Pag-IBIG MP2, or the Pag-IBIG Fund's Mutual Fund Program 2, is a popular investment option for Filipinos seeking to save for their future. It offers a range of mutual funds designed to provide investors with potential returns while also ensuring their savings are protected. However, like any investment, it's crucial to understand the risks and benefits before committing your money. This paragraph will explore the safety and potential of Pag-IBIG MP2, providing insights into why it might be a wise choice for investors.

What You'll Learn

- Risk Assessment: Evaluate Pag-IBIG MP2's risk profile and historical performance

- Fees and Charges: Understand associated costs and their impact on returns

- Liquidity: Assess the ease of accessing funds without penalties

- Regulation and Oversight: Ensure compliance with financial regulations and investor protection

- Long-Term Outlook: Analyze MP2's potential for sustained growth and stability

Risk Assessment: Evaluate Pag-IBIG MP2's risk profile and historical performance

When considering an investment in Pag-IBIG MP2, a social security program in the Philippines, it's crucial to conduct a thorough risk assessment to ensure a well-informed decision. This assessment involves evaluating both the program's risk profile and its historical performance.

Risk Profile:

Pag-IBIG MP2, or the Pag-IBIG Fund's Mutual Fund Program, is designed to provide members with investment opportunities. However, it's important to recognize that all investments carry some level of risk. The primary risks associated with Pag-IBIG MP2 include market risk, interest rate risk, and liquidity risk. Market risk pertains to the potential decline in the value of investments due to economic conditions or market volatility. Interest rate risk is the possibility of losses if interest rates rise, affecting fixed-income securities. Liquidity risk refers to the challenge of selling investments quickly without incurring significant losses.

Historical Performance:

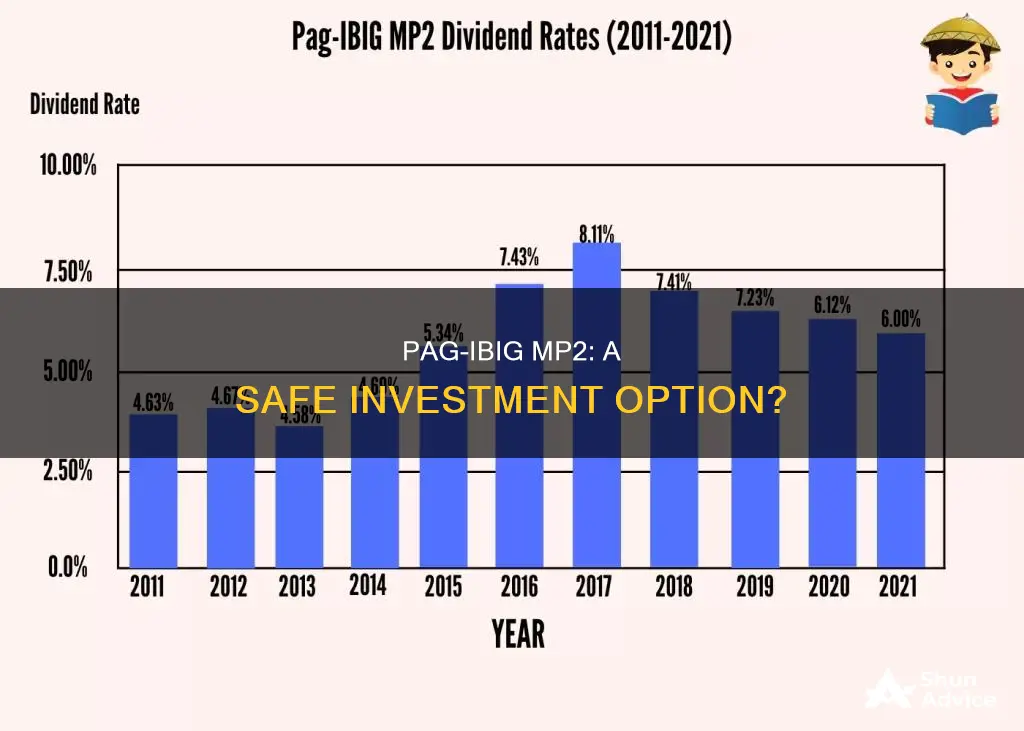

A historical analysis of Pag-IBIG MP2's performance can provide valuable insights. Examining past returns and volatility can help investors understand the fund's behavior over time. It is essential to consider both the highest and lowest returns achieved, as well as the consistency of performance. A well-diversified fund with a strong track record of consistent returns is generally considered more reliable. Additionally, reviewing the fund's performance during different economic cycles can offer a comprehensive view of its resilience.

Risk Mitigation Strategies:

To enhance the safety of investing in Pag-IBIG MP2, investors can employ various strategies. Diversification is key, as spreading investments across different asset classes can reduce market risk. Regularly reviewing and rebalancing the portfolio ensures that it aligns with the investor's risk tolerance and goals. Additionally, understanding the fund's investment objectives and associated risks is essential for making informed decisions.

In summary, a comprehensive risk assessment is vital when evaluating Pag-IBIG MP2 as an investment option. By analyzing the risk profile and historical performance, investors can make more confident choices. It is recommended to consult financial advisors and conduct thorough research to ensure a safe and successful investment journey.

Investment Management Services: Your Wealth, Our Priority

You may want to see also

Fees and Charges: Understand associated costs and their impact on returns

When considering an investment in the Pag-IBIG MP2 program, it's crucial to have a comprehensive understanding of the associated fees and charges to make an informed decision. These costs can significantly impact your overall returns, so being aware of them is essential. Here's a breakdown of the key fees and their implications:

Management Fees: One of the primary expenses in Pag-IBIG MP2 is the management fee, which is typically a percentage of the investment amount. This fee covers the operational and administrative costs of the fund manager. The rate can vary, but it's important to note that higher management fees may result in lower net returns for investors. It's advisable to compare the management fee structure of different investment options to ensure you're getting a competitive rate.

Transaction Costs: Investing often involves various transactions, such as buying, selling, or transferring assets. In the case of Pag-IBIG MP2, transaction costs may include brokerage fees, stamp taxes, or other charges associated with fund transactions. These costs can accumulate over time, especially for frequent traders. Understanding the transaction expenses and their frequency can help investors estimate the potential impact on their investment returns.

Performance Fees (if applicable): Some investment vehicles, including certain mutual funds, may charge performance fees based on the fund's success. While this fee is designed to incentivize fund managers, it can also reduce the overall returns for investors. In the context of Pag-IBIG MP2, if performance fees are applicable, they should be clearly disclosed. Investors should carefully consider the potential impact of these fees on their investment strategy.

Withdrawal and Redemption Fees: When investors decide to withdraw their funds or redeem their investments, they may incur additional charges. These fees can vary depending on the investment vehicle and the timing of the withdrawal. It's important to review the terms and conditions of the Pag-IBIG MP2 program to understand any applicable withdrawal fees and their potential impact on your investment strategy.

By carefully examining these fees and charges, investors can make more strategic decisions. Understanding the associated costs allows for better comparison of investment options and helps in assessing the potential impact on long-term returns. It is always advisable to seek professional financial advice to ensure that the chosen investment path aligns with your financial goals and risk tolerance.

Private Equity's Impact on Healthcare: Patient Investment

You may want to see also

Liquidity: Assess the ease of accessing funds without penalties

When considering the liquidity of Pag-IBIG MP2, it's important to understand the nature of the investment and the associated risks. Pag-IBIG MP2 is a type of investment plan offered by the Pag-IBIG Fund, which is a social security and insurance agency in the Philippines. This plan is designed to provide members with a way to save for retirement and other financial goals.

Liquidity refers to the ease of converting an investment into cash without incurring significant penalties or losses. In the case of Pag-IBIG MP2, members typically have the option to withdraw their contributions and benefits at any time, but there are certain conditions and penalties to be aware of. The plan usually allows for partial withdrawals, which can be useful if you need access to some funds for emergencies or other financial needs. However, it's crucial to understand the withdrawal rules and any associated fees.

One important aspect of liquidity is the frequency of access to funds. Pag-IBIG MP2 may have specific rules regarding how often members can withdraw their money. For instance, some plans might allow for monthly or quarterly withdrawals, while others may permit one-time withdrawals. It's essential to review the plan's terms and conditions to understand the frequency of access and any restrictions.

Additionally, members should be aware of any penalties or fees associated with early withdrawals. If you decide to withdraw your funds before the designated maturity date, you may be subject to penalties, which could reduce the overall value of your investment. These penalties are often a percentage of the withdrawal amount and are designed to discourage premature access to funds. It's crucial to carefully consider the financial implications and ensure that you have a clear understanding of the potential costs.

Assessing the liquidity of Pag-IBIG MP2 involves evaluating the flexibility it offers in accessing your funds. While the plan may provide some level of liquidity through partial withdrawals, it's essential to weigh the benefits against the potential risks and penalties. Members should carefully review the plan's documentation, understand the withdrawal policies, and consider their financial goals and needs before making any decisions regarding their investments.

Equity Investments: Renting and Building Wealth at Home

You may want to see also

Regulation and Oversight: Ensure compliance with financial regulations and investor protection

When considering an investment in Pag-IBIG MP2, it is crucial to understand the regulatory framework surrounding it. The Philippines' financial sector is heavily regulated to protect investors and maintain market integrity. The Securities and Exchange Commission (SEC) is the primary regulatory body responsible for overseeing investment products and ensuring compliance with financial regulations.

Pag-IBIG MP2, being an investment plan offered by the Pag-IBIG Fund, is subject to SEC regulations. These regulations aim to safeguard investors by implementing strict guidelines for fund management, transparency, and disclosure. Investors should be aware that the SEC requires all investment funds to adhere to specific standards, including regular reporting, financial disclosure, and the protection of investor assets. This regulatory oversight ensures that the fund operates within legal boundaries and provides a level of assurance to investors.

Compliance with financial regulations is essential to maintain investor confidence and trust. The SEC enforces rules that require investment funds to provide accurate and timely information to investors. This includes detailed financial reports, risk assessments, and clear explanations of investment strategies. By adhering to these regulations, Pag-IBIG MP2 demonstrates its commitment to transparency and investor protection. Investors can make informed decisions by accessing this information, which helps them assess the fund's performance and potential risks.

Furthermore, the regulatory environment in the Philippines promotes fair competition and market stability. The SEC's oversight ensures that investment products, like Pag-IBIG MP2, are not misleading or fraudulent. It also encourages fund managers to maintain high standards of governance and ethical practices. This regulatory framework provides a safe investment environment, allowing investors to participate with confidence, knowing their interests are protected.

In summary, the regulation and oversight of financial products, including Pag-IBIG MP2, are vital for investor protection and market stability. The SEC's role in enforcing regulations ensures that investment funds comply with legal requirements, providing transparency and trust. Investors can make informed choices by relying on the regulatory framework, which safeguards their interests and promotes a healthy investment climate in the Philippines. Understanding these regulations is essential for anyone considering an investment in Pag-IBIG MP2.

Crafting Compelling Investment Presentations: A Definitive Guide

You may want to see also

Long-Term Outlook: Analyze MP2's potential for sustained growth and stability

When considering the long-term outlook for Pag-IBIG MP2 investments, it's essential to understand the nature of this investment vehicle and its potential for sustained growth and stability. Pag-IBIG, short for the Home Development Mutual Fund, is a government-owned financial institution in the Philippines that offers various savings and investment plans, including the MP2 program. This program is designed to provide members with a stable and secure way to save for housing and other financial goals.

MP2, or the Pag-IBIG Fund's Mutual Fund Program, is a long-term investment option that aims to offer members a balanced approach to saving and growing their money. It is structured to provide a steady rate of return while also offering some level of liquidity, which is crucial for investors seeking both growth and flexibility. The program's focus on stability and security makes it an attractive choice for those looking to invest for the long term, especially for individuals who prioritize risk mitigation.

One of the key advantages of MP2 is its diversification strategy. The fund invests in a variety of assets, including government securities, corporate bonds, and other income-generating instruments. This diversification helps to spread risk and provides a more consistent income stream over time. As a result, investors can expect a relatively stable return on their investments, which is particularly beneficial for long-term financial planning. The fund's management also ensures that the portfolio is regularly reviewed and adjusted to maintain a balanced risk-reward profile.

In terms of growth potential, MP2 offers a competitive advantage over traditional savings accounts due to its investment nature. While it may not provide the same level of volatility as stocks or high-risk bonds, it can still offer a higher return over the long term compared to more conservative savings options. The fund's historical performance and its ability to adapt to market conditions suggest that it can generate positive returns, especially when compared to fixed-income investments. However, it's important to note that the rate of return can vary, and investors should be prepared for some fluctuations in their investment value over time.

For investors seeking stability and a secure investment option, Pag-IBIG MP2 presents a compelling choice. Its focus on diversification, risk management, and historical performance indicates a strong potential for sustained growth and stability. While the rate of return may not be as high as some other investment vehicles, the low-risk nature of MP2 makes it an ideal long-term savings strategy for those who prioritize security and consistent returns. As with any investment, due diligence and ongoing monitoring are recommended to ensure that the fund continues to meet the investor's financial objectives.

Private Equity: Post-Investment Strategies and Next Steps

You may want to see also

Frequently asked questions

Pag-IBIG MP2, also known as the Pag-IBIG Fund's Mutual Fund Program, is a retirement savings plan offered by the Pag-IBIG Fund in the Philippines. It is designed to provide members with a way to invest their contributions and potentially earn higher returns over time.

When you enroll in Pag-IBIG MP2, your monthly contributions are invested in a diversified portfolio of assets managed by the Pag-IBIG Fund. The fund manager allocates your money across various investment vehicles, such as stocks, bonds, and money market instruments, to grow your savings. The program offers different investment options, allowing members to choose their risk preference and investment strategy.

While Pag-IBIG MP2 offers a relatively safe investment option, it's important to understand that all investments carry some level of risk. The fund's performance depends on market conditions and the overall health of the economy. The Pag-IBIG Fund manages the risks by diversifying the portfolio, but there is still a possibility of losses, especially in volatile markets. It is recommended to review your investment regularly and consider your risk tolerance before making any decisions.

Investing in Pag-IBIG MP2 can provide several advantages. Firstly, it offers a tax-deferred savings plan, allowing your contributions to grow without immediate tax implications. Secondly, the program provides a structured way to save for retirement, ensuring a steady stream of income during your golden years. Additionally, Pag-IBIG MP2 offers flexibility with various investment options, allowing members to align their savings with their financial goals and risk preferences.