Mutual funds are a great way to grow your money, but it's important to understand the tax implications of your investments. Mutual funds are typically regarded as one of the most profitable investment options, and their tax efficiency is one of their most significant benefits. However, it's essential to consider the taxation on dividends, redemption, etc., as it will impact your cash flow. The taxation of mutual funds depends on various factors, including the type of fund and the length of the investment. So, before investing in mutual funds, it's crucial to understand how your returns will be taxed.

Characteristics of Mutual Fund Investment Tax

| Characteristics | Values |

|---|---|

| Type of Tax | Capital Gains Tax |

| Taxable Entity | Mutual Fund Gains and Profits |

| Tax Rate Influencing Factors | Fund Types, Dividends, Capital Gains, Holding Period |

| Tax Rate | Depends on the Holding Period and Type of Mutual Fund |

| Taxation of Dividends | Added to Taxable Income and Taxed at Income Tax Slab Rate |

| Taxation of Capital Gains | Depends on Holding Period and Type of Mutual Fund |

| Securities Transaction Tax (STT) | 0.001% on Equity and Hybrid Equity-Oriented Funds |

| Tax on SIPs | Depends on Holding Period |

| Tax Declaration in ITR | Necessary |

What You'll Learn

Taxation of Dividends Offered by Mutual Funds

Dividends offered by mutual fund schemes are generally taxed in a classical manner. That is, dividends received by investors are added to their taxable income and taxed at their respective income tax slab rates. This is in accordance with amendments made in the Union Budget 2020. Previously, dividends were tax-free as companies paid dividend distribution tax (DDT) before distributing dividends.

Dividend distributions from mutual funds are typically taxed as ordinary income. If your mutual fund buys and sells dividend stocks frequently, any dividends you receive will likely be taxed as ordinary income. For example, if you are in the 25% income tax bracket and receive $1,000 in dividend payments from your actively managed fund, you will pay $250 at tax time.

However, there are two important exceptions: qualified dividends and tax-free interest. Dividend distributions from your mutual fund may be subject to the capital gains tax rate if they are considered qualified dividends by the IRS. To be qualified, the dividend must be paid by a stock issued by a US or qualified foreign corporation. Additionally, your mutual fund must have held the stock for more than 60 days within the 121-day period beginning 60 days before the ex-dividend date.

The other way to minimise your income tax bill is to invest in so-called tax-free mutual funds. These funds invest in government and municipal bonds, also called "munis", which pay tax-free interest. While municipal bond earnings are exempt from federal income tax, they may still be subject to state or local income taxes. Bonds issued in your state of residence may be triple-tax-free, meaning they are exempt from all income taxes.

In summary, dividends offered by mutual funds are generally taxed as ordinary income, but there are exceptions where they may be taxed at the capital gains rate or be tax-free. The specific taxation of dividends received will depend on multiple factors, including the type of mutual fund, the dividend amount, and the investor's income tax bracket.

Best Direct Mutual Fund Investment Apps: Your Guide

You may want to see also

Taxation of Capital Gains Offered by Mutual Funds

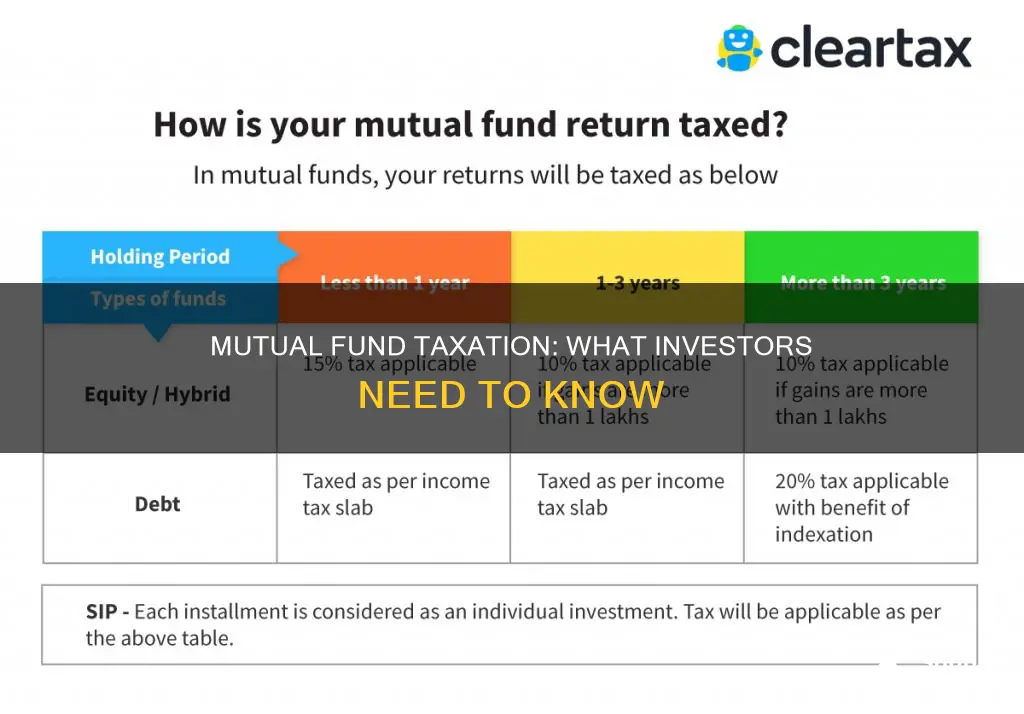

The taxation of capital gains from mutual funds depends on the holding period and the type of mutual fund. Mutual funds offer returns in the form of dividends and capital gains, with both being taxable in the hands of investors. Capital gains are profits made from the sale of capital assets, such as mutual fund units, at a higher price than their total investment amount.

Short-Term vs. Long-Term Capital Gains

Mutual funds realise short-term capital gains when units are sold after being held for less than a year, and long-term capital gains when units are sold after being held for more than a year. The holding period influences the tax rate payable on capital gains, with longer holding periods resulting in lower taxes.

Types of Mutual Funds

The taxation of capital gains also differs based on the type of mutual fund:

- Equity Mutual Funds: These funds invest more than 65% of their total fund in equity shares of companies. Short-term capital gains are taxed at a flat rate of 15%, while long-term capital gains up to Rs 1 lakh per year are tax-exempt.

- Debt Mutual Funds: Funds with a debt exposure of over 65% and equity exposure of up to 35% are known as debt mutual funds. Starting April 1, 2023, gains from debt funds will be taxed at the slab rate, added to the taxable income, and will no longer receive indexation benefits.

- Hybrid Mutual Funds: The taxation of capital gains on hybrid funds depends on their equity exposure. If equity exposure exceeds 65%, the fund is taxed like an equity fund; otherwise, debt fund taxation rules apply.

Securities Transaction Tax (STT)

In addition to the taxes on capital gains, an STT of 0.001% is levied by the government when buying or selling equity fund or hybrid equity-oriented fund units. This tax does not apply to the sale of debt fund units.

Taxation of Capital Gains When Invested Through SIPs

Systematic Investment Plans (SIPs) allow investors to invest small amounts periodically in a mutual fund scheme. When redeeming units purchased through SIPs, the duration of the investment holding for each instalment must be considered. Units purchased first are considered long-term holdings and are taxed accordingly, while units purchased from the second month onwards are considered short-term holdings and taxed at a flat rate of 15%.

Tax-Free Mutual Funds

To minimise your income tax bill, you can invest in tax-free mutual funds, which invest in government and municipal bonds. These funds pay tax-free interest, although this may still be subject to state or local income taxes.

Vanguard's Anti-Gun Investment: Funds for a Safer Future

You may want to see also

Taxation of Capital Gains of Equity Funds

Equity funds are a type of mutual fund where more than 65% of the total fund amount is invested in equity shares of companies. The taxation of capital gains on equity funds depends on the holding period.

If you redeem your equity fund units within a year, you realise short-term capital gains, which are taxed at a flat rate of 15%, irrespective of your income tax bracket.

If you sell your equity fund units after holding them for over a year, you make long-term capital gains. These capital gains of up to Rs 1 lakh a year are tax-exempt. Any long-term capital gains exceeding this limit attract LTCG tax at 10%, without indexation benefit.

The holding period for long-term capital gains on equity funds is 12 months.

It is important to note that the holding period for equity funds is different from that of debt funds, and their taxability also differs.

Factor Funds: Where to Invest Now?

You may want to see also

Taxation of Capital Gains of Debt Funds

Debt funds are mutual funds that predominantly invest in fixed-income securities, such as bonds, treasury bills, debentures, and other debt instruments. They are considered a preferred investment choice for conservative investors due to the relatively lower risks associated with them. The taxability of debt mutual funds has undergone several changes in recent years, with significant amendments occurring as recently as 2023. Here is a detailed overview of the taxation of capital gains of debt funds:

- Taxation Before 1st April 2023: Prior to this date, the taxation of debt mutual funds was governed by the holding period rule. If the debt mutual fund unit was sold within 36 months (three years) of purchase, the gains were considered short-term capital gains (STCG) and taxed at slab rates. If the units were sold after 36 months, the gains were classified as long-term capital gains (LTCG) and taxed at 20% with an indexation benefit.

- Taxation After 1st April 2023: Amendments to the Finance Bill 2023 removed the indexation benefit for debt mutual funds. Consequently, debt mutual funds are now taxed at the investor's slab rates, similar to fixed deposits. This change simplifies the tax treatment but may impact long-term investment strategies. Additionally, the changes affect gold mutual funds, hybrid mutual funds, international equity mutual funds, and funds of funds (FOF), as they will no longer receive indexation benefits when computing LTCG.

- Comparison of Taxation Before and After 1st April 2023: The removal of the indexation benefit will negatively impact investors falling under the 20%-30% tax bracket. For example, consider an investor who invested Rs. 10,00,000 in FY 2020-21 in a debt mutual fund and sold the investments after three years in FY 2023-24 for Rs. 20,00,000, resulting in a capital appreciation of Rs. 10,00,000. Before the amendments, the long-term capital gain would be taxed at 20% with indexation, resulting in a lower tax liability. After the changes, the entire gain is taxed at the slab rate, increasing the tax burden.

- Impact on Mutual Fund Houses and Investors: The removal of the indexation benefit may adversely affect mutual fund houses as investors may prefer to invest directly in debt securities rather than debt mutual funds to avoid AUM fees/charges. Additionally, the change may impact the attractiveness of debt mutual funds as an investment option due to the potential increase in the tax burden on profits.

- Taxation of Dividends from Debt Mutual Funds: Before March 31, 2020, dividends from debt funds were tax-free for investors as the Asset Management Company (AMC) or the fund house paid Dividend Distribution Tax (DDT). However, since the DDT was abolished in Budget 2020, dividends are now added to the total income of investors and taxed according to their applicable slab rate.

- Set-off and Carry Forward of Losses: One advantage of debt mutual funds over fixed deposits is that profits from debt mutual funds are classified as capital gains, while fixed deposits are categorized as 'income from other sources'. This allows investors to carry forward and offset losses from debt mutual funds against gains, providing greater flexibility in tax planning.

Marijuana Index Funds: A Guide to Investing in Cannabis

You may want to see also

Taxation of Capital Gains of Hybrid Funds

Hybrid funds are a type of mutual fund that invests in a mix of equity and debt securities, aiming to provide investors with regular income and long-term capital appreciation. The taxation of capital gains on hybrid funds depends on the fund's equity exposure. If a hybrid fund's portfolio has an equity exposure of more than 65%, it is taxed like an equity fund. On the other hand, if the equity exposure is below 65%, the rules for taxing debt funds apply.

For equity-oriented hybrid funds, long-term capital gains (LTCG) tax applies to profits made after holding the investment for more than one year from the investment date. The LTCG rate for equity funds is 10%, and any gains above Rs 1 lakh are taxed at 10% plus cess and surcharge. Short-term capital gains (STCG) on equity funds are taxed at a rate of 15%.

For debt-oriented hybrid funds, LTCG applies to profits made after three years from the investment date. The LTCG rate for debt funds is 20% with indexation. For STCG in debt funds, the profits are added to the investor's net income and taxed according to their income tax slab rate.

It is important to note that the taxation rules for mutual funds can vary based on factors such as fund types, dividend distribution, capital gains, and holding periods. Additionally, there may be other taxes and surcharges applicable, such as the Securities Transaction Tax (STT) levied on the purchase or sale of mutual fund units of equity or hybrid equity-oriented funds.

Maximizing Investment Returns: Strategies for Utility-Focused Investors

You may want to see also

Frequently asked questions

Yes, mutual funds are taxable based on the gains earned from them. The tax on mutual funds depends on factors such as the type of fund and the holding period of the investment.

Capital gains from mutual funds are taxed based on the holding period of the investment. Short-term capital gains (held for less than a year) are typically taxed at a higher rate than long-term capital gains.

Yes, mutual funds are considered tax-efficient investment vehicles. They can help you reduce your overall tax expense if you structure your investments appropriately. Additionally, certain types of mutual funds, such as Equity Linked Savings Schemes (ELSS), offer tax benefits under specific sections of the Income Tax Act.