Equity investments are a crucial component of long-term asset allocation for many investors. These investments, which include stocks and mutual funds, represent ownership in companies and offer the potential for significant returns over extended periods. While equity investments can be volatile in the short term, they are generally considered long-term assets due to their ability to grow in value over time, providing investors with the opportunity to build wealth and achieve financial goals. Understanding the nature of equity investments and their role in a diversified investment portfolio is essential for making informed financial decisions.

What You'll Learn

- Equity investments are typically considered long-term assets due to their potential for capital appreciation over time

- The long-term nature of equity investments is often associated with the company's growth and market performance

- Investors often hold equity investments for extended periods, expecting compound growth and dividend returns

- Long-term equity investments can provide diversification and reduce risk through a balanced asset allocation strategy

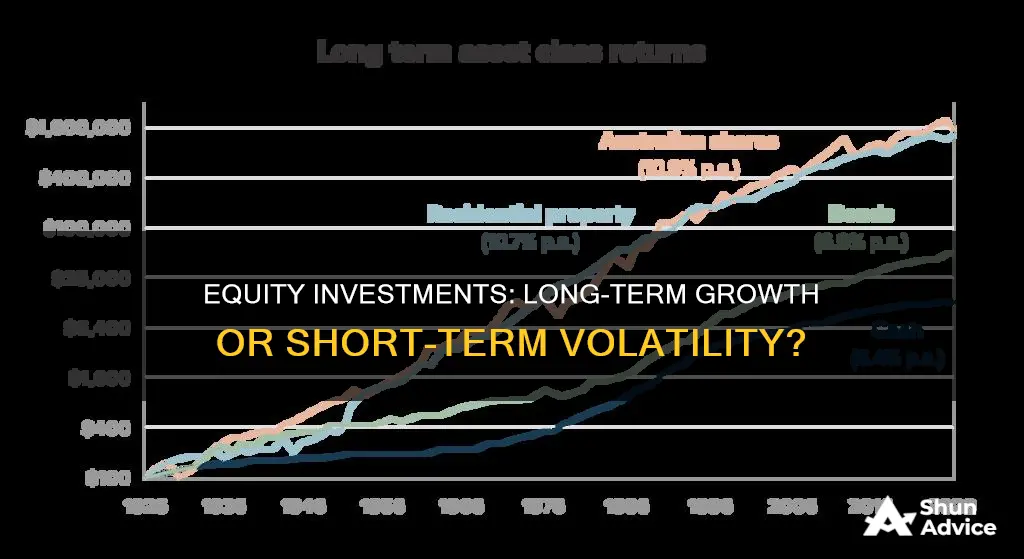

- Historical data shows that long-term equity investments have outperformed short-term speculative trades in the stock market

Equity investments are typically considered long-term assets due to their potential for capital appreciation over time

Equity investments are a crucial component of long-term financial planning for many investors. These investments are typically associated with a longer-term perspective due to their inherent characteristics and the nature of the markets they operate in. When an investor purchases equity, they are essentially buying a portion of a company, which can be seen as a long-term commitment to the company's growth and success. This commitment is what often drives the idea that equity investments are a long-term play.

The primary reason equity investments are considered long-term assets is the potential for capital appreciation. Over time, companies can grow, expand, and increase their profitability, leading to a rise in the value of the investor's equity stake. This appreciation can be attributed to various factors, including market growth, innovative product launches, effective management strategies, and overall economic conditions. Investors often hold these investments for extended periods, allowing the compound effect of appreciation to work in their favor.

Additionally, the nature of the stock market itself encourages a long-term approach. The stock market is designed to reward patient investors who allow their investments to mature. Short-term market fluctuations are common, and trying to time the market can be challenging and risky. However, historical data shows that over the long term, the stock market has consistently provided positive returns, making it an attractive option for those seeking wealth accumulation.

Another aspect to consider is the investment horizon of institutional investors and high-net-worth individuals. These investors often have a long-term focus, allowing them to weather short-term market volatility. They may hold equity investments for years, even decades, to achieve their financial goals. This long-term perspective further reinforces the idea that equity investments are a strategic, long-term asset class.

In summary, equity investments are considered long-term assets because they offer the potential for significant capital gains over time. This potential is tied to the growth and success of the companies in which investors choose to invest. By adopting a long-term investment strategy, investors can benefit from the power of compounding returns and the overall upward trend of the stock market.

Tony Robbins' Investment Journey: Long-Term Performance Unveiled

You may want to see also

The long-term nature of equity investments is often associated with the company's growth and market performance

The long-term nature of equity investments is a fundamental aspect that distinguishes them from other financial instruments. When an investor purchases equity, they are essentially buying a fractional ownership in a company, which is a long-term commitment. This commitment is often aligned with the company's growth trajectory and its performance in the market. Equity investments are typically held for extended periods, sometimes even decades, allowing investors to benefit from the company's long-term success and market position.

In the world of finance, equity investments are considered a long-term strategy due to their intrinsic connection with the company's growth and development. These investments are not meant for short-term gains but rather for participating in the company's long-term success. As a company grows, its equity becomes more valuable, and investors can potentially realize significant returns on their initial investments. This long-term perspective encourages investors to focus on the company's fundamentals, such as its financial health, management quality, and market position, rather than short-term market fluctuations.

The association between equity investments and long-term assets is further strengthened by the fact that companies often require time to mature and establish themselves in the market. Startups and young companies may not immediately show substantial profits, but with long-term investments, they can grow and become established businesses. Investors who believe in the company's potential and its ability to navigate market challenges over time are more likely to hold their equity investments for extended periods.

Moreover, the long-term nature of equity investments allows investors to benefit from the compounding effect. As the company grows and generates profits, these earnings can be reinvested, leading to further growth and increased equity value. This compounding effect is a powerful incentive for investors to maintain their long-term holdings, as it can significantly impact the overall return on their investments.

In summary, the long-term nature of equity investments is intrinsically linked to the company's growth and market performance. Investors who embrace this long-term perspective can potentially reap substantial rewards as they witness the company's evolution and success over time. Understanding this relationship is crucial for investors seeking to build a robust and sustainable investment portfolio.

Maximizing Returns: Smart Short-Term Investment Strategies

You may want to see also

Investors often hold equity investments for extended periods, expecting compound growth and dividend returns

Equity investments are indeed a long-term strategy for many investors, and this approach is often driven by the potential for compound growth and the steady income generated through dividends. When investors purchase shares in a company, they become partial owners, and this ownership stake can be held for years, sometimes even decades. The long-term nature of equity investments is a fundamental aspect of building wealth over time, as it allows investors to benefit from the company's growth and success.

One of the primary reasons investors opt for a long-term holding period is the power of compounding. Compound growth refers to the process where the returns on an investment are reinvested, generating additional returns over time. In the context of equity investments, this means that investors can benefit from the growth of the company's earnings and the subsequent increase in the value of their shares. For instance, if an investor buys shares of a company at $100 each and the company's earnings grow by 10% annually, the investor's initial investment will grow exponentially over the years. This compound growth potential is a significant incentive for investors to hold equity investments for the long term.

Dividend returns are another crucial aspect of long-term equity investments. Many companies, especially established and successful ones, distribute a portion of their profits as dividends to their shareholders. These dividends provide a regular income stream for investors, offering a tangible benefit in the form of cash flow. Over time, reinvesting these dividends can lead to a substantial accumulation of wealth. For example, an investor who consistently reinvests dividends from a well-performing stock might see their initial investment grow significantly, even if the stock price remains relatively stable.

The long-term nature of equity investments also allows investors to weather short-term market fluctuations and economic cycles. Stock markets often experience periods of volatility, and short-term price movements can be discouraging for investors who are not committed to a long-term strategy. However, history has shown that over extended periods, markets tend to trend upwards, and investors who stay invested can benefit from this long-term growth. This is particularly true for well-managed companies with a strong track record of performance and consistent dividend payments.

In summary, equity investments are often considered long-term assets due to the potential for compound growth and the steady income provided by dividends. Investors who adopt a long-term perspective can benefit from the power of compounding, allowing their investments to grow exponentially over time. Additionally, the regular dividend income provides a financial cushion and encourages reinvestment, further enhancing the long-term growth potential of equity investments. This strategy is particularly appealing to those seeking to build wealth and secure financial stability for the future.

Maximize Your Wealth: A Guide to Long-Term Investing with E*TRADE

You may want to see also

Long-term equity investments can provide diversification and reduce risk through a balanced asset allocation strategy

Long-term equity investments are a crucial component of a well-rounded investment strategy, offering both diversification and risk mitigation through a balanced asset allocation approach. This strategy involves allocating a portion of your portfolio to equity investments with a long-term horizon, typically spanning several years or even decades. By embracing this approach, investors can achieve a more stable and resilient financial position.

Diversification is a key benefit of long-term equity investments. By spreading your investments across various companies, sectors, and industries, you create a more balanced portfolio. This diversification reduces the impact of any single investment's performance on your overall portfolio. For instance, if one stock in your portfolio underperforms, the positive returns from other investments can offset this loss, ensuring that your overall investment strategy remains on track. Over time, this approach can lead to more consistent and steady growth, providing a more reliable source of wealth accumulation.

Asset allocation is another critical aspect of this strategy. It involves dividing your investment portfolio among different asset classes, such as stocks, bonds, real estate, and commodities. By carefully selecting and allocating these assets, investors can further enhance their risk management efforts. Long-term equity investments, when combined with other asset classes, can create a well-rounded portfolio that is less volatile and more resilient to market fluctuations. For example, during periods of economic downturn, stocks might underperform, but other asset classes like real estate or bonds could provide a stable source of income, thus maintaining the overall health of the portfolio.

The power of long-term equity investments lies in their ability to provide a steady return over an extended period. While short-term market volatility can be a concern, historical data shows that well-diversified equity portfolios have consistently outperformed other asset classes over the long term. This is particularly true when compared to more volatile short-term investments. By focusing on long-term gains, investors can avoid the pitfalls of short-term market swings and build a more secure financial future.

In summary, long-term equity investments are a strategic choice for investors seeking to diversify their portfolios and manage risk effectively. By adopting a balanced asset allocation strategy, investors can benefit from the potential for steady growth, reduced volatility, and a more stable financial position. This approach allows individuals to build wealth over time, providing a solid foundation for their financial goals and a more secure investment journey.

Unlocking Retirement Wealth: IRA's Long-Term Investment Potential

You may want to see also

Historical data shows that long-term equity investments have outperformed short-term speculative trades in the stock market

The concept of long-term equity investments versus short-term speculative trades is a fundamental debate in the world of finance and investing. When examining historical market performance, it becomes evident that long-term equity investments have consistently demonstrated superior returns compared to their short-term counterparts. This phenomenon can be attributed to several key factors that influence the market's behavior over extended periods.

One of the primary reasons for the outperformance of long-term equity investments is the power of compounding. Over time, the cumulative effect of reinvesting dividends and capital gains becomes a significant driver of growth. Long-term investors benefit from this compounding effect, allowing their investments to grow exponentially. In contrast, short-term traders often focus on quick profits, frequently buying and selling assets, which may limit the potential for long-term gains.

Historical data reveals that long-term equity investments have a higher probability of success due to their alignment with the fundamental principles of investing. These investments are typically made in companies with strong fundamentals, solid management, and a history of growth. By holding these investments for extended periods, investors can weather market volatility and benefit from the long-term growth potential of these businesses. Short-term speculative trades, on the other hand, often rely on market sentiment, news, and technical analysis, which can be more unpredictable and less reliable in the long run.

Additionally, the cost of trading and transaction fees associated with short-term trades can eat into potential profits. Long-term investors benefit from lower trading costs as they hold their positions for extended periods, allowing them to accumulate wealth more efficiently. This cost advantage further contributes to the outperformance of long-term equity investments.

In summary, historical evidence strongly supports the notion that long-term equity investments have outperformed short-term speculative trades. The power of compounding, the alignment with fundamental investing principles, and the cost advantages associated with long-term holding periods all contribute to this superior performance. While short-term trades may offer quick gains, the data consistently highlights the benefits of a long-term investment strategy in the stock market.

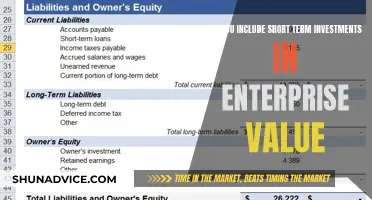

Understanding the Role of Short-Term Investments in the Current Ratio

You may want to see also

Frequently asked questions

Equity investments are typically classified as long-term assets on a company's balance sheet. These investments are considered a form of financial asset and are not intended for immediate sale or conversion into cash within one year. They are often held for the long term to generate returns through dividends, capital appreciation, or both.

Equity investments can significantly influence a company's financial position and performance. These investments provide a source of funding for the company, allowing it to expand operations, invest in growth opportunities, or manage cash flow. While they are considered long-term assets, the company's ability to sell or liquidate these investments quickly can impact its liquidity and financial flexibility.

No, the classification of equity investments as long-term assets depends on the company's investment strategy and financial policies. Some companies may hold equity investments for the long term, focusing on capital appreciation and dividend income. Others might have a more dynamic approach, buying and selling investments based on market conditions or strategic goals. In such cases, equity investments may be classified as short-term or current assets, depending on the holding period and the company's intentions.