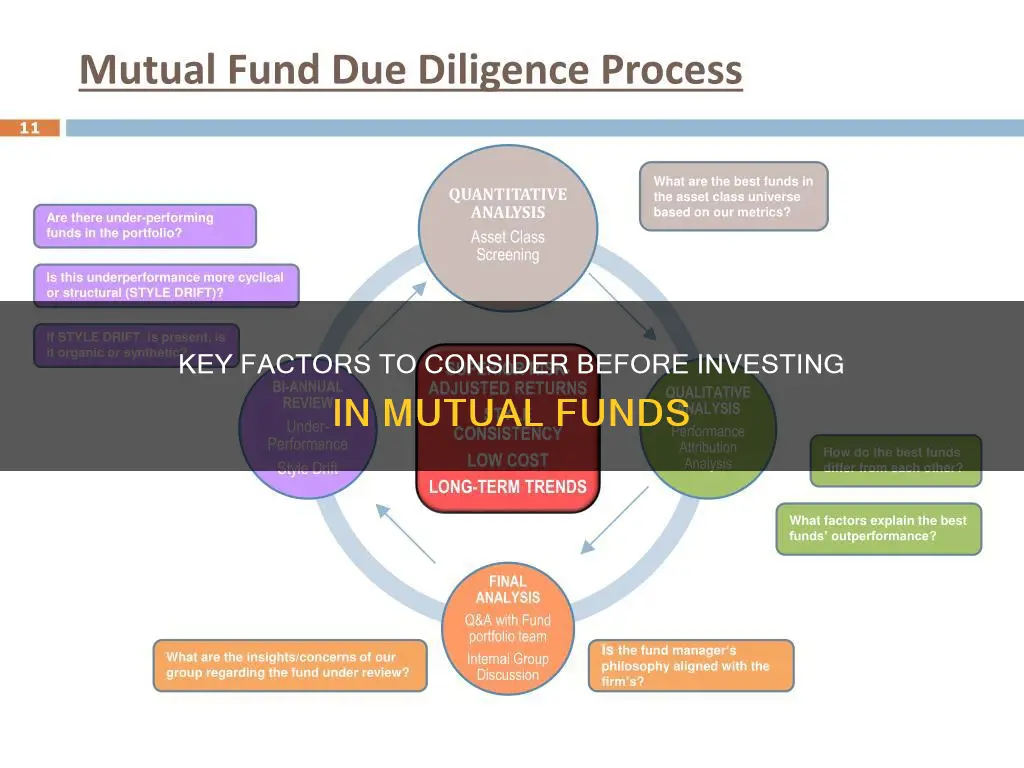

Investing in mutual funds is a popular way to grow your wealth. However, before diving into mutual funds, it's essential to conduct thorough due diligence. Here are some key things to check before investing in mutual funds:

- Investment goals and risk tolerance: Understand your financial objectives and risk tolerance. Are you investing for wealth creation, retirement planning, or buying a home? How much risk can you comfortably take? This will help you choose funds that align with your goals.

- Fund type and category: Mutual funds come in various types, such as equity funds, debt funds, hybrid funds, and thematic funds, each with a different level of risk. Ensure the funds you choose match your risk tolerance and investment goals.

- Historical performance: Research the fund's historical performance over different timeframes (1 year, 3 years, 5 years). Look for consistency in returns and compare it to its benchmark index and peer group.

- Pedigree and age of the fund house: Older funds with a proven track record and time-tested processes are generally considered more reliable. Check the history of the fund house and the fund manager's performance.

- Expense ratio: Mutual funds charge an expense ratio, which is the annual cost of managing the fund as a percentage of assets. Lower expense ratios are generally more favourable for investors, as they result in higher net returns.

- Risk factors: Understand the fund's exposure to different asset classes, sectors, and securities. Consider factors like credit risk, interest rate risk, and market risk.

- Exit load and liquidity: Check if the fund imposes an exit load for redeeming units before a specified duration. Also, evaluate the liquidity of the fund – how quickly can you redeem your units if needed?

- Tax implications: Different types of funds are subject to varying tax treatment. Understand the tax implications of your mutual fund investments to ensure your investment returns are effective.

- Disclosure documents: Read the scheme document carefully to understand the fund's objectives, strategy, fees, and risks, and ensure it aligns with your investment goals.

| Characteristics | Values |

|---|---|

| Investment goals | Wealth creation, retirement planning, buying a home, etc. |

| Risk tolerance | High, moderate, low |

| Investment horizon | Short-term, medium-term, long-term |

| Fund type and category | Equity funds, debt funds, hybrid funds, thematic funds |

| Historical performance | Consistent returns over different timeframes |

| Age of fund house | Older funds have more time-tested processes and internal control |

| Expense ratio | Lower expense ratios are more favourable for investors |

| Risk factors | Credit risk, interest rate risk, market risk |

| Exit load and liquidity | Check for exit load and how quickly units can be redeemed |

| Tax implications | Different types of funds are subject to varying tax treatment |

| Disclosure documents | Read scheme document to understand if scheme fits investment goals |

| Monitoring | Regularly monitor mutual fund investments to ensure they align with goals and risk tolerance |

What You'll Learn

Define your investment goals and risk tolerance

Before investing in mutual funds, it is crucial to define your investment goals and risk tolerance. This involves understanding your financial objectives, such as wealth creation, retirement planning, or purchasing a home, and determining how much risk you are comfortable with. Are you seeking high returns and willing to tolerate market volatility, or do you prefer a more conservative approach?

When defining your investment goals, consider the following:

- Time horizon: Are your goals short-term, medium-term, or long-term? Long-term goals allow for a focus on growth-oriented equity funds, while mid-term goals should balance growth and stability. For short-term goals, consider investing in funds that are easy to redeem and provide regular income.

- Risk tolerance: Evaluate your willingness to take risks. If you have a high-risk tolerance, consider equity funds, especially mid-cap and small-cap funds. Large-cap funds are relatively safer, and hybrid funds offer a mix of stocks and bonds. Debt funds provide further stability.

- Investment objectives: Plan out your specific objectives, such as retirement funding, children's education, emergency funds, or medical expenses.

Once you have defined your investment goals and risk tolerance, you can choose the right category of mutual funds, such as equity, debt, or hybrid funds, and select specific funds that align with your goals and risk appetite. Remember to consider factors such as fund performance, Net Asset Value (NAV), the track record of the Asset Management Company (AMC), expense ratios, exit loads, and the experience of the fund manager.

T. Rowe Price Funds: Cruise Investment Options Explored

You may want to see also

Understand the tax implications of your investments

Before investing in mutual funds, it is crucial to understand the tax implications of your investments. Different types of funds are subject to different tax treatments, and this can impact your overall returns. Here are some key considerations:

- Long-term capital gains: Long-term capital gains on certain types of funds, such as equity funds, may be tax-exempt, while others, such as debt funds, may incur tax liabilities.

- Short-term capital gains: The tax treatment of short-term capital gains will also vary depending on the type of mutual fund.

- Dividend distribution tax (DDT): DDT is imposed by the government on companies based on dividends paid to investors. The DDT rate for non-equity funds, such as money market, liquid, and debt funds, is typically higher than for equity funds.

- Tax benefits: Some mutual funds offer tax benefits, which can be advantageous if you are investing with the goal of saving taxes. For example, Equity-Linked Saving Schemes (ELSS) offer tax benefits under certain sections of the tax code.

- Expense ratios: Mutual funds charge an expense ratio, which is the annual cost of managing the fund as a percentage of assets. While this is not directly related to taxes, it can impact your overall returns. Lower expense ratios generally result in higher net returns for investors.

- Tax planning: Without proper tax planning, your investment returns may not be as effective. Consider seeking professional advice to understand the specific tax implications of your mutual fund investments based on your location and tax status.

Index Funds vs Roth IRA: Where Should You Invest?

You may want to see also

Research the fund's historical performance

Researching a mutual fund's historical performance is a crucial step in determining whether it aligns with your investment goals and risk tolerance. Here are some detailed instructions on how to research a mutual fund's historical performance:

- Review historical performance data: Analyze the fund's performance over different time frames, such as 1-year, 3-years, and 5-years. Look for consistency in returns and compare the fund's performance to its benchmark index and peer group. Keep in mind that past performance does not guarantee future results.

- Evaluate consistency: A fund that consistently delivers steady returns is often preferable to one that provides high returns in some years and negative returns in others. Consistency helps control losses and increases the likelihood of achieving good long-term returns.

- Dig into the numbers: Don't just look at the average returns; examine the individual yearly returns as well. A fund with a high five-year average return may have had one phenomenal year that skewed the average. Make sure the fund has consistently outperformed its benchmark.

- Compare with peers: Compare the historical performance of the fund with similar funds in its category. This will give you a better understanding of its relative performance.

- Consider market downturns: Look for funds that have withstood market downturns and demonstrated resilience during challenging economic conditions.

- Analyze upside and downside data: In addition to returns, consider the fund's upside and downside potential compared to similar funds. This will give you a more comprehensive view of its performance.

- Use analytical tools: Utilize mutual fund screener tools, such as Morningstar, to analyze and compare the historical performance of different funds. These tools provide valuable insights into a fund's risk, returns, and other relevant metrics.

- Study standard deviations: Historical return data can be useful for estimating where future data points may fall in terms of standard deviations. This analysis can provide insights into the volatility and variability of returns.

- Calculate historical returns: You can calculate the historical return of a mutual fund by subtracting the most recent price from the oldest price and then dividing the result by the oldest price. This will give you the percentage return.

- Analyze historical chart patterns: Technical analysts study historical return trends and patterns to forecast potential future market outcomes. While this analysis is more commonly applied to short-term price movements of volatile assets, it can still provide insights into the overall performance of the fund.

- Consider the age of the fund: Older funds with a proven track record and time-tested processes can provide more reliable historical performance data.

- Understand the impact of economic conditions: Keep in mind that historical returns are influenced by economic conditions, which can vary over time. For example, comparing historical returns during a recession may not accurately predict future returns if the underlying economic conditions are different.

Mutual Fund Investing: What You Need to Know

You may want to see also

Check the pedigree and age of the fund house

When investing in mutual funds, it is important to check the pedigree and age of the fund house. This is because older funds with a good pedigree have time-tested processes and internal controls in place. They have a track record of performance that you can examine to understand how they have fared over the years.

Balwant Jain, a tax and investment expert, advises investors to "check the history of past performance of the fund house as well as the fund manager". The time horizon of your investment goals is also important when selecting a mutual fund scheme. Older funds will have a longer performance history for you to evaluate.

You should also consider the fund's expense ratio, which is the annual cost of managing the fund as a percentage of its assets. Lower expense ratios are generally more favourable for investors as they result in higher net returns. Compare the expense ratios of similar funds to make an informed choice.

Mutual Fund Investment: Current Smart Choices

You may want to see also

Compare expense ratios of similar funds

When investing in mutual funds, it is important to compare the expense ratios of similar funds. This is because mutual funds and exchange-traded funds (ETFs) charge an expense ratio to cover the total annual operating expenses, including management and marketing. The expense ratio is expressed as a percentage of a fund's average net assets and is taken directly from the fund's returns. Therefore, a high expense ratio can significantly impact an investor's returns.

Expense ratios are calculated using the following formula:

> Expense ratio = Annual fund expenses / Total assets under management

For example, if a fund spends $100,000 a year on operating costs and has $10 million in assets, its expense ratio would be 1% (or 0.01 in decimal form). Sometimes, expense ratios are expressed as basis points, where 100 basis points is equal to 1%. So, if a fund charges 40 basis points, the expense ratio will be 0.40%.

Expense ratios for mutual funds tend to be higher than those of ETFs. While ETF expense ratios top out at no more than 2.5%, mutual fund costs can be significantly higher. As such, it is important to compare the expense ratios of similar funds to make an informed choice. For example, it would make sense to compare the costs of multiple international funds, as these are typically very expensive to operate due to their global scope. However, comparing the costs of an international fund to a large-cap fund would not make sense, as large-cap funds tend to be less expensive to operate.

When comparing the expense ratios of similar funds, investors can use several tools, including fund prospectuses, financial news websites, fund screeners, and news journals. By comparing expense ratios, investors can identify funds with lower costs, which will result in higher net returns.

Bond Fund Investment: What Percentage is Smart to Invest?

You may want to see also

Frequently asked questions

There are several types of mutual funds, including equity funds, debt funds, hybrid funds, and thematic funds. Each type carries a different level of risk. For example, equity funds are suitable for long-term wealth creation but come with higher volatility, while debt funds are lower-risk options that provide income and capital preservation.

Direct plans have a lower expense ratio than regular plans, leading to higher returns. Direct plans do not have an agent or broker, resulting in lower costs and no commission or brokerage fees.

You can measure a fund's performance by comparing it with other schemes in the same category and benchmark indices. Look for consistency in returns and consider the fund's risk-adjusted returns. Keep in mind that past performance does not guarantee future results.

Mutual funds come with various costs and fees, including management, promotion, administration, and distribution charges. The expense ratio is the total percentage of fund assets charged to cover these expenses, typically ranging from 1-2%. A lower expense ratio is generally more favourable for investors as it results in higher net returns.