Research and development (R&D) is a critical component of innovation and growth, but its long-term impact often raises questions about its short-term value. While R&D can lead to significant breakthroughs and advancements, it is often a costly and time-consuming process, which may prompt discussions about its immediate returns. This paragraph aims to explore the debate surrounding whether R&D is a short-term investment, considering the potential risks and benefits of this strategic approach.

What You'll Learn

- Cost-Benefit Analysis: Evaluate short-term vs. long-term financial impact of R&D

- Market Timing: Assess if R&D aligns with market trends and customer needs

- Innovation Risk: Consider the potential risks and rewards of new product development

- Intellectual Property: Understand the value of patents and trademarks in short-term investments

- Competitive Advantage: Determine if R&D provides a competitive edge within a short timeframe

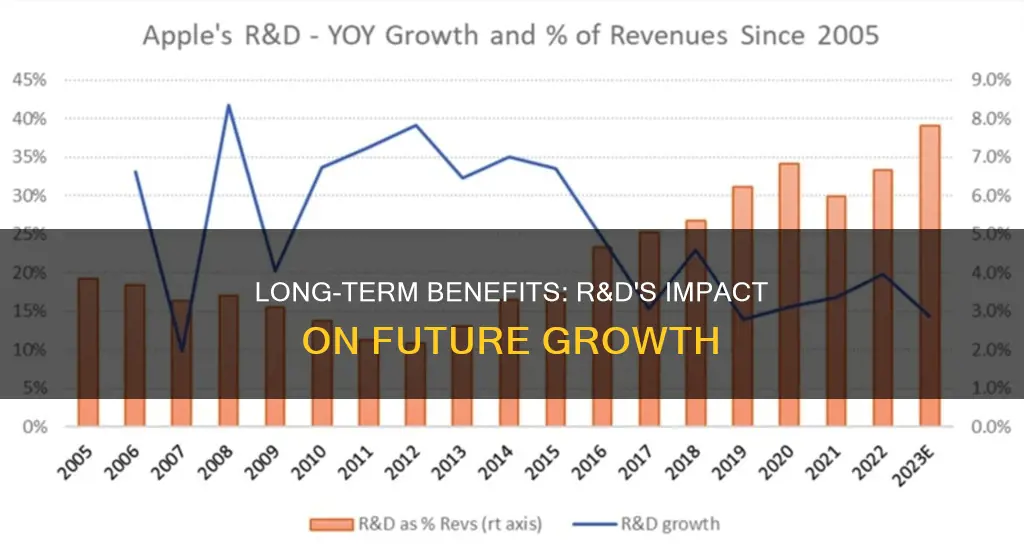

Cost-Benefit Analysis: Evaluate short-term vs. long-term financial impact of R&D

Research and Development (R&D) is a critical aspect of innovation and growth for any organization, but it often comes with a significant financial commitment. When considering R&D as an investment, it's essential to conduct a thorough cost-benefit analysis to understand its short-term and long-term financial impact. This analysis will help businesses make informed decisions about allocating resources and managing expectations.

Short-Term Financial Impact:

In the short term, R&D investments can be challenging to justify financially. The initial costs of research, development, and testing can be substantial, often requiring significant capital expenditure. These expenses may include hiring specialized personnel, purchasing equipment, conducting experiments, and securing intellectual property rights. During this phase, the primary focus is on generating ideas, prototyping, and validating concepts, which can be costly and time-consuming. The return on investment (ROI) might not be immediately apparent, and the financial benefits may not outweigh the expenses. However, it's crucial to recognize that short-term investments in R&D can lead to long-term gains and competitive advantages.

Long-Term Financial Benefits:

The long-term financial impact of R&D is where the true value becomes evident. Successful R&D initiatives can result in groundbreaking innovations, improved products or services, and enhanced market positioning. Here are some key long-term benefits:

- Market Advantage: R&D can lead to the development of unique products or processes, providing a competitive edge in the market. This advantage can result in increased market share, higher revenue, and improved customer loyalty.

- Cost Reduction: Over time, R&D can identify more efficient production methods, reduce material costs, or streamline processes, leading to significant cost savings.

- Intellectual Property: Investing in R&D allows companies to protect their innovations through patents, trademarks, or copyrights, providing a long-term barrier to competition.

- Future-Proofing: Continuous R&D ensures that a company stays ahead of industry trends and adapts to changing market demands, reducing the risk of obsolescence.

- Increased Efficiency: R&D can lead to the development of new technologies or improved processes, enhancing overall operational efficiency and productivity.

Cost-Benefit Analysis:

Conducting a comprehensive cost-benefit analysis is essential to evaluate the financial health of R&D projects. This analysis should consider the following:

- Identify Costs: List all direct and indirect costs associated with the R&D project, including personnel, equipment, research expenses, and potential risks.

- Estimate Benefits: Determine the potential financial gains, including increased revenue, cost savings, market expansion, and improved product/service quality.

- Risk Assessment: Evaluate the risks and uncertainties associated with the R&D project and develop strategies to mitigate them.

- Timeframe Analysis: Compare the short-term and long-term costs and benefits to understand the investment's overall financial impact.

- ROI Calculation: Calculate the Net Present Value (NPV) or Internal Rate of Return (IRR) to quantify the financial viability of the R&D investment.

In summary, while R&D may require significant short-term investments, it is a strategic decision that can drive long-term success and sustainability. A well-structured cost-benefit analysis will enable businesses to make informed choices, ensuring that R&D efforts are aligned with overall financial goals and market opportunities. This analysis is crucial for managing expectations and securing the necessary support for R&D initiatives within an organization.

Understanding Long-Term Investment: Cash Flow and Asset Allocation

You may want to see also

Market Timing: Assess if R&D aligns with market trends and customer needs

When considering whether research and development (R&D) is a short-term investment, it's crucial to evaluate its alignment with market trends and customer needs. This assessment is vital for ensuring that R&D efforts are not only financially sound but also strategically directed. Here's a detailed breakdown of how to approach this evaluation:

Market Trends Analysis: Begin by conducting a thorough analysis of current market trends. This involves studying industry reports, consumer behavior patterns, and emerging technologies. Identify the key trends that are shaping your industry and the broader market. For instance, are there new regulatory changes, technological advancements, or consumer preferences that are gaining traction? Understanding these trends will help you anticipate future demands and position your R&D accordingly. For example, if the market is shifting towards sustainable products, investing in R&D to develop eco-friendly solutions could be a strategic move.

Customer Needs Assessment: Understanding your target customers is paramount. Conduct surveys, focus groups, and interviews to gather insights into their needs, preferences, and pain points. Identify the specific problems your customers are facing and the solutions they seek. This customer-centric approach ensures that your R&D efforts are directed towards addressing real-world issues. For instance, if your customers consistently express a need for improved product durability, investing in R&D to enhance product quality and longevity could be a direct response to their requirements.

Competitor Analysis: A comprehensive analysis of your competitors' strategies is essential. Identify what they are investing in and why. Are they focusing on R&D in specific areas? What are the outcomes of their R&D efforts? Understanding your competitors' moves can provide valuable insights into market gaps and opportunities. If a competitor is investing heavily in a particular technology, it might indicate a potential market shift. By analyzing this data, you can make informed decisions about where to direct your R&D resources.

Strategic Alignment: The ultimate goal is to ensure that your R&D efforts are strategically aligned with your business objectives and market dynamics. Ask yourself: Does the proposed R&D project support our long-term goals? Is it in line with our market positioning and competitive advantage? For instance, if your company aims to become a leader in innovative, sustainable solutions, R&D projects should reflect this focus. Aligning R&D with market trends and customer needs ensures that your investments are not only profitable but also contribute to your overall business success.

Risk Assessment: Market dynamics can change rapidly, so it's essential to assess the risks associated with R&D projects. Consider the potential for market shifts, technological obsolescence, or customer preferences changing. Develop contingency plans to mitigate these risks. For example, if a new technology is expected to disrupt your industry, investing in R&D to adapt and integrate this technology could be a proactive approach.

By following these steps, you can make informed decisions about R&D investments, ensuring they are not just short-term gains but long-term strategies that drive your business forward in a dynamic market environment. This approach allows for a more agile and responsive R&D process, ultimately benefiting your organization's growth and sustainability.

Pepsi's Potential: A Long-Term Investment Strategy

You may want to see also

Innovation Risk: Consider the potential risks and rewards of new product development

When considering the realm of innovation and new product development, it's crucial to acknowledge the inherent risks and rewards that come with such ventures. The decision to invest in research and development (R&D) is a strategic one, often requiring a careful balance between short-term gains and long-term potential. Here's an exploration of the risks and rewards associated with this critical aspect of business growth:

Market Uncertainty: One of the primary risks in R&D is the uncertainty surrounding market acceptance. Introducing a new product or service always carries the risk that it may not resonate with the target audience. Consumers' preferences can be fickle, and what works today might not be as successful tomorrow. For instance, a tech company might invest heavily in developing the latest smartphone features, only to find that consumers prefer a simpler, more affordable model. This risk underscores the importance of thorough market research and understanding customer needs.

Financial Investment: R&D is a significant financial commitment. Companies must allocate resources, including time, money, and talent, towards research and development. The process can be lengthy and costly, especially for complex innovations. There's a risk that these investments may not yield immediate returns, and the product might not reach profitability within the desired timeframe. Startups, in particular, face the challenge of securing funding for R&D, and the pressure to demonstrate quick results can be immense.

Competition and Obsolescence: The business landscape is dynamic, and innovation often attracts competition. When a company invests in R&D, it opens the door to competitors doing the same. This can lead to a race to market, where the first to launch might not necessarily win. Additionally, the risk of product obsolescence is ever-present. Rapid technological advancements can render a product or service outdated quickly, especially in industries like technology and healthcare. Staying ahead of the curve requires continuous innovation and adaptation.

Reward: Market Advantage and Growth: Despite the risks, the rewards of successful R&D can be substantial. Innovating can lead to a competitive edge, allowing a company to capture a larger market share. Unique products or services can become industry game-changers, attracting customers and driving revenue growth. For instance, a pharmaceutical company's investment in a groundbreaking drug could lead to a monopoly in the treatment of a specific disease, generating significant profits.

Long-Term Sustainability: R&D that focuses on long-term sustainability and environmental impact can also be a rewarding venture. Consumers are increasingly conscious of the environmental and social implications of their purchases. Companies that invest in green technologies or socially responsible innovations can build a loyal customer base and gain a positive brand image. This type of innovation can lead to long-term success and resilience in a rapidly changing market.

In summary, while the path of innovation is fraught with potential risks, it is also a powerful driver of growth and success. Companies must carefully weigh the short-term costs against the long-term benefits, ensuring that R&D efforts are aligned with market demands and strategic goals. By understanding and managing these risks, businesses can turn innovation into a powerful tool for survival and prosperity.

Franchising: A Long-Term Investment Strategy for Success

You may want to see also

Intellectual Property: Understand the value of patents and trademarks in short-term investments

Intellectual property (IP) is a critical asset for any business, especially when considering short-term investments. Patents and trademarks are two key components of IP that can significantly impact a company's financial health and strategic direction. Understanding their value and how they can be leveraged in the short term is essential for making informed business decisions.

Patents are a powerful tool for protecting and monetizing innovative ideas and inventions. In the short term, patents can provide a competitive edge by preventing competitors from copying or using your unique technology. This exclusivity can lead to increased market share and revenue, especially in industries where innovation is rapid and constant. For instance, a tech startup might secure a patent for a novel software algorithm, allowing them to license this technology to other companies, generating immediate income. Additionally, the patent can attract investors who recognize the potential for future growth and market dominance.

Trademarks, on the other hand, are essential for building brand recognition and customer loyalty. In the short term, a strong trademark can differentiate your product or service from competitors, leading to increased sales and customer trust. For example, a fashion brand might register a unique logo or brand name, ensuring that their products are easily identifiable and memorable to consumers. This can result in higher brand awareness and customer loyalty, which are valuable assets in the short term, especially during the initial stages of market penetration.

The value of patents and trademarks in short-term investments is often realized through strategic licensing and partnerships. Companies can license their IP rights to others, generating immediate revenue and potentially forming valuable alliances. For instance, a pharmaceutical company might license a patent for a new drug to a larger corporation, ensuring a faster market entry and access to a wider customer base. Similarly, a software company could license its trademarks to multiple vendors, creating a network of associated brands and increasing market visibility.

In the context of research and development (R&D), short-term investments in IP can be particularly beneficial. R&D often involves high costs and long development cycles, but securing patents and trademarks during this process can provide a significant return on investment. For instance, a company might invest in R&D to create a breakthrough product, and by securing patents and trademarks simultaneously, they can protect their intellectual assets and potentially license them for short-term gains. This approach not only safeguards their innovations but also provides a competitive advantage in the market.

In summary, patents and trademarks are valuable assets that can significantly impact short-term investments. They offer protection, market differentiation, and revenue generation opportunities. By understanding and strategically utilizing IP, businesses can make informed decisions about R&D investments, ensuring that their short-term goals are aligned with long-term success and market dominance. This approach to IP management is crucial for any company aiming to thrive in a highly competitive business landscape.

Mastering Long-Term Investment Diversification: Strategies for Success

You may want to see also

Competitive Advantage: Determine if R&D provides a competitive edge within a short timeframe

Research and Development (R&D) is a strategic investment that often takes time to bear fruit, but it can significantly impact a company's competitive advantage in the short term. While R&D is traditionally associated with long-term gains, its immediate effects can still provide a competitive edge in various ways.

In today's fast-paced business environment, companies must stay agile and responsive to market changes. R&D can contribute to this agility by enabling businesses to quickly adapt to new trends, customer demands, and technological advancements. For instance, a company might invest in R&D to develop innovative products or services that can be quickly introduced to the market, giving them a head start over competitors. This rapid product development and launch can create a temporary competitive advantage, especially if it allows the company to capture a larger market share during the initial stages of a new product's lifecycle.

One of the key short-term benefits of R&D is the ability to gain insights and intelligence about the market and competitors. By conducting market research and analyzing competitor strategies, companies can identify gaps in the market and develop products or services that address these unmet needs. This proactive approach can lead to a competitive edge, as it allows the company to position itself as a market leader by offering unique and valuable solutions. For example, a tech company might invest in R&D to understand emerging technologies and then develop a product that integrates these advancements, giving them a competitive advantage over peers who have not yet caught up.

Additionally, R&D can contribute to a competitive edge by fostering a culture of innovation and creativity within the organization. Encouraging employees to think outside the box and experiment with new ideas can lead to unexpected breakthroughs. This internal innovation can result in short-term improvements in processes, product quality, or customer service, all of which can enhance the company's reputation and market position. For instance, a manufacturing company might invest in R&D to streamline its production processes, reducing costs and improving efficiency, which can give them a competitive edge over less efficient competitors.

However, it is essential to note that the success of R&D in providing a competitive advantage within a short timeframe depends on various factors. These include the company's ability to manage resources effectively, the relevance of the research to the market, and the speed at which the results are translated into actionable products or services. A well-planned R&D strategy, coupled with efficient execution, can indeed provide a competitive edge, even in the short term, by driving innovation, improving market understanding, and fostering a culture of continuous improvement.

Understanding Long-Term Investment: A Guide to Current Asset Classification

You may want to see also

Frequently asked questions

No, R&D is typically viewed as a long-term investment. It involves a significant financial commitment and often requires a substantial amount of time to bear fruit. The process can be lengthy, as it involves exploring new ideas, conducting experiments, and iterating on prototypes. R&D is crucial for innovation and can lead to groundbreaking discoveries and advancements in various industries.

R&D plays a vital role in driving a company's long-term success and sustainability. It enables businesses to stay competitive in the market by developing new products, improving existing ones, and creating unique solutions. Through R&D, companies can identify and address customer needs, gain a competitive edge, and expand their market share. This investment in innovation can lead to increased revenue, improved efficiency, and a stronger brand presence over time.

Short-term R&D approaches may carry certain risks. Focusing solely on immediate gains could lead to a lack of innovation and creativity. Companies might miss out on exploring groundbreaking ideas that could revolutionize their industry. Additionally, short-term strategies may not provide the same level of competitive advantage as long-term R&D, as they might not address fundamental challenges or create sustainable solutions. Balancing short-term goals with long-term R&D efforts is essential for a comprehensive and successful investment approach.