Goodwill is a complex and often misunderstood concept in accounting and finance. It represents the difference between the purchase price of an acquired company and the fair value of its tangible and identifiable intangible assets. While it is not considered a long-term investment in the traditional sense, it plays a crucial role in the financial health of a business. This paragraph will explore the nature of goodwill and its implications for long-term financial planning and decision-making.

What You'll Learn

- Definition and Measurement: Goodwill is a non-physical asset, challenging to quantify and measure accurately over time

- Impairment Testing: Regular assessments are necessary to determine if goodwill has lost value, requiring complex financial analysis

- Amortization Periods: The length of time over which goodwill is amortized varies, impacting its reported value on financial statements

- Market Conditions: Economic fluctuations and industry trends significantly influence the perceived value and longevity of goodwill

- Acquisition Costs: The expenses incurred during an acquisition play a crucial role in determining the initial value of goodwill

Definition and Measurement: Goodwill is a non-physical asset, challenging to quantify and measure accurately over time

Goodwill is a complex and often intangible asset that represents the value of a business's reputation, customer relationships, and brand equity. It is a crucial component of a company's overall value, especially when a business is acquired. However, the very nature of goodwill as a non-physical asset presents a significant challenge when it comes to its definition and measurement over time.

Defining goodwill is the first hurdle. It encompasses the premium paid over the fair value of the tangible assets of a business when one company acquires another. This premium is often attributed to the future economic benefits expected from the acquired company's customer base, market position, and competitive advantages. However, identifying and assigning a value to these intangible assets is a complex task. The challenge lies in determining the fair value of the acquired company's customer relationships, brand recognition, and other intangible factors that contribute to goodwill.

Measuring goodwill accurately is equally difficult. Traditional accounting methods often treat goodwill as an indefinite asset, which can be a source of concern. Over time, the value of goodwill may fluctuate due to various factors such as market changes, competition, and shifts in consumer behavior. As a result, accurately assessing the worth of goodwill becomes a complex and dynamic process. It requires a comprehensive understanding of the acquired company's business, industry trends, and future prospects.

The challenge of measuring goodwill is further compounded by the fact that it is a non-physical asset. Unlike tangible assets like property or equipment, goodwill cannot be physically measured or assessed. Instead, its value is derived from the future cash flows and profitability associated with the acquired company's operations. This makes it challenging to provide a precise and objective measurement of goodwill, especially when the acquired business is part of a larger, more complex organization.

In conclusion, the definition and measurement of goodwill as a non-physical asset are intricate processes. Assigning a value to goodwill requires a deep understanding of the acquired company's unique characteristics and future potential. Accurate measurement over time is essential for financial reporting, investment decisions, and ensuring the integrity of a company's balance sheet. As such, organizations must employ sophisticated methodologies and expert judgment to navigate the complexities of valuing and managing goodwill effectively.

Unraveling the True Nature of Short-Term vs. Long-Term Investments

You may want to see also

Impairment Testing: Regular assessments are necessary to determine if goodwill has lost value, requiring complex financial analysis

Goodwill, an intangible asset representing the premium paid for a business acquisition, is a crucial component of many companies' balance sheets. However, determining whether goodwill is a long-term investment or a potential liability requires a nuanced understanding of impairment testing. Impairment testing is a critical process that ensures the financial statements accurately reflect the current value of goodwill. It involves a comprehensive analysis to assess whether the asset has lost value, which can significantly impact a company's financial health and investor confidence.

The process of impairment testing is intricate and demands a thorough examination of various financial indicators. It requires assessing the fair value of the reporting unit, which is the smallest identifiable group of assets and liabilities that is capable of being sold or disposed of. This involves comparing the carrying amount of the reporting unit, including goodwill, with its recoverable amount, which is the higher of its fair value less costs to sell and its value in use. If the carrying amount exceeds the recoverable amount, an impairment loss is recognized, indicating that the goodwill has lost value.

Regular assessments are essential to ensure the accuracy and reliability of financial statements. Impairment testing should be conducted at least annually, or more frequently if certain events or changes in circumstances suggest a potential impairment. For instance, a company might need to perform an impairment review if there is a significant decline in market value, a change in the business's strategic direction, or an economic downturn affecting the industry. The frequency and depth of these assessments are crucial to maintaining the integrity of financial reporting.

Financial analysts and accountants employ various methods to determine impairment, including comparable company analysis, market multiples, and discounted cash flow models. These techniques involve complex calculations and require a deep understanding of the company's operations, industry trends, and economic factors. The goal is to identify any indicators that suggest the goodwill may be impaired, allowing for prompt corrective actions.

In summary, impairment testing is a critical aspect of managing goodwill as a long-term investment. It requires a meticulous approach, combining financial expertise and a comprehensive understanding of the business and its environment. By conducting regular assessments, companies can ensure that their financial statements accurately reflect the value of goodwill, providing stakeholders with a clear and reliable picture of the organization's financial health. This process is essential for maintaining investor trust and making informed strategic decisions.

Long-Term Investments: Navigating the Balance Between Growth and Liability

You may want to see also

Amortization Periods: The length of time over which goodwill is amortized varies, impacting its reported value on financial statements

The concept of amortization periods is crucial when understanding the treatment of goodwill on financial statements. Goodwill, an intangible asset representing the excess purchase price over the fair value of a company's net tangible assets, is typically amortized over a specific period. This amortization process directly impacts the reported value of goodwill on a company's balance sheet.

The length of the amortization period for goodwill can vary significantly across different industries and companies. This variation is primarily due to the diverse nature of businesses and the unique circumstances surrounding their acquisitions. For instance, a software company acquiring a smaller tech startup might amortize goodwill over a shorter period, reflecting the rapid obsolescence of technology. In contrast, a utility company acquiring a local distribution business might amortize goodwill over a much longer period, considering the stability and longevity of the acquired assets.

The choice of an amortization period involves a trade-off between matching the revenue generated by the goodwill with the expenses incurred to acquire it and providing a realistic representation of the company's financial position. A shorter amortization period results in higher amortization expenses in the early years, which can impact the company's reported earnings and cash flows. Conversely, a longer amortization period spreads the expense over more years, potentially providing a more stable financial picture.

Regulators and accounting standards often provide guidelines for determining the appropriate amortization period for goodwill. These standards aim to ensure that the amortization period is reasonable and reflects the economic substance of the acquisition. For example, the International Financial Reporting Standards (IFRS) require that the amortization period for goodwill should not be longer than 40 years, ensuring a more conservative approach to accounting.

In summary, the amortization period for goodwill is a critical factor in financial reporting, influencing the timing and amount of expenses recognized. Companies must carefully consider the unique characteristics of their acquisitions and adhere to relevant accounting standards to ensure a fair and accurate representation of their financial health. Understanding these amortization periods is essential for investors and analysts to interpret financial statements and assess the long-term investment potential of a company's goodwill.

Maximize Your 10K: Short-Term Investment Strategies for Quick Returns

You may want to see also

Market Conditions: Economic fluctuations and industry trends significantly influence the perceived value and longevity of goodwill

The concept of goodwill in the context of business acquisitions is a complex and often misunderstood aspect of corporate finance. When discussing whether goodwill is a long-term investment, it's crucial to consider the dynamic nature of market conditions and how they impact the value and longevity of this intangible asset. Economic fluctuations and industry trends play a pivotal role in shaping the perception of goodwill's worth and its potential as a long-term holding.

In a thriving economy, where markets are expanding and industries are experiencing growth, the value of goodwill can be more pronounced. During these periods, businesses often expand, acquire new customers, and establish a strong market presence. As a result, the goodwill associated with a company's brand, customer relationships, and competitive advantages becomes more apparent and valuable. For instance, a well-known brand in a growing industry might have significant goodwill due to its established reputation and customer loyalty, making it an attractive long-term investment.

Conversely, economic downturns and industry-specific challenges can significantly impact the perceived value of goodwill. In a recession or when an industry is facing structural changes, businesses might struggle to maintain their market position and customer base. This can lead to a reevaluation of goodwill, as its value is closely tied to the company's ability to sustain and grow its operations. For example, a company in a declining industry might see its goodwill diminish as the market shifts, making it a less attractive long-term investment.

Industry trends also contribute to the fluctuation of goodwill's value. Technological advancements, regulatory changes, and shifts in consumer behavior can all impact a company's goodwill. For instance, a tech company might gain significant goodwill due to its innovative products and services, attracting investors who recognize the long-term potential of its intellectual property. However, if the industry undergoes rapid disruption, the same company's goodwill could be at risk if it fails to adapt.

Understanding the market conditions and their impact on goodwill is essential for investors and business owners alike. Economic cycles and industry dynamics can either enhance or diminish the perceived value of goodwill, influencing its long-term viability as an investment. Therefore, a comprehensive analysis of market conditions is necessary to assess the true potential of goodwill as a strategic asset.

Unlocking Long-Term Wealth: ETFs as a Strategic Investment Strategy

You may want to see also

Acquisition Costs: The expenses incurred during an acquisition play a crucial role in determining the initial value of goodwill

The concept of goodwill is an essential aspect of business valuation, particularly when a company is acquired. It represents the premium paid over the tangible assets of a target company, reflecting the value of its intangible assets, such as brand reputation, customer relationships, and intellectual property. However, the calculation of goodwill is a complex process, and one of the critical factors that significantly influence its determination is the acquisition costs incurred during the purchase.

Acquisition costs encompass a wide range of expenses associated with the process of buying a business. These costs can include legal fees, due diligence expenses, advisory services, and the actual purchase price. When a company is acquired, these costs are directly linked to the creation of goodwill. The initial value of goodwill is calculated by subtracting the net tangible assets (assets minus liabilities) of the target company from the total purchase price. This calculation is a fundamental step in determining the premium that the acquiring company is willing to pay to acquire the target's intangible assets.

The expenses incurred during the acquisition process can vary widely depending on the complexity of the deal and the size of the companies involved. For instance, a large-scale merger or acquisition might involve extensive due diligence, legal contracts, and advisory services, all of which contribute to the overall acquisition costs. These costs are not merely one-time expenses but can have a lasting impact on the financial health of the acquiring company. As such, they play a pivotal role in shaping the initial value of goodwill.

In many cases, the acquisition costs are significant and can sometimes exceed the value of the target company's tangible assets. This is especially true for companies with valuable intangible assets, such as those in the technology, media, or consumer goods sectors. When the acquisition costs are substantial, they directly impact the calculation of goodwill, potentially leading to a higher initial value. This, in turn, can influence the long-term financial strategies of the acquiring company, as it may affect their capital structure, cash flow, and overall investment decisions.

Understanding the relationship between acquisition costs and goodwill is crucial for investors, financial analysts, and business owners. It highlights the importance of thorough due diligence and cost management during the acquisition process. By carefully considering these expenses, companies can ensure that the initial value of goodwill is accurately determined, providing a more reliable basis for long-term investment decisions and financial planning. This process is a critical step in the overall assessment of whether goodwill can be considered a long-term investment, as it directly influences the financial health and stability of the acquiring company.

Unleash Your Financial Power: A Beginner's Guide to Short-Term Investing

You may want to see also

Frequently asked questions

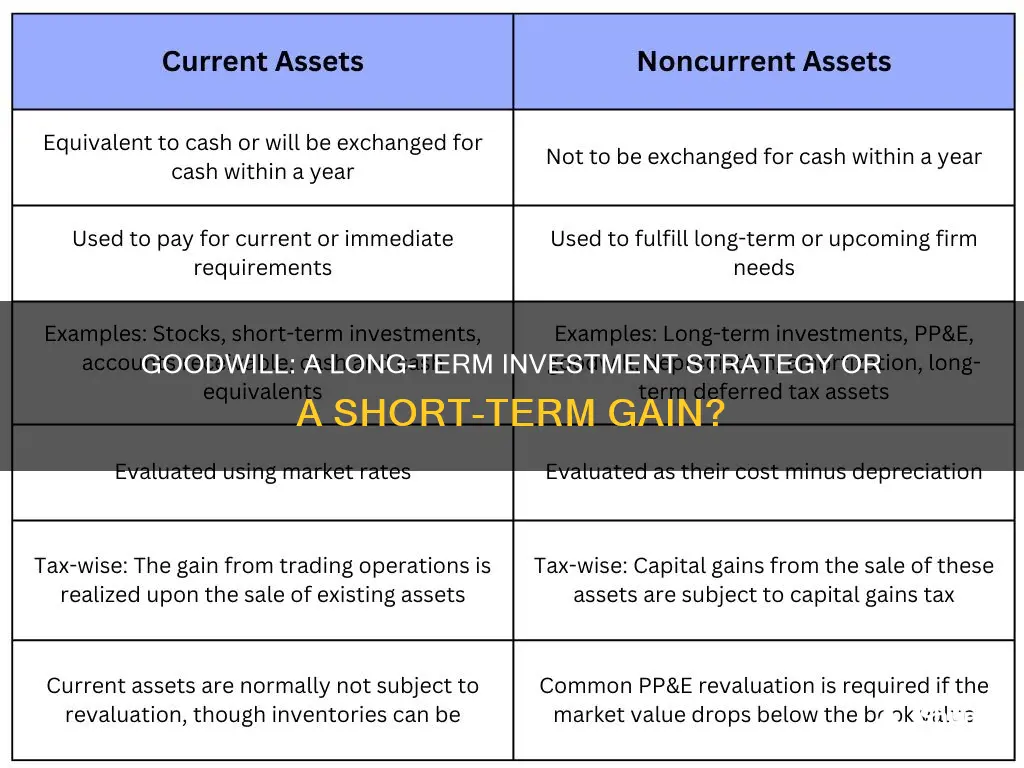

Goodwill is an intangible asset that represents the premium value of a company's reputation, customer relationships, and other factors that contribute to its success. It is often associated with the purchase of a business and represents the difference between the purchase price and the fair market value of the tangible assets.

Goodwill is considered a long-term investment because it is expected to provide benefits to the company over an extended period. It is not a current asset that is readily convertible into cash and is typically not sold or liquidated within a year. Instead, it is amortized over a specific period, usually the useful life of the business or asset it is associated with.

Investors should consider goodwill as it can significantly impact a company's financial health and long-term prospects. A high amount of goodwill may indicate that a company has paid a premium for an acquisition, which could be a sign of future growth potential. However, it also carries the risk of impairment, where the value of goodwill may decrease if the acquired business underperforms.

Yes, goodwill can become impaired, which means its value decreases below its carrying amount. Impairment occurs when the fair value of the asset or business is less than its book value. Companies must perform impairment tests regularly to assess the recoverability of goodwill. If impairment is identified, it is treated as an extraordinary item and can significantly impact the company's financial statements.

Amortization is the process of allocating the cost of goodwill over its useful life. It is a non-cash expense, meaning it doesn't involve an actual cash outflow. Amortization is important for financial reporting as it provides a more accurate representation of a company's financial performance and the value of its assets. The amortization period can vary depending on the specific circumstances of the acquisition and the acquired business.