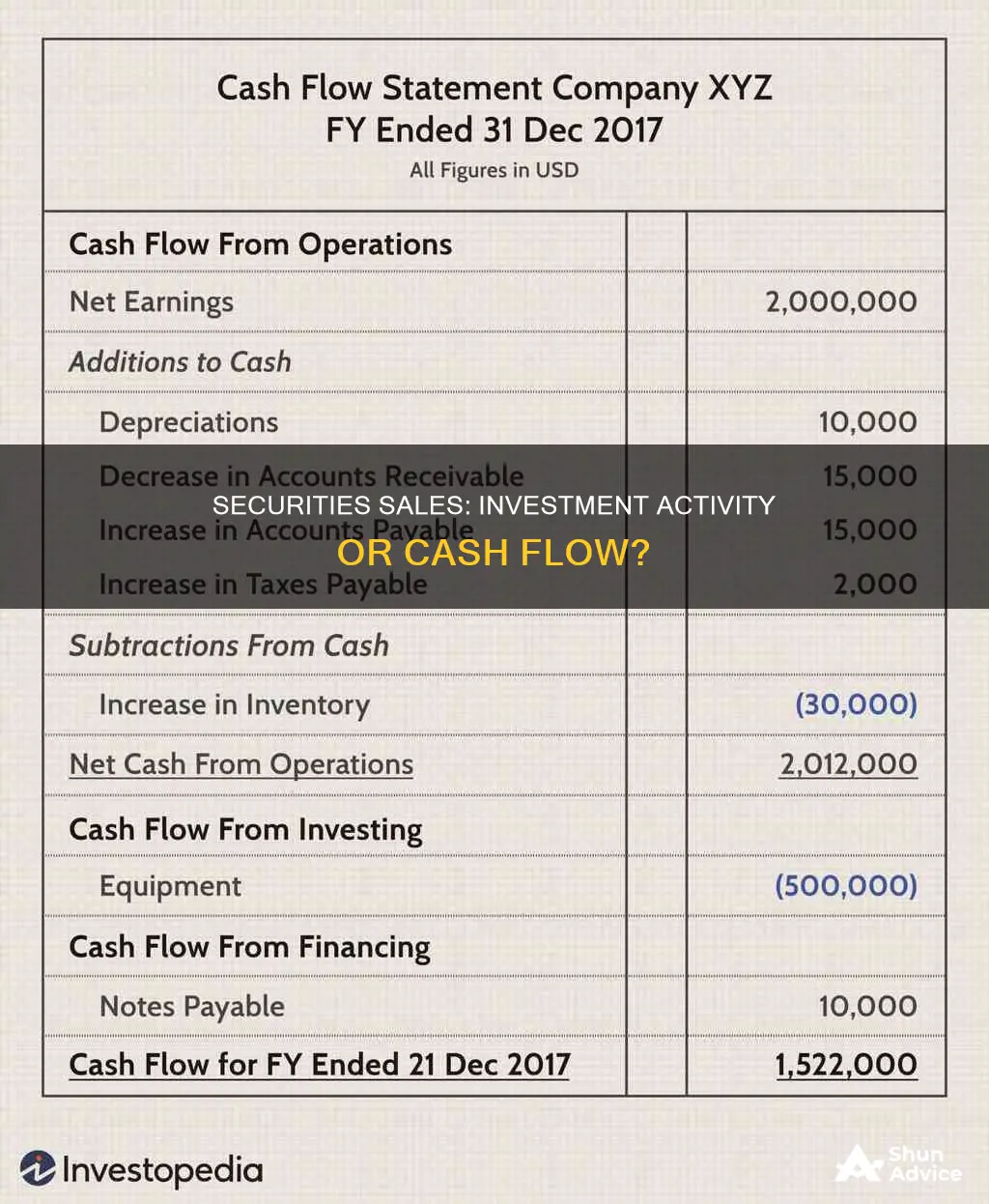

The sale of securities is an investment activity that affects a company's cash flow. Cash flow from investing activities is one of the sections of a company's cash flow statement, which reports the amount of cash generated or spent on investment activities over a specific period. This includes the sale of securities or assets, which can result in a positive cash flow. However, it's important to note that negative cash flow from investing activities may not always indicate poor financial health, as it could mean that the company is investing in long-term growth.

What You'll Learn

The sale of securities or assets

Definition and Examples

For example, if a company sells some old machinery it no longer needs, the cash received from the sale would be recorded as a positive cash flow from investing activities. This is true even if the company sells the asset at a loss, as it still results in cash inflow.

Importance

- It can provide cash inflow for the business, improving its liquidity and financial health.

- It can help a company free up cash by selling assets that are no longer needed or underperforming.

- It can be a source of funds for reinvestment in more profitable opportunities or for paying off debts.

- It can be a way for a company to divest from certain business areas or investments that are no longer strategic or profitable.

Formula and Calculation

To calculate the impact of the sale of securities or assets on cash flow from investing activities, you can use the following formula:

Cash flow from investing activities = CapEx/purchase of non-current assets + marketable securities + business acquisitions – divestitures (sale of investments)

In this formula, the sale of securities or assets would be considered a positive value, as it represents cash inflow. This value would be subtracted from the total cash outflows (negative values) from other investing activities to determine the net cash flow from investing activities.

Investing Excess Cash in Shares: An Investment Activity?

You may want to see also

Cash flow from investing activities

Investing activities include the purchase and sale of physical assets, investments in securities, and the acquisition and disposal of other businesses.

The purchase of physical assets, such as property, plant, and equipment, is a type of capital expenditure. This also includes the acquisition of other businesses.

The sale of physical assets, such as proceeds from the sale of property and equipment, is also included. This also includes the sale of other businesses.

Investments in securities, such as stocks, bonds, and shares, are also part of investing activities. This includes the purchase and sale of these securities.

Loans made to third parties and the collection of loans made by the entity are also included in cash flow from investing activities.

The following are not included:

- Cash received from sales of goods and services

- Payments made to vendors and suppliers

- Tax-related payments

- Payment of dividends

- Expenses related to asset depreciation

- Debt and equity financing

- Income and expenses related to normal business operations

Calculating Cash Flow from Investing Activities

To calculate cash flow from investing activities, you can use the following formula:

Alternatively, you can simply add up all the cash inflow from the sale of non-current assets and any money received from the sale of marketable securities, and then subtract the costs of purchasing non-current assets and securities.

Importance of Cash Flow from Investing Activities

A negative cash flow from investing activities does not always indicate poor financial health. It could mean that the company is investing in assets, research, or other long-term development activities that are important for its health and continued operations.

Cash App Investing: Are There Any Fees Involved?

You may want to see also

Cash flow from operating activities

The cash flow statement provides an account of the cash used in operations, including working capital and financing. It bridges the gap between the income statement and the balance sheet by showing how much cash is generated or spent on operating, investing, and financing activities.

While negative cash flow is generally an indicator of poor company performance, this is not always the case for cash flow from operating activities. A negative cash flow from operating activities may indicate that a company is investing heavily in its future operations and growth.

Easy Ways to Earn Paytm Cash Without Investment

You may want to see also

Cash flow from financing activities

Financing activities include transactions involving debt, equity, and dividends. Debt and equity financing are reflected in the cash flow from financing section, and these vary with different capital structures, dividend policies, or debt terms.

The formula for calculating CFF is:

> CFF = CED − (CD + RP)

Where:

- CED = Cash inflows from issuing equity or debt

- CD = Cash paid as dividends

- RP = Repurchase of debt and equity

Positive CFF numbers indicate that more money is flowing into the company than out, increasing the company's assets. However, a positive CFF may not always be a good thing, especially if the company is already saddled with a large amount of debt.

Conversely, negative CFF numbers can indicate that the company is servicing debt, but it can also mean the company is retiring debt or making dividend payments and stock repurchases, which investors may view as positive.

Some examples of cash inflows from financing activities include stock issuance, borrowings, and other financing arrangements. Examples of cash outflows from financial activities include repayment of loans, stock buybacks, and dividend payments.

Securities Trading: Part of Investing Cash Flow?

You may want to see also

Long-term uses of cash

Long-term cash flow forecasting is a projection that looks beyond 12 months and typically projects three years into the future. It is more significant than a short-term forecast and can help you identify potential credit risks and determine how investments made today will pay off in the long run. It can also help you understand how financial decisions made today could impact your business beyond its immediate future.

Benefits

- Having an idea about your business’s potential expenses and income in advance can help you manage your cash flow.

- It can help you enhance your staffing forecast, allowing you to hire more efficiently, reduce labor costs, and enhance the quality of your employees.

- It can help you improve production by working with your sales department to create long-term demand forecasts and anticipate large orders or potential seasonal spikes.

- It can help you improve asset management by reviewing your building, land, computer equipment, machinery, inventory, property, software, and systems.

Drawbacks

- The accuracy of long-term forecasts decreases the more extended the forecast, especially when economic downturns occur due to pandemics, market unpredictability, or real estate and technology bubbles.

- Long-term forecasting may cost more than expected due to the need for the right team and technologies.

- It is time-consuming and labor-intensive, requiring intensive data gathering, organizing, coordination, and analysis.

- If your business doesn't have accurate historical data, your long-term projections will be less reliable.

Long-term cash flow is an important aspect of a company's financial planning and can provide valuable insights for decision-making. However, it is essential to consider both short-term and long-term forecasting methods to get a comprehensive view of your business's financial landscape.

Owner's Investment Cash: Operating Activity?

You may want to see also

Frequently asked questions

The sale of securities is a type of investing activity that involves selling stocks, bonds, or other financial instruments that a company owns. This can be done to generate cash flow, reallocate resources, or divest from certain investments.

Yes, the sale of securities is classified as an investment activity on a company's cash flow statement. It falls under the category of cash flow from investing activities, which includes any inflows or outflows of cash from the sale or purchase of long-term investments.

There can be several reasons why a company may choose to sell securities. Some common reasons include:

- Generating cash flow to reinvest in other areas of the business or to cover operating expenses.

- Divesting from underperforming or non-core assets to focus on more profitable investments.

- Reallocating resources to more strategic areas of the business.

- Taking advantage of market conditions to maximize returns.

Some examples include:

- A company selling stocks or bonds that it owns to generate cash.

- A company selling its stake in another company as part of a strategic decision.

- A company liquidating its investments in a particular industry or sector.