Understanding the nature of long-term investments is crucial for anyone looking to build wealth and secure their financial future. These investments, which include stocks, bonds, real estate, and other assets held for an extended period, play a significant role in personal and business finance. While they can be considered assets due to their potential for growth and income generation, they also carry risks and responsibilities that can be viewed as liabilities. This dual nature makes the question of whether long-term investments are assets or liabilities a complex and important one to explore.

What You'll Learn

- Definition of Long-Term Investments: Financial assets held for more than a year, like stocks, bonds, or property

- Classification in Balance Sheets: Long-term investments are typically listed as assets, not liabilities, on a company's balance sheet

- Impact on Financial Health: They contribute to a company's net worth and financial stability over time

- Risk and Return: Long-term investments offer potential for higher returns but also carry market and credit risks

- Tax Implications: Tax laws often treat long-term capital gains differently from short-term gains, impacting overall financial planning

Definition of Long-Term Investments: Financial assets held for more than a year, like stocks, bonds, or property

Long-term investments are a crucial component of an individual's or an entity's financial portfolio, representing assets that are intended to be held for an extended period, typically over a year. These investments are a strategic approach to growing wealth and achieving financial goals. When we refer to long-term investments, we are primarily talking about financial instruments that are not expected to be converted into cash or sold within the short-term market fluctuations.

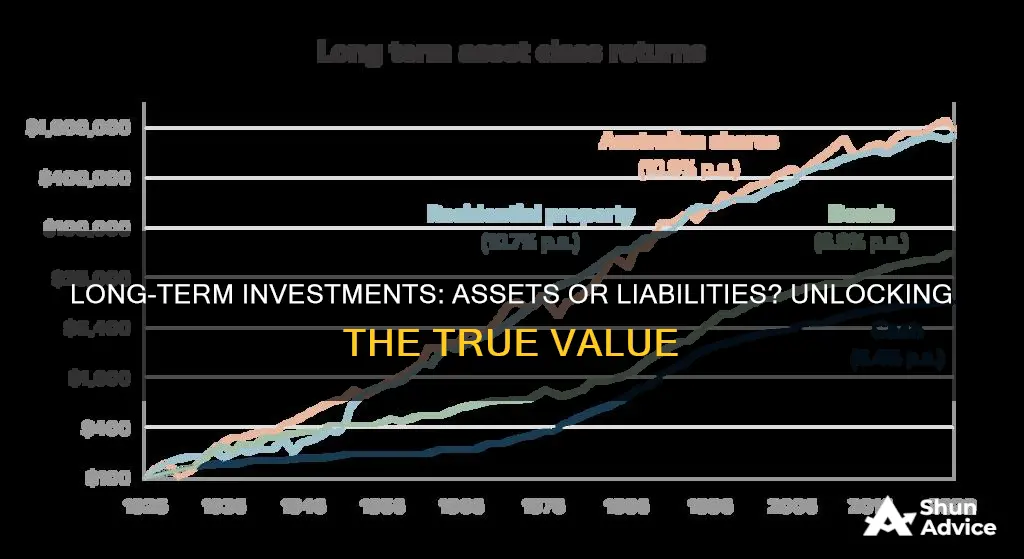

The definition of long-term investments encompasses a variety of financial assets, each with its own characteristics and potential benefits. One of the most common examples is stocks, which represent ownership in a company. Investors buy stocks with the expectation that the company's value will increase over time, allowing them to sell at a higher price in the future. Another category is bonds, which are essentially loans made to governments or corporations. Bondholders receive interest payments over the life of the bond and can redeem the principal amount at maturity. These investments are often considered low-risk compared to stocks, making them attractive to risk-averse investors.

Real estate is another asset class that falls under the long-term investment category. This includes properties purchased for rental income or as a long-term asset. The value of real estate can appreciate over time, providing significant returns on investment. Additionally, investors can leverage real estate to generate passive income through rentals, making it a popular choice for those seeking a steady cash flow.

The key aspect of long-term investments is the time horizon. These investments are designed to weather market volatility and economic cycles, providing stability and growth over an extended period. Unlike short-term investments, which may focus on quick gains, long-term investments are more about building wealth for the future. This approach often involves a higher level of risk tolerance, as short-term market fluctuations are less concerning when the investment is expected to be held for years.

In summary, long-term investments are financial assets that offer a strategic approach to wealth accumulation. They include stocks, bonds, and real estate, each providing unique benefits and contributing to a well-diversified investment portfolio. Understanding the nature of these investments is essential for anyone looking to build a secure financial future, as it allows for better decision-making and risk management.

Afs Investments: Long-Term Strategy or Short-Term Gamble?

You may want to see also

Classification in Balance Sheets: Long-term investments are typically listed as assets, not liabilities, on a company's balance sheet

Long-term investments are a crucial component of a company's financial health and are an essential topic to understand when analyzing a business's balance sheet. These investments are a type of asset that companies hold with the expectation of generating returns over an extended period, often several years or more. When classifying these investments, it is essential to recognize that they are not considered liabilities but rather assets. This distinction is vital for several reasons.

On a company's balance sheet, assets are items of value that the business owns, while liabilities are the obligations or debts the company owes to others. Long-term investments fall under the asset category because they represent the company's financial resources that are expected to provide future economic benefits. These investments can include various financial instruments such as stocks, bonds, or other securities that the company plans to hold for an extended duration.

The classification of long-term investments as assets is a conservative approach, ensuring that the financial statements provide a realistic view of the company's financial position. By listing these investments as assets, companies acknowledge their potential to generate returns and contribute to future growth. This classification also allows for better financial analysis and decision-making, as it provides a clear picture of the company's resources and their potential impact on long-term profitability.

When preparing a balance sheet, companies must carefully assess and categorize their investments. Long-term investments are typically valued at their fair value, which is the price they would receive in a current sale. This valuation ensures that the financial statements reflect the current market conditions and the potential risks and rewards associated with these investments.

In summary, long-term investments are an essential asset class for companies, representing their financial resources and potential for future growth. Proper classification as assets on the balance sheet is crucial for accurate financial reporting and analysis. It allows investors and stakeholders to understand the company's investment strategy and the potential impact on its long-term financial health. This classification also highlights the company's ability to manage and grow its assets over time, contributing to overall business success.

Understanding Long-Term Investment: A Guide to Current Asset Classification

You may want to see also

Impact on Financial Health: They contribute to a company's net worth and financial stability over time

Long-term investments are indeed crucial components of a company's financial health and play a significant role in its overall stability and net worth. These investments, often referred to as long-term assets, have a profound impact on a company's financial well-being in the long run. Firstly, they contribute to a company's net worth by being recorded on the balance sheet as assets. This is a fundamental aspect of accounting, where long-term investments are valued at their historical cost or fair value, whichever is more relevant. By having these investments, companies can showcase their financial strength and ability to generate returns over extended periods.

The impact of long-term investments on financial stability is twofold. Firstly, they provide a source of long-term capital that can be utilized for various business operations. This capital can be reinvested in the company's core business, expansion projects, or research and development, fostering growth and innovation. Secondly, these investments act as a buffer during economic downturns or market fluctuations. When the market takes a hit, companies with substantial long-term investments can rely on these assets to maintain their financial stability and avoid liquidity issues. This is especially important for businesses aiming to weather economic storms and emerge stronger.

Moreover, the strategic allocation of long-term investments can significantly influence a company's financial health. Companies often diversify their investment portfolios to minimize risk. This diversification can include a mix of stocks, bonds, real estate, and other assets. By carefully selecting and managing these investments, companies can ensure a steady return on investment, which, in turn, contributes to their overall financial performance. A well-managed investment portfolio can provide a consistent income stream, enabling companies to meet their financial obligations and maintain a positive cash flow.

In the context of financial reporting, long-term investments are typically classified as non-current assets, indicating their long-term nature. This classification is essential for accurate financial analysis and decision-making. Investors and creditors closely examine a company's long-term investments to assess its financial health and stability. A robust and well-diversified investment portfolio can enhance a company's creditworthiness and attract investors, further contributing to its financial stability.

In summary, long-term investments are vital assets that significantly impact a company's financial health and stability. They contribute to a company's net worth, provide long-term capital for growth, and act as a financial safety net during challenging times. Effective management and strategic allocation of these investments are essential for businesses to thrive and maintain a strong financial position in the market. Understanding the role of long-term investments is crucial for companies aiming to build a robust and resilient financial foundation.

Unveiling the Potential: Is Short-Term Investment an Asset?

You may want to see also

Risk and Return: Long-term investments offer potential for higher returns but also carry market and credit risks

Long-term investments are indeed a crucial aspect of financial planning, offering individuals and institutions the opportunity to grow their wealth over extended periods. These investments are typically characterized by their extended maturity or holding periods, often spanning several years or even decades. While they present the allure of potentially higher returns, it is essential to understand the risks associated with such investments.

One of the primary risks in long-term investments is market risk. This type of risk is inherent in any investment and refers to the potential for losses due to fluctuations in the market. Long-term investments, such as stocks, bonds, or real estate, can experience significant price changes based on market conditions. For instance, a prolonged economic downturn could lead to a decline in the value of these investments, impacting the overall portfolio. Investors must carefully consider their risk tolerance and ensure that their long-term investment strategy aligns with their financial goals and risk profile.

Credit risk is another critical factor to consider. Long-term investments, especially those in the form of bonds or fixed-income securities, are subject to credit risk. This risk arises when the issuer of the investment fails to make timely interest payments or, in extreme cases, defaults on the principal amount. Credit ratings play a vital role in assessing this risk, as they provide an evaluation of the issuer's creditworthiness. Investors should research and analyze the creditworthiness of the entities behind their long-term investments to minimize the potential for losses due to credit defaults.

Additionally, long-term investments may also face liquidity risk. This risk pertains to the difficulty of converting an investment into cash without incurring significant losses. Certain long-term assets, such as private equity or real estate, can be challenging to sell quickly, and investors might need to accept lower prices during market downturns. Understanding the liquidity of an investment is crucial for managing cash flow and ensuring that investors can access their funds when needed.

In summary, long-term investments offer the prospect of substantial returns but come with inherent risks. Market risk, credit risk, and liquidity risk are essential considerations for investors. Diversification, thorough research, and a clear understanding of one's financial objectives are key strategies to navigate these risks effectively. By carefully assessing these factors, investors can make informed decisions and build a robust long-term investment portfolio that aligns with their risk appetite and financial aspirations.

Understanding the Essentials of Long-Term Investment Strategies

You may want to see also

Tax Implications: Tax laws often treat long-term capital gains differently from short-term gains, impacting overall financial planning

When it comes to the tax implications of long-term investments, understanding the differences between short-term and long-term capital gains is crucial for effective financial planning. Tax laws in many countries recognize that long-term investments, which are typically held for an extended period, often provide a more stable and reliable return compared to short-term investments. As a result, these long-term gains are often taxed at a more favorable rate.

In many jurisdictions, long-term capital gains are taxed at a lower rate than ordinary income. This preferential treatment encourages investors to hold their assets for the long term, promoting a more stable investment environment. For example, in the United States, long-term capital gains are taxed at 0%, 15%, or 20%, depending on the taxpayer's income level, whereas short-term capital gains are taxed as ordinary income, which can be significantly higher. This significant difference in tax rates can have a substantial impact on an investor's overall financial strategy.

The tax treatment of long-term investments also extends to the calculation of gains. Long-term capital gains are generally determined by comparing the final sale price of an asset with its original purchase price, and the holding period is a critical factor. If an asset is held for more than a specified period (often one year or more), the gain is considered long-term. This distinction allows investors to optimize their tax liability by strategically planning the timing of their investments and sales.

For financial planners and investors, this tax differential has important implications. It encourages a long-term investment horizon, which can lead to more consistent and potentially higher returns over time. Additionally, it provides an incentive to diversify investment portfolios, as holding a variety of assets for the long term can offer tax advantages and reduce the overall tax burden. When structuring investment strategies, financial advisors often consider the tax implications to ensure that clients' portfolios are optimized for both growth and tax efficiency.

Understanding these tax laws and their impact on long-term investments is essential for making informed financial decisions. It allows investors to make strategic choices regarding asset allocation, investment timing, and tax-efficient selling strategies. By recognizing the tax benefits associated with long-term holdings, investors can potentially enhance their overall financial performance and better manage their tax obligations. This knowledge is particularly valuable for high-net-worth individuals and those seeking to build a substantial investment portfolio over time.

The Long-Term Value of Real Estate: A Smart Investment Strategy

You may want to see also

Frequently asked questions

Long-term investments are typically classified as assets. These are financial investments that a company plans to hold for an extended period, usually more than one year. Examples include stocks, bonds, and other securities. They are considered assets because they represent future economic benefits and can be converted into cash or used to generate income over time.

Long-term investments can significantly influence a company's financial position and performance. They provide an opportunity for the company to grow its wealth over time through capital appreciation and dividend income. These investments can also serve as a source of liquidity if needed, as they can be sold to generate cash without incurring significant short-term losses. However, the value of these investments can fluctuate, and any losses realized upon sale would be reported as a reduction in assets.

The primary distinction between long-term and short-term investments lies in the time horizon. Short-term investments are generally expected to be converted into cash or sold within a year or less. They are often used for liquidity purposes or to take advantage of short-term market opportunities. In contrast, long-term investments are held for an extended period, providing a more stable and secure investment option. Short-term investments are typically more liquid and may include money market funds, certificates of deposit, or highly tradable securities.