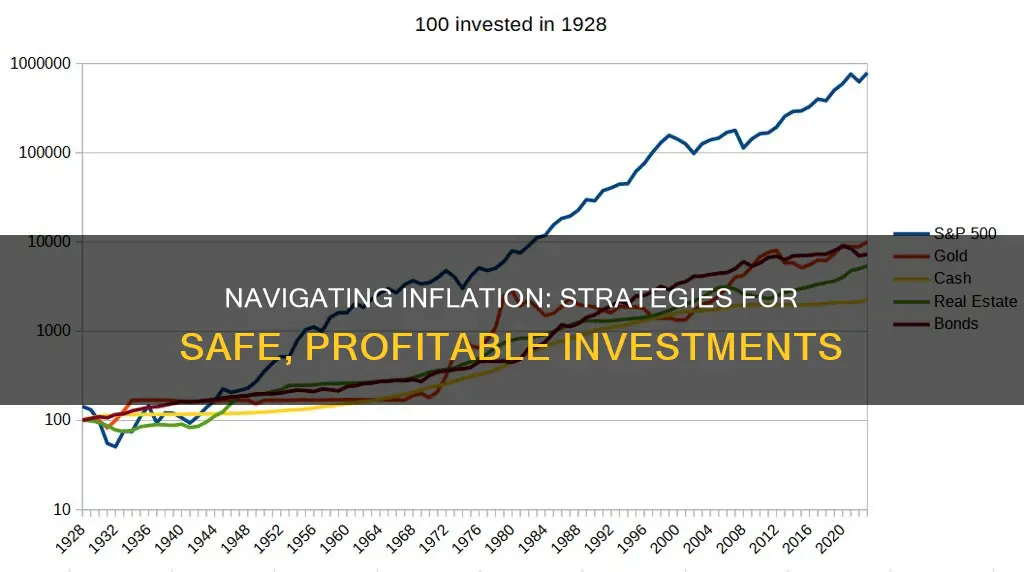

Inflation can erode the value of your money over time, making it crucial to invest wisely to protect your financial future. During periods of rising prices, certain investments can help safeguard your wealth and even offer opportunities for growth. In this article, we'll explore some of the best safe investments to consider during inflation, providing you with the knowledge to make informed decisions and secure your financial well-being.

What You'll Learn

- Treasury Bills: Short-term, low-risk, and highly liquid, offering protection against inflation

- High-Yield Savings Accounts: These offer higher interest rates, providing a hedge against inflation

- Real Estate Investment Trusts (REITs): Diversify with REITs to benefit from property appreciation and rental income

- Inflation-Indexed Bonds: These bonds adjust their value with inflation, ensuring real returns

- Commodities: Gold, silver, and other commodities can act as a hedge against inflation

Treasury Bills: Short-term, low-risk, and highly liquid, offering protection against inflation

Treasury bills are a type of short-term debt instrument issued by the government, typically with maturities ranging from a few days to a year. They are considered one of the safest investments during periods of inflation due to their low-risk nature and the fact that they are backed by the full faith and credit of the government. This means that investors can be confident that they will receive the principal amount back at maturity, providing a secure hedge against inflation.

One of the key advantages of Treasury bills is their liquidity. They are highly liquid assets, meaning they can be easily bought and sold in the market. This liquidity ensures that investors can access their funds quickly if needed, making Treasury bills a versatile investment option. During times of economic uncertainty or rising inflation, investors often seek safe-haven assets, and Treasury bills fit this criterion perfectly.

The short-term nature of Treasury bills also makes them an attractive choice. With maturities ranging from a few days to a year, these bills offer investors a way to park their money in a secure and accessible manner. This is particularly useful for those who want to preserve capital and generate a modest return while also protecting against the eroding effects of inflation. As inflation rises, the purchasing power of money decreases, and Treasury bills provide a way to maintain the value of one's investment.

In addition to their safety and liquidity, Treasury bills offer a competitive return, especially when compared to other low-risk investments. While the returns may not be as high as some other investments, they provide a reliable and consistent income stream, which is crucial during inflationary periods. Investors can benefit from the stability of the government's creditworthiness while also having the flexibility to reinvest the proceeds into other opportunities as needed.

For those seeking a safe and inflation-resistant investment, Treasury bills are an excellent choice. Their short-term nature, low risk, and high liquidity make them a versatile and accessible option. By investing in Treasury bills, individuals can protect their capital and generate a modest return, ensuring that their money retains its value even during challenging economic times. This investment strategy is particularly appealing to risk-averse investors who prioritize capital preservation and inflation protection.

Microsoft: A Safe Investment Choice for the Long Haul

You may want to see also

High-Yield Savings Accounts: These offer higher interest rates, providing a hedge against inflation

In times of rising inflation, investors often seek safe havens for their money, and high-yield savings accounts have emerged as a popular choice. These accounts offer a unique blend of safety and potential returns, making them an attractive option for those looking to protect their wealth. Here's a detailed look at why high-yield savings accounts can be a wise investment strategy during periods of inflation.

High-yield savings accounts, often provided by online banks or credit unions, offer significantly higher interest rates compared to traditional savings accounts. While inflation erodes the purchasing power of money, these accounts provide a way to potentially outpace the rising costs of goods and services. The key advantage is that they are typically FDIC-insured or similar insurance schemes, ensuring the safety of your principal amount. This insurance guarantees that your money is protected up to a certain amount, providing peace of mind for investors.

When inflation is high, central banks often respond by raising interest rates. This can lead to higher returns on savings accounts, as the interest rates offered by financial institutions tend to move in tandem with central bank policies. As a result, high-yield savings accounts can offer a competitive advantage over traditional savings, allowing investors to grow their money at a faster rate. This is particularly beneficial for those looking to save for short-term goals or maintain a liquid asset for unexpected expenses.

One of the most appealing aspects of high-yield savings accounts is their accessibility. These accounts are often easily accessible through online banking platforms, allowing investors to manage their money conveniently. Many providers offer the ability to open and fund accounts online, providing a seamless experience for those who prefer digital banking. This accessibility ensures that investors can take advantage of higher interest rates without the need for extensive paperwork or frequent trips to a physical bank.

Additionally, high-yield savings accounts can be a strategic tool for diversifying one's investment portfolio. By allocating a portion of your savings to these accounts, you can balance the need for safety with the potential for growth. This approach allows investors to benefit from the higher interest rates while still having access to their funds when needed. It's a prudent strategy for those who want to make the most of their savings during challenging economic times.

In summary, high-yield savings accounts offer a compelling solution for investors seeking safe investments during periods of inflation. With their competitive interest rates, insurance protection, and accessibility, these accounts provide a hedge against rising costs while also offering the potential for growth. By incorporating high-yield savings into an investment strategy, individuals can navigate economic challenges and work towards their financial goals with greater confidence.

Where to Invest: India or USA?

You may want to see also

Real Estate Investment Trusts (REITs): Diversify with REITs to benefit from property appreciation and rental income

Real Estate Investment Trusts (REITs) offer a unique and attractive investment strategy, especially during periods of inflation. These trusts are a powerful tool for investors seeking to diversify their portfolios and benefit from the real estate market's resilience. By investing in REITs, you gain exposure to the property market without directly owning physical real estate, which can be a significant advantage in times of economic uncertainty.

REITs are companies that own and operate income-generating real estate properties. They are structured as trusts, allowing them to offer shares to investors. The primary source of income for REITs is rental payments from the properties they own, which can include office buildings, shopping malls, apartments, and even data centers. This rental income provides a steady cash flow, making REITs an attractive option for investors looking for regular returns. During inflationary periods, when traditional investments may struggle, REITs often demonstrate remarkable stability due to their diverse property portfolio and the inherent value of real estate.

One of the key benefits of REITs is the potential for property appreciation. As inflation rises, the value of real estate tends to increase, and REITs can leverage this trend. When the economy is performing well, and inflation is under control, REITs can benefit from the overall growth of the property market. This appreciation can lead to higher share prices, providing investors with capital gains. Additionally, REITs offer a hedge against inflation as the rental income they generate can often keep pace with or even outpace rising prices, ensuring that investors maintain their purchasing power.

Diversification is a critical aspect of managing risk in investments, and REITs excel in this area. By investing in a REIT, you gain exposure to multiple properties and locations, reducing the impact of any single property's performance. This diversification strategy is particularly important during inflationary periods when certain sectors or regions may be more affected than others. With REITs, your investment is spread across various assets, providing a more stable and balanced approach to real estate investment.

In summary, Real Estate Investment Trusts (REITs) are a valuable addition to an investment portfolio, especially when considering the challenges of inflation. They offer a unique combination of rental income, property appreciation, and diversification. By investing in REITs, you can benefit from the real estate market's inherent value and stability, even during economic fluctuations. This strategy allows investors to navigate inflationary periods with a sense of security and the potential for long-term growth.

European Equities: A Smart Investment Choice

You may want to see also

Inflation-Indexed Bonds: These bonds adjust their value with inflation, ensuring real returns

Inflation-indexed bonds are a type of fixed-income security designed to protect investors from the eroding effects of inflation. These bonds are a valuable tool for those seeking to preserve the purchasing power of their investments over time. Here's a detailed look at how they work and why they can be a safe investment during periods of rising prices.

When you invest in a traditional bond, you typically receive a fixed interest rate over a specified period. However, during inflationary periods, the purchasing power of that interest payment diminishes. Inflation-indexed bonds address this issue by adjusting the bond's value in relation to inflation. As inflation rises, the bond's value increases, ensuring that the real return (after accounting for inflation) remains positive. This is achieved through a mechanism called indexing, where the bond's principal and interest payments are adjusted based on a specific inflation measure, such as the Consumer Price Index (CPI).

For example, if you purchase an inflation-indexed bond with a face value of $1,000 and an initial interest rate of 2%, the bond's value will be adjusted annually based on the inflation rate. If inflation rises by 3% in the first year, the bond's value will increase to $1,030 (1000 * 1.03). In the second year, if inflation remains at 3%, the interest payment will be applied to this new value, resulting in a higher real return for the investor. This process continues until maturity, ensuring that the bond's value keeps pace with or exceeds inflation.

One of the key advantages of inflation-indexed bonds is their ability to provide stable, real returns over time. This makes them an attractive option for investors looking to protect their portfolios during periods of economic uncertainty and rising prices. These bonds are particularly suitable for long-term investors who want to ensure that their savings maintain their value in the face of inflation.

Additionally, these bonds often offer lower risk compared to other investments during inflationary periods. Since the bond's value is directly linked to inflation, it provides a hedge against the potential depreciation of other asset classes. This characteristic makes inflation-indexed bonds a popular choice for conservative investors who prioritize capital preservation.

In summary, inflation-indexed bonds are a strategic investment option for those aiming to safeguard their wealth during inflation. By adjusting their value in line with inflation, these bonds offer real returns that can outpace the erosion of purchasing power. This makes them a valuable addition to any investment portfolio, especially in uncertain economic times.

Strategies for a Smart Home Investment

You may want to see also

Commodities: Gold, silver, and other commodities can act as a hedge against inflation

Inflation can erode the value of money over time, making it crucial for investors to seek assets that can maintain or even increase their purchasing power. One of the most well-known and widely recognized safe-haven investments during inflationary periods is gold. Gold has a long history of being a reliable store of value, often referred to as 'the yellow metal'. When inflation rises, the purchasing power of currencies tends to decrease, and gold's intrinsic value becomes more apparent as a tangible asset. It is a finite resource, and its supply is limited, which makes it a valuable commodity. During times of economic uncertainty or when inflation is high, investors often turn to gold as a safe-haven investment, buying it to protect their wealth and as a hedge against the potential devaluation of currencies.

Silver, another precious metal, also serves as a valuable hedge against inflation. Often considered a 'poor man's gold', silver is more affordable and can be a cost-effective way to diversify one's investment portfolio. Like gold, silver has intrinsic value and is a finite resource, making it a stable investment during inflationary periods. Its industrial uses and increasing demand for jewelry and other products further solidify its status as a safe investment.

Beyond precious metals, other commodities such as oil, natural gas, and agricultural products can also act as effective hedges against inflation. These commodities are essential for various industries and daily life, and their prices tend to rise during inflationary trends. For instance, oil is a critical resource for transportation and manufacturing, and its price often increases when inflation is high, providing a hedge for investors. Similarly, natural gas and agricultural products like wheat or corn can be valuable investments as their prices may rise due to inflationary pressures on food and energy costs.

Investing in commodities can be done through various means, including physical purchases, exchange-traded funds (ETFs), or futures contracts. Physical gold and silver can be bought and stored, providing a tangible asset that retains value. ETFs that track the performance of specific commodities or commodity indices offer a more liquid and cost-effective way to invest in these assets. Futures contracts allow investors to speculate on the future price movements of commodities, providing leverage and the potential for significant returns.

In summary, during periods of high inflation, commodities such as gold, silver, oil, natural gas, and agricultural products can serve as excellent hedges against the erosion of currency value. These investments have a proven track record of maintaining or increasing their value during inflationary trends, making them attractive options for investors seeking to protect their wealth and diversify their portfolios.

Revisiting Investment Portfolio: Strategies for Staying Ahead

You may want to see also