Understanding the financial health of a business often involves delving into the intricacies of its cash flow. One crucial aspect is identifying the cash flow invested in long-term assets, which plays a significant role in assessing a company's ability to fund its long-term growth and sustainability. This process involves analyzing various financial statements and ratios to determine how much cash is allocated to long-term investments, such as property, plant, and equipment, or intangible assets like patents and trademarks. By examining these financial indicators, investors and analysts can gain valuable insights into a company's financial strategy and its potential impact on future performance.

What You'll Learn

- Asset Identification: Recognize and categorize long-term assets like property, plant, and equipment

- Depreciation Methods: Apply consistent depreciation to reflect asset value over time

- Cash Flow Analysis: Examine cash inflows and outflows related to asset purchases and sales

- Capital Expenditure Planning: Understand the timing and impact of asset investments on cash flow

- Financial Reporting Standards: Adhere to accounting guidelines for accurate asset valuation and disclosure

Asset Identification: Recognize and categorize long-term assets like property, plant, and equipment

Asset identification is a crucial step in understanding and analyzing a company's financial health, especially when it comes to assessing cash flow investments in long-term assets. Long-term assets are those that are expected to provide benefits to the business over an extended period, typically more than a year. These assets are a significant part of a company's capital structure and can include property, plant, and equipment, as well as intangible assets like patents and trademarks. Proper identification and categorization of these assets are essential for accurate financial reporting and analysis.

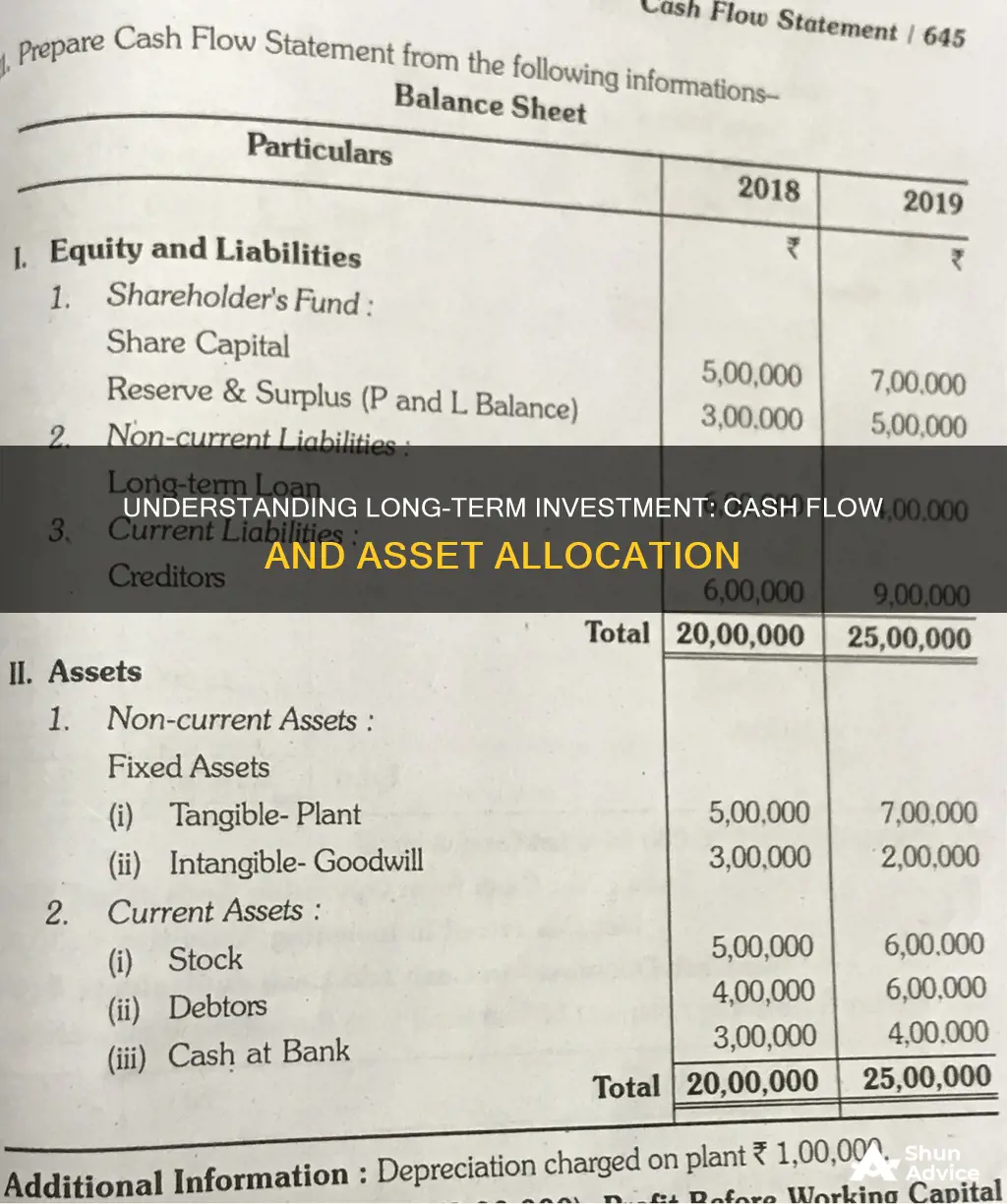

To begin the process of asset identification, start by examining the company's balance sheet, which provides a snapshot of its financial position at a given point in time. The balance sheet lists all the company's assets, liabilities, and shareholders' equity. Look for sections that specifically categorize assets, such as "Property, Plant, and Equipment" or "Intangible Assets." These sections will provide a detailed breakdown of each asset type, including their acquisition cost, accumulated depreciation, and any associated notes or disclosures.

When categorizing long-term assets, it's important to understand the nature and purpose of each asset. Property, plant, and equipment (PP&E) are tangible assets that are used in the company's operations and are expected to provide benefits over multiple accounting periods. This category includes items like buildings, machinery, vehicles, and office furniture. Each PP&E item should be individually identified and evaluated based on its expected useful life, depreciation method, and any specific characteristics that may impact its value or usage.

For example, a manufacturing company's factory building, production machinery, and delivery trucks are all considered PP&E. Each of these assets should be separately identified and analyzed. The factory building, due to its size and purpose, may have a longer useful life and be depreciated over an extended period, while the production machinery might have a shorter useful life and be depreciated more rapidly.

Additionally, intangible assets should also be identified and categorized. These assets lack physical substance but possess value due to their legal or contractual rights. Examples include patents, trademarks, copyrights, and goodwill. Each intangible asset should be evaluated based on its acquisition cost, expected useful life, and any associated risks or benefits. For instance, a patent might provide a competitive advantage for a certain period, while goodwill represents the premium paid for an acquisition and is typically amortized over a specific period.

By thoroughly identifying and categorizing long-term assets, companies can ensure that their financial statements accurately reflect the value and nature of these assets. This process enables better decision-making, as it provides a clear understanding of the company's capital investments and their potential impact on future cash flows. Accurate asset identification is a fundamental step in determining how much cash flow is invested in long-term assets and how these investments contribute to the company's overall financial performance.

Long-Term Investments vs. Long-Term Debt: Understanding the Difference

You may want to see also

Depreciation Methods: Apply consistent depreciation to reflect asset value over time

To determine the cash flow invested in long-term assets, it's essential to understand the concept of depreciation and how it impacts these assets over time. Depreciation is a method used to allocate the cost of a tangible or intangible asset over its useful life, reflecting the decrease in its value due to wear and tear, obsolescence, or other factors. This process is crucial for accurately representing the financial health and performance of a business.

When it comes to long-term assets, such as property, plant, and equipment, consistent depreciation is applied to ensure that the asset's value is properly reflected in the financial statements. The primary goal is to match the expense of using the asset with the revenue it generates over its useful life. There are several depreciation methods to choose from, each with its own advantages and considerations.

One common method is the straight-line depreciation, where the asset's cost is evenly spread over its useful life. This approach provides a consistent expense each year, making it easy to calculate and predict. For example, if a company purchases a piece of machinery for $10,000 with an expected useful life of 5 years, the straight-line depreciation would be $2,000 per year ($10,000 / 5 years). This method is straightforward and widely used, ensuring that the asset's value is consistently reduced over its operational period.

Another depreciation method is the declining balance method, which applies a higher depreciation rate to the asset's initial value. This method results in higher depreciation expenses in the early years and lower expenses in later years. It is particularly useful for assets that become less valuable over time, such as certain types of machinery or vehicles. The declining balance method can provide a more accurate representation of the asset's value, especially when the asset's productivity or market value decreases over its useful life.

Additionally, companies may opt for the double-declining balance method, which is a variation of the declining balance method. This approach applies an even higher depreciation rate, resulting in even more significant depreciation expenses in the early years. It is often used for assets that are expected to have a shorter useful life or are subject to rapid technological obsolescence. By applying consistent and appropriate depreciation methods, businesses can ensure that their financial statements accurately reflect the value and performance of their long-term assets.

Navigating Short-Term Investments: Asset or Liability?

You may want to see also

Cash Flow Analysis: Examine cash inflows and outflows related to asset purchases and sales

To determine the cash flow invested in long-term assets, it's essential to delve into the specific transactions related to asset purchases and sales. This analysis provides valuable insights into a company's financial health and its ability to manage its asset base. Here's a step-by-step guide to understanding this process:

Asset Purchases: When a company decides to acquire long-term assets, such as property, equipment, or investments, it typically involves a significant cash outflow. The purchase process begins with identifying the asset, negotiating its price, and finalizing the transaction. For instance, if a company buys a piece of machinery for its manufacturing process, the cash flow statement will reflect a negative cash flow as the company pays for the asset. This outflow is recorded as a capital expenditure, which is a non-operating expense, and is crucial for understanding the financial impact of these purchases.

Sales of Assets: Conversely, when a company sells long-term assets, it generates a cash inflow. This could be the sale of a business unit, property, or any other long-term asset. For example, if a company decides to sell a division that includes a factory and its equipment, the cash received from the sale will be a positive cash flow. This inflow is recorded as a decrease in assets and an increase in cash, providing a clear picture of the financial benefits derived from these transactions.

Cash Flow Analysis: Examining these cash inflows and outflows is a critical aspect of financial analysis. It allows investors and stakeholders to assess the efficiency of asset management and the overall financial strategy. By comparing the cash generated from asset sales with the cash spent on purchases, one can evaluate the company's ability to optimize its asset portfolio. This analysis is particularly useful for understanding the company's long-term financial planning and its impact on cash reserves.

In the context of long-term assets, this analysis becomes even more crucial. Long-term assets are typically those that are expected to provide benefits over multiple accounting periods, such as property, plant, and equipment, or intangible assets. The cash flow from these assets is often tied to their depreciation, which is a systematic allocation of the asset's cost over its useful life. Understanding the cash flow patterns related to these assets is essential for financial forecasting and decision-making.

By carefully examining the cash flows associated with asset purchases and sales, investors and financial analysts can make informed decisions regarding a company's financial health, growth prospects, and overall asset management strategy. This analysis provides a comprehensive view of how a company's cash position is influenced by its long-term asset investments.

Unlocking Long-Term Wealth: Are Trading Securities a Wise Investment Strategy?

You may want to see also

Capital Expenditure Planning: Understand the timing and impact of asset investments on cash flow

When it comes to capital expenditure planning, understanding the timing and impact of asset investments on cash flow is crucial for any business. Long-term assets, such as property, equipment, and infrastructure, are significant investments that can have a substantial effect on a company's financial health. Proper planning and analysis are essential to ensure that these investments are made strategically and do not disrupt the company's cash flow.

The process of determining the cash flow invested in long-term assets involves a comprehensive review of the company's financial statements and future projections. Firstly, identify the assets that fall under the long-term category, such as property, plant, and equipment. These assets are typically expected to provide benefits over multiple accounting periods and are not intended for immediate sale. Calculate the initial investment in these assets, including the purchase price, installation costs, and any other expenses incurred to bring them into use.

Next, analyze the cash flow implications of these long-term assets. This involves understanding the timing of cash outflows and inflows associated with the assets. For example, when a company purchases a piece of equipment, it will experience an immediate cash outflow. However, over time, the asset may generate cash inflows through its operational activities. The key is to forecast these cash flows accurately to ensure that the business has sufficient liquidity to meet its short-term obligations and fund its long-term investments.

To gain a comprehensive view, consider the entire lifecycle of the asset. This includes the initial investment, subsequent maintenance and repair costs, and eventual disposal or replacement. For instance, a company might invest in a new manufacturing plant, which requires a significant upfront cash outlay. Over time, the plant generates revenue and contributes to the company's profitability. However, regular maintenance and upgrades are necessary to ensure optimal performance, incurring additional cash expenses. By understanding these cash flow patterns, businesses can make informed decisions about when and how to invest in long-term assets.

Effective capital expenditure planning also involves evaluating the impact of these investments on the company's overall financial health. This includes assessing the potential for increased revenue, cost savings, or operational efficiency. For example, investing in new technology might improve productivity, leading to higher sales and reduced costs over time. By analyzing these factors, businesses can determine the strategic value of an asset investment and its potential to enhance long-term cash flow.

In summary, capital expenditure planning requires a meticulous approach to understanding the timing and consequences of long-term asset investments. By carefully analyzing cash flows, considering the asset's lifecycle, and evaluating its strategic impact, businesses can make informed decisions that optimize their financial resources and ensure a healthy cash flow position. This process enables companies to balance short-term obligations with long-term growth prospects.

Mastering Short-Term Investing: Strategies for Quick Profits

You may want to see also

Financial Reporting Standards: Adhere to accounting guidelines for accurate asset valuation and disclosure

Financial reporting standards play a crucial role in ensuring the accuracy and transparency of financial statements, especially when it comes to the valuation and disclosure of long-term assets. These standards provide a framework for companies to follow, enabling stakeholders to make informed decisions and assess the financial health of an organization. When determining the cash flow invested in long-term assets, it is essential to adhere to these guidelines to maintain consistency and reliability in financial reporting.

One of the primary sources of guidance for asset valuation is the International Financial Reporting Standards (IFRS) and the Generally Accepted Accounting Principles (GAAP). These standards emphasize the importance of fair value measurements for long-term assets, such as property, plant, and equipment, as well as intangible assets. Fair value is determined by considering the present value of the future cash flows that the asset is expected to generate. This approach ensures that assets are valued based on their future economic benefits rather than historical cost. For instance, a company should not simply rely on the original purchase price of a piece of machinery but instead assess its current value based on its remaining useful life and expected cash flows.

To calculate the cash flow invested in long-term assets, companies should analyze the expected cash outflows and inflows associated with these assets over their useful lives. This involves forecasting future cash flows, considering factors such as revenue generation, maintenance costs, and potential disposal proceeds. By doing so, organizations can determine the net cash flow generated or absorbed by these assets. For example, a manufacturing company might calculate the cash flow from its factory equipment by considering the revenue it generates, the maintenance costs, and the potential sale value at the end of its useful life.

Accurate valuation and disclosure of long-term assets are essential for several reasons. Firstly, it provides a true and fair view of the company's financial position, allowing investors and creditors to assess the quality of the company's assets and their potential impact on future cash flows. Secondly, proper valuation ensures that the financial statements reflect the economic substance of the assets, which is crucial for decision-making. Misvaluation of assets can lead to incorrect financial ratios, misleading financial statements, and potential legal issues if regulatory bodies are involved.

In addition to valuation, financial reporting standards also require companies to disclose relevant information about their long-term assets. This includes details such as the nature and purpose of the assets, their acquisition costs, depreciation methods, and any significant changes in value during the reporting period. Disclosure ensures that users of financial statements have access to the necessary data to interpret the financial information accurately. For instance, a company might disclose the expected useful life of its property assets and the depreciation method used, providing transparency and enabling users to assess the asset's impact on the company's financial performance.

In summary, adhering to financial reporting standards is vital for accurate asset valuation and disclosure. By following the guidelines provided by IFRS and GAAP, companies can ensure that their long-term assets are valued fairly and that relevant information is disclosed. This promotes transparency, enables better decision-making, and maintains the integrity of financial statements, ultimately benefiting all stakeholders involved.

Maximizing Returns: The Power of Long-Term Investment Strategies

You may want to see also

Frequently asked questions

Cash flow invested in long-term assets refers to the amount of cash a company allocates towards purchasing or acquiring long-term assets, such as property, plant, and equipment, or other long-term investments. This is a crucial metric for understanding a company's investment strategy and its ability to fund long-term growth.

To calculate this, you need to analyze the company's cash flow statement. Look for the section on cash flow from operating activities and identify the cash outflows related to long-term asset purchases. This can be found in the 'Capital Expenditures' or 'Property, Plant, and Equipment' line items. Subtracting these cash outflows from the total cash flow from operations will give you the cash flow invested in long-term assets.

This metric is essential for investors as it provides insights into a company's financial health and growth prospects. A positive cash flow invested in long-term assets indicates that the company is reinvesting its cash effectively in future growth opportunities. It shows a commitment to long-term sustainability and can be a sign of a well-managed business. Investors can use this information to assess the company's ability to fund its operations and make informed decisions regarding their investments.