Understanding the difference between cash flow and profit is essential for investors and business owners to evaluate the financial health of a company. Cash flow is the net balance of cash moving into and out of a business, and it can be positive or negative. Positive cash flow means a company has more money coming in than going out, while negative cash flow indicates the opposite. Negative cash flow is common for new businesses, but it cannot be sustained long-term as it will eventually lead to a lack of funds.

There are three types of cash flow: operating cash flow, investing cash flow, and financing cash flow. Operating cash flow refers to the net cash generated from a company's normal business operations, while investing cash flow refers to the net cash generated from investment-related activities such as the purchase or sale of assets. Financing cash flow refers to how cash moves between a company and its investors, owners, or creditors.

While negative cash flow is generally seen as a warning sign, it is important to consider the context. Negative cash flow from investing activities, for example, can indicate that a company is investing in long-term assets to position itself for future growth. Therefore, when evaluating a company with negative cash flow, it is crucial to analyse its cash flow statement and the specific activities that are driving the negative cash flow.

| Characteristics | Values |

|---|---|

| Nature of Outside Investment | Positive cash flow from outside investment is when a company has more money moving into it than out of it. Negative cash flow is when the opposite is true. |

| Positive or Negative | Positive cash flow is generally a good sign, indicating a company has more funds to invest in growth and development. Negative cash flow is common for new businesses and can be a sign of poor financial management or timing issues. |

| Impact on Business | Positive cash flow allows companies to reinvest in their business, pay expenses, and facilitate growth. Negative cash flow can hinder a company's ability to pay expenses, expand, and grow. |

| Analysis | Investors and analysts should review the entire cash flow statement, including cash flow from operations and financing activities, to accurately interpret a company's financial health and performance. |

What You'll Learn

Positive cash flow from investing activities

- Sale of fixed assets: When a company sells physical assets such as property, plant, and equipment (PPE), it generates a positive cash flow. This can be seen in the case of Vincent, a manufacturer of e-bikes, who sold his old workshop for a higher price due to the area becoming trendy, resulting in a positive cash flow of £300k.

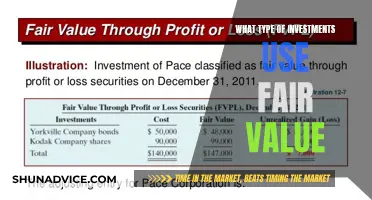

- Proceeds from the sale of marketable securities: Companies may sell marketable securities such as stocks, bonds, or shares, resulting in a positive cash flow. For example, Apple Inc. had proceeds from the sale of marketable securities of $5.83 billion, contributing to their positive cash flow from investing activities.

- Collection of loans and insurance proceeds: When a company lends money and collects repayments, it generates a positive cash flow. This includes collecting loan repayments from borrowers.

- Proceeds from insurance settlements: If a company receives insurance settlements related to damaged fixed assets, it can result in a positive cash flow.

It is important to note that positive cash flow from investing activities does not always indicate the overall financial health of a company. It should be analysed in conjunction with other financial statements, such as the balance sheet and income statement, to get a comprehensive understanding of the company's financial performance.

Cash Expenditure vs Investment: What's the Difference?

You may want to see also

Negative cash flow from investing activities

A negative cash flow from investing activities will appear on the "cash from investing activities" section of a company's cash flow statement. This is one of three sections that make up a company's statement of cash flows, the other two being cash from operating activities and cash from financing activities. The cash flow statement complements the balance sheet and income statement.

The cash flow statement indicates how well a company's management generates cash to pay its debts and fund its operating expenses. It can reveal what phase the business is in. For example, a company in an early startup phase may be purchasing the facilities or equipment it needs to ramp up.

To decide if a company's negative cash flow from investing activities is a positive or negative sign, investors should review the entire cash flow statement. It's important to analyse the entire cash flow statement and all its components to determine if the negative cash flow is a positive or negative sign.

A negative cash flow from investing activities could also be a warning sign that the company's management is not efficiently using its assets to generate revenue. For example, a drop in fixed-asset investment could signify that a company is no longer profitable. If a company is consistently reducing investments in fixed assets, it can be a signal that the company doesn't believe there are potential opportunities in its current business.

Cash Flows: Luring Investors with Predictable Returns

You may want to see also

Long-term assets

Negative cash flow from investing activities, such as long-term assets, is not always a bad sign. It can indicate that a company is investing in its long-term health and future growth. For example, a company may invest in fixed assets like property, plant, and equipment to grow the business. While this will show as negative cash flow in the short term, it may help the company generate cash flow in the long term.

A company's cash flow statement will show whether it has positive or negative cash flow from investing activities. This is one of three sections on the cash flow statement, the other two being cash flow from operations and cash flow from financing activities.

Negative cash flow from long-term assets can indicate that a company is putting more money into its long-term success than it is earning. However, this is not always a warning sign, and it is common for growing companies to have negative cash flow from investing activities.

It is important to analyse the entire cash flow statement and all its components to determine whether negative cash flow is a positive or negative sign.

Angel Investment Cash Flow Statement Strategies

You may want to see also

Cash flow statement

A cash flow statement is a financial document that provides a detailed analysis of the movement of cash into and out of a business during a specified period. It is one of the three main financial statements used by a business, alongside the balance sheet and income statement.

The cash flow statement is divided into three sections:

- Cash flow from operating activities: This includes any spending or sources of cash that are part of a company's day-to-day business operations, such as cash received from the sale of goods and services, salary and wages paid, and payments to suppliers.

- Cash flow from financing activities: This section shows the net cash flows involved in funding the company's operations, including bond offerings that generate cash and cash received from investors or owners.

- Cash flow from investing activities: This section reports the amount of cash generated or spent on investment-related activities, such as the purchase or sale of securities, physical assets, or other investments.

The cash flow statement is important because it provides insight into a company's financial health and performance. It helps investors and business owners understand the true activities of the company and make informed decisions. For example, a company can be profitable and still have negative cash flow, which can hinder its ability to pay expenses, expand, and grow.

Negative cash flow from investing activities does not always indicate poor financial health. It often means that the company is investing in long-term assets, research, or other activities important for the company's health and continued operations. However, consistent negative cash flow can be a sign of poor financial management or a struggling business.

To evaluate a company with negative cash flow from investing activities, investors should review the entire cash flow statement and analyse the specific investments made. It is also important to consider the company's growth stage and overall financial health.

Smart Ways to Invest 40K: Strategies for Success

You may want to see also

Cash flow forecasting

Understanding Cash Flow

Cash flow is the net balance of cash moving into and out of a business. It can be positive, indicating more money is coming in than going out, or negative, where expenses outweigh income. A healthy cash flow is necessary for a business to function and grow, allowing it to cover day-to-day expenses, such as employee salaries and utility bills.

Components of Cash Flow

There are three main components of cash flow:

- Operating Cash Flow: This refers to the money generated from a company's normal business operations. For actively growing companies, positive cash flow in this area is crucial to sustain growth.

- Investing Cash Flow: This is the money generated from investment-related activities, such as buying or selling assets, equipment, or securities. This area often shows negative cash flow, especially for companies investing in their future growth.

- Financing Cash Flow: This component focuses on the flow of cash between a company and its investors, owners, or creditors. It includes debt, equity, and dividend payments.

Cash Flow Statement

The cash flow statement is a financial document that provides a detailed analysis of a company's cash flow over a specific period. It is divided into the three components mentioned above: operating, investing, and financing activities. This statement helps investors and business owners understand the company's financial health and make informed decisions.

Negative Cash Flow

Negative cash flow, where expenses exceed income, is not uncommon, especially for new or growing businesses. However, it cannot be sustained long-term without external investment or financing. Negative cash flow can be due to poor timing of income and expenses or a loss-making business. It hinders a company's ability to reinvest in itself and constrains growth.

Positive Cash Flow

Positive cash flow, on the other hand, indicates a company has more money coming in than going out. This is necessary for sustaining business growth and ensuring financial obligations can be met. However, even profitable companies can experience negative cash flow due to poor cash flow management or ill-timed expenses.

Forecasting Techniques

To forecast cash flow, businesses can use automated accounting software or perform calculations manually. The basic principle is to predict and sum up all expected cash inflows from sales, investments, and financing, and then subtract all anticipated cash outflows from expenses and investments. The result is an expected net cash flow for the specified period.

Benefits of Cash Flow Forecasting

- Identifying Cash Shortages: Forecasting allows businesses to predict and prepare for potential cash shortages, helping them avoid financial difficulties.

- Informed Decision-Making: Accurate cash flow predictions enable better financial planning, including decisions about investments, financing, and growth strategies.

- Improved Cash Management: Forecasting helps businesses optimize their cash management by identifying areas where cash can be allocated more efficiently.

- Enhanced Financial Health: Ultimately, cash flow forecasting contributes to the financial health and stability of a business, reducing the risk of financial crises and supporting sustainable growth.

In conclusion, cash flow forecasting is a vital tool for businesses to understand and manage their finances effectively. It provides a forward-looking perspective that complements historical financial data, enabling businesses to make informed decisions and ensure they have the necessary resources to achieve their goals.

Buyers' Strategies to Minimize Cash Outlay During Acquisitions

You may want to see also

Frequently asked questions

No, negative cash flow is not always negative. While it can indicate a company's poor performance, it can also mean that significant amounts of cash have been invested in the long-term health of the company, such as research and development.

Outside investment can help a company with negative cash flow to stay afloat and continue its operations. It can also be used to finance growth and expansion.

Outside investment can be a positive indicator of a company's financial health, as it shows that investors are confident in the company's future prospects. However, if a company relies too heavily on outside investment, it may be a sign that the company is struggling to generate sufficient cash flow to fund its operations.

Outside investment can dilute the ownership and control of existing shareholders. It can also increase a company's financial leverage, leading to higher interest expenses and the risk of default.