Trading investments can be both short-term and long-term strategies, depending on the investor's goals and risk tolerance. Short-term trading involves taking advantage of market fluctuations over a relatively brief period, often aiming to capitalize on price movements within days or weeks. In contrast, long-term trading focuses on holding assets for an extended duration, typically months or years, with the goal of generating steady returns through compound interest and market growth. Understanding the differences between these approaches is crucial for investors to make informed decisions and align their strategies with their financial objectives.

What You'll Learn

- Market Timing: Deciding when to buy or sell based on market trends

- Risk Tolerance: Understanding your ability to withstand market volatility

- Investment Horizon: The length of time you plan to hold the investment

- Tax Implications: Considering tax effects on short-term vs. long-term gains

- Liquidity Needs: Assessing the need for quick access to funds

Market Timing: Deciding when to buy or sell based on market trends

Market timing is a critical aspect of investment strategy, focusing on the precise moment to enter or exit a market to maximize returns. It involves analyzing market trends, economic indicators, and various technical and fundamental factors to make informed decisions. This approach is particularly relevant for short-term traders who aim to capitalize on short-term price movements, but it can also be a valuable tool for long-term investors seeking to optimize their portfolio performance.

The core principle of market timing is to identify the optimal points in the market cycle to buy or sell assets. Buying at the right time can lead to significant gains, especially in volatile markets, as investors can take advantage of short-term price swings. Conversely, selling at the peak of a market cycle can help lock in profits and minimize potential losses. Market timers often use various tools and techniques to identify these turning points, including chart patterns, technical indicators, and market sentiment analysis.

One common strategy is to follow the trend, which involves buying when the market is rising and selling when it starts to decline. This approach is based on the assumption that markets tend to follow a cyclical pattern, and by aligning with the trend, investors can benefit from the momentum. However, market timing is not an exact science, and predicting the exact top or bottom of a market is challenging. Many investors use a combination of technical analysis, such as moving averages and relative strength index (RSI), and fundamental analysis, studying economic data and company-specific factors, to make more informed decisions.

Another aspect of market timing is the concept of "buy the dip" and "sell the rally." This strategy involves buying when prices have temporarily dropped due to market panic or negative news and selling when prices start to recover. It requires a keen eye for market sentiment and the ability to recognize when a correction is likely to end. Market timers also consider global economic events, geopolitical risks, and industry-specific news to anticipate market reactions.

Successful market timing requires discipline, patience, and a well-defined strategy. Investors must be prepared to act quickly when opportunities arise, but they should also avoid impulsive decisions based on short-term market fluctuations. A comprehensive understanding of market dynamics, risk management techniques, and a long-term investment perspective are essential to navigate the challenges of market timing effectively. Additionally, diversifying investments across different asset classes and markets can help mitigate risks associated with timing the market.

Maximize Your Wealth: A Guide to Long-Term Investing with E*TRADE

You may want to see also

Risk Tolerance: Understanding your ability to withstand market volatility

Risk tolerance is a critical aspect of investing, as it determines an individual's ability to handle the inherent volatility and uncertainty of financial markets. It is a measure of an investor's willingness and capacity to accept risk, which can vary significantly from person to person. Understanding your risk tolerance is essential for making informed investment decisions that align with your financial goals and comfort level with potential losses.

When assessing risk tolerance, investors should consider their financial situation, investment objectives, and time horizon. These factors play a pivotal role in determining the type of investments one can comfortably pursue. For instance, a young, high-income earner with a long-term investment horizon might be more inclined to take on higher risks, such as investing in volatile stocks or derivatives, to potentially achieve greater returns over time. In contrast, a retiree with a shorter time horizon might prefer more conservative investments like bonds or fixed-income securities to ensure capital preservation.

Market volatility is an inherent characteristic of financial markets, and it can significantly impact investment performance. Volatile markets are often associated with increased risk, as asset prices can fluctuate rapidly in response to various economic, political, or global events. Investors with a low risk tolerance may find such volatility stressful and may be more inclined to make impulsive decisions, such as selling investments prematurely, to avoid potential losses. On the other hand, those with a higher risk tolerance might view market downturns as opportunities to buy assets at discounted prices, believing that the market will eventually recover.

To gauge your risk tolerance, it's essential to evaluate your emotional response to market fluctuations. Do you become anxious or stressed during market declines? Or do you remain calm and view these periods as opportunities to buy quality investments at lower prices? Understanding your emotional reaction to market volatility is crucial, as it can influence your investment decisions and overall financial well-being.

In summary, risk tolerance is a fundamental concept in investing, as it shapes an individual's approach to market volatility. By assessing your financial situation, investment goals, and emotional response to market fluctuations, you can make informed decisions about the types of investments that suit your risk profile. This self-awareness is vital for building a robust investment strategy that aligns with your long-term financial objectives.

Ripple: A Long-Term Investment Strategy?

You may want to see also

Investment Horizon: The length of time you plan to hold the investment

The investment horizon is a critical factor in determining whether an investment is considered short-term or long-term. It refers to the length of time an investor plans to hold a particular asset or security. This decision significantly impacts an investor's strategy, risk tolerance, and potential returns. Understanding the investment horizon is essential for anyone looking to navigate the complex world of trading and investing.

Short-term investments typically involve holding assets for a brief period, often ranging from a few days to a few months. These investments are characterized by a focus on capital appreciation and quick gains. Traders who adopt a short-term investment horizon often engage in frequent buying and selling, aiming to capitalize on short-term market fluctuations and price movements. This approach requires a keen eye for market trends and a high level of market knowledge. Short-term traders often use various strategies, such as day trading, swing trading, or scalping, to take advantage of small price changes within a short time frame.

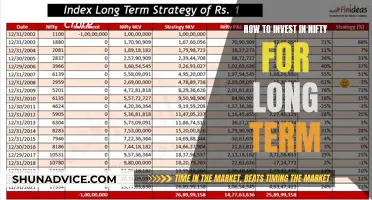

On the other hand, long-term investments are designed for investors who are willing to commit their capital for an extended period, often years or even decades. This investment strategy focuses on building wealth over time through compound interest, dividend reinvestment, and the power of long-term market growth. Long-term investors typically have a higher risk tolerance and are less concerned with short-term market volatility. They believe that markets tend to trend upwards over the long run and aim to benefit from this trend. This approach often involves investing in a well-diversified portfolio of assets, such as stocks, bonds, or mutual funds, and holding them for an extended period.

The investment horizon also influences the types of assets and investment vehicles an investor chooses. Short-term traders might prefer highly liquid assets that can be quickly bought and sold, such as forex, cryptocurrencies, or short-term stock options. In contrast, long-term investors often seek assets that provide steady returns over time, like real estate, long-term bonds, or well-established companies with a history of dividend payments.

Determining the appropriate investment horizon requires careful consideration of an individual's financial goals, risk tolerance, and time availability. It is essential to assess one's investment knowledge, experience, and the level of market research and analysis one can dedicate to making informed decisions. A well-defined investment horizon helps investors stay disciplined, avoid impulsive decisions, and make choices aligned with their long-term financial objectives.

Understanding Short-Term Investments: Are They Cash Equivalents?

You may want to see also

Tax Implications: Considering tax effects on short-term vs. long-term gains

When it comes to investing in the stock market, understanding the tax implications of short-term and long-term gains is crucial for investors. The tax treatment of these gains can significantly impact an investor's overall returns and financial planning. Here's a detailed breakdown of the tax considerations for both short-term and long-term investments:

Short-Term Gains:

- Short-term capital gains are typically taxed at the investor's ordinary income tax rate. This means that the tax rate applied to these gains is the same as the tax rate on other sources of income, such as wages or salaries.

- The tax rate for short-term gains can vary depending on the investor's income level and tax bracket. In many jurisdictions, short-term gains are taxed at a higher rate compared to long-term gains.

- Investors should be aware that short-term gains are often subject to higher tax rates, which can reduce the net profit from their trading activities. For example, if an investor sells a stock at a profit within a year, the gain may be taxed at their regular income tax rate, which could be significantly higher than the long-term capital gains tax rate.

Long-Term Gains:

- Long-term capital gains, on the other hand, are generally taxed at a lower rate. The specific tax rate can vary, but it is often more favorable for investors. In many countries, long-term capital gains are taxed at a reduced rate, which is usually lower than the ordinary income tax rate.

- The long-term capital gains tax rate is often applied to investments held for more extended periods, typically over a year. This tax advantage encourages investors to adopt a long-term investment strategy, allowing them to benefit from compounding returns over time.

- For instance, in the United States, long-term capital gains are taxed at 0%, 15%, or 20%, depending on the investor's income. This lower tax rate provides an incentive for investors to hold their positions for the long term, potentially leading to more significant wealth accumulation.

Tax Strategies:

- Investors can employ various tax strategies to optimize their gains. One approach is to time the sale of investments to take advantage of lower tax rates. Selling investments with long-term gains before a significant income tax increase can be a strategic move.

- Additionally, investors can consider tax-efficient investment accounts, such as retirement accounts or tax-advantaged mutual funds, to defer or reduce tax liabilities. These accounts may offer tax benefits, allowing investors to grow their wealth more efficiently.

- It is essential to consult with a tax professional or financial advisor to understand the specific tax laws in your jurisdiction and develop a tailored tax strategy. They can provide guidance on tax-efficient investment practices and help navigate the complexities of tax regulations.

In summary, the tax implications of short-term and long-term gains are distinct and can significantly impact an investor's financial decisions. Short-term gains are often taxed at higher rates, while long-term gains may benefit from reduced tax rates. Investors should be mindful of these tax considerations and explore strategies to optimize their tax efficiency, ensuring that their investment decisions align with their financial goals and tax planning.

Forex: Long-Term Investment or Short-Term Speculation?

You may want to see also

Liquidity Needs: Assessing the need for quick access to funds

Liquidity needs are a critical aspect of investment strategy, especially when considering the nature of trading investments. These needs refer to the requirement for quick access to funds, ensuring that investors can meet their financial obligations and take advantage of opportunities without delay. Assessing liquidity needs is essential for investors to make informed decisions and manage their investments effectively.

When evaluating liquidity needs, investors should consider their short-term and long-term financial goals. Short-term goals often involve immediate expenses, such as living expenses, debt payments, or unexpected costs. In these cases, having a liquid asset or a readily available investment can provide the necessary funds to cover these expenses promptly. For example, if an investor needs to pay for a child's education or cover a medical emergency, having a liquid investment can ensure they have the financial resources to do so without selling other long-term holdings.

Long-term goals, on the other hand, may include retirement planning, purchasing a home, or funding a child's education in the future. Here, liquidity needs are more about having a strategy to access funds when required. Investors might consider setting aside a portion of their portfolio as a liquid reserve, which can be easily converted into cash. This reserve can be used to take advantage of investment opportunities, such as buying undervalued assets or diversifying into new markets. For instance, if an investor identifies a promising startup that requires immediate investment, having a liquid asset can enable them to act quickly.

To assess liquidity needs, investors should create a comprehensive financial plan. This plan should outline their short-term and long-term goals, as well as the potential sources of funds required to achieve these goals. It is crucial to regularly review and update this plan to account for changing circumstances and financial obligations. Additionally, investors should consider their risk tolerance and the time horizon for their investments. More aggressive investors might require higher liquidity to take advantage of short-term opportunities, while those with a long-term investment strategy may prioritize capital growth over immediate access to funds.

In the context of trading investments, liquidity needs become even more critical. Trading often involves frequent buying and selling of assets, and investors need to ensure they can quickly convert their holdings into cash to meet their trading strategies. This might include setting aside a portion of their portfolio as a trading reserve, which can be used to finance trades or take advantage of market opportunities. Effective liquidity management in trading investments can help investors capitalize on short-term market trends and optimize their returns.

In summary, assessing liquidity needs is a vital step in investment planning, especially for trading activities. It involves understanding short-term and long-term financial goals, creating a financial plan, and considering risk tolerance. By ensuring quick access to funds, investors can make timely decisions, take advantage of opportunities, and effectively manage their investments, whether for short-term gains or long-term wealth accumulation.

Maximize Your $20K: Short-Term Investment Strategies for Quick Wins

You may want to see also

Frequently asked questions

Trading is generally classified as a short-term investment approach. It involves taking advantage of short-term market fluctuations and price movements to generate quick profits. Traders often hold positions for a few minutes, hours, or days, aiming to capitalize on small price changes. This strategy requires active monitoring and quick decision-making, making it distinct from long-term investing.

Short-term trading offers several benefits. Firstly, it allows investors to take advantage of market opportunities that may arise in a short period. Traders can profit from both rising and falling markets, as they can go long (buy) or short (sell) depending on their market analysis. Additionally, short-term trades can provide a higher frequency of trades, potentially increasing returns in a shorter time frame.

Yes, short-term trading has its drawbacks. One significant disadvantage is the increased risk and volatility associated with frequent buying and selling. Traders may face higher transaction costs due to multiple trades, and the impact of market slippage can be more pronounced. Moreover, short-term strategies require constant attention and may not be suitable for those seeking a more passive investment approach.

Long-term investing is a strategy that focuses on holding investments for an extended period, typically years or even decades. It involves buying and holding assets with the expectation that their value will appreciate over time. Long-term investors often aim to benefit from compound interest and the overall growth of the market. This approach is less time-consuming and requires less frequent intervention compared to short-term trading.