Short-term investments are a crucial aspect of financial planning, and understanding their nature as cash equivalents is essential for investors. Cash equivalents are highly liquid assets that can be quickly converted into cash with minimal impact on their value. These investments are typically considered low-risk and are used to meet short-term financial goals or as a temporary holding for surplus funds. Short-term investments, such as money market funds, treasury bills, and certificates of deposit (CDs), are indeed cash equivalents, offering investors a safe and accessible way to grow their money while maintaining liquidity.

What You'll Learn

- Definition: Cash equivalents are highly liquid investments that can be quickly converted to cash with minimal impact on value

- Characteristics: They are short-term, highly liquid, and have minimal credit risk

- Examples: Treasury bills, short-term government bonds, and commercial paper are common cash equivalents

- Risk: Despite low risk, they may still experience market fluctuations and liquidity issues

- Regulation: Financial institutions must adhere to specific regulations regarding the classification and reporting of cash equivalents

Definition: Cash equivalents are highly liquid investments that can be quickly converted to cash with minimal impact on value

Cash equivalents are a crucial concept in finance, representing a specific type of investment that offers both liquidity and safety. These investments are highly sought after by investors and financial institutions alike due to their unique characteristics. The term "cash equivalents" refers to a category of short-term, highly liquid assets that can be readily converted into cash with minimal loss of value. This definition highlights the dual nature of cash equivalents: they provide the liquidity of cash while also offering a level of safety and stability typically associated with more traditional investments.

In the world of finance, cash equivalents are often used as a benchmark for measuring the liquidity and safety of other investments. They are considered low-risk instruments, making them an essential component of a well-diversified investment portfolio. The key characteristic that sets cash equivalents apart is their ability to be quickly and efficiently converted into cash without incurring significant losses. This feature is particularly important for investors who prioritize liquidity and want to ensure they can access their funds when needed.

These investments are typically short-term in nature, with maturity periods ranging from a few days to a few months. This short-term focus aligns with the need for liquidity, as it allows investors to access their funds quickly without being tied up for extended periods. Common examples of cash equivalents include treasury bills, short-term government bonds, and money market funds. These instruments are highly regulated and considered low-risk, making them a preferred choice for risk-averse investors.

The definition of cash equivalents emphasizes the balance between liquidity and value preservation. These investments are designed to provide a safe haven for investors while also offering the flexibility to access funds promptly. This dual benefit is particularly attractive to businesses and individuals who require a stable investment option without compromising their ability to access capital when necessary. As such, cash equivalents play a vital role in various financial strategies, from short-term funding needs to long-term portfolio diversification.

In summary, cash equivalents are a critical financial concept, representing highly liquid investments that can be swiftly converted into cash with minimal value depreciation. Their short-term nature and low-risk profile make them an essential tool for investors seeking both liquidity and safety. Understanding the definition and characteristics of cash equivalents is crucial for anyone looking to optimize their investment strategies and manage their financial resources effectively.

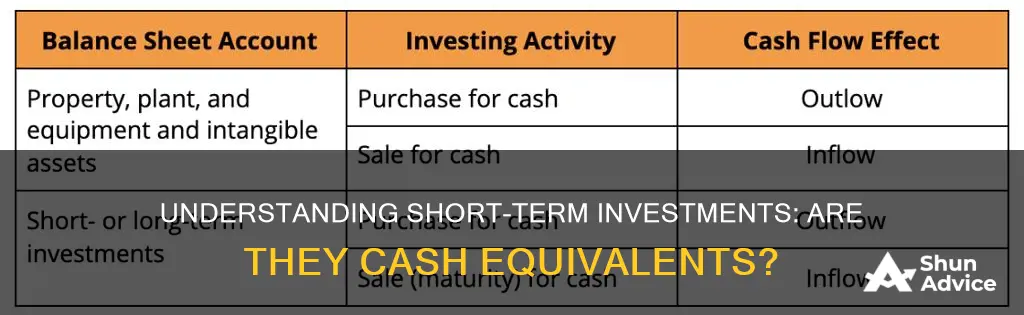

Understanding Short-Term Investments: A Balance Sheet Guide

You may want to see also

Characteristics: They are short-term, highly liquid, and have minimal credit risk

Short-term investments, often referred to as cash equivalents, are a crucial component of an investment strategy, especially for those seeking a safe and liquid asset class. These investments are characterized by their short-term nature, high liquidity, and minimal credit risk, making them an attractive option for investors who prioritize capital preservation and quick access to funds.

One of the key characteristics of short-term investments is their short duration. These investments typically mature within a year or less, providing investors with a relatively short-term horizon for their capital. This short-term focus allows investors to take advantage of opportunities that may arise quickly and manage their risk exposure effectively. For instance, if an investor needs to access their funds for an unexpected expense, short-term investments can provide the necessary liquidity without significant loss of value.

Highly liquid assets are another defining feature of cash equivalents. Liquidity refers to the ease with which an asset can be converted into cash without a significant impact on its price. Short-term investments are designed to be readily convertible into cash, often with minimal transaction costs. This liquidity is essential for investors who want to maintain a flexible approach to their investments, ensuring they can quickly reallocate their funds if needed. For example, treasury bills, a common type of short-term investment, can be sold at any time, providing immediate access to the invested amount.

Minimal credit risk is a critical aspect that sets short-term investments apart. Credit risk is the possibility of an investor losing money due to a borrower's failure to repay a loan or meet financial obligations. In the case of cash equivalents, the credit risk is significantly reduced because these investments are typically backed by governments or highly creditworthy entities. This low credit risk ensures that investors' capital is protected, making short-term investments a safer choice compared to longer-term debt instruments.

In summary, short-term investments, or cash equivalents, are characterized by their short-term nature, high liquidity, and minimal credit risk. These features make them an ideal choice for investors seeking a safe, accessible, and flexible investment option. By understanding and embracing these characteristics, investors can effectively manage their risk and take advantage of short-term opportunities in the financial markets.

Understanding Short-Term Investments: Strategies for Quick Financial Growth

You may want to see also

Examples: Treasury bills, short-term government bonds, and commercial paper are common cash equivalents

When considering short-term investments, the term "cash equivalents" is often used to describe highly liquid assets that can be quickly converted into cash with minimal risk. These investments are typically considered low-risk and are used by investors seeking a safe place to park their funds temporarily while still earning a small return. Here are some key examples of what constitutes cash equivalents:

Treasury Bills: These are short-term debt securities issued by the government. Treasury bills mature in less than a year and are considered one of the safest investments due to their low default risk. They are often used by investors to meet short-term financial goals or to bridge gaps between transactions. For instance, a company might purchase a 90-day Treasury bill to cover upcoming expenses, ensuring they have immediate access to funds.

Short-Term Government Bonds: Similar to Treasury bills, these bonds are issued by governments and offer a secure investment option. They provide a fixed return over a short period, typically ranging from a few months to a year. Government bonds are attractive to risk-averse investors as they are backed by the full faith and credit of the issuing government.

Commercial Paper: This is a short-term unsecured promissory note typically issued by corporations to finance their short-term needs. It is a popular cash equivalent for businesses and investors alike. Commercial paper is generally considered low-risk and is often used by companies to manage their cash flow and meet short-term liabilities. For example, a large corporation might issue commercial paper to finance inventory purchases, ensuring they have the necessary funds without incurring long-term debt.

These cash equivalents are favored by investors and businesses for their liquidity and relatively low risk. They provide a safe haven for short-term capital, allowing investors to maintain their investment value while also having the flexibility to access their funds when needed. It's important to note that while these investments are considered low-risk, they still carry some level of risk, and investors should carefully consider their investment horizons and financial goals before making any decisions.

Long-Term Investments: Separating Fact from Fiction

You may want to see also

Risk: Despite low risk, they may still experience market fluctuations and liquidity issues

Short-term investments, often referred to as cash equivalents, are generally considered low-risk assets due to their short duration and high liquidity. These investments are typically used by investors seeking a safe haven for their funds while still earning a modest return. However, it's important to understand that even with their low-risk profile, short-term investments can still be subject to certain risks, including market fluctuations and liquidity issues.

Market fluctuations can impact short-term investments, even though they are generally considered less volatile than long-term investments. This is primarily because short-term investments are still subject to market conditions and economic factors that can cause their value to fluctuate. For instance, changes in interest rates, credit ratings, and overall market sentiment can all influence the value of these investments. During periods of market volatility, short-term investments may experience price changes, which can affect the returns for investors.

Liquidity is another critical aspect of short-term investments. While these investments are designed to be highly liquid, meaning they can be easily converted to cash, there are still potential issues. If an investor needs to sell their short-term investment before the maturity date, they may face a penalty or experience a loss. Additionally, during times of financial stress or market panic, liquidity can dry up, making it challenging to sell these investments at a fair price. This can be a concern for investors who may need quick access to their funds.

Furthermore, the nature of short-term investments can also impact their risk profile. These investments often include a variety of financial instruments, such as money market funds, commercial paper, and treasury bills. Each of these instruments has its own set of risks and characteristics. For example, commercial paper is typically short-term debt issued by corporations, and its risk can vary depending on the creditworthiness of the issuing company. Treasury bills, on the other hand, are low-risk but offer very low returns. Understanding the composition of a short-term investment portfolio is crucial for assessing the overall risk exposure.

In summary, while short-term investments are generally considered low-risk, investors should be aware of the potential risks associated with market fluctuations and liquidity issues. Market conditions can still impact the value of these investments, and liquidity concerns may arise, especially during times of financial stress. A thorough understanding of the investment's composition and the underlying risks is essential for investors to make informed decisions and manage their portfolios effectively.

Understanding Long-Term Investment Strategies: Key Factors to Consider

You may want to see also

Regulation: Financial institutions must adhere to specific regulations regarding the classification and reporting of cash equivalents

Financial institutions play a crucial role in the global economy, and their management of short-term investments, including cash equivalents, is subject to stringent regulations. These regulations are designed to ensure transparency, stability, and risk management within the financial sector. When it comes to cash equivalents, the term itself refers to highly liquid assets that can be quickly converted into cash with minimal impact on their market value. These assets are considered low-risk investments, making them an essential component of a financial institution's short-term investment strategy.

Regulators and financial authorities have established specific guidelines to classify and report these cash equivalents accurately. One of the primary regulations is the requirement to categorize these investments based on their liquidity and risk profile. Cash equivalents are typically divided into two main categories: 'Level 1' and 'Level 2'. Level 1 cash equivalents are the most liquid and readily convertible into cash, such as treasury bills and commercial paper. These are considered the most reliable and are often used as a benchmark for short-term investment. Level 2 cash equivalents include other highly liquid assets like money market funds and certain corporate bonds, which are still relatively easy to sell but may have a slightly higher risk or less frequent trading.

Financial institutions must adhere to strict reporting standards when dealing with cash equivalents. They are required to provide detailed information about their short-term investments, including the classification of each asset under Level 1 or Level 2. This transparency ensures that investors and regulators can assess the financial institution's liquidity, risk exposure, and overall financial health. Regular reporting also helps in identifying potential issues or discrepancies in the investment portfolio.

The regulations further emphasize the importance of accurate valuation and pricing of cash equivalents. Financial institutions must employ appropriate valuation techniques to determine the fair value of these assets, considering market conditions and liquidity. This ensures that the reported financial statements reflect the true value of the investments, providing a clear picture of the institution's financial position.

In summary, financial institutions are subject to comprehensive regulations that govern the classification, reporting, and valuation of cash equivalents. These rules are essential to maintain market integrity, protect investors, and promote financial stability. By adhering to these standards, financial institutions can effectively manage their short-term investments, providing a more secure and transparent environment for investors and contributing to the overall health of the financial system.

Maximizing Profits: A Beginner's Guide to Short-Term Rental Investing

You may want to see also

Frequently asked questions

Short-term investments are financial assets that are expected to be converted into cash or sold within a short period, typically one year or less. These investments are considered highly liquid and are often used to meet short-term financial goals or to manage cash flow.

The primary distinction lies in the time horizon. Short-term investments are for the near future, providing quick access to funds, while long-term investments are held for an extended period, often years, with the goal of capital appreciation and growth.

Short-term investments are generally considered low-risk, especially when compared to long-term investments. They are typically less volatile and offer a higher level of liquidity, making them a safe option for those seeking to preserve capital while still earning some returns.

Yes, short-term investments can offer returns, but they are usually lower compared to long-term investments. These investments often provide a steady income through interest or dividends, and some may also experience capital appreciation if market conditions are favorable.

Common examples include money market funds, certificates of deposit (CDs), treasury bills, and short-term corporate bonds. These assets are highly liquid and are often used by individuals and institutions to manage their cash and meet short-term financial obligations.