When a shareholder invests cash in a corporation, the corporation's cash assets increase. This is reflected on the balance sheet, where assets equal liabilities plus shareholders' equity. Shareholders' equity, or stockholders' equity, is the value of the company's obligation to shareholders and is also listed on the balance sheet. It is calculated as the total assets minus total liabilities, or the sum of common shares, preferred shares, paid-in capital, and retained earnings. Shareholders' equity increases when a shareholder invests cash, improving the company's financial health and stability.

What You'll Learn

Shareholder equity increases with cash investments

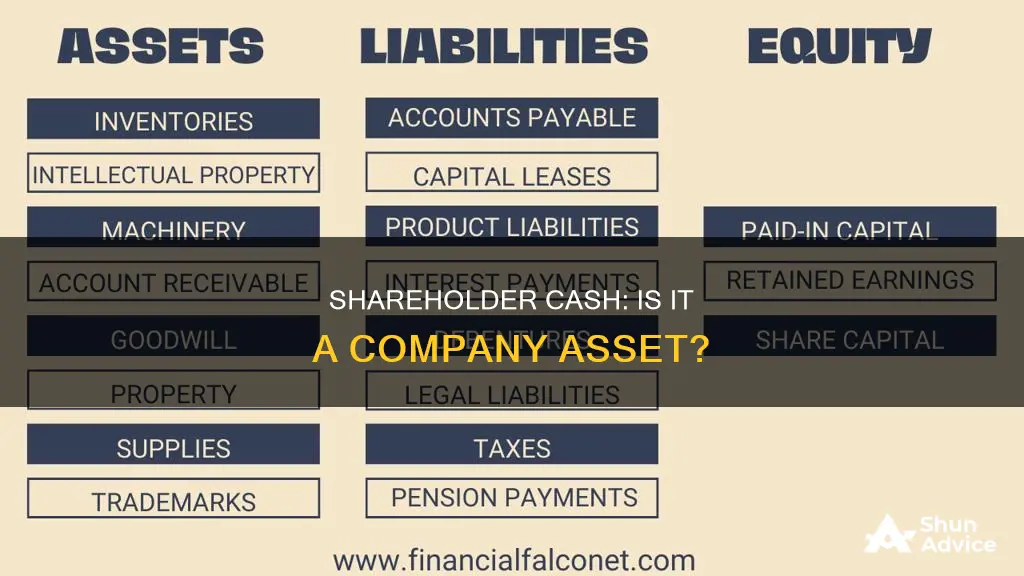

Shareholder equity, also known as stockholders' equity, is a company's net worth. It is the total dollar amount that would be returned to shareholders if the company were liquidated and all its debts paid off. In other words, shareholder equity is the company's total assets minus its total liabilities.

Shareholder equity is an important metric for investors and analysts to evaluate a company's financial health and make better investment decisions. It helps them understand the company's financial ratios and overall stability.

When a shareholder invests cash in a corporation, the shareholder's equity increases by the amount of cash invested. This is because cash is considered a short-term or current asset on the balance sheet. As a result, the cash investment increases the amount of cash listed under the asset "Cash" on the balance sheet.

For example, if a shareholder invests $10,000 in a company, the company's cash assets increase by $10,000, leading to a corresponding increase in shareholder equity. This increase in shareholder equity represents an injection of capital into the company, which can be used to finance operations, purchase assets, or strengthen the balance sheet.

In addition to increasing shareholder equity, a cash investment by a shareholder also results in an increase in the shareholder's ownership stake in the company. The shareholder receives a stock certificate that specifies the number of shares purchased with the cash investment. This stock certificate denotes the increase in ownership percentage based on the company's valuation at the time of the investment.

Therefore, shareholder equity increases with cash investments as the amount of cash listed under assets increases, and the shareholder's ownership stake in the company grows.

Understanding Cash Flow: Investing Activities Analysis

You may want to see also

Shareholders gain ownership stake and potential dividends

When a shareholder invests cash in a corporation, they gain an ownership stake in the company and the chance to receive dividends and participate in any value increase. This ownership stake, also known as equity, represents the level of ownership and control the shareholder has over the company. It is calculated by dividing the number of shares held by the total number of outstanding shares and is typically expressed as a percentage.

The benefits of having a higher ownership stake include increased voting power and a larger say in decision-making processes. Shareholders with larger ownership stakes also have a greater claim on the company's assets and earnings, receiving a larger share of dividends and profits. In the case of majority stakeholders, they often have significant influence or outright control over the company, including the power to appoint and remove CEOs and other executives. On the other hand, minority shareholders may not have the power to dictate the company's direction, but they still benefit from rights such as access to company information and dividends.

Dividends are a distribution of a company's earnings to shareholders and are generally paid quarterly. They are decided by the board of directors and can be paid in cash or additional shares. Dividends are often expected by shareholders as their share of the company's profits and are seen as a sign of stable cash flow and profitability. A steady track record of paying dividends also makes stocks more attractive to investors.

In summary, shareholders who invest cash gain an ownership stake in the company, which gives them voting rights and the potential to receive dividends and participate in the company's success. The size of their ownership stake determines the level of control and influence they have, as well as the proportion of dividends and profits they are entitled to receive.

Liquidating US Investments: A Country's Cash Out Strategy

You may want to see also

Shareholder equity is not the same as company assets

When a shareholder invests cash in a corporation, the corporation obtains cash to finance operations and purchase assets. In return, the shareholder gets an ownership stake in the corporation and the chance to receive dividends and participate in any value increase.

Shareholder equity, also known as stockholders' equity, is the net worth of a company. It is the total dollar amount that would be returned to the shareholders if the company were liquidated and all its debts paid off. It is calculated as the total assets minus total liabilities.

Shareholder equity is an important metric for investors and analysts to evaluate a company's financial health and stability. It helps them understand the company's degree of leverage and its ability to take on more debt.

Easy Ways to Earn Paytm Cash Without Investment

You may want to see also

Shareholder equity is an important indicator of financial health

Shareholder equity is an important indicator of a company's financial health. It is a company's net worth and is equal to the total dollar amount returned to shareholders if the company is liquidated and all its debts are paid off. Shareholder equity is calculated by subtracting a company's total liabilities from its total assets.

Positive shareholder equity means that a company has enough assets to cover its liabilities. If a company's shareholder equity is negative, it is considered balance sheet insolvent. Many investors view companies with negative shareholder equity as risky or unsafe investments. However, shareholder equity alone is not a definitive indicator of a company's financial health and should be used in conjunction with other tools and metrics.

Shareholder equity is also referred to as stockholders' equity and represents a corporation's net worth. It appears on a company's balance sheet and documents the funding the corporation has received from the sale of common or preferred stock. Shareholder equity increases with stock sales and profit retention and decreases with net loss generation or dividend distribution.

The shareholder equity ratio is an important metric that indicates how much of a company's assets have been generated by issuing equity shares rather than taking on debt. The ratio is expressed as a percentage and is calculated by dividing total shareholders' equity by the company's total assets. A ratio closer to 100% indicates that a company has financed more of its assets with stock rather than debt.

Cashing in on Fidelity: Investment Check Options

You may want to see also

Shareholder equity can be negative or positive

Shareholder equity, also known as stockholders' equity, is the net worth of a corporation. It is calculated as the total assets minus total liabilities. This figure can be positive or negative.

Positive shareholder equity means a company has enough assets to cover its liabilities. This is a good sign for investors, indicating the company is financially healthy and stable.

On the other hand, negative shareholder equity is a red flag, indicating that a company's debts exceed its assets. This situation may suggest impending bankruptcy or financial distress. It can also indicate that the company has insufficient assets to offset its debts and may not provide a good return to investors. Negative shareholder equity can be caused by various factors, such as accumulated losses, large dividend payments, or excessive debt incurred to cover losses.

When a shareholder invests cash in a corporation, shareholder equity increases by the amount of cash invested. This is because cash is considered a short-term or current asset on the balance sheet. As such, shareholder invested cash is an asset to the corporation.

Cash App Investing: Free or Fee-Based?

You may want to see also

Frequently asked questions

An asset is anything of value or a resource of value that can be converted into cash. Individuals, companies, and governments can own assets. For a company, an asset might generate revenue, or a company might benefit in some way from owning or using the asset.

Shareholder equity is the value of the company's obligation to shareholders. It is also referred to as stockholders' equity and represents the company's net worth. It is calculated as the total assets minus total liabilities, or the sum of share capital and retained earnings less treasury shares.

No, shareholder invested cash is not an asset. Shareholder invested cash increases the company's cash holdings, which are listed as an asset on the balance sheet. However, the shareholder invested cash itself is not an asset, but rather an injection of capital that increases the company's overall assets.