Cash dividends are a way for companies to distribute a portion of their earnings to their shareholders. This is usually done through cash payments, such as checks or electronic transfers, or by providing shareholders with additional stock. Cash dividends are often paid on a regular basis, such as monthly or quarterly, but can also be one-time payouts. Dividends are typically paid out of a company's current earnings or accumulated profits, and they are subject to taxation. The purpose of cash dividends is to return wealth to shareholders, providing them with regular income and exposure to capital appreciation. However, it's important to note that cash dividends cause a company's share price to drop and have tax consequences for the recipients.

What You'll Learn

Cash dividends are paid directly in money

Cash dividends are a distribution of funds or money paid directly to stockholders from a company's current earnings or accumulated profits. They are a common way for companies to return capital to their shareholders, typically on a quarterly basis, but sometimes as one-time payouts.

Cash dividends are paid in money, as opposed to stock dividends, where investors are paid in additional shares. Cash dividends are often paid on a regular basis, but can also be distributed after certain non-recurring events, such as legal settlements.

The dividend is decided by the board of directors, with the purpose of returning wealth to the shareholders. Cash dividends provide investors with regular income, but also have tax consequences and cause the company's share price to drop. Dividends are usually paid by check or electronic transfer.

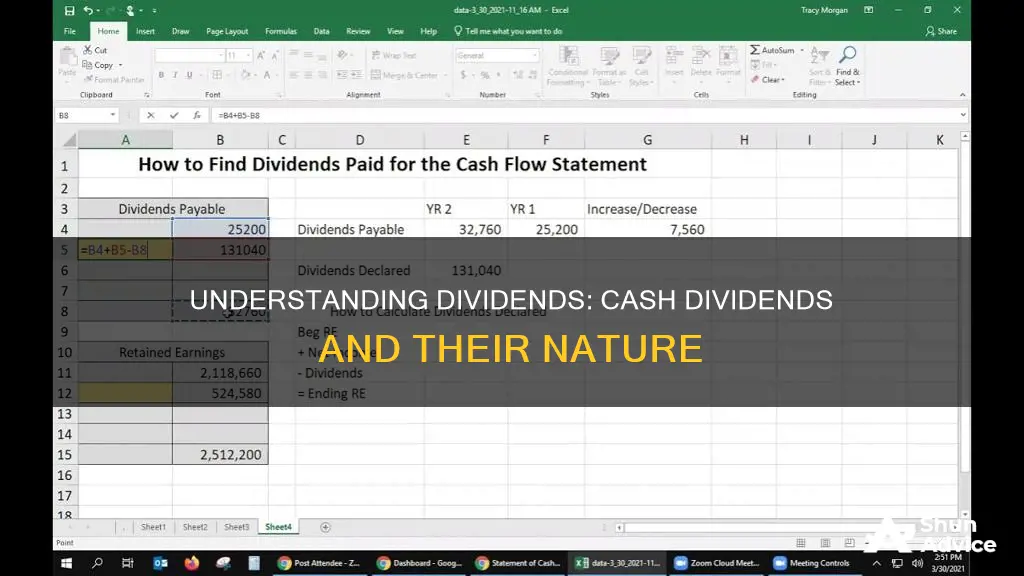

Cash dividends are reported in the financing section of a company's cash flow statement, which shows the net flow of funds used to run the company, including debt, equity, and dividend transactions.

Understanding Cash Flow: Investing Activities Explained

You may want to see also

Cash dividends are taxable

Cash dividends are indeed taxable. However, the amount of tax you pay depends on several factors, including the type of dividend, your filing status, and your taxable income.

There are two types of dividends: qualified and nonqualified (also known as ordinary). Qualified dividends are taxed at a lower rate than nonqualified dividends. For the 2024 tax year, qualified dividends are taxed at 0%, 15%, or 20%, depending on your taxable income and filing status. For example, if your taxable income falls below a certain threshold (which varies depending on your filing status), you may pay a 0% tax rate on qualified dividends. Above these thresholds, the qualified dividend tax rate increases to 15%. If your taxable income exceeds the maximum threshold, the qualified dividend tax rate is 20%.

On the other hand, nonqualified dividends are taxed as ordinary income, with rates of up to 37%. These include dividends from real estate investment trusts (REITs) and certain dividend payments that don't meet the requirements for qualified dividends, such as capital gains distributions and dividends from farmers' cooperatives.

It's important to note that you must report all dividend income, even if you reinvest your dividends or receive them in the form of additional shares through a stock dividend. Additionally, you may need to fill out Schedule B if your dividend income exceeds a certain amount.

To determine the tax rate on your cash dividends, you can refer to IRS Form 1099-DIV, which financial institutions use to report dividend income to you and the IRS. This form will indicate whether your dividends are qualified or nonqualified and will help you accurately report your dividend income on your tax return.

Cashing Out Putnam Investments: A Step-by-Step Guide

You may want to see also

Cash dividends are paid periodically

Cash dividends are a common way for companies to return capital to their shareholders in the form of periodic cash payments. Dividends are earnings that a company gives back to its shareholders, as decided by the board of directors. Cash dividends are paid directly in money, typically on a quarterly basis, but they can also be paid monthly, annually, or semi-annually. They are often paid on a regular basis, but there are also one-time payouts after certain events, such as legal settlements.

Cash dividends are a distribution of funds paid to stockholders, usually from the corporation's current earnings or accumulated profits. They are a way to transfer economic value from the company to the shareholders, instead of using the money for operations. This transfer of value causes the company's share price to drop by a similar amount. For example, if a company issues a cash dividend equal to 5% of the stock price, shareholders will see a resulting loss of around 5% in the price of their shares.

Cash dividends are taxable for the recipients, further reducing their final value. Despite this, cash dividends are beneficial as they provide shareholders with regular income on their investments, along with exposure to capital appreciation. Most brokers offer shareholders a choice to reinvest or accept cash dividends.

Cash dividends are reported in the financing section of a company's cash flow statement. This statement has three sections: cash flow from operating activities, cash flow from investing, and cash flow from financing activities. Cash flow from financing activities measures the movement of cash between a firm and its owners, investors, and creditors, including debt, equity, and dividend transactions.

Investments and Cash Equivalents: What's the Real Difference?

You may want to see also

Cash dividends are paid by mature companies

Cash dividends are a distribution of funds paid to stockholders from a company's current earnings or accumulated profits. They are paid directly in money, as opposed to stocks or other forms of value. Cash dividends are often paid on a regular basis, such as monthly or quarterly, but can also be one-time payouts.

Companies that pay dividends are typically established, with stable cash flow, and beyond the growth stage. This is why cash dividends are usually paid by mature companies. Mature companies are more likely to have stable cash flows and be beyond the growth stage, meaning they do not need to reinvest their earnings into the company and can afford to pay dividends.

Young, rapidly growing companies typically do not pay dividends as they need to reinvest their cash back into operations during pivotal growth stages. Companies that are still growing rapidly usually want to invest as much as possible in further growth. However, mature companies that believe they can increase value by reinvesting their earnings may also choose not to pay dividends.

Mature companies that pay dividends benefit from increased demand for their stock. Many investors are attracted to the steady income associated with dividends, and investors also see dividend payments as a sign of a company's financial strength and positive future outlook. As a result, the stock of companies that pay dividends is more attractive to investors, and the increased demand leads to higher stock prices.

Cash Flow and Investing: What's the Real Relationship?

You may want to see also

Cash dividends are paid from current earnings or profits

Cash dividends are a distribution of a company's earnings to its shareholders. They are paid directly in money, as opposed to stock dividends, which are paid in additional shares. Cash dividends are often paid on a regular basis, such as monthly or quarterly, but can also be one-time payouts following a settlement.

Companies that pay dividends tend to be established, with stable cash flow, and beyond the growth stage. They are returning wealth to shareholders rather than reinvesting profits in their operations. Dividend-paying companies often have dividend reinvestment plans (DRIPs) in place, allowing shareholders to reinvest their cash dividends.

Cash dividends are typically paid out of a company's current earnings or accumulated profits. When a corporation declares a dividend, it debits its retained earnings and credits a liability account called a dividend payable. On the date of payment, the company reverses the dividend payable with a debit entry and credits its cash account for the respective cash outflow.

Cash dividends do not affect a company's income statement but do reduce its shareholders' equity and cash balance. They must be reported in the financing activity section of a company's cash flow statement. Dividends received are included in the cash flow from operating activities of a non-financing company.

Capital Investment Project: Cash Flows Strategy

You may want to see also

Frequently asked questions

A cash dividend is a payment made by a company out of its earnings, distributed to investors or stockholders in the form of cash (check or electronic transfer).

Cash dividends are paid directly in money, as opposed to being paid as a stock dividend or other form of value. They are often paid on a regular basis, such as monthly or quarterly, but can also be one-time-only payouts.

The purpose of dividends, in general, is to return wealth back to the shareholders of a company. Cash dividends provide investors with income and regular cash flow.

Receivers of cash dividends must pay tax on the value of the distribution, lowering its final value.

A cash dividend causes the company's share price to drop by roughly the same amount as the dividend. This is due to the economic value transfer from the company to the shareholders.