A company's cash flow statement is a crucial indicator of its financial health and efficiency. It provides an overview of the sources and use of cash over a specific period, including cash flow from operations, investing, and financing activities. This statement is particularly useful for understanding a company's investment performance and capital allocation decisions. Cash flow from investing activities (CFI) is a section of the cash flow statement that details the cash inflows and outflows from investment activities, including the acquisition and disposal of long-term assets, investments in securities, and acquisitions of other businesses.

| Characteristics | Values |

|---|---|

| Definition | Cash flow from investing activities |

| Type of financial statement | Cash flow statement |

| section of | Cash flow statement |

| Reports | How much cash has been generated or spent from various investment-related activities in a specific period |

| Includes | Purchases of physical assets, investments in securities, or the sale of securities or assets |

| Capital expenditures | |

| Loans made to third parties | |

| Proceeds from the sale of a division or cash out as a result of a merger or acquisition | |

| Calculation | Total cash inflow – Total cash outflow |

What You'll Learn

- Investing activities include purchases of physical assets, investments in securities, or the sale of securities or assets

- Negative cash flow from investing activities is not always a bad sign, it can indicate that management is investing in the long-term health of the company

- Cash flow from investing activities reveals a company's investment performance and capital allocation decisions

- Cash flow from investing activities is calculated by subtracting total cash outflows from total inflows related to investing activities to find the net cash flow

- A positive net cash flow from investing activities indicates that a company is effectively managing its investments and can be a sign of future growth and profitability

Investing activities include purchases of physical assets, investments in securities, or the sale of securities or assets

Investing activities are a crucial component of a company's cash flow statement, offering insights into its investment performance and capital allocation decisions. These activities encompass a range of transactions, including the acquisition and disposal of assets, investments in securities, and mergers or acquisitions.

One of the key aspects of investing activities is the purchase of physical assets, such as property, plant, and equipment (PP&E). This falls under capital expenditures, which are essential for the growth and development of a business. When a company invests in physical assets, it is typically reflected as a cash outflow in the investing activities section of the cash flow statement.

Another important facet of investing activities is investments in securities. This involves purchasing marketable securities such as stocks, bonds, debentures, and other financial instruments. These investments can be made to generate income or as long-term investments to support the company's health and performance. The acquisition of securities is usually associated with a negative cash flow, as it involves spending money on investments.

On the other hand, investing activities also include the sale of securities or assets. When a company sells securities or assets, it generates a positive cash flow. This can include proceeds from the sale of fixed assets, such as property or equipment, as well as the sale of investment securities.

It's important to note that investing activities are separate from operating activities and financing activities, which are also reflected in the cash flow statement. Operating activities cover day-to-day business operations, while financing activities relate to funding the company's operations through debt, equity, or other means.

Overall, investing activities provide valuable information about a company's financial health, growth prospects, and capital allocation strategies. They are a key indicator of how effectively a company manages its cash and investments, contributing to its long-term success and profitability.

Understanding Owner Cash Investments: Reporting and Strategies

You may want to see also

Negative cash flow from investing activities is not always a bad sign, it can indicate that management is investing in the long-term health of the company

Negative cash flow from investing activities is not always indicative of poor financial health. It can be a sign that a company is investing in long-term assets, research, or other long-term development activities that are crucial to the company's health and continued operations.

For example, a company may invest in fixed assets such as property, plant, and equipment to expand its business. While this may signal a negative cash flow from investing activities in the short term, it could potentially help the company generate cash flow in the long term. Similarly, a company may choose to invest cash in short-term marketable securities to boost profits.

A company's cash flow statement can offer insights into its investment performance and capital allocation decisions. It is important to closely examine the cash flow statement to determine whether negative cash flow is a result of poor management or strategic investments for future growth.

Negative cash flow is common among new businesses with high start-up costs and growing companies that invest heavily in long-term assets. As long as these investments are managed well, they can lead to significant growth and gains in the long term.

It is also essential to consider the stage of the corporate lifecycle, the reason behind the negative cash flow, the type of capital investments being made, and the funding sources when evaluating the financial health of a company with negative cash flow.

Understanding Dividends: Cash Dividends and Their Nature

You may want to see also

Cash flow from investing activities reveals a company's investment performance and capital allocation decisions

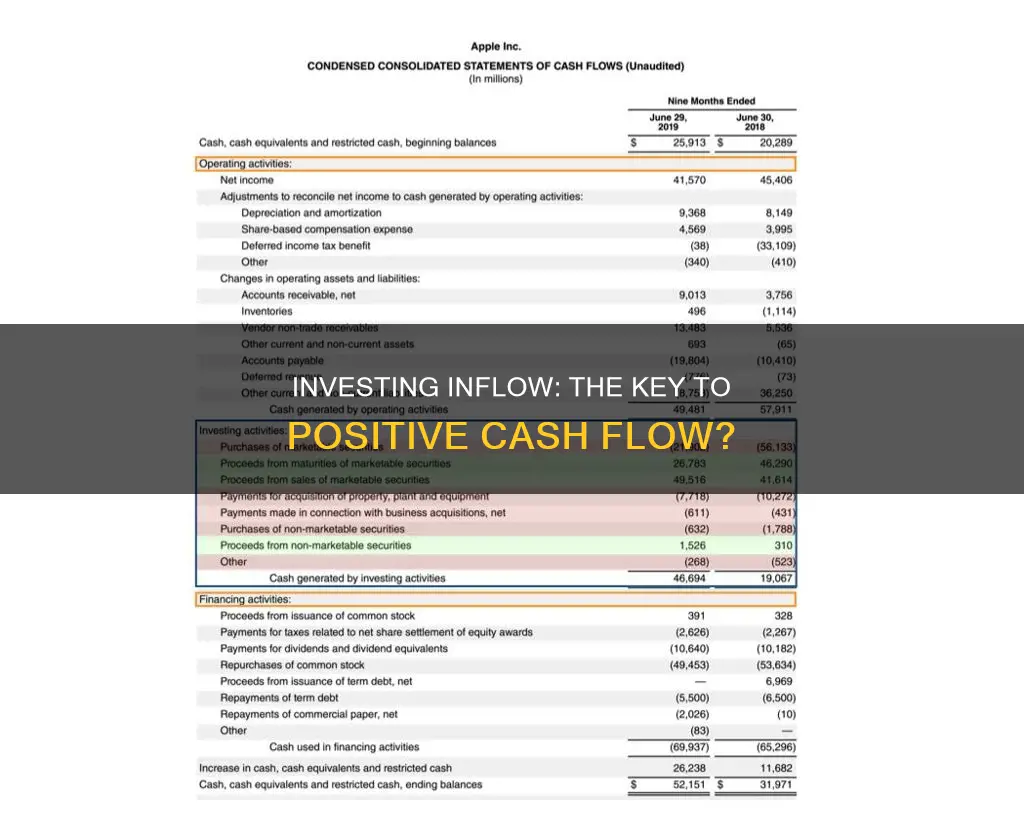

Cash flow from investing activities (CFI) is a critical component of a company's cash flow statement, offering valuable insights into its financial health and strategic direction. CFI reveals a company's investment performance and capital allocation decisions by capturing cash transactions related to long-term assets and investment activities.

CFI includes cash inflows and outflows from the acquisition or disposal of long-term assets, such as property, plant, equipment, and investments. These activities can be positive (cash generated by sales) or negative (cash spent on acquisitions or investments). For example, a company investing in a new factory building would record a cash outflow, while the sale of old machinery would result in a cash inflow.

Understanding CFI is essential for evaluating a company's commitment to growth and expansion. A positive CFI indicates a company's willingness to invest in new projects and technologies, while a negative CFI may signal a focus on divestment or significant capital expenditures. CFI also provides insights into a company's ability to optimise its asset base and manage its investments effectively.

Additionally, CFI helps stakeholders analyse a company's strategic decisions and capital allocation. It showcases whether a company prioritises internal growth or seeks external opportunities. By interpreting CFI alongside other financial indicators, investors, lenders, and management can make informed decisions about a company's investment strategies, financial health, and long-term growth potential.

Overall, CFI is a pivotal tool for assessing a company's investment activities, capital allocation, and long-term strategic vision. It provides a comprehensive view of a company's financial decisions and their potential impact on future success.

Enhancing Cash Flow: Investing Strategies for Positive Returns

You may want to see also

Cash flow from investing activities is calculated by subtracting total cash outflows from total inflows related to investing activities to find the net cash flow

Cash flow from investing activities is a critical component of a company's financial health assessment, providing insights into its investment performance and capital allocation decisions. This section of the cash flow statement outlines the cash inflows and outflows from investment activities, primarily involving the acquisition and disposal of long-term assets such as property, plant, equipment, and investments in marketable securities.

To calculate cash flow from investing activities, it is essential to identify and sum up all the relevant cash inflows and outflows. Cash inflows typically include proceeds from asset sales, dividends received, and interest earned on investments. In contrast, cash outflows encompass purchases of property, plant, equipment, and investments in securities or other businesses.

The formula for calculating cash flow from investing activities is straightforward:

Cash flow from investing activities = Total cash inflows from investing activities – Total cash outflows from investing activities

By subtracting the total cash outflows from the total cash inflows, we can determine the net cash flow from investing activities. This calculation provides a clear picture of the company's investment-related cash position and helps assess its ability to generate cash from these activities.

For example, let's consider a company that has the following investing activities for a given year:

- Cash inflow from the sale of an old factory building: $2,000,000

- Cash outflow for the purchase of new machinery: $1,500,000

- Cash outflow for the acquisition of another company: $500,000

- Cash inflow from dividends received on investments: $200,000

Using the formula, we can calculate the net cash flow from investing activities as follows:

Cash flow from investing activities = $2,000,000 – ($1,500,000 + $500,000) + $200,000 = $200,000

In this example, the company has a positive net cash flow from investing activities, indicating that their investment decisions have resulted in a net cash gain of $200,000 for that particular year.

It is important to note that a positive cash flow from investing activities suggests effective investment management and strategic decisions that can enhance future growth and profitability. On the other hand, a negative cash flow may not always be a cause for concern, as it could indicate investments in the long-term health and growth of the company, such as research and development.

Cashing Out Stash Investments: A Step-by-Step Guide

You may want to see also

A positive net cash flow from investing activities indicates that a company is effectively managing its investments and can be a sign of future growth and profitability

A positive net cash flow from investing activities is a good sign for a company, indicating effective management of investments and potential future growth and profitability. This is because the company is generating more cash from its investing activities than it is spending.

A positive net cash flow from investing activities can be the result of a company's successful investment decisions and strategic investments in long-term assets. This may include the acquisition of physical assets, such as property, plant, and equipment, or the purchase and sale of investment securities, such as stocks and bonds. Positive cash flow can also be achieved through the collection of loans, proceeds from insurance settlements, or the sale of old machinery or business units.

A company's cash flow statement provides valuable insights into its financial health and performance. It is one of the three main financial statements used by businesses, alongside the balance sheet and income statement. The cash flow statement bridges the gap between the income statement and the balance sheet by detailing the sources and uses of cash within a specific period.

While negative cash flow from investing activities is often associated with poor performance, it is important to note that this is not always the case. Negative cash flow can indicate that a company is investing in long-term assets and the health of the company, which may lead to significant growth and gains if managed effectively. Therefore, it is crucial to analyse the entire cash flow statement and consider the specific context of the company's operations and investments.

In summary, a positive net cash flow from investing activities is a positive indicator of a company's financial health and management effectiveness. It suggests that the company is making profitable investment decisions and positioning itself for future growth and profitability.

Cash App Investing: How to Stop and Withdraw

You may want to see also

Frequently asked questions

Cash flow from investing activities (CFI) is a section of a company's cash flow statement that shows the cash generated by or spent on investment activities.

Investing activities include the purchase of physical assets, investments in securities, or the sale of securities or assets.

To calculate cash flow from investing activities, add the purchases or sales of property and equipment, other businesses, and marketable securities.

Cash flow from investing activities is important because it shows how a company is allocating cash for the long term. For example, a company may invest in fixed assets such as property, plant, and equipment to grow the business.

An example of cash flow from investing activities is Hershey's net annual cash flow from investing activities for the year 2023. Hershey's made significant investments in capital expenditures, acquiring fixed assets to support its operations. The net cash flow from investing activities was calculated to be -$1,198,676 thousand.