Investment advisors and portfolio managers are financial professionals who help clients manage their money and plan for the future. While both roles involve money management, they differ in the scope of services offered. Investment advisors provide comprehensive financial advice and help with investment management, retirement planning, estate management, tax management, budgeting, and debt management. On the other hand, portfolio managers primarily focus on investment-related services, including creating and managing investment portfolios, and providing investment recommendations.

| Characteristics | Values |

|---|---|

| Role | Investment advisors assess investor profiles and goals to find relevant investment opportunities. They also provide consultation services via analysis and research reports. |

| Management | Investment advisors do not actively manage your funds. |

| Expertise | Investment advisors carry financial expertise but do not necessarily manage the funds of their clients. |

| Recommendations | Investment advisors make recommendations related to investments. |

| Payment | Investment advisors are paid in exchange for their advice. They can choose their mode of payment, often opting for an hourly rate. They might also receive a commission and other fees for recommending and selling a certain financial product. |

| Fiduciary duty | Investment advisors are not bound by law to adhere to a fiduciary standard. However, they have a fiduciary duty to their clients, always putting the client's interests first. |

| Specialisation | Investment advisors are specialists in assessing the investor profile and helping clients find the best-fit investment opportunities. |

What You'll Learn

Investment advisors assess risk tolerance and capacity.

Investment advisors are professionals who help clients make financial decisions. They assess an investor's risk tolerance and capacity to help them realise their financial goals. Risk tolerance is a measure of how a client reacts to the decrease in the value of their investment portfolio. Risk capacity, on the other hand, is the client's ability to weather financial storms. It is measured by how much time they have until retirement, how much wealth they have, and their income.

While risk tolerance and capacity often go hand-in-hand, they can diverge. For example, a client may have sufficient resources to handle a market crash (high-risk capacity) but may be very distressed watching the value of their assets fall (low-risk tolerance). Therefore, investment advisors must understand both these factors to create a client 'risk profile' and ascertain their goals.

For instance, Morgan, who is in their mid-sixties and nearing retirement, is looking mainly for capital preservation for their portfolio. On the other hand, Alex, who is 30 years old, wants to buy a home, fund their children's education in a decade, and save for retirement.

Once the risk profile and goals are determined, the investment advisor can begin the asset selection process. Most advisors or advisory firms have predetermined "client portfolios," also known as "model portfolios," which are then integrated with the particular needs of individual clients.

Savings vs Investments: What's the Real Difference?

You may want to see also

They then create a 'risk profile' for the client

Investment advisors and portfolio managers are two different roles that can help individuals manage their finances. While portfolio managers are more focused on helping individuals invest and managing their investment portfolios, investment advisors offer a broader range of services, including investment management, retirement planning, estate management, tax management, budgeting, and debt management.

When creating a risk profile for a client, investment advisors will first assess the investor's tolerance for and capacity for risk. Risk tolerance refers to how the client will feel and react if their investment portfolio drops in value. Risk capacity, on the other hand, considers the client's ability to weather financial storms by evaluating the time they have until retirement, their wealth, and their income.

By understanding both the client's risk tolerance and risk capacity, investment advisors can determine how much risk a client can handle. For example, a client with high-risk capacity may have sufficient resources to handle a market crash but may still be very distressed watching the value of their assets fall, indicating low-risk tolerance.

Additionally, investment advisors must also understand the client's financial goals. For instance, an older client nearing retirement may be primarily interested in capital preservation, while a younger client may have goals such as buying a home, funding their children's education, and saving for retirement.

Once the risk profile and financial goals are established, investment advisors can begin the process of building a client's investment portfolio. They often use predetermined "client portfolios" or "model portfolios" that can be adapted to suit individual clients' needs and preferences. These portfolios are based on the firm's investment policy and strategy and are then integrated with the specific requirements of each client.

Furthermore, investment advisors may utilise tools and technologies, such as Monte Carlo simulations, to assist in selecting client investments. These simulations create a statistical probability distribution or risk assessment for a particular investment, which is then compared to the client's risk tolerance to determine the suitability of the investment.

By following these steps, investment advisors can create a risk profile for their clients, enabling them to provide tailored investment advice and help clients achieve their financial goals while managing their risk exposure.

Investment Portfolio Strategies for a Comfortable Retirement

You may want to see also

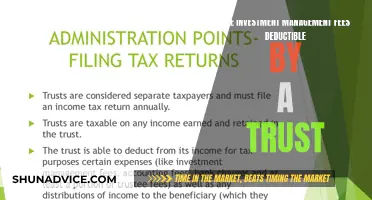

Advisors have a fiduciary duty to act in the client's best interest

Investment advisors have a fiduciary duty to act in their client's best interest. This means that they are legally and ethically bound to put their client's interests ahead of their own.

Fiduciaries are held to a "prudent person standard of care", which stems from an 1830 court ruling, Harvard College vs. Armory. This ruling requires fiduciaries to act with the needs of beneficiaries in mind, ensuring that any decisions are made with the client's best interests at heart.

In the context of investment advisors, this means that they must make investment choices that are best for their clients, rather than their own financial benefit. This is particularly important as advisors can earn commissions from the financial products they sell, creating a potential conflict of interest.

To avoid this conflict, investment advisors who are fiduciaries will often follow a fee-only method, where they charge according to the assets under management or a predefined fee. This way, their income is directly linked to their client's growth, and any potential for bias is minimised.

It is important to note that not all financial advisors are fiduciaries. When hiring an investment advisor, it is crucial to understand their qualifications, fee structure, and whether they have a fiduciary duty.

Portfolio Investment Increase: Global Economic Growth and Diversification

You may want to see also

Portfolio advisors vs. portfolio managers

When it comes to managing your finances, hiring a professional is crucial. You may come across various job titles, such as investment advisors, portfolio managers, financial planners, wealth managers, and asset managers. These professionals can be broadly categorized into two groups: portfolio managers and investment advisors. While they offer guidance on different financial topics, they share a common goal of money management.

Portfolio Managers

Portfolio managers primarily focus on helping you invest and managing your investment portfolio. They create and maintain an investment account on your behalf, providing advice and reports on individual securities, asset allocation, and market trends. They also monitor and handle your investment portfolio end-to-end. According to the Securities and Exchange Commission (SEC), portfolio managers are compensated for their advice and reports. They earn commissions from the financial securities they sell.

Portfolio managers are also known as money managers, investment consultants, or investment advisors. However, it's important to note that not all portfolio managers offer the same scope of services. When engaging with a portfolio manager, it is crucial to understand their expertise and the level of support they can provide in managing your investment portfolio.

Portfolio managers are well-suited for individuals with a larger net worth who desire a customized approach to wealth management and a closer relationship with their advisor. They help you select, create, and manage a portfolio of stocks, bonds, mutual funds, target-date funds, exchange-traded funds (ETFs), and other alternative investments to meet your financial objectives.

Investment Advisors

Investment advisors, also known as financial advisors or financial counsellors, offer holistic and professional advice based on your specific needs and financial situation. They assess your financial goals, investment preferences, life stage, risk tolerance, and other factors to provide comprehensive financial guidance. Investment advisors can help with various financial aspects, including budgeting, debt management, tax management, retirement planning, estate planning, succession management, and healthcare management. They can also assist in building an emergency fund, saving for education, or achieving financial goals such as buying a home.

Most investment advisors follow a fiduciary duty, which means they are ethically committed to acting in your best interest at all times. They are required to be unbiased in their advice and maintain the highest standards of professionalism.

Key Differences

The main difference between portfolio managers and investment advisors lies in the scope of services they provide. Portfolio managers primarily offer investment recommendations and support, helping you create and manage your investment portfolio. On the other hand, investment advisors provide more comprehensive financial advice, covering various aspects of your financial well-being, such as budget, retirement, taxes, estate planning, and healthcare planning.

Another distinction is in their fee structures. Portfolio managers typically charge a percentage fee based on the portfolio they are managing and do not receive commissions based on transaction volume. This allows them to maintain a higher level of objectivity in their investment recommendations. In contrast, investment advisors may charge a flat fee, hourly rate, or asset-based rate (AUM) for their services.

Whether you choose to hire a portfolio manager or an investment advisor depends on your specific needs and financial goals. If you seek only investment-related counsel, a portfolio manager would be a suitable option. On the other hand, if you desire more comprehensive financial support, including investment advice, an investment advisor would be a better choice.

Diverse Portfolios: Smart Investing for Long-Term Success

You may want to see also

Advisors can help with debt management and tax planning

Investment advisors can help with debt management and tax planning in several ways.

Firstly, they can help you create a plan for managing your debt. This usually involves paying off debts with the highest interest rates first and then working down the list. They can also help you analyse and restructure your debts, as some debts have less of an impact on your finances than others. For example, mortgages generally have lower interest rates and can help you build an asset, whereas credit cards and payday loans have higher interest rates. A financial advisor can help you prioritise your payments and establish a budget.

Secondly, investment advisors can help you establish a long-term plan suited to your specific needs. They will take a holistic approach to considering all your financial goals, such as life insurance, emergency funds, and retirement savings accounts. They should provide you with a written plan that details the recommended course of action, including financial milestones and red flags, so that you can check your progress and make any necessary changes.

Thirdly, investment advisors can help with tax planning. They can help you prepare tax returns, maximise tax deductions, schedule tax-loss harvesting security sales, ensure the best use of capital gains tax rates, and plan to minimise taxes in retirement.

Finally, investment advisors can provide emotional support and perspective during volatile economic times such as recessions and periods of market turbulence.

Assessing Investment Risk: Measuring Portfolio Riskiness

You may want to see also

Frequently asked questions

Portfolio managers are focused on helping you invest and managing your investment portfolio. Investment advisors offer a broader range of services, including investment management, retirement planning, estate management, tax management, budgeting, and debt management.

Investment advisors help individuals manage their money and map out a plan for the future, including retirement. They offer a range of services, from financial planning to investment management, and provide advice and recommendations based on their clients' needs and goals.

Investment advisors first assess their clients' risk tolerance and capacity, and then create a 'risk profile'. They use this to select investments that align with their clients' goals and risk appetite.

Investment advisors provide expertise and guidance to help individuals make informed financial decisions. They can offer a sense of security and peace of mind, knowing that a professional is managing their finances with their best interests in mind.

When choosing a financial advisor, it is important to evaluate your financial situation and goals. Consider the advisor's qualifications, experience, and whether they specialise in a particular area relevant to your needs. Ask about their fees and ensure they abide by fiduciary standards, acting in your best interests.