Understanding the intricacies of tax deductions can be complex, especially when it comes to investment interest. This paragraph aims to shed light on whether investment interest qualifies as an itemized deduction. It will explore the criteria that determine its deductibility and the potential benefits for investors, providing a comprehensive overview of this essential tax consideration.

What You'll Learn

- Taxable Income: Investment interest is deductible if it exceeds a certain threshold, reducing taxable income

- Itemized Deductions: Investment interest can be claimed as an itemized deduction, reducing overall tax liability

- Limitations: There are limits on investment interest deductions, such as the investment income ceiling

- Carryover: Excess investment interest can be carried forward to future years for deduction

- Tax Law: Specific tax laws govern investment interest deductions, varying by jurisdiction

Taxable Income: Investment interest is deductible if it exceeds a certain threshold, reducing taxable income

Understanding the tax implications of investment interest is crucial for investors, as it can significantly impact their taxable income. When it comes to tax deductions, investment interest is indeed an itemized deduction, but there are specific rules and thresholds to consider.

For individuals, investment interest is deductible up to a maximum of $500 per year. This means that if your investment interest exceeds this amount, you can claim a deduction to reduce your taxable income. However, it's important to note that this deduction is limited to the amount of your taxable income. If your investment interest is less than $500, you can claim the full amount as a deduction.

To calculate the deduction, you need to determine the excess of your investment interest over the $500 threshold. For example, if your investment interest is $1,000, you can deduct $500, reducing your taxable income by that amount. This deduction can be applied to various investment-related expenses, such as interest on loans used for investments, investment advisory fees, and certain investment-related travel costs.

It's worth mentioning that the rules for investment interest deductions may vary for different types of investors, such as corporations and partnerships. These entities may have different thresholds and limitations, so it's essential to consult tax professionals or refer to the relevant tax regulations for specific guidance.

In summary, investment interest can be a valuable deduction to reduce taxable income, but it is limited to a certain threshold. Understanding these rules and calculating the excess investment interest is essential for maximizing tax benefits. Proper documentation and adherence to tax laws are crucial to ensure compliance and take full advantage of this deduction.

Understanding Investment Interest Expense: How It Affects Adjusted Gross Income

You may want to see also

Itemized Deductions: Investment interest can be claimed as an itemized deduction, reducing overall tax liability

Understanding the tax implications of investment activities is crucial for investors, as it can significantly impact their overall financial well-being. One important aspect to consider is whether investment interest can be claimed as an itemized deduction, which can lead to a reduction in tax liability.

When it comes to itemized deductions, taxpayers have the option to claim specific expenses that exceed a certain threshold, thus reducing their taxable income. Investment interest is indeed one of the eligible expenses that can be included in this category. This means that the interest incurred from investments, such as loans taken for business purposes or mortgage interest on rental properties, can be deducted from the taxpayer's income. By doing so, it directly reduces the overall tax amount owed.

The key advantage of claiming investment interest as an itemized deduction is the potential for a substantial tax savings. For investors, especially those with significant investment portfolios, the interest expenses can accumulate over time. By deducting these expenses, taxpayers can lower their taxable income, which in turn reduces the tax burden. This is particularly beneficial for high-income earners or those with substantial investment-related expenses.

To claim investment interest as an itemized deduction, taxpayers must provide detailed documentation and evidence of the interest incurred. This typically includes interest statements from financial institutions, mortgage agreements, or any other relevant records. Accurate record-keeping is essential to ensure compliance with tax regulations and to support the deduction claim.

It is important to note that there are specific rules and limitations associated with itemized deductions, including investment interest. Taxpayers should consult with tax professionals or refer to the latest IRS guidelines to ensure they meet all the requirements and maximize their deductions. Properly utilizing itemized deductions, including investment interest, can result in significant tax savings and a more favorable financial outcome for investors.

Unlocking the Potential: Is Your Car Loan a Smart Investment?

You may want to see also

Limitations: There are limits on investment interest deductions, such as the investment income ceiling

When it comes to itemizing deductions, investment interest can be a valuable deduction for investors. However, it's important to understand the limitations and restrictions imposed by the tax laws. One significant limitation is the investment income ceiling, which sets a maximum limit on the amount of investment interest that can be deducted.

The investment income ceiling is a rule that applies to individuals and certain businesses. It states that the total investment interest deduction cannot exceed the total investment income earned during the tax year. This means that if your investment income is below a certain threshold, you may not be able to fully deduct all your investment interest expenses. For example, if your investment income is $50,000 and the ceiling is set at $10,000, you can only deduct up to $10,000 of investment interest, leaving the remaining $40,000 untaxed.

This limitation is designed to prevent excessive tax benefits for high-income investors. By capping the deduction, the tax code aims to ensure fairness and prevent abuse of the tax system. It encourages investors to consider the potential tax implications of their investment decisions and may prompt them to diversify their portfolios to meet the income threshold.

It's worth noting that this ceiling applies to the total investment interest deduction, not individual investments. Therefore, if you have multiple investments, the combined interest expenses may still be limited by the ceiling. Additionally, the specific rules and thresholds can vary depending on the tax jurisdiction and individual circumstances.

Understanding these limitations is crucial for investors who want to maximize their tax benefits. It highlights the importance of careful financial planning and considering the tax implications of investment strategies. By being aware of the investment income ceiling, investors can make informed decisions and potentially adjust their investment approaches to optimize their tax position.

Higher Interest Rates: A Catalyst for Investment or a Hindrance?

You may want to see also

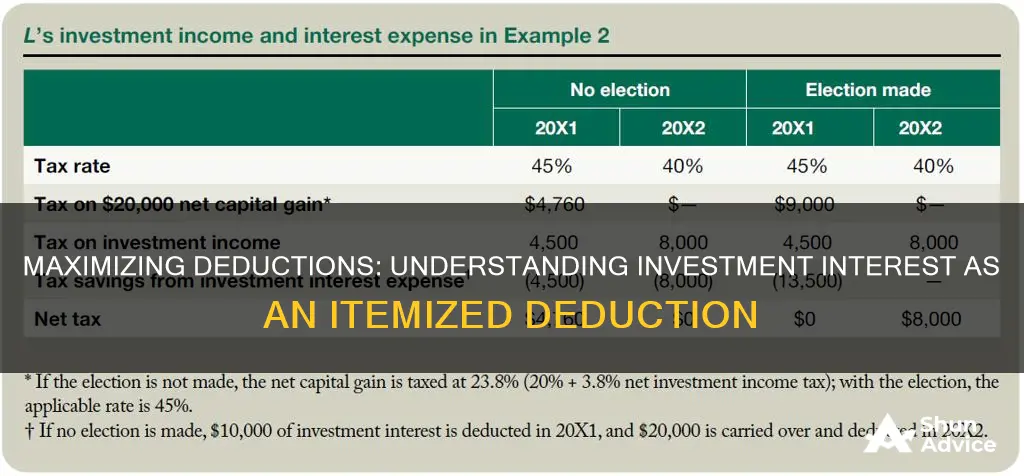

Carryover: Excess investment interest can be carried forward to future years for deduction

When it comes to tax deductions, understanding the intricacies of investment interest can be crucial for maximizing your financial benefits. One important aspect to consider is the carryover rule for excess investment interest. This rule allows individuals to carry forward any unused or excess investment interest to future tax years, providing an opportunity to deduct it in subsequent years.

The carryover mechanism is particularly useful for those who have incurred significant investment interest expenses but may not have had enough income or deductions to fully utilize the deduction in the current year. By carrying forward the excess interest, taxpayers can ensure that they can claim the deduction when their financial situation allows for it. This strategy can be especially beneficial for individuals with fluctuating income or those who have recently experienced a decrease in taxable income.

To take advantage of this carryover, it is essential to keep detailed records of your investment interest expenses. These records should include the amount of interest incurred, the corresponding investment, and any supporting documentation. Proper documentation is key to ensuring that you can accurately calculate the excess interest and carry it forward when needed.

Furthermore, it is important to stay organized and plan ahead. Taxpayers should be aware of the carryover period, which typically allows for the excess interest to be carried forward indefinitely until it is utilized. This means that if you don't have enough deductions in the current year, the excess interest can be saved and deducted in future years, providing long-term tax benefits.

In summary, the carryover rule for excess investment interest is a valuable tool for taxpayers. It allows individuals to manage their tax liabilities more effectively by carrying forward unused interest expenses. By understanding this carryover provision and maintaining proper records, taxpayers can optimize their tax strategy and potentially reduce their overall tax burden.

High Interest Rates: A Double-Edged Sword for Investment

You may want to see also

Tax Law: Specific tax laws govern investment interest deductions, varying by jurisdiction

The deductibility of investment interest is a complex and nuanced topic, with specific tax laws and regulations varying significantly across different jurisdictions. Understanding these laws is crucial for investors to ensure they are taking full advantage of any available deductions while remaining compliant with tax authorities.

In the United States, for instance, investment interest is generally considered a deductible expense. However, there are specific rules and limitations. Under the Internal Revenue Code, investment interest is defined as the amount of interest paid or accrued during the tax year that is directly connected to a trade or business activity or a rental property. This includes interest on loans used to purchase or improve investment assets. The deduction is limited to the taxpayer's investment income, typically defined as the sum of their capital gains, dividends, and other investment-related income. Any excess investment interest over this limit can be carried forward to future years for deduction.

The rules become more intricate when dealing with international tax laws. Different countries have their own tax treaties and agreements that can significantly impact how investment interest is treated. For example, some countries may allow a full deduction of investment interest, while others may cap it at a certain percentage of the taxpayer's income or investment income. In some cases, tax treaties may provide for the allocation of investment interest deductions between countries, ensuring that double taxation is avoided.

Furthermore, the specific tax laws governing investment interest deductions can vary based on the type of investment. For instance, interest on loans used to purchase rental properties may be deductible, but the rules for interest on loans used for personal investments or business expenses might differ. Understanding these nuances is essential for investors to maximize their deductions while adhering to the relevant tax laws.

In summary, the deductibility of investment interest is a critical aspect of tax planning, and investors must navigate the specific tax laws and regulations in their respective jurisdictions. These laws can vary widely, impacting the amount and timing of deductions available. Staying informed about these variations is essential to ensure compliance and optimize tax strategies related to investment activities.

Maximizing Returns: Understanding Send-Home Investment Interest

You may want to see also

Frequently asked questions

Yes, investment interest can be a deductible expense for individuals who actively participate in the investment market. It is considered a miscellaneous itemized deduction, which means it can be claimed on Schedule A of Form 1040 if the total of all miscellaneous deductions exceeds 2% of your adjusted gross income (AGI).

Investment interest is typically calculated as the total interest paid or accrued on investment-related expenses, such as mortgage payments on rental properties, loan payments, or other investment-related debts. It is important to keep detailed records of these expenses to ensure accurate reporting.

Yes, there are certain limitations and rules associated with investment interest deductions. The investment interest deduction is limited to the total of your investment income, including capital gains, dividends, and other investment-related income. Any excess investment interest over this limit can be carried forward to the following year.

Yes, investment interest deductions can also apply to small business owners. If you use your home office or a portion of your home exclusively for business purposes, you may be able to deduct the interest on a home equity loan or line of credit used to finance that portion of your home.

You report investment interest on Schedule A of Form 1040, along with other itemized deductions. You need to provide the total investment interest paid or accrued and any relevant supporting documentation. It is recommended to consult a tax professional or use tax preparation software to ensure accurate reporting.