The sale of a long-term investment is a critical financial transaction that can significantly impact a company's financial statements. It is essential to understand whether this sale is considered an operating activity or a non-operating one. Operating activities are those that are directly related to the company's core business operations, generating revenue and managing expenses. In contrast, non-operating activities involve transactions that are not central to the company's primary business, such as the sale of long-term investments. This distinction is crucial for financial reporting and analysis, as it affects how the sale is recorded and presented in the company's financial statements.

What You'll Learn

- Definition of Operating Activities: Activities directly related to a company's core business operations

- Long-Term Investment Sale: Selling assets like property, equipment, or investments held for more than a year

- Impact on Financial Statements: Sale affects income statement, balance sheet, and cash flow

- Tax Implications: Capital gains tax considerations for long-term investment sales

- Disclosure Requirements: Companies must disclose details of long-term investment sales in financial reports

Definition of Operating Activities: Activities directly related to a company's core business operations

Operating activities are the day-to-day actions and processes that a company engages in to generate revenue and manage its core business. These activities are fundamental to the company's primary operations and are essential for its long-term success and sustainability. When discussing the definition of operating activities, it is crucial to understand that these are the activities that directly contribute to the company's ability to earn a profit and maintain its financial health.

In the context of a company's financial statements, operating activities are typically presented in the income statement, also known as the profit and loss statement. This statement provides a clear picture of the company's financial performance over a specific period, showing the revenue generated from core operations and the associated expenses. Operating activities are distinct from other financial activities, such as investing and financing, as they are directly tied to the company's primary business functions.

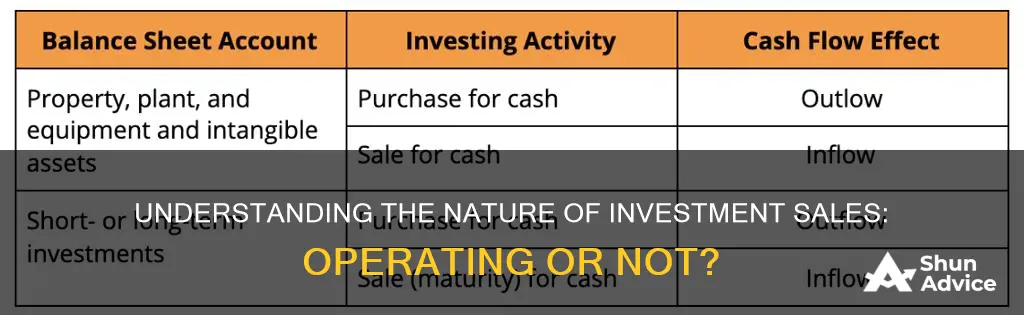

The sale of a long-term investment is generally not considered an operating activity. Long-term investments are typically financial assets held by a company for a prolonged period, often with the intention of generating returns or capital appreciation. These investments can include stocks, bonds, or other securities. When a company sells such an investment, it is usually classified as an investing activity in the statement of cash flows. This classification is because the sale of long-term investments is related to the company's strategy of managing its investment portfolio and generating returns from non-core business operations.

Operating activities, on the other hand, involve the company's primary revenue-generating processes. These may include sales, production, service delivery, and cost management. For example, a manufacturing company's operating activities would include the production of goods, the sale of those goods to customers, and the associated costs of production and distribution. Similarly, a retail business's operating activities would encompass selling products, managing inventory, and handling customer service inquiries.

In summary, operating activities are the core functions that drive a company's business and generate revenue. They are distinct from investing and financing activities, which are more related to the management of assets, liabilities, and capital structure. Understanding the definition and scope of operating activities is essential for analyzing a company's financial performance and making informed decisions about its operations and overall financial health.

Is ETF a Good Long-Term Investment? Unlocking the Potential

You may want to see also

Long-Term Investment Sale: Selling assets like property, equipment, or investments held for more than a year

The sale of long-term investments is a significant financial transaction that can have various implications for a business or individual. When you sell an asset that has been held for more than a year, it is generally classified as a long-term investment. This category includes various holdings, such as real estate, equipment, and certain types of securities. Understanding the nature of these sales is crucial for accurate financial reporting and analysis.

When you decide to sell a long-term investment, it is essential to recognize that this transaction typically falls outside the realm of operating activities. Operating activities are the day-to-day business operations that generate revenue and incur expenses. These activities are central to the core functions of a business and are reflected in the income statement. Selling a long-term investment, on the other hand, is more akin to an investment activity, which involves the management of financial assets and the realization of gains or losses from their sale.

The sale of long-term investments often involves a different set of considerations compared to operating activities. For instance, the sale may result in a capital gain or loss, which needs to be reported accordingly. This gain or loss is calculated based on the difference between the sale price and the original purchase price of the investment, adjusted for any depreciation or impairment charges. Proper accounting for these transactions ensures that financial statements provide a comprehensive view of a company's financial health and performance.

In financial reporting, the sale of long-term investments is typically reported in the statement of cash flows under the category of "Investing Activities." This classification highlights the nature of the transaction, which is primarily related to the management of long-term assets and the generation of financial gains or losses. It is important to distinguish these sales from operating activities to maintain the integrity of financial reporting and provide stakeholders with meaningful insights.

For individuals and businesses, the sale of long-term investments can have tax implications. Capital gains taxes may apply, depending on the holding period and the tax laws in the relevant jurisdiction. Understanding these tax considerations is vital for effective financial planning and management. Proper documentation and reporting of these sales ensure compliance with tax regulations and help individuals and businesses optimize their financial strategies.

Maximizing Long-Term Wealth: Understanding Your Investment Horizon

You may want to see also

Impact on Financial Statements: Sale affects income statement, balance sheet, and cash flow

The sale of a long-term investment can have significant implications for a company's financial statements, impacting the income statement, balance sheet, and cash flow. This transaction is typically classified as a non-operating activity, as it does not directly relate to the company's core business operations. Here's a detailed breakdown of its effects:

Income Statement: When a company sells a long-term investment, it recognizes a gain or loss on the sale. This is reported in the income statement under the 'Other Income' or 'Other Expenses' section. The amount of gain or loss depends on the difference between the sale price and the original purchase price, including any accumulated depreciation. For instance, if the investment is sold at a higher price than its purchase cost, it results in a gain, and vice versa. This transaction does not impact the company's ongoing revenue or cost of goods sold, making it a non-operating item.

Balance Sheet: The sale of a long-term investment will have a direct effect on the company's balance sheet. On the asset side, the investment account will be reduced by the sale proceeds. This reduction is a permanent entry, as the investment is no longer owned. Simultaneously, the cash account will increase by the same amount, reflecting the cash received from the sale. Additionally, if the investment was previously classified as a long-term asset, its sale might impact the presentation of current and non-current assets, depending on the company's accounting policies.

Cash Flow Statement: The cash flow statement provides a clear picture of the cash generated or used in a particular period. The sale of a long-term investment is reported as a financing activity in the cash flow statement. This is because the transaction involves the receipt of cash (or cash equivalent) in exchange for the sale of an asset. The cash inflow from the sale will be shown under 'Net Cash Flow from Investing Activities,' indicating that the cash flow is derived from investing activities rather than operating or financing activities.

Furthermore, the sale might also impact the company's future cash flows. For instance, if the investment was a significant source of future cash inflows, its sale could reduce the company's potential future cash receipts. This could be a critical consideration for investors and analysts when assessing the company's financial health and stability.

In summary, the sale of a long-term investment is a non-operating activity that primarily affects the income statement through the recognition of gains or losses. It also impacts the balance sheet by adjusting asset accounts and cash, and the cash flow statement by categorizing the transaction as a financing activity. Understanding these impacts is crucial for financial reporting and analysis, ensuring that the company's financial statements accurately reflect its financial position and performance.

Understanding Short-Term Investments: Current or Noncurrent Assets?

You may want to see also

Tax Implications: Capital gains tax considerations for long-term investment sales

When selling a long-term investment, understanding the tax implications is crucial for investors. The sale of a long-term investment can trigger capital gains tax, which is levied on the profit made from the sale. This tax is applicable to various types of investments, including stocks, bonds, real estate, and other assets held for more than a year. The tax rate for capital gains varies depending on the investor's income and the holding period of the investment.

Capital gains tax is calculated based on the difference between the sale price and the original purchase price of the investment. If the sale price is higher than the purchase price, it results in a capital gain, which is then taxed. The tax rate for long-term capital gains is generally lower than the ordinary income tax rate, providing an incentive for investors to hold investments for the long term. However, it's important to note that this tax benefit is available only if the investment is held for more than a year.

One key consideration is the tax treatment of different types of investments. For example, in the United States, long-term capital gains on the sale of assets held for more than a year are taxed at 0%, 15%, or 20%, depending on the taxpayer's income. This preferential tax rate is designed to encourage long-term investment strategies. On the other hand, short-term capital gains, which are profits from investments held for a year or less, are taxed at the ordinary income tax rate.

Additionally, investors should be aware of any deductions or credits that may be available to reduce their tax liability. For instance, certain expenses related to the investment, such as brokerage fees or investment management costs, may be deductible. It is essential to keep detailed records of these expenses to ensure proper tax reporting. Furthermore, in some jurisdictions, tax laws may provide relief for certain types of investments, such as start-up companies or real estate, offering reduced tax rates or special tax treatment.

In summary, the sale of a long-term investment can have significant tax implications, primarily in the form of capital gains tax. Investors should carefully consider the tax rates, holding periods, and potential deductions to minimize their tax burden. Seeking professional advice from a tax specialist or financial advisor can provide valuable insights tailored to an individual's investment portfolio and tax situation. Proper tax planning can ensure that investors maximize their returns while adhering to the relevant tax regulations.

Debt Issuance: A Strategic Investment or Financial Move?

You may want to see also

Disclosure Requirements: Companies must disclose details of long-term investment sales in financial reports

When a company sells a long-term investment, it is crucial to understand the implications and the subsequent disclosure requirements. The sale of such investments is not considered an operating activity but rather a financial activity. Operating activities are those that are directly related to the company's core business operations, generating revenue and managing expenses. In contrast, the sale of long-term investments is a financial transaction that involves the disposal of assets held for a prolonged period, typically with the aim of realizing a profit or loss.

According to accounting standards, companies must provide specific details about these transactions in their financial reports. This transparency ensures that investors and stakeholders have a comprehensive understanding of the company's financial activities and their impact on the overall financial health. The disclosure requirements typically include the following:

- Investment Details: Companies should disclose the nature and description of the long-term investment sold, including the asset's original cost, acquisition date, and any subsequent adjustments. This information helps users of the financial statements trace the investment's journey and understand its significance.

- Sale Proceeds: The amount received from the sale should be clearly stated, along with any associated gains or losses. This figure is essential for assessing the financial impact of the sale and its contribution to the company's net income or loss.

- Comparison and Analysis: Financial reports should provide a comparative analysis of the sale proceeds with previous investment values and market trends. This comparison aids in evaluating the company's investment strategy and the overall performance of its financial assets.

- Impact on Financial Statements: Disclosure should also highlight the effects of the sale on the company's balance sheet, income statement, and cash flow statement. This includes changes in assets, liabilities, revenue, and cash flows, offering a comprehensive view of the transaction's financial implications.

By adhering to these disclosure requirements, companies ensure that their financial reports are informative and transparent. This transparency is vital for maintaining investor confidence, facilitating informed decision-making, and promoting the overall integrity of the financial markets. It also enables stakeholders to assess the company's financial health, investment strategies, and the effectiveness of its financial management.

Axie Infinity: A Long-Term Investment Strategy?

You may want to see also

Frequently asked questions

No, the sale of a long-term investment is typically classified as a financing or investing activity. Operating activities are those that are directly related to the company's core business operations and generate revenue. The sale of long-term investments is more about managing the company's financial assets and is not a part of the day-to-day business operations.

Operating activities are defined as the principal activities of a business that generate revenue and cash flows. These activities involve the production, sale, and distribution of goods or services. The sale of long-term investments, on the other hand, is a separate financial transaction and is not considered an operating activity.

Yes, the sale of a long-term investment can impact a company's cash flow statement, but it is not an operating activity. The cash flow from such a sale would be reported under investing activities. Operating cash flow is primarily influenced by the company's core business operations, including revenue generation, cost management, and operational efficiency.