax rates for inheritance tax. For example, in Pennsylvania, the inheritance tax can range from 0% to 15% depending on the relationship between the deceased and the heir. Spouses are typically exempt from paying inheritance tax, while direct descendants may have to pay a lower tax rate compared to other heirs.

Strategies for Reducing Inheritance Taxes

Strategies exist to reduce or eliminate inheritance taxes. During their lifetime, individuals can make gifts to heirs or charities or set up an irrevocable trust. Trusts can be used to transfer assets to heirs in a way that minimizes inheritance tax liability. Life insurance policies can also be used, as the death benefit from an insurance policy is typically not subject to inheritance taxes.

Understanding How Inheritance Tax Is Calculated

Important Considerations for Heirs

It is important for heirs to understand the potential tax liabilities associated with inheritance. In most states, heirs can get an extension to file their inheritance taxes, usually up to 6 months. However, failing to pay inheritance taxes can result in the state filing a lien against the assets of the heir. The state may also charge interest and penalties on the unpaid inheritance tax. Therefore, it is crucial for heirs to be aware of their tax obligations and seek appropriate financial advice when necessary.

Savings and Investment Spending: Friends or Foes?

You may want to see also

Frequently asked questions

Any profits made from equity investments will be subject to tax. However, there are some exceptions. You do not pay tax when trading within an individual savings account (ISA) or self-invested personal pension (SIPP).

The main ways you can be taxed on equity investments include income tax, dividend tax, capital gains tax (CGT), and stamp duty.

The amount of tax you pay depends on several factors, including your personal tax situation, the amount of profit made, and the type of equity investment. For example, the tax rate on dividend income is 8.75% for basic-rate taxpayers, 33.75% for higher-rate taxpayers, and 39.35% for additional-rate taxpayers.

To reduce the amount of tax you pay on equity investments, consider using tax-efficient products such as ISAs or pensions. These products allow your investments to grow free from certain taxes, such as dividend and capital gains tax. Additionally, pensions offer further tax benefits, as your money grows free from income tax.