Gladstone Investment Corporation (GAIN) is a business development company that focuses on acquiring mature, lower middle-market companies with strong fundamentals and management teams. As a publicly-traded fund, it differs from other private equity funds by offering long-term capital without partnership end-of-life deadlines.

Gladstone Capital Corporation (GLAD) is a business development company specialising in lower middle-market, growth capital, and debt investments.

Both companies have been identified as strong buy candidates, with GLAD upgraded from a hold/accumulate status.

| Characteristics | Values |

|---|---|

| Stock Symbol | GAIN |

| Company Name | Gladstone Investment Corporation |

| Business Type | Business development company |

| Focus | Acquiring mature, lower middle market companies with EBITDA between $4 and $15 million |

| Portfolio Diversification | Manufacturing, consumer products, business/consumer services |

| Investment Rating | Strong Buy Candidate |

| 52-Week High | $23.82 |

| 52-Week Low | $9.20 |

| Market Capitalization | 516.017M |

| Next Earnings Date | Jul 24, 2024 |

What You'll Learn

Gladstone Investment's stock price

Gladstone Investments Stock Price

Gladstone Investment Corporation (NASDAQ: GAIN) is a business development company that focuses on acquiring mature, lower middle-market companies. As of July 2024, the stock price for Gladstone Investment Corporation (GAIN) was rated as a "Strong Buy Candidate" by StockInvest.us. The stock price gained 0.127% on July 5, 2024, rising from $23.69 to $23.72. The stock has seen gains for seven consecutive days and is expected to rise by 13.84% over the next three months.

Gladstone Capital Corporation (NASDAQ: GLAD), a business development company specializing in lower middle-market investments, has also been identified as a Strong Buy by StockInvest.us. The stock price for Gladstone Capital Corporation (GLAD) as of July 5, 2024, was $23.72, with a 52-week high of $23.82 and a 52-week low of $9.20. The company recently announced a 1-for-2 reverse stock split, which was approved by its board of directors.

Gladstone Commercial Corporation (NASDAQ: GOOD) is another company in the Gladstone group that focuses on commercial real estate investments. While there is limited information available on its stock price, it has been identified as having a "Neutral pattern" by Yahoo Finance.

Overall, the Gladstone group of companies, particularly Gladstone Investment Corporation (GAIN) and Gladstone Capital Corporation (GLAD), have been identified as strong investment opportunities by stock analysis websites.

Pay-for-Performance: Unraveling the Investment Advisor's Fee Structure

You may want to see also

Gladstone's market outlook

Gladstone Investment Corporation (GAIN) is a business development company that focuses on acquiring mature, lower middle-market companies with strong fundamentals and management teams. Their portfolio is diversified across manufacturing, consumer products, and business/consumer services.

Recent Performance

Gladstone Capital Corporation's stock has been upgraded from a Hold/Accumulate to a Strong Buy Candidate, with a projected annual return of 134.85% over the next 5 years. The stock has gained for 7 consecutive days, rising from $23.69 to $23.72, and is expected to rise further within a strong rising trend over the next 3 months.

Investment Strategy

Gladstone's investment strategy involves providing most, if not all, of the equity and debt capital required for transactions, which increases the speed and certainty of closing deals. As a publicly-traded fund, they differ from other private equity funds by having no partnership end-of-life deadlines, allowing them to provide patient, long-term capital.

Financial Metrics

- Price: $23.72 as of Jul 5, 2024

- 52-Week Range: $9.20 - $23.82

- Market Capitalization: $516.017M

- Next Earnings Date: Jul 24, 2024

Analyst Recommendations

Zacks recommends buying Gladstone Investment Corporation stock, citing positive signals and a strong rising trend. They suggest that investors should take advantage of the current trend and expect further gains in the next 3 months.

The Great Housing Grab: Are Investment Firms Buying Up Our Homes?

You may want to see also

Gladstone's business model

The Gladstone Companies are a family of four publicly traded investment funds, headquartered in the Washington DC area. They provide financing to and acquire lower middle-market companies, acquire commercial real estate and farmland nationwide, and pay monthly cash distributions to their shareholders.

Gladstone Investment Corporation (GAIN), a business development company, is a private equity fund focused on acquiring mature, lower middle-market companies with EBITDA between $4 and $15 million, solid fundamentals, and strong management teams. Gladstone Investment typically provides most, if not all, of the equity and debt capital required to close a transaction, increasing the certainty and speed of closing. As a publicly traded fund, it has no partnership end-of-life deadlines, allowing it to provide patient, long-term capital.

Gladstone Investment's portfolio is diversified across manufacturing, consumer products, and business/consumer services. The company partners with management teams, entrepreneurs, and private equity sponsors to provide financing solutions for its target market segment.

Gladstone Capital, another company within the Gladstone family, also focuses on providing financing solutions for lower middle-market companies by partnering with management teams, entrepreneurs, and private equity sponsors.

Whole Life Insurance: Paying for Protection or Investing in a Policy?

You may want to see also

Gladstone's financial health

Gladstone Investment Corporation (GAIN) is a business development company and private equity fund. It focuses on acquiring mature, lower middle-market companies with earnings of between $4 and $15 million, strong fundamentals, and robust management teams.

Gladstone Investment provides most, if not all, of the equity and debt capital required to close a transaction, increasing the certainty and speed of closing. As a publicly-traded fund, it has no partnership end-of-life deadlines and can provide long-term capital. Its portfolio is diversified across manufacturing, consumer products, and business/consumer services.

The Gladstone Companies, of which Gladstone Investment is a part, are headquartered in the Washington, D.C. area. They provide financing for and acquire lower middle-market companies, acquire commercial real estate and farmland nationwide, and pay monthly cash distributions to their shareholders. The Gladstone Companies consist of four publicly-traded investment funds: Gladstone Capital (GLAD), Gladstone Investment (GAIN), Gladstone Commercial (GOOD), and Gladstone Land (LAND).

Gladstone Capital partners with management teams, entrepreneurs, and private equity sponsors to provide financing solutions for lower middle-market companies nationwide.

Creative Strategies for Paying Investors Who Own a Fifth of Your Company

You may want to see also

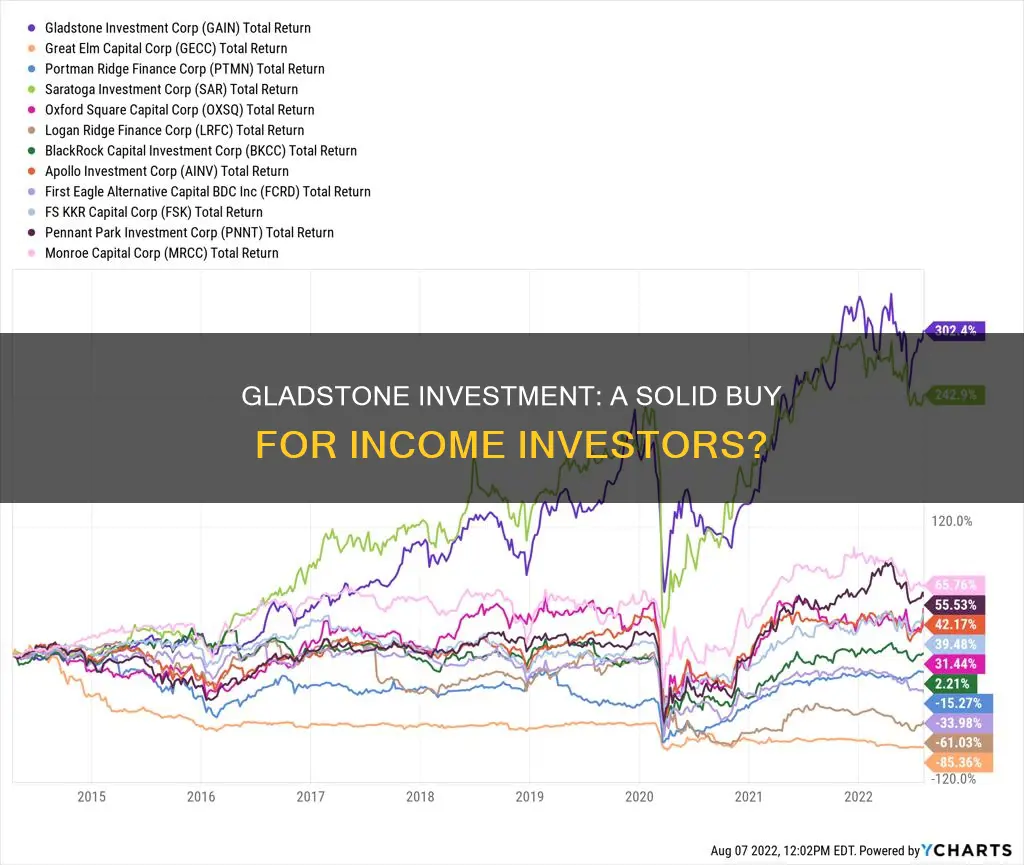

Gladstone's competitors

As a business development company, Gladstone Investment Corporation (NASDAQ: GAIN) has several competitors in the investment banking and securities sector. However, no specific competitors have been identified.

Gladstone Investment is a private equity fund that focuses on acquiring mature, lower middle-market companies with strong fundamentals and management teams. They provide debt and equity investment services to small and mid-sized businesses, and their portfolio is diversified across manufacturing, consumer products, and business/consumer services.

Gladstone Investment's unique approach to middle-market buyouts involves investing alongside management teams and independent sponsors. They provide most, if not all, of the equity and debt capital required to close a transaction, increasing the certainty and speed of closing. As a publicly-traded fund, they have no partnership end-of-life deadlines, allowing them to offer patient, long-term capital.

With their headquarters in McLean, Virginia, and a focus on investing in lower middle-market companies, Gladstone Investment likely competes with other investment firms and private equity funds targeting similar companies and sectors. These competitors may include other business development companies, private equity funds, and investment banks operating in the same geographic regions or targeting similar investment opportunities.

Supplemental Retirement Plans: Maximizing Your Golden Years

You may want to see also

Frequently asked questions

Gladstone Investment Corporation (GAIN) is a business development company and a private equity fund. It focuses on acquiring mature, lower middle-market companies with EBITDA between $4 million and $15 million.

Gladstone Investment's stock symbol is GAIN.

As of July 6, 2024, the price of a Gladstone Capital Corporation (GLAD) share was $23.72.

As of July 6, 2024, Gladstone Capital Corporation stock was upgraded from Hold/Accumulate to Strong Buy Candidate. The stock price has been rising and is expected to rise 13.84% during the next 3 months.