Long-term investments are a crucial aspect of financial planning and can significantly impact an entity's financial health. These investments are typically held for an extended period, often with the expectation of generating returns over time. When considering whether long-term investments qualify as operating assets, it's essential to understand the distinction between these two categories. Operating assets are resources used in the day-to-day operations of a business, such as inventory, equipment, and accounts receivable. In contrast, long-term investments are financial instruments like stocks, bonds, or mutual funds purchased with the aim of generating income or capital appreciation over an extended period. This paragraph aims to explore the criteria that determine whether long-term investments can be classified as operating assets and the implications of such classification for financial reporting and analysis.

What You'll Learn

- Definition and Classification: Understanding the criteria for classifying long-term investments as operating assets

- Accounting Treatment: Exploring how long-term investments are accounted for in financial statements

- Risk and Return: Analyzing the relationship between long-term investments and operating asset risk

- Liquidity Considerations: Examining the impact of liquidity on the classification of long-term investments

- Regulatory Guidelines: Reviewing industry standards and regulations regarding long-term investments and operating assets

Definition and Classification: Understanding the criteria for classifying long-term investments as operating assets

Long-term investments are a crucial aspect of financial management, and understanding their classification as operating assets is essential for accurate financial reporting and analysis. Operating assets are typically those that are directly involved in the day-to-day operations of a business and are expected to generate revenue or contribute to the company's core activities. In contrast, long-term investments are financial assets held by a company with the intention of holding them for an extended period, often beyond one year.

The classification of long-term investments as operating assets depends on several criteria. Firstly, the investment must be closely related to the company's primary business operations. This means that the investment should have a direct impact on the company's ability to generate revenue or incur expenses. For example, a company might invest in long-term bonds or stocks of its suppliers or customers, which are integral to its supply chain and revenue generation. These investments are considered operating assets because they facilitate the ongoing business operations.

Secondly, the investment's maturity or expected holding period is a critical factor. Long-term investments are typically those with a maturity date beyond one year. This classification is important because it distinguishes between assets that are intended for short-term liquidity and those that are meant for long-term financial growth. For instance, a company might hold long-term government bonds or equity securities, which are not expected to be sold or converted into cash within the next year. These investments are classified as long-term and are not considered operating assets.

Furthermore, the nature of the investment and its intended purpose play a significant role in classification. Operating assets are often used in the day-to-day business activities and are expected to provide a continuous benefit. For example, a company's inventory, accounts receivable, and prepaid expenses are considered operating assets because they are directly involved in the production and sale of goods or services. In contrast, long-term investments are more focused on financial growth and may not directly contribute to the immediate operational activities.

In summary, classifying long-term investments as operating assets requires a careful evaluation of the investment's relationship to the company's core operations, its maturity period, and the nature of its intended purpose. By understanding these criteria, financial analysts and accountants can ensure accurate financial reporting, providing valuable insights into a company's financial health and investment strategies. This classification is essential for making informed decisions and assessing the overall financial position of a business.

Master Short-Term Investments: A Comprehensive Audit Guide

You may want to see also

Accounting Treatment: Exploring how long-term investments are accounted for in financial statements

Long-term investments are a crucial component of a company's financial portfolio, and their accounting treatment is an essential aspect of financial reporting. These investments, which are typically held for more than one year, are not considered operating assets but rather financial assets. The distinction is vital for accurate financial statement presentation and analysis.

In accounting, the classification of long-term investments is primarily based on their nature and the company's intent. These investments can be further categorized into two main types: available-for-sale and held-to-maturity. Available-for-sale investments are those that the company intends to hold indefinitely or sell in the near future. They are valued at fair value, with any changes in value recognized in the profit or loss statement. This approach ensures that the financial statements reflect the current market conditions and potential risks associated with these investments.

On the other hand, held-to-maturity investments are those with fixed maturity dates and fixed interest rates. These investments are typically debt instruments, such as bonds, and are accounted for at their amortized cost, which is the original cost plus or minus any adjustments for premium or discount. This method provides a more stable representation of the investment's value over time.

The accounting standards, such as International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP), provide specific guidelines for the treatment of long-term investments. According to IFRS 9, financial assets are classified based on their characteristics and the business model used to manage them. This classification determines how changes in value are recognized and reported. For instance, available-for-sale investments are marked to market, while held-to-maturity investments are amortized.

In summary, long-term investments are not considered operating assets but are classified as financial assets based on their nature and the company's holding period. The accounting treatment varies depending on the type of investment, with available-for-sale investments valued at fair value and held-to-maturity investments amortized. Adhering to these standards ensures that financial statements provide a clear and accurate representation of a company's financial position and performance.

Understanding Inventory's Role in Short-Term Investment Strategies

You may want to see also

Risk and Return: Analyzing the relationship between long-term investments and operating asset risk

The relationship between long-term investments and operating assets is a critical aspect of financial management, especially for businesses aiming to balance their short-term operations with long-term growth. Operating assets are those that are integral to the day-to-day functioning of a business, such as property, plant, and equipment, while long-term investments encompass a broader range of financial instruments, including stocks, bonds, and other securities. Understanding the interplay between these two categories is essential for assessing the risk and return associated with a company's financial health.

Long-term investments are often seen as a strategic move to diversify a company's portfolio and generate returns over an extended period. These investments can include purchasing stocks in other companies, acquiring real estate, or investing in long-term projects. While they offer the potential for higher returns, they also carry a higher level of risk. The risk associated with long-term investments is often categorized as financial risk, which can be further broken down into market risk, credit risk, and liquidity risk. Market risk refers to the potential for losses due to fluctuations in the value of the investment, credit risk is the possibility of default by the issuer, and liquidity risk pertains to the ease of converting the investment into cash without significant loss.

Operating assets, on the other hand, are more closely tied to the company's core business operations. They are essential for generating revenue and contribute to the overall efficiency and productivity of the business. The risk associated with operating assets is primarily operational risk, which includes the potential for losses due to internal processes, people, and systems. For instance, a manufacturing company's machinery (an operating asset) may break down, causing production delays and financial losses. Similarly, a software company's IT infrastructure could fail, disrupting operations and potentially leading to customer dissatisfaction and financial setbacks.

The relationship between long-term investments and operating assets is a delicate balance. While long-term investments can provide financial gains, they may also divert resources away from the core business operations, potentially impacting the stability and efficiency of operating assets. For example, a company might invest heavily in a new technology venture, which could be a long-term growth strategy but may also strain its cash flow and divert attention from maintaining and upgrading its existing operating assets. This shift in focus can lead to increased operational risk if the new investment does not pan out as expected.

In analyzing this relationship, financial analysts and managers must consider the following: first, the strategic importance of long-term investments in relation to the company's overall goals and objectives. Second, the potential impact of these investments on the company's cash flow and financial stability. Third, the risk assessment of both long-term investments and operating assets to ensure that the company's risk appetite is not exceeded. Finally, the need for regular review and adjustment of investment strategies to align with the evolving business environment and market conditions. By carefully navigating this relationship, businesses can optimize their financial health, ensuring that long-term investments complement and support the efficient operation of their core assets.

Cardano's Long-Term Potential: A Deep Dive into Its Future

You may want to see also

Liquidity Considerations: Examining the impact of liquidity on the classification of long-term investments

The classification of long-term investments as an operating asset or a non-current asset is a critical consideration for investors and accountants, especially when evaluating the liquidity and financial health of a company. Liquidity refers to the ease with which an asset can be converted into cash without significant loss of value. In the context of long-term investments, liquidity is a key factor that determines their classification and impact on a company's financial statements.

Long-term investments are typically those held by a company for an extended period, often with the intention of generating returns over time. These investments can include stocks, bonds, and other securities. When assessing liquidity, it is essential to consider the nature of these investments and their potential to be converted into cash promptly if needed. Highly liquid investments, such as government bonds or certain corporate bonds, can be quickly sold without a substantial impact on their market value. In contrast, less liquid investments, such as private equity or certain real estate holdings, may take longer to sell and could result in a significant loss of value.

The impact of liquidity on the classification of long-term investments is twofold. Firstly, it influences the accounting treatment. According to International Financial Reporting Standards (IFRS), long-term investments are generally classified as non-current assets, meaning they are not expected to be converted into cash or used in the operating cycle within one year. However, if an investment is highly liquid and can be readily converted into cash without a significant loss, it may be classified as a current asset, impacting the company's financial ratios and liquidity metrics.

Secondly, liquidity considerations affect the overall financial health and risk assessment of a company. Investors and creditors closely monitor a company's liquidity position, especially regarding its long-term investments. A company with a diverse and highly liquid portfolio of long-term investments may be perceived as less risky, as it can quickly respond to financial obligations or market opportunities. Conversely, a concentration of illiquid investments could pose a significant challenge if the company needs to access its assets quickly.

In summary, the classification of long-term investments as operating assets or non-current assets is closely tied to their liquidity. Highly liquid investments provide flexibility and can be easily classified as current assets, impacting financial reporting and risk assessment. Understanding the liquidity characteristics of long-term investments is essential for investors and accountants to make informed decisions and accurately represent a company's financial position.

Maximizing Long-Term Wealth: Understanding Your Investment Horizon

You may want to see also

Regulatory Guidelines: Reviewing industry standards and regulations regarding long-term investments and operating assets

When reviewing industry standards and regulations related to long-term investments and operating assets, it is crucial to understand the distinctions and classifications that govern these financial instruments. Long-term investments are typically categorized as non-current assets, which are expected to be held for more than one year. These investments can include various financial instruments such as bonds, stocks, and other marketable securities. On the other hand, operating assets are those that are directly involved in the company's day-to-day operations and are expected to be converted into cash or used up within one year. This distinction is essential for financial reporting and compliance purposes.

Regulatory guidelines often require companies to provide detailed disclosures regarding their long-term investments. These guidelines aim to ensure transparency and provide stakeholders with a comprehensive understanding of the company's financial position. Companies must disclose the nature and valuation of these investments, including any significant risks or uncertainties associated with them. For instance, regulations may mandate the disclosure of the investment's fair value, any impairment losses, and the reasons for holding such investments. This information is vital for investors and analysts to assess the company's financial health and make informed decisions.

Operating assets, on the other hand, are subject to different regulations and reporting requirements. Companies must classify and value these assets appropriately to ensure accurate financial statements. Operating assets can include inventory, accounts receivable, and prepaid expenses, which are essential for ongoing business operations. Regulatory standards often require companies to provide detailed explanations of the valuation methods used for these assets and any estimates or assumptions made during the valuation process. This transparency ensures that users of financial statements can understand the company's operational efficiency and liquidity.

Industry standards and regulations also address the accounting treatment of long-term investments and operating assets. For long-term investments, companies may need to follow specific accounting standards, such as the International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP), to ensure consistency and comparability in financial reporting. These standards provide guidelines on how to recognize, measure, and present these investments in the financial statements. Similarly, operating assets may have specific accounting guidelines to ensure accurate representation of a company's short-term financial position and operational capabilities.

In summary, regulatory guidelines play a critical role in reviewing industry standards for long-term investments and operating assets. Companies must adhere to these guidelines to ensure compliance, transparency, and accurate financial reporting. By understanding the distinctions between these asset categories and following the relevant regulations, businesses can provide valuable insights to investors and stakeholders, fostering trust and confidence in their financial operations. Regular review and updates to these guidelines are essential to keep pace with evolving market conditions and accounting practices.

Understanding Long-Term Investment Strategies: Key Factors to Consider

You may want to see also

Frequently asked questions

A long-term investment is an asset that is expected to provide benefits to the company over an extended period, typically more than one year. These investments are not intended for immediate sale and are often held for strategic financial gains or to support business operations.

An investment is classified as an operating asset when it is directly related to the company's primary business activities and generates revenue or reduces expenses. Operating assets are integral to the day-to-day operations and are expected to provide ongoing benefits.

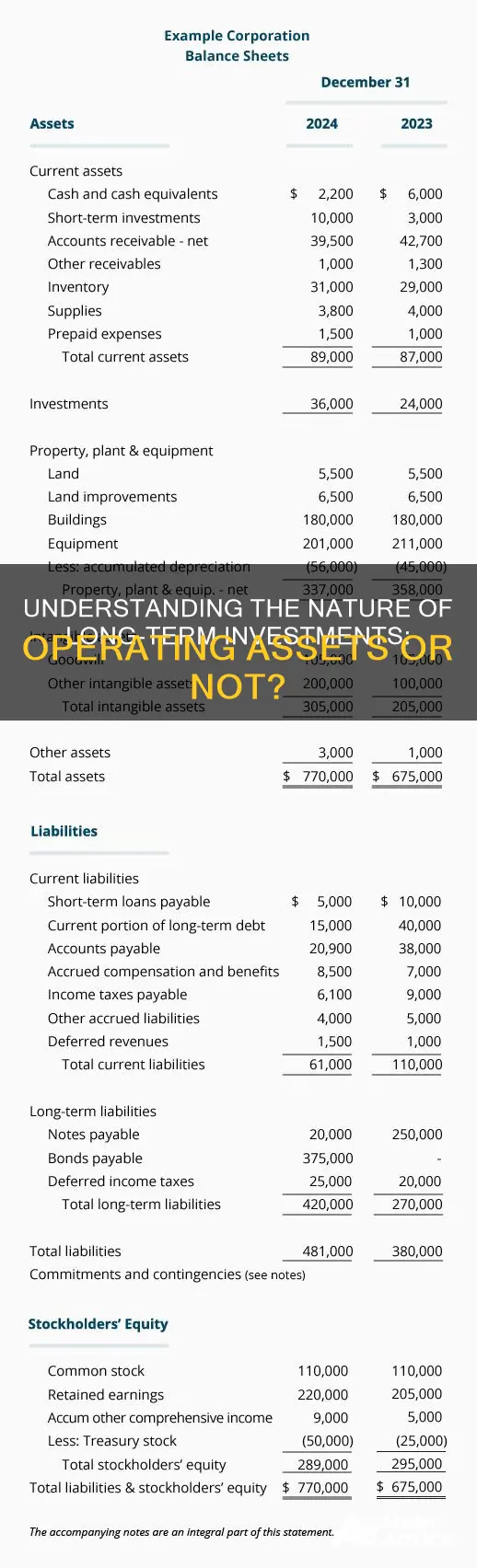

One example is property, plant, and equipment (PPE). This includes tangible assets like buildings, machinery, and vehicles used in the company's operations. These assets are expected to provide long-term benefits and are a crucial part of the business's infrastructure.

When an investment is considered an operating asset, it may be subject to different tax treatments. Depreciation is a common method used to account for the reduction in value of these assets over time. This allows companies to spread the cost of the asset over its useful life, impacting the financial statements and tax liabilities accordingly.

Yes, there are potential risks. If an investment is classified as an operating asset, it may be exposed to market fluctuations, obsolescence, or changes in technology. Companies must carefully assess the nature of the investment and its expected lifespan to ensure accurate financial reporting and risk management.