MasterWorks, a platform that allows investors to purchase shares in famous paintings, has gained attention as a unique investment opportunity. However, the question of whether it is a safe investment is complex and depends on various factors. This paragraph will explore the potential risks and benefits of investing in MasterWorks, considering the market volatility of art, the platform's liquidity, and the potential for long-term appreciation in the value of the artworks.

What You'll Learn

- Market Volatility: Masterworks' stock price can fluctuate, making it a risky investment

- Liquidity Concerns: Selling Masterworks shares quickly may be challenging due to limited trading volume

- Company Performance: Masterworks' success and growth potential are key factors in investment safety

- Regulatory Changes: New laws or policies could impact Masterworks' operations and investor returns

- Competition: Masterworks faces competition from other companies, affecting its market position and profitability

Market Volatility: Masterworks' stock price can fluctuate, making it a risky investment

Masterworks, a company that allows investors to own shares in valuable artwork, has gained attention as an alternative investment opportunity. However, it's important to consider the potential risks associated with investing in this unique asset class. One significant factor to be aware of is market volatility, which can impact the value of Masterworks' stock.

Market volatility refers to the rapid and significant price fluctuations in a security or asset. In the case of Masterworks, the company's stock price can be highly volatile due to several factors. Firstly, the art market itself is inherently unpredictable and can be influenced by various economic and cultural trends. Masterworks' performance is directly tied to the value of the artwork in its portfolio, which can vary widely based on market conditions, artist popularity, and overall economic health. During periods of economic downturn or a decline in the art market, the value of Masterworks' holdings may decrease, leading to a drop in the company's stock price.

Additionally, Masterworks, as a relatively new and specialized investment vehicle, may not have a large and liquid market. This means that the stock might be more susceptible to price swings due to limited trading volume. When there is less trading activity, small changes in supply and demand can result in more substantial price movements. Investors should be prepared for the possibility of quick and significant price changes, which can make the investment less stable and more risky.

Another aspect to consider is the company's growth and development. Masterworks is still in its early stages, and the business may face challenges as it expands. These challenges could include the successful acquisition and management of artwork, effective marketing and sales strategies, and maintaining a strong brand presence. If the company fails to navigate these obstacles, it may impact its financial performance and, consequently, the value of its stock.

In summary, while Masterworks offers an innovative way to invest in art, market volatility poses a notable risk. Investors should be cautious and conduct thorough research to understand the potential price fluctuations and the underlying factors that could influence the company's performance. Diversification and a long-term investment strategy may be beneficial approaches to mitigate the risks associated with market volatility in this unique investment opportunity.

Savings, Investments, and the Economy's Vital Balance

You may want to see also

Liquidity Concerns: Selling Masterworks shares quickly may be challenging due to limited trading volume

Masterworks, a platform that allows investors to buy shares in famous artworks, has gained popularity for its unique investment opportunity. However, one aspect that potential investors should be aware of is the liquidity of Masterworks shares. Liquidity refers to how easily an asset can be bought or sold without significantly impacting its price. In the case of Masterworks, the limited trading volume can pose challenges for investors who may need to sell their shares quickly.

When an asset has low liquidity, it becomes more difficult to find buyers or sellers, and the process of selling can take longer and may result in lower prices. Masterworks, being a relatively new investment vehicle, has not yet established a large and active trading market. This means that there might be fewer buyers interested in purchasing Masterworks shares, especially for specific artworks or at certain price points. As a result, investors may face delays in selling their holdings or might have to accept lower prices than they initially paid.

The limited trading volume can also lead to wider bid-ask spreads. The bid-ask spread is the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). With fewer transactions, the bid-ask spread may be wider, making it more expensive for investors to buy or sell Masterworks shares. This can impact the overall return on investment, especially for those who need to access their funds quickly.

To mitigate these liquidity concerns, investors should carefully consider their investment strategy and time horizon. If an investor plans to hold Masterworks shares for the long term, the impact of limited liquidity may be less significant. However, for those who require quick access to their funds, it is essential to be prepared for potential challenges. Diversifying one's investment portfolio and exploring other investment options alongside Masterworks can also provide a safety net.

In summary, while Masterworks offers an innovative way to invest in art, investors should be mindful of the potential liquidity issues. The limited trading volume may result in longer selling periods and lower prices. Understanding these concerns can help investors make more informed decisions and manage their expectations when considering Masterworks as a safe investment option.

Invest in Yourself: Strategies to Attract Funding and Support

You may want to see also

Company Performance: Masterworks' success and growth potential are key factors in investment safety

Masterworks, a company that offers fractional ownership of fine art, has been making waves in the investment world, particularly in the realm of alternative investments. The question of whether Masterworks is a safe investment is a valid concern for any prospective investor. To assess this, we need to delve into the company's performance, growth trajectory, and the factors that contribute to its investment safety.

Masterworks' success can be attributed to its innovative approach to investing in art. By allowing investors to purchase fractional shares of valuable artworks, the company has democratized access to the art market. This strategy has resonated with a growing number of investors seeking diversification beyond traditional assets. The company's platform provides an accessible way to invest in a portfolio of carefully curated masterpieces, which can be a compelling proposition for those looking to add a unique asset class to their investment mix.

The growth potential of Masterworks is evident in its expanding user base and increasing market presence. As of the latest financial reports, the company has experienced significant year-over-year growth in terms of user acquisition and revenue. This growth is further bolstered by positive reviews and testimonials from satisfied investors, who appreciate the ease of use and the potential for capital appreciation in the art market. Masterworks' ability to attract and retain investors is a strong indicator of its market appeal and long-term viability.

When considering investment safety, it is crucial to examine Masterworks' business model and risk management strategies. The company has implemented robust security measures to protect its investors' assets, including insurance coverage for the artworks in its portfolio. Additionally, Masterworks' team comprises experienced professionals with a deep understanding of the art market and its unique risks. Their expertise allows for informed decision-making and the implementation of strategies to mitigate potential risks associated with art investments.

In summary, Masterworks' success and growth potential are significant factors in assessing its investment safety. The company's innovative approach to art investing, coupled with its expanding user base and positive market reception, suggests a promising future. However, investors should also consider the inherent risks associated with the art market and ensure that they are comfortable with the level of risk Masterworks' business model entails. A thorough understanding of the company's performance, growth prospects, and risk management strategies is essential for making an informed investment decision.

Smart Investment Strategies: Maximizing Your Money Wisely

You may want to see also

Regulatory Changes: New laws or policies could impact Masterworks' operations and investor returns

Masterworks, a company that allows investors to buy shares in famous paintings and other artworks, has gained popularity as an alternative investment option. However, like any investment, it is important to consider the potential risks and impacts of regulatory changes. Here are some key points to understand regarding how new laws and policies could affect Masterworks and its investors:

Market Regulation and Oversight: One of the primary concerns for any investment platform is the level of regulatory scrutiny. Governments worldwide are increasingly focusing on financial markets and the protection of investors. New laws or amendments to existing regulations could introduce stricter oversight for companies like Masterworks, especially if they facilitate the trading of unique assets. This might include enhanced reporting requirements, increased transparency, and more stringent customer due diligence processes. While these measures aim to protect investors, they could also potentially increase operational costs for Masterworks and impact its ability to offer certain services or products.

Taxation and Legal Considerations: Regulatory changes related to taxation and legal frameworks can significantly influence investor behavior and Masterworks' operations. For instance, a new tax policy could impact the overall cost of investing in Masterworks, making it more or less attractive to potential investors. Additionally, changes in laws governing the art market, such as import/export regulations or restrictions on art ownership, might affect the availability and accessibility of artworks for investment. These legal shifts could potentially limit Masterworks' portfolio options and, consequently, the diversity of investment opportunities for its clients.

Impact on Liquidity and Exit Strategies: Regulatory changes can also influence the liquidity of investments. If new laws restrict the secondary trading of artworks or impose additional fees and taxes on such transactions, it could reduce the attractiveness of Masterworks as an investment vehicle. Investors might seek alternative ways to realize their gains, which could impact the overall liquidity of the platform. Furthermore, changes in regulations regarding the sale and transfer of assets might affect Masterworks' ability to facilitate smooth exit strategies for investors, potentially leading to longer holding periods or reduced investment appeal.

Global Regulatory Environment: Masterworks operates in a global market, and investors may be subject to different regulations in various jurisdictions. New international agreements or policies could impact the cross-border operations of the company. For example, changes in import/export regulations or tax treaties between countries might affect the cost structure and operational efficiency of Masterworks, ultimately influencing investor returns. Staying informed about global regulatory trends is crucial for investors to make well-informed decisions.

In summary, while Masterworks offers an innovative investment approach, it is essential to recognize that regulatory changes can introduce both risks and opportunities. Investors should stay updated on legal and policy developments that could impact their investments. Additionally, Masterworks must navigate the evolving regulatory landscape to ensure compliance and maintain its position as a safe and reliable investment platform. As with any investment, thorough research and due diligence are recommended to make informed choices.

Investing for Profit: Strategies for Success

You may want to see also

Competition: Masterworks faces competition from other companies, affecting its market position and profitability

Masterworks, a company that offers fractional shares of valuable artwork, has carved out a unique niche in the investment world. However, its success and viability as an investment vehicle are not without challenges, particularly when considering the competitive landscape. The concept of investing in Masterworks is appealing to many as it provides an opportunity to own a piece of art history, which can be a diversification strategy for investors. But, the question of safety and the potential for growth is a complex one, especially when other companies and platforms enter the market.

The art investment space is not entirely new, and several companies have already established themselves as competitors. For instance, companies like Artspace and Artfinder offer similar services, allowing investors to buy and sell artwork online. These platforms provide a more traditional e-commerce experience, where investors can browse, purchase, and potentially sell artwork, often with more immediate liquidity. This direct competition could impact Masterworks' ability to attract and retain investors, especially those who prefer more conventional investment avenues.

Another aspect of competition is the emergence of alternative investment platforms that offer fractional ownership in various assets, not just artwork. These platforms, such as Robinhood and Acorns, have gained popularity for their user-friendly interfaces and low-cost trading. While they may not directly compete with Masterworks' art-focused model, they do offer a similar concept of fractional ownership, which could attract investors seeking diverse investment opportunities. As these platforms expand their offerings, they may capture a portion of the market that Masterworks is targeting.

The competitive environment also extends to the financial services industry, where traditional investment firms and wealth management companies are increasingly offering alternative investment products. These institutions may provide access to art investments through their portfolios or as part of a broader diversification strategy. As a result, Masterworks might face challenges in positioning itself as a unique and attractive investment option, especially if these traditional players can offer similar benefits with established reputations and extensive resources.

In summary, while Masterworks has a novel approach to investing in art, its success is not guaranteed in the face of competition. The company must continually innovate and adapt to stay ahead, ensuring that its investment model remains appealing and safe for investors. This includes providing transparent and accessible information about the artwork, market trends, and potential risks associated with the art market. By doing so, Masterworks can maintain its market position and offer a compelling investment opportunity in a highly competitive landscape.

Strategic Investment Portfolio Management: A Comprehensive Guide

You may want to see also

Frequently asked questions

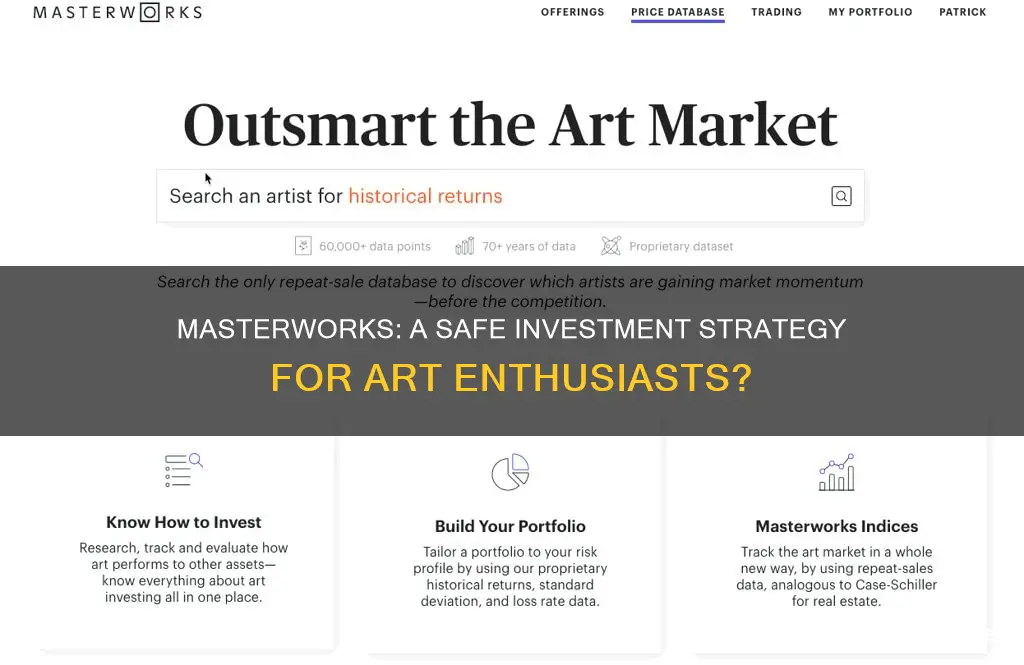

Masterworks is a platform that allows investors to buy shares in iconic pieces of art, specifically limited-edition prints of renowned artworks. It provides an opportunity for individuals to invest in the art market, which is traditionally considered a niche and exclusive domain.

While investing in Masterworks can be considered relatively safe compared to other alternative investment options, it is important to understand that art investments carry inherent risks. The value of artworks can fluctuate based on various factors such as market trends, artist popularity, and the specific artwork's condition. Masterworks aims to mitigate some of these risks by offering a diversified portfolio and providing thorough research and authentication for each artwork.

Masterworks employs a rigorous process to ensure the authenticity and quality of the artworks they offer. They work with reputable auction houses and art experts to verify the provenance and condition of each piece. Additionally, Masterworks provides insurance coverage for the artworks in their possession, protecting investors' interests. The platform also offers a buy-back guarantee, allowing investors to sell their shares back to Masterworks at a guaranteed price, providing a level of security for investors.

Despite the safety measures, there are still risks associated with art investments. Market sentiment and economic conditions can impact the overall art market, affecting the value of your investment. Additionally, the secondary market for art can be volatile, and the liquidity of your investment may be limited. It is essential to diversify your portfolio and conduct thorough research before investing in any platform like Masterworks.