The world of decentralized finance (DeFi) has opened up new investment opportunities, but it also comes with unique risks. As the DeFi space continues to grow, many investors are wondering: Is investing in DeFi safe? This question is crucial for anyone looking to participate in this innovative financial ecosystem. DeFi, built on blockchain technology, offers a decentralized alternative to traditional financial systems, allowing for peer-to-peer transactions and lending without intermediaries. However, the lack of regulation and the relatively new nature of the technology mean that investors must approach DeFi with caution. This introduction aims to explore the safety aspects of investing in DeFi, considering the potential benefits and risks associated with this emerging financial sector.

What You'll Learn

- Risk Assessment: Understanding the risks and rewards of DeFi investments

- Decentralized Exchanges: Exploring the safety and security of DeFi exchanges

- Smart Contract Audits: The importance of audits in ensuring DeFi contract safety

- Liquidity Provision: How liquidity provision impacts the safety of DeFi investments

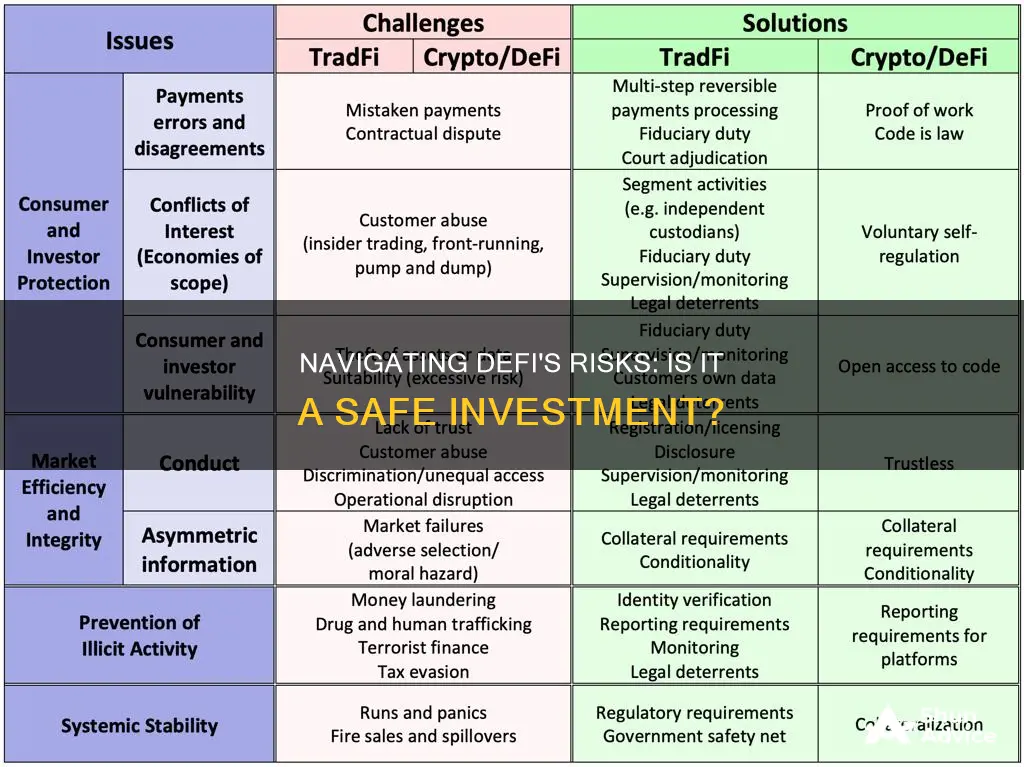

- Regulatory Considerations: Navigating legal and regulatory challenges in DeFi

Risk Assessment: Understanding the risks and rewards of DeFi investments

When considering investments in Decentralized Finance (DeFi), it's crucial to approach with a comprehensive risk assessment in mind. The DeFi space, while offering unprecedented opportunities, also presents unique challenges and potential pitfalls that investors should be aware of. This risk assessment aims to provide a structured understanding of the risks and rewards associated with DeFi investments, enabling investors to make informed decisions.

One of the primary risks in DeFi is the inherent volatility of the market. DeFi protocols and assets are often subject to rapid price fluctuations, which can be influenced by various factors such as market sentiment, regulatory changes, and the overall performance of the cryptocurrency market. This volatility can lead to significant gains but also carries the risk of substantial losses. Investors should be prepared for these price swings and consider implementing risk management strategies, such as setting stop-loss orders or diversifying their portfolios across multiple DeFi projects.

Smart contract security is another critical aspect of DeFi investments. DeFi platforms rely on smart contracts to facilitate transactions and manage assets. While these contracts are designed to be secure, vulnerabilities can exist, and hackers have successfully exploited them in the past. A notable example is the 2020 DeFi yield farming attack, where hackers drained millions of dollars from various DeFi protocols. Investors should conduct thorough research on the security measures implemented by DeFi projects and consider the potential impact of smart contract vulnerabilities on their investments.

Liquidity risk is also a significant consideration in DeFi. Many DeFi protocols rely on liquidity pools, where users provide funds to facilitate trading and earn rewards. However, low liquidity can lead to slippage, where the execution price of a trade deviates significantly from the expected price due to the lack of sufficient market depth. Slippage can result in unfavorable trade outcomes and potential losses. Investors should assess the liquidity of the DeFi projects they are interested in and consider the impact of liquidity risk on their investment strategies.

Regulatory and legal risks are additional factors to consider. The DeFi space is still evolving, and regulatory frameworks are not yet fully established. Changes in cryptocurrency regulations can impact the legality and compliance of DeFi projects. Investors should stay informed about the regulatory landscape and assess the potential risks associated with legal uncertainties in the DeFi sector.

Despite these risks, DeFi investments offer attractive rewards. The decentralized nature of DeFi provides opportunities for higher returns compared to traditional financial systems. DeFi protocols often offer competitive interest rates, yield farming incentives, and the potential for token appreciation. However, it is essential to strike a balance between risk and reward, ensuring that investors are well-informed and prepared for the challenges that come with this innovative financial ecosystem.

In summary, investing in DeFi carries market volatility, smart contract security, liquidity, and regulatory risks. A thorough risk assessment is vital to navigate these challenges. Investors should educate themselves, diversify their portfolios, and stay updated on industry developments to make informed decisions in the ever-evolving world of DeFi.

Is Canvas Annuity a Safe Investment? Unveiling the Truth

You may want to see also

Decentralized Exchanges: Exploring the safety and security of DeFi exchanges

The world of decentralized finance (DeFi) has opened up exciting opportunities for investors, offering a new paradigm for financial services that operates on blockchain technology. Among the various DeFi applications, decentralized exchanges (DEXs) have gained significant attention as they enable peer-to-peer trading without the need for intermediaries. However, as with any investment, it is crucial to understand the safety and security aspects of engaging with these exchanges.

Decentralized exchanges operate on a peer-to-peer model, utilizing smart contracts to facilitate trades directly between users. This architecture provides several advantages, including increased transparency, reduced counterparty risk, and enhanced privacy. Unlike traditional exchanges, DEXs are not controlled by a central authority, making them less susceptible to single points of failure and potential regulatory interventions. This decentralization is a key factor in attracting investors who value autonomy and the elimination of intermediaries.

One of the primary concerns in the DeFi space is the security of user funds. DEXs employ various mechanisms to safeguard assets, such as multi-signature wallets, which require multiple approvals for transactions, and liquidity pools that provide a decentralized source of funds. These measures aim to prevent unauthorized access and mitigate the risks associated with smart contract vulnerabilities. Additionally, the open-source nature of many DEX platforms allows for community-driven audits and continuous improvement, ensuring that security is a top priority.

However, the very nature of DeFi also presents certain challenges. Smart contracts, while innovative, can be complex and may contain bugs or vulnerabilities. These issues have led to significant losses in the past, highlighting the importance of thorough due diligence. Investors should carefully review the code of the DEX they intend to use, assess the security audits conducted, and consider the reputation and track record of the project. Staying informed about the latest security developments and best practices in the DeFi community is essential for making well-informed investment decisions.

Furthermore, the regulatory landscape surrounding DeFi is still evolving. Investors should be aware of the legal and compliance considerations associated with this emerging space. As DeFi gains traction, regulators are increasingly focusing on ensuring consumer protection and market integrity. Staying updated on regulatory changes and understanding the legal implications of investing in DeFi exchanges is vital to navigate this evolving environment safely.

In summary, decentralized exchanges in the DeFi ecosystem offer a promising alternative to traditional financial systems, providing enhanced security and transparency. While the benefits are significant, investors must approach this space with caution, conducting thorough research and staying informed about security practices and regulatory developments. By understanding the unique characteristics of DEXs, investors can make more confident decisions and potentially benefit from the innovative nature of DeFi while minimizing risks.

Who is Drew Butler? Age and Investment Management Career Explored

You may want to see also

Smart Contract Audits: The importance of audits in ensuring DeFi contract safety

The world of decentralized finance (DeFi) has revolutionized the way we interact with financial systems, offering unprecedented accessibility and transparency. However, the very nature of DeFi, which relies on smart contracts, also introduces unique risks. These risks are primarily associated with the potential for vulnerabilities and bugs within the code, which could lead to significant financial losses. This is where smart contract audits come into play as a critical safeguard.

Smart contract audits are a comprehensive process of reviewing and analyzing the code of these contracts to identify and rectify potential security flaws, logical errors, and compliance issues. These audits are essential in the DeFi space because they provide a layer of assurance that the contracts are secure, reliable, and function as intended. By engaging professional auditors, DeFi projects can ensure that their smart contracts are robust and resistant to exploitation.

The process typically involves a thorough examination of the contract's architecture, logic, and interactions with other contracts and systems. Auditors use a variety of tools and techniques, including static analysis, code reviews, and formal verification, to detect potential issues. These issues may include reentrancy attacks, integer overflows, unauthorized access, and other common vulnerabilities that could compromise the integrity and security of the DeFi protocol.

One of the key benefits of smart contract audits is the ability to proactively identify and fix issues before they become critical problems. By doing so, projects can prevent potential exploits and maintain the trust of their users. Audits also help in ensuring compliance with industry standards and best practices, which is crucial for attracting institutional investors and mainstream adoption. Furthermore, a well-audited contract can enhance the overall reputation of the DeFi project, making it more attractive to investors and users alike.

In the context of investing in DeFi, smart contract audits provide a much-needed layer of confidence. Investors can make more informed decisions by knowing that the contracts they are engaging with have been rigorously tested and evaluated. This transparency and security assurance can encourage more people to participate in the DeFi ecosystem, driving its growth and development. As the DeFi space continues to evolve, smart contract audits will remain a vital component, ensuring the safety and reliability of these innovative financial systems.

A Guide to Investing in the S&P 500 from India

You may want to see also

Liquidity Provision: How liquidity provision impacts the safety of DeFi investments

Liquidity provision is a critical aspect of decentralized finance (DeFi) that significantly influences the safety and stability of investments within this emerging financial ecosystem. In the context of DeFi, liquidity provision refers to the process of supplying funds or assets into a liquidity pool, which is a fundamental component of many decentralized exchanges and financial protocols. This mechanism ensures that users can trade and interact with various financial instruments without the need for intermediaries, offering a more transparent and efficient system.

When investors provide liquidity, they contribute to the pool of funds available for trading, enabling the execution of transactions and facilitating the functioning of the entire DeFi network. This process is particularly important in automated market maker (AMM) protocols, where liquidity providers earn rewards in the form of fees or tokens for their contributions. The concept of liquidity provision is essential for maintaining market depth and ensuring that trading pairs remain liquid, allowing investors to enter and exit positions with minimal slippage.

The safety of DeFi investments is closely tied to the stability and reliability of liquidity provision. Adequate liquidity ensures that investors can quickly convert their assets into the desired currency without significant price fluctuations, which is crucial for risk management. Inadequate liquidity, on the other hand, can lead to increased price volatility and potential losses for investors. Liquidity providers play a vital role in mitigating these risks by ensuring that the market remains deep and liquid, especially during periods of high trading volume or market volatility.

One of the key benefits of liquidity provision is the ability to provide price oracles and market-making services. Liquidity providers often act as market makers, quoting both buy and sell prices for various assets, which helps to maintain order book depth and reduce the impact of large trades on asset prices. This mechanism is essential for preventing front-running and ensuring fair trading practices within the DeFi space. By providing liquidity, investors contribute to a more efficient and stable market environment, reducing the risks associated with price manipulation and market manipulation.

However, the safety of DeFi investments also depends on the security of the protocols and platforms that facilitate liquidity provision. Smart contract vulnerabilities and security breaches can lead to significant losses for liquidity providers and the wider DeFi community. Therefore, it is crucial for investors to conduct thorough research, assess the security measures implemented by the protocols, and diversify their investments across multiple platforms to minimize risks. Additionally, the decentralized nature of DeFi encourages community governance and transparency, allowing investors to actively participate in decision-making processes and contribute to the overall security and safety of the ecosystem.

Understanding the Risk of Losing Your Investments

You may want to see also

Regulatory Considerations: Navigating legal and regulatory challenges in DeFi

The decentralized finance (DeFi) space, while offering immense potential for innovation and financial inclusion, is not without its legal and regulatory complexities. As the industry continues to evolve, investors and participants must navigate a web of legal considerations to ensure compliance and mitigate risks. Here's an overview of the regulatory landscape and the challenges it presents:

Understanding the Regulatory Environment: DeFi operates in a gray area between traditional financial systems and emerging technologies. Regulators worldwide are still grappling with how to classify and oversee these novel financial instruments. The lack of a uniform regulatory framework means that DeFi protocols and platforms may be subject to varying legal standards across different jurisdictions. This complexity can be daunting for investors, especially those new to the space, as it requires a deep understanding of local financial laws and compliance requirements.

Legal Classification and Compliance: One of the primary challenges is determining the legal classification of DeFi products and services. Are they securities, derivatives, or something else entirely? This classification often depends on the specific nature of the DeFi offering and the jurisdiction in question. For instance, a decentralized lending protocol might be considered a security in one country but not in another. As a result, investors must carefully analyze the legal implications and ensure that their activities comply with local regulations to avoid unintended legal consequences.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: DeFi's decentralized nature, while promoting openness, also presents challenges for AML and KYC procedures. Traditional financial institutions have established processes to verify customer identities and monitor transactions for suspicious activities. In DeFi, these processes need to be adapted to fit the decentralized model. Many DeFi platforms are now implementing self-sovereign identity solutions and on-chain KYC protocols to comply with regulatory requirements while maintaining user privacy and security.

Smart Contract Audits and Security: The use of smart contracts is integral to DeFi, but they also introduce unique legal considerations. Smart contracts are self-executing and transparent, but they can also be complex and prone to vulnerabilities. Investors should be aware of the potential risks associated with smart contract code, including the possibility of bugs, backdoors, or other security flaws. Regular security audits and robust testing are essential to mitigate these risks. Additionally, as smart contracts are often governed by international law, understanding the legal implications of on-chain agreements is crucial.

Navigating Tax Implications: The tax treatment of DeFi activities is another area of concern. As DeFi gains popularity, tax authorities are increasingly focusing on this space. Investors must consider the tax implications of their DeFi engagements, including staking rewards, yield farming, and token swaps. Tax laws vary by region, and what may be tax-free in one country could be taxable in another. Staying informed about local tax regulations and seeking professional advice is essential to ensure compliance.

In summary, while DeFi offers exciting opportunities, investors must approach it with a keen awareness of the regulatory landscape. Navigating legal and regulatory challenges requires a comprehensive understanding of local financial laws, compliance measures, and the unique characteristics of DeFi. As the industry matures, regulatory clarity is expected to improve, but for now, investors must stay informed and adapt to the evolving legal environment to ensure a safe and compliant DeFi journey.

NRI Investment: India or USA?

You may want to see also

Frequently asked questions

Decentralized Finance (DeFi) is an emerging financial technology that aims to revolutionize traditional banking by utilizing blockchain and smart contracts. It allows users to access financial services without intermediaries like banks. DeFi platforms offer various services such as lending, borrowing, trading, and earning interest, all while maintaining control and ownership of assets in the hands of users.

While DeFi offers exciting opportunities, it is essential to approach it with caution. The space is still relatively new and evolving, and it carries certain risks. Smart contract vulnerabilities, liquidity issues, and market volatility are some of the potential risks associated with DeFi. However, many projects are actively working on improving security and transparency. Users should conduct thorough research, diversify their investments, and consider using reputable DeFi platforms to mitigate risks.

Protecting your funds in DeFi involves several strategies. Firstly, ensure you understand the risks and only invest what you can afford to lose. Secondly, use trusted and audited protocols, as they are more likely to have robust security measures. Thirdly, enable two-factor authentication (2FA) and use secure wallets to store your assets. Additionally, stay informed about the latest security practices and keep your software updated to patch any vulnerabilities.