Understanding the relationship between short-term borrowings and investments is crucial for assessing a company's financial health and strategic decisions. While short-term borrowings refer to funds obtained for a limited period, typically within one year, investments encompass a broader range of financial activities, such as purchasing assets or securities with the expectation of generating returns. This distinction is essential as it highlights the different purposes and implications of these financial activities, impacting a company's liquidity, capital structure, and overall financial strategy.

What You'll Learn

- Definition of Short-Term Borrowings: Understanding the financial instruments used for short-term borrowing

- Investment vs. Debt: Distinguishing between short-term debt and long-term investments

- Liquidity and Cash Flow: How short-term borrowings impact a company's liquidity and cash flow

- Risk and Returns: Assessing the risks and potential returns of short-term investments

- Regulation and Compliance: Legal and regulatory considerations for short-term borrowings and investments

Definition of Short-Term Borrowings: Understanding the financial instruments used for short-term borrowing

Short-term borrowings are a crucial aspect of financial management, especially for businesses and individuals seeking to meet their short-term financial obligations or invest in opportunities that require immediate capital. These borrowings are typically characterized by their short duration, often ranging from a few days to a year, and are designed to provide quick access to funds. The primary purpose of short-term borrowings is to bridge the gap between the need for immediate cash and the availability of long-term financing options.

In the financial world, short-term borrowings can take various forms, each with its own unique features and advantages. One common instrument is the short-term loan, which is a temporary credit facility provided by financial institutions. These loans are usually unsecured or secured by assets, and they offer a flexible way to access funds for a limited period. For instance, a business might take out a short-term loan to cover operational expenses until its next revenue stream arrives.

Another form of short-term borrowing is the use of commercial paper, which is a short-term unsecured promissory note. Companies often issue commercial paper to finance their short-term needs, such as managing accounts payable or funding inventory. This instrument is highly liquid and allows businesses to quickly raise capital without the lengthy processes associated with traditional loans.

Additionally, short-term borrowings can also involve the utilization of lines of credit. These are agreements with financial institutions that provide a predetermined amount of credit for a specified period. Businesses can draw funds as needed, up to the agreed limit, and only pay interest on the amount used. This flexibility is particularly useful for managing cash flow fluctuations.

Understanding short-term borrowings is essential for anyone involved in financial decision-making. It allows individuals and businesses to make informed choices about their capital structure and liquidity management. By recognizing the various financial instruments available for short-term borrowing, one can effectively plan and execute strategies to meet immediate financial requirements while maintaining a healthy balance sheet.

Unlocking Long-Term Wealth: The Power of Portfolio Diversification

You may want to see also

Investment vs. Debt: Distinguishing between short-term debt and long-term investments

The terms "short-term borrowings" and "investments" are often used in financial contexts, but they represent distinct concepts with different implications for an individual's or a company's financial health. Understanding the difference between these two is crucial for making informed financial decisions.

Short-Term Borrowings:

Short-term borrowings refer to funds that a business or individual borrows with the intention of repaying within a relatively short period, typically one year or less. This includes various forms of debt, such as short-term loans, lines of credit, and commercial paper. These borrowings are essential for businesses to manage their cash flow, finance short-term projects, or cover unexpected expenses. For individuals, it might involve personal loans or credit cards, which are designed to be repaid quickly. The key characteristic is the short repayment period, which often comes with relatively higher interest rates compared to long-term debt.

Investments:

In contrast, investments are long-term financial commitments aimed at generating returns over an extended period. This can include a wide range of assets, such as stocks, bonds, real estate, or mutual funds. Investments are typically purchased with the expectation that they will appreciate in value over time, providing capital gains or regular income through dividends or interest. For individuals, investments are a way to grow their wealth, while for businesses, they can be a strategy to expand operations, enter new markets, or diversify their revenue streams. Investments are generally less liquid than short-term borrowings, meaning they may take longer to convert into cash without incurring losses.

Distinguishing Between the Two:

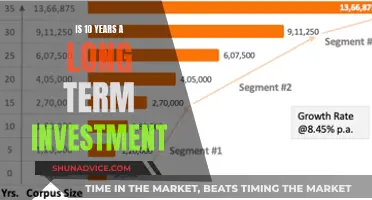

The primary distinction lies in the duration and purpose of the financial arrangement. Short-term borrowings are used for immediate needs and are intended to be repaid quickly, often within a year. They are a tool for managing cash flow and covering short-term financial obligations. On the other hand, investments are long-term financial commitments made with the goal of growing wealth or generating income over an extended period.

For individuals, short-term borrowings might include credit card debt or a personal loan for a vacation, while investments could be a retirement plan, a real estate property, or stocks in a growing company. For businesses, short-term borrowings could finance inventory or pay for short-term projects, while investments might include acquiring new equipment, expanding into new markets, or purchasing long-term assets like property or intellectual property.

Understanding this difference is essential for financial planning and risk management. Short-term borrowings should be managed carefully to avoid long-term financial strain, while investments can contribute to long-term financial goals and wealth creation.

Unveiling the Tricks: How Short-Term Investments Are Manipulated

You may want to see also

Liquidity and Cash Flow: How short-term borrowings impact a company's liquidity and cash flow

Short-term borrowings, often referred to as short-term debt or current liabilities, are a crucial aspect of a company's financial management, especially in terms of liquidity and cash flow. These borrowings are typically due within one year or the company's operating cycle, whichever is longer. Understanding how short-term borrowings impact a company's liquidity and cash flow is essential for investors, creditors, and management alike.

Impact on Liquidity:

Liquidity refers to a company's ability to meet its short-term financial obligations. Short-term borrowings directly affect a company's liquidity position. When a company takes on short-term debt, it increases its current liabilities, which can temporarily reduce its liquidity. This is because a portion of the company's assets is now tied up in repaying these debts. As a result, the company may have less cash available to cover its immediate expenses and obligations. For instance, if a company borrows $100,000 for a period of three months, it will need to allocate a portion of its cash reserves to service this debt, potentially limiting its ability to fund day-to-day operations.

Cash Flow Considerations:

Short-term borrowings have a direct and immediate impact on a company's cash flow. Repaying these debts requires the company to use its cash reserves, which can disrupt the normal cash flow cycle. This disruption can be particularly critical for businesses with seasonal fluctuations or those in industries with unpredictable cash inflows and outflows. For example, a retail company might borrow to finance inventory for the holiday season, but the repayment of this debt in the following months could strain its cash flow during a typically slow period. Effective management of short-term borrowings is essential to ensure that the company can meet its short-term cash flow needs without compromising its long-term financial health.

Strategic Use and Benefits:

Despite the potential negative impact on liquidity and cash flow, short-term borrowings can also be a strategic tool for businesses. Companies may use short-term debt to take advantage of opportunities, such as investing in temporary projects, acquiring assets, or managing seasonal fluctuations. For instance, a construction company might borrow to secure a lucrative contract, knowing that the debt will be repaid once the project is completed. In such cases, the short-term borrowings can contribute to long-term growth and profitability. However, it is crucial to carefully plan and manage these borrowings to ensure they do not become a burden.

Risk Mitigation and Financial Planning:

To maintain a healthy financial position, companies should engage in proactive financial planning and risk management. This includes regularly reviewing and assessing short-term borrowings to ensure they align with the company's cash flow projections and overall financial strategy. By monitoring these borrowings, companies can identify potential issues early on and take corrective actions. Effective financial planning also involves exploring alternative financing options, such as long-term loans or equity financing, to reduce the reliance on short-term borrowings and mitigate the associated risks.

In summary, short-term borrowings have a significant impact on a company's liquidity and cash flow. While they can provide flexibility and support short-term goals, careful management is essential to avoid liquidity crises and cash flow disruptions. Understanding the relationship between short-term debt and a company's financial health is a critical aspect of financial management and decision-making.

Mastering Long-Term Investment Diversification: Strategies for Success

You may want to see also

Risk and Returns: Assessing the risks and potential returns of short-term investments

When considering short-term investments, it's crucial to understand the associated risks and potential returns. Short-term investments typically involve funds that are expected to be held for a period of less than one year. These investments are often sought by individuals and institutions looking for a safe and liquid way to grow their money while still having easy access to their capital. However, it's important to recognize that short-term investments come with their own set of risks and considerations.

One of the primary risks associated with short-term investments is market volatility. While these investments are generally considered less risky than long-term ones, they can still be affected by market fluctuations. Economic events, such as interest rate changes or geopolitical tensions, can impact the value of short-term investments. For instance, if interest rates rise, the value of short-term bonds or money market funds may decrease, as newer investments offer higher yields. Similarly, unexpected market downturns can lead to a decline in the value of short-term investments, especially in volatile sectors like technology or small-cap stocks.

Another risk to consider is credit risk, which is particularly relevant for short-term investments in the form of corporate bonds or commercial paper. These investments rely on the creditworthiness of the issuing entity. If the borrower defaults or faces financial difficulties, the value of these short-term investments can be significantly impacted. Assessing the credit quality of the issuer is essential to mitigate this risk.

Despite the risks, short-term investments can offer attractive potential returns. These investments often provide a higher yield compared to traditional savings accounts due to their lower risk profile. Money market funds, for example, offer a competitive interest rate while maintaining a high level of liquidity. Short-term bonds or treasury bills can also provide a steady income stream with relatively low risk. The key is to strike a balance between risk and return, ensuring that the investment aligns with your financial goals and risk tolerance.

In summary, short-term investments offer a way to grow your money while maintaining liquidity, but they come with their own set of risks. Market volatility and credit risk are important factors to consider. By carefully assessing these risks and understanding the potential returns, investors can make informed decisions and build a well-diversified portfolio that suits their financial objectives. It is always advisable to consult with a financial advisor to tailor investment strategies to individual needs.

Understanding the Quick Ratio: Short-Term Investments and Their Role

You may want to see also

Regulation and Compliance: Legal and regulatory considerations for short-term borrowings and investments

Short-term borrowings and investments are distinct financial instruments, each with its own set of legal and regulatory considerations. While short-term borrowings involve the temporary acquisition of funds to meet immediate financial obligations, investments typically refer to the purchase of assets with the expectation of generating returns over a longer period. Understanding the regulatory landscape surrounding these activities is crucial for businesses and individuals alike to ensure compliance and mitigate potential risks.

In the context of short-term borrowings, regulations often focus on protecting lenders and borrowers from fraudulent activities and ensuring transparency. Lenders must adhere to lending regulations, which may include disclosing all terms and conditions of the loan, verifying the borrower's creditworthiness, and obtaining necessary licenses or permits. For borrowers, it is essential to understand the legal implications of borrowing, such as the potential for default, interest rate caps, and the rights and responsibilities outlined in loan agreements.

When it comes to investments, regulatory frameworks aim to safeguard investors and promote market integrity. Investment regulations may require companies to disclose financial information, provide detailed investment reports, and ensure fair treatment of investors. For individuals, regulations often dictate the types of investments they can make, such as restrictions on high-risk investments or the requirement to obtain financial advice. Additionally, tax regulations play a significant role in investments, with rules governing capital gains, dividends, and other investment-related income.

Compliance with these regulations is essential to avoid legal consequences and maintain the integrity of financial markets. Businesses must establish robust internal controls and policies to ensure that short-term borrowings and investments are managed according to legal requirements. This includes proper documentation, accurate record-keeping, and regular audits to verify compliance. Individuals should also seek professional advice to navigate the complex regulatory environment and make informed investment decisions.

In summary, short-term borrowings and investments are subject to different legal and regulatory frameworks. Short-term borrowings require lenders and borrowers to adhere to lending regulations, ensuring transparency and protecting against fraud. Investments, on the other hand, are governed by regulations aimed at investor protection and market fairness. Compliance with these regulations is vital to avoid legal pitfalls and maintain the stability of financial activities.

Local Government Investment Pools: Long-Term Strategy or Short-Term Gain?

You may want to see also

Frequently asked questions

Short-term borrowings refer to funds that a company borrows for a relatively short period, typically up to one year. These borrowings are usually used for operational needs, such as managing cash flow or financing short-term projects. On the other hand, investments are long-term financial commitments where a company allocates capital with the expectation of generating returns over an extended period.

Short-term borrowings are reported as a current liability on a company's balance sheet. They are considered a short-term obligation and are expected to be repaid within one year. This liability is an important indicator of a company's liquidity and short-term financial health.

No, investments are not the same as short-term borrowings. Investments are typically made with the intention of holding them for a long time, often with the goal of capital appreciation or generating income. They are not borrowed funds but rather a way to allocate capital for future growth.

Yes, short-term borrowings can be utilized for investment activities, but it is generally not recommended. Borrowing for investments may lead to increased financial risk and can be a short-term solution that may not align with long-term financial goals. It's important to have a clear strategy and assess the potential risks before using borrowings for investment purposes.

Advantages include quick access to funds for immediate needs and the ability to manage cash flow effectively. However, short-term borrowings may come with higher interest rates and the risk of repaying the debt within a short timeframe. Disadvantages include potential financial strain if not managed properly and the possibility of long-term debt accumulation.