Investing in the top 50 companies, often referred to as the blue-chip stocks, is a popular strategy for many investors. These companies are typically well-established, with a strong market presence and a history of financial stability. However, the question of whether it is safe to invest in these top 50 companies is a complex one. While these companies generally have a solid track record, market conditions can change rapidly, and no investment is entirely without risk. This paragraph will explore the factors that contribute to the safety of investing in these top 50 companies, including their financial health, market position, and potential risks.

What You'll Learn

- Market Volatility: Understanding price fluctuations in the top 50 M's stock performance

- Risk Assessment: Evaluating potential risks associated with investing in these companies

- Financial Health: Analyzing the financial stability and growth potential of the top 50 M's

- Industry Trends: Exploring market trends and their impact on the top 50 M's

- Regulatory Compliance: Ensuring investments adhere to legal and regulatory standards

Market Volatility: Understanding price fluctuations in the top 50 M's stock performance

Market volatility is an inherent aspect of the stock market, and it becomes even more crucial when considering investments in the top 50 multinational corporations (MNCs). These companies, often referred to as the 'blue chips', are considered leaders in their respective industries and are highly sought after by investors. However, their success and prominence do not guarantee a stable investment journey. Understanding the factors that drive price fluctuations in these stocks is essential for investors to make informed decisions.

Volatility in the stock market can be attributed to various factors, including economic conditions, industry-specific news, company-specific events, and global market trends. For the top 50 MNCs, external factors often play a significant role. Economic indicators such as interest rates, inflation, and GDP growth can impact the overall market sentiment and, consequently, the stock prices of these companies. For instance, a rising interest rate environment might lead to decreased investor confidence in growth stocks, causing a decline in the share prices of top MNCs. Similarly, geopolitical events, such as trade wars or political instability in key markets, can create uncertainty and cause price swings.

Company-specific news and events also contribute to market volatility. This includes earnings reports, product launches, management changes, and legal issues. Positive news, such as impressive earnings growth or a groundbreaking product release, can drive stock prices higher. Conversely, negative news, like a major lawsuit or a product recall, can lead to a rapid decline in share prices. Investors should stay informed about these developments to anticipate potential price movements.

Additionally, global market trends and investor sentiment can significantly influence the stock performance of top 50 MNCs. Market sentiment, often driven by investor confidence and market expectations, can cause rapid shifts in stock prices. Positive sentiment might lead to a surge in demand for these stocks, while negative sentiment can result in a sell-off. Keeping track of market trends and understanding the broader economic and geopolitical landscape is crucial for investors to navigate market volatility effectively.

In conclusion, investing in the top 50 MNCs offers the potential for significant returns but also comes with the challenge of market volatility. Investors should approach these investments with a comprehensive understanding of the factors influencing price fluctuations. Staying informed about economic indicators, company-specific news, and global market trends is essential to make timely and informed investment decisions. While volatility can be a concern, it also presents opportunities for investors who can identify undervalued stocks or capitalize on short-term price movements.

Investment Management Lawyers: Guiding Your Financial Journey

You may want to see also

Risk Assessment: Evaluating potential risks associated with investing in these companies

When considering investing in the top 50 companies, it's crucial to conduct a thorough risk assessment to ensure a well-informed decision. Here's an analysis of the potential risks associated with such investments:

Market Volatility: One of the primary risks is the inherent volatility of the market. Top 50 companies, while influential, are still subject to market fluctuations. Economic downturns, industry-specific crises, or global events can significantly impact their stock prices. Investors should be prepared for potential short-term losses and understand that long-term gains may be more stable but still carry risks. Diversification across various sectors and asset classes can help mitigate this risk.

Regulatory and Legal Challenges: These companies often operate in highly regulated industries, such as finance, healthcare, or technology. Changes in government policies, new regulations, or legal challenges can directly affect their business models and profitability. For instance, a tech company might face increased scrutiny over data privacy, leading to potential fines and reputational damage. Investors should stay updated on regulatory news and assess how these companies navigate legal complexities.

Competition and Market Share: The business landscape is highly competitive, and the top 50 companies are often vying for market dominance. New entrants, innovative startups, or disruptive technologies can challenge their market share. Investors should analyze the competitive environment, assess the company's ability to innovate, and consider the potential impact of industry disruptions. Staying ahead of the competition is vital for long-term success.

Operational and Management Risks: Internal factors, such as management quality and operational efficiency, play a significant role in investment risk. Poor decision-making, mismanagement of resources, or internal conflicts can negatively impact a company's performance. Investors should evaluate the company's leadership, track record, and ability to execute their strategies. A robust corporate governance structure and transparent reporting can help mitigate these risks.

Economic and Industry-Specific Risks: Different industries face unique challenges. For instance, a retail company might be susceptible to changing consumer trends, while a real estate firm could be affected by interest rate fluctuations. Investors should conduct industry-specific research and assess the long-term viability of the business model. Understanding the economic cycles and industry trends is essential for making informed investment choices.

In summary, investing in the top 50 companies offers potential rewards but also carries various risks. A comprehensive risk assessment should consider market dynamics, regulatory factors, competition, internal management, and industry-specific challenges. By staying informed and adopting a strategic investment approach, investors can navigate these risks and make more confident decisions.

Invest Wisely: Strategies to Earn 100K Annually

You may want to see also

Financial Health: Analyzing the financial stability and growth potential of the top 50 M's

When considering the financial health and investment safety of the top 50 multinationals (MNCs), a comprehensive analysis is essential. These companies, often referred to as the global elite, have a significant impact on the world economy and are attractive investment prospects for many. However, assessing their financial stability and growth potential requires a nuanced approach.

Firstly, examining the financial stability of these MNCs involves a thorough review of their balance sheets and financial statements. Investors should look beyond the headline figures and delve into the details. Key metrics such as debt-to-equity ratios, current ratios, and cash flow from operations provide insights into a company's financial health. For instance, a low debt-to-equity ratio indicates a more financially stable company, while consistent positive cash flow suggests a robust ability to generate profits and manage expenses. A comprehensive analysis of these ratios across the top 50 MNCs can help investors identify potential risks and opportunities.

Secondly, growth potential is a critical aspect of investment analysis. The top 50 MNCs often operate in highly competitive and dynamic industries. Investors should assess these companies' ability to innovate, adapt to market changes, and expand their market share. This includes evaluating their research and development (R&D) expenditures, product pipelines, and strategic partnerships. For example, companies investing heavily in R&D and showcasing a strong product development strategy are likely to have a competitive edge, ensuring long-term growth potential. Analyzing these factors can provide a clearer picture of which MNCs are well-positioned for sustained success.

Additionally, a comparative analysis of these companies' financial performance over time can be insightful. Investors can track key financial indicators, such as revenue growth, profit margins, and return on investment, to identify trends and potential areas of concern. By comparing the top 50 MNCs, investors can gain a broader perspective on industry performance and make more informed decisions. This analysis should also consider external factors like economic conditions, industry trends, and geopolitical risks that could impact the overall financial health of these MNCs.

In conclusion, investing in the top 50 MNCs requires a meticulous approach to financial analysis. By examining financial stability through balance sheet metrics and cash flow analysis, and assessing growth potential through R&D investments and market strategies, investors can make more informed choices. A comprehensive understanding of these companies' financial health will enable investors to navigate the complexities of the global market and potentially identify safe and profitable investment opportunities.

Large Corporations: Where and How They Invest

You may want to see also

Industry Trends: Exploring market trends and their impact on the top 50 M's

The concept of investing in the 'Top 50 Ms' is an intriguing one, especially when considering the dynamic nature of global markets. These 'Ms' typically refer to the largest multinational corporations, often dominating their respective industries. While investing in these giants might seem like a safe bet, it's essential to delve into the industry trends that could significantly impact their performance and, consequently, the returns on investment.

One of the most prominent trends shaping the business landscape is the rapid shift towards digital transformation. Many Top 50 Ms are investing heavily in technology to enhance their operations, improve customer experiences, and stay competitive. This includes adopting cloud computing, artificial intelligence, and automation. For instance, companies in the financial sector are utilizing AI for fraud detection and personalized financial advice, while retailers are employing augmented reality to enhance online shopping experiences. This digital revolution is not only creating new business opportunities but also forcing traditional players to adapt or risk becoming obsolete.

Another critical trend is the growing emphasis on sustainability and corporate social responsibility (CSR). Consumers and investors are increasingly conscious of environmental and ethical issues, pushing companies to adopt more sustainable practices. Top 50 Ms are responding by integrating sustainability into their core business strategies. This might involve reducing carbon footprints, implementing circular economy models, or promoting ethical sourcing. For example, a leading automotive company might invest in electric vehicle technology, while a food and beverage giant could focus on sustainable agriculture practices. These initiatives not only appeal to environmentally conscious consumers but also position these companies as forward-thinking and responsible, potentially attracting a wider investor base.

The rise of emerging markets and the expansion of global trade networks also present significant opportunities and challenges for the Top 50 Ms. As these companies expand their global footprint, they gain access to new consumer bases and markets. However, this expansion also brings risks, such as navigating complex regulatory environments and managing cultural differences. For instance, a technology company might tap into the growing digital economies of Southeast Asia, while a pharmaceutical firm could target under-served markets in Africa. These strategic moves can lead to substantial growth but also require careful planning and a deep understanding of local markets.

Lastly, the impact of macroeconomic factors, such as global economic policies, interest rates, and geopolitical events, cannot be overlooked. These factors can influence market sentiment and, consequently, the performance of the Top 50 Ms. For example, a change in trade policies might affect the supply chain of a manufacturing company, while a global recession could impact the sales of a luxury goods brand. Investors need to stay informed about these macroeconomic trends and their potential impact on their investments.

In conclusion, investing in the Top 50 Ms offers a promising prospect, but it requires a nuanced understanding of the industry trends that could shape their future. From digital transformation to sustainability and global expansion, these trends are not only driving innovation but also presenting unique challenges. By staying abreast of these developments, investors can make more informed decisions, ensuring their investments are aligned with the evolving business landscape.

High-Risk, High-Reward: Navigating the Most Volatile Investment Sectors

You may want to see also

Regulatory Compliance: Ensuring investments adhere to legal and regulatory standards

In the world of finance, regulatory compliance is a critical aspect of ensuring the safety and integrity of investments. When considering the 'Top 50 M' investments, it is essential to understand the legal and regulatory framework that governs these opportunities. Regulatory compliance involves adhering to a set of rules and standards designed to protect investors, maintain market stability, and promote fair practices. This is particularly important in the context of high-value investments, where the potential risks and consequences of non-compliance can be significant.

The primary goal of regulatory compliance is to safeguard investors' interests. This includes ensuring that investment products and services are transparent, fair, and free from fraudulent activities. Regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, enforce strict guidelines to prevent insider trading, market manipulation, and other illegal practices. For instance, the SEC's regulations require companies to disclose material information, ensuring investors have access to accurate and timely data to make informed decisions.

Compliance also involves a thorough understanding of the legal and tax implications of investments. Investors must navigate complex regulations to ensure their activities are tax-efficient and compliant with local laws. This includes staying updated on tax codes, reporting requirements, and any industry-specific regulations. For instance, in the real estate sector, investors must comply with zoning laws, building regulations, and property tax obligations. Similarly, in the financial services industry, compliance officers must ensure that investment strategies adhere to anti-money laundering (AML) and know-your-customer (KYC) regulations to prevent financial crimes.

Additionally, regulatory compliance plays a vital role in risk management. Investment firms and financial institutions are required to implement robust compliance programs to identify, assess, and mitigate potential risks. This includes regular audits, internal controls, and employee training to ensure a strong compliance culture. By adhering to regulatory standards, investors can minimize legal and financial exposure, protect their assets, and maintain a positive reputation in the market.

In summary, regulatory compliance is an indispensable aspect of investing in the 'Top 50 M' opportunities. It ensures that investments are made within a legal framework, protecting investors and maintaining market integrity. By staying informed about relevant regulations, seeking professional advice, and implementing robust compliance measures, investors can navigate the complex landscape of high-value investments with confidence and security. This approach fosters a stable and transparent environment, encouraging long-term growth and success in the financial markets.

Instruments: Attractive Arbitrage and Investment Opportunities

You may want to see also

Frequently asked questions

The Top 50 M Investment refers to a strategy where investors focus on the top 50 most valuable companies in a specific market or industry. This approach involves allocating capital to these leading companies, which are often considered to have strong fundamentals, innovative capabilities, and a competitive edge.

While investing in the Top 50 M can be considered relatively safe compared to other investment options, it is not without risks. These companies are subject to market volatility and may face challenges like economic downturns, industry-specific regulations, or competitive pressures. Diversification and thorough research are essential to mitigate these risks.

To ensure the safety of your investment, consider the following:

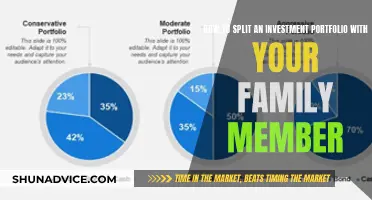

- Diversify your portfolio across multiple sectors and industries within the Top 50 M list.

- Conduct thorough research on each company's financial health, management team, and competitive position.

- Stay updated on market trends and news related to these companies.

- Regularly review and rebalance your portfolio to manage risk and take advantage of growth opportunities.