VXUS, a mutual fund that focuses on investing in companies across various sectors in the United States, has been a topic of interest for investors seeking long-term growth opportunities. This fund aims to provide exposure to a diverse range of industries, including technology, healthcare, and consumer staples, which are known for their resilience and potential for sustained performance over time. With a strategy that emphasizes a mix of large-cap and mid-cap stocks, VXUS offers investors a balanced approach to capturing the benefits of both established and emerging companies. The fund's historical performance and its ability to navigate market cycles make it an attractive option for those looking to build a long-term investment portfolio.

What You'll Learn

- Market Volatility: VXUS may experience significant price swings, impacting long-term returns

- Economic Cycles: Investment performance is influenced by economic cycles and market sentiment

- Diversification Benefits: VXUS offers diversification, reducing risk compared to individual stock investments

- Historical Performance: Past performance is not indicative of future results; historical data provides context

- Risk Management: Long-term investors should consider risk management strategies to protect capital

Market Volatility: VXUS may experience significant price swings, impacting long-term returns

The VXUS exchange-traded fund (ETF) is designed to track the performance of large-cap companies in the United States and across the globe. While it offers a way to gain exposure to a diverse range of US and international markets, it's important to understand the potential risks associated with market volatility.

Market volatility refers to the rapid and significant price fluctuations in financial markets. The VXUS ETF, which primarily focuses on US and international stocks, is not immune to these price swings. When market conditions are volatile, the value of the ETF can experience substantial changes in a short period. This volatility can be attributed to various factors, including economic news, geopolitical events, and shifts in investor sentiment. For instance, a sudden announcement of a new trade policy could cause a ripple effect across global markets, leading to rapid price movements in the VXUS ETF.

Long-term investors often seek to build a diversified portfolio to mitigate the impact of market volatility. However, the VXUS ETF's nature as a global equity fund means it is inherently exposed to international markets, which can introduce additional volatility. During periods of economic uncertainty or geopolitical tension, international markets may react more dramatically, affecting the VXUS ETF's performance. This can result in substantial price swings, which may deter investors seeking stable, long-term returns.

To navigate this volatility, investors should consider their risk tolerance and investment goals. While the VXUS ETF offers a broad market exposure, it may not be suitable for those seeking a more stable, long-term investment. Diversification is key; investors might consider combining the VXUS ETF with other asset classes to create a well-rounded portfolio. Additionally, staying informed about global economic trends and market news can help investors make more strategic decisions during volatile periods.

In summary, while the VXUS ETF provides access to a diverse range of markets, its exposure to global equity markets makes it susceptible to significant price fluctuations. Investors should be prepared for potential short-term volatility and consider their risk profile before making long-term investment decisions. A comprehensive understanding of market dynamics and a well-diversified portfolio can help mitigate the impact of volatility.

Mastering Long-Term Investing: Strategies for Building Wealth Over Time

You may want to see also

Economic Cycles: Investment performance is influenced by economic cycles and market sentiment

The performance of investments, particularly in the context of long-term strategies, is significantly impacted by economic cycles and market sentiment. Understanding these influences is crucial for investors aiming to make informed decisions and navigate the complexities of the financial markets. Economic cycles, often referred to as the business cycle, are recurring patterns of expansion and contraction in the economy. These cycles are characterized by phases such as growth, peak, contraction, and recovery. During the growth phase, the economy expands, leading to increased corporate profits and rising stock prices. This is often a favorable period for investors, as it presents opportunities for capital appreciation. However, as the economy approaches its peak, inflationary pressures may start to emerge, and central banks might raise interest rates to curb excessive growth. This shift can lead to a decline in stock prices and a reevaluation of investment strategies.

Market sentiment, on the other hand, refers to the overall attitude and emotions of investors and traders. It is a collective mindset that can drive market trends and influence investment decisions. Positive market sentiment often coincides with economic growth, where investors are optimistic about future prospects, leading to increased buying activity. This can further fuel the growth cycle, creating a self-reinforcing positive feedback loop. Conversely, negative sentiment during economic downturns can lead to widespread selling, causing asset prices to drop. Investors must be aware that market sentiment can sometimes be irrational, leading to market bubbles or crashes.

The interplay between economic cycles and market sentiment creates a dynamic environment for investment. During economic expansions, investors might focus on growth-oriented investments, such as technology or small-cap stocks, expecting continued upward momentum. However, as the economy slows down, these investments may become less attractive, and investors might shift their portfolios towards more defensive sectors like utilities or consumer staples. This strategic adjustment is essential for risk management and long-term wealth preservation.

In the context of 'is VXUS a long-term investment?' one must consider the economic cycles and market sentiment to make an informed decision. VXUS, a potential investment vehicle, could be a diversified fund or an index that tracks a specific market or asset class. If the economy is in a growth phase, VXUS might offer strong returns, especially if it includes growth-oriented sectors. However, during a contraction or a period of negative sentiment, the performance of VXUS could be impacted, and investors might need to reassess their holdings.

In summary, economic cycles and market sentiment are critical factors that influence investment performance. Investors should stay informed about economic trends and market psychology to make timely adjustments to their investment strategies. Long-term investors, in particular, need to be prepared for the volatility that comes with economic cycles and be willing to adapt their portfolios accordingly. By understanding these influences, investors can make more strategic choices, ensuring their investments align with their financial goals and risk tolerance.

Tesla's Long-Term Potential: A Sustainable Investment?

You may want to see also

Diversification Benefits: VXUS offers diversification, reducing risk compared to individual stock investments

When considering long-term investments, many investors turn to diversified portfolios to manage risk effectively. One such investment option that provides broad exposure to the global market is the iShares MSCI ACWI IMI UCITS ETF (VXUS). This exchange-traded fund (ETF) offers a unique approach to diversification, allowing investors to spread their risk across various regions, sectors, and asset classes.

The VXUS ETF tracks the MSCI ACWI IMI Index, which comprises large and mid-cap stocks from developed and emerging markets worldwide. By investing in this ETF, investors gain exposure to over 2,000 companies, ensuring a diverse range of industries and geographic regions. This diversification is a key advantage, as it helps reduce the impact of any single stock or market's performance on the overall investment.

In the world of investing, the old adage "don't put all your eggs in one basket" rings true. VXUS embodies this principle by offering a basket of eggs, so to speak, in the form of a well-rounded global portfolio. By holding a wide array of companies, the ETF mitigates the risks associated with individual stock volatility. For instance, if a particular industry or region experiences a downturn, the overall impact on the investment is less severe due to the diversification.

This strategy of diversification is particularly beneficial for long-term investors who aim to build wealth over an extended period. By spreading investments across various sectors and markets, VXUS provides a more stable and consistent return potential. Historical data and market trends often demonstrate that diversified portfolios tend to outperform concentrated ones, especially during turbulent economic periods.

In summary, the VXUS ETF is an excellent tool for investors seeking long-term growth and risk management. Its global reach and broad diversification offer a compelling strategy to navigate the complexities of the financial markets. By investing in VXUS, individuals can build a robust portfolio that withstands the test of time, providing a solid foundation for their investment goals.

Non-Operating Assets: Are They Short-Term Investments?

You may want to see also

Historical Performance: Past performance is not indicative of future results; historical data provides context

When considering whether VXUS (an exchange-traded fund or ETF that tracks the performance of large-cap companies in the United States) is a suitable long-term investment, it's crucial to understand the concept of historical performance and its limitations. Past performance, while informative, should not be the sole factor in making investment decisions. Here's why:

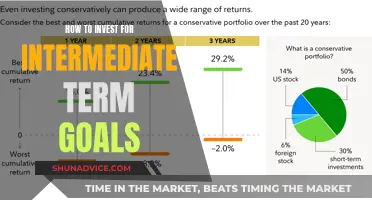

Firstly, historical data provides a context for understanding the potential risks and rewards associated with an investment. By examining the performance of VXUS over an extended period, investors can gain insights into the fund's volatility, growth patterns, and overall trend. For instance, if VXUS has consistently outperformed the market over the last decade, it suggests a strong performance record. However, it's essential to recognize that past performance alone does not guarantee future results.

The stock market is inherently unpredictable, and various factors can influence investment outcomes. Economic cycles, geopolitical events, industry-specific trends, and company-specific news can all impact stock prices. For example, a company's performance might have been strong in the past due to favorable market conditions, but a shift in the economy could lead to different results in the future. Therefore, relying solely on historical performance may not provide a comprehensive understanding of the investment's potential risks and rewards.

Additionally, the nature of the investment itself matters. VXUS, being a large-cap ETF, typically invests in well-established, blue-chip companies. These companies often have a history of stability and resilience, which can be an advantage during market downturns. However, even these companies can experience significant fluctuations in stock prices due to various market forces. Thus, while historical performance can offer valuable insights, it should be considered alongside other factors to make an informed investment decision.

In summary, while historical performance is a useful starting point for evaluating VXUS as a long-term investment, it should not be the sole criterion. Investors should conduct thorough research, consider market trends, economic factors, and the specific characteristics of the investment. By taking a comprehensive approach, investors can make more informed decisions and better manage their expectations regarding the potential returns and risks associated with VXUS.

Gold vs. Silver: Which is the Better Long-Term Investment?

You may want to see also

Risk Management: Long-term investors should consider risk management strategies to protect capital

When it comes to long-term investing, risk management is a critical aspect that investors should not overlook. The goal of long-term investing is to build wealth over an extended period, often with a focus on achieving consistent returns. However, this journey is not without its challenges and potential pitfalls. Effective risk management strategies are essential to ensure that your investments remain on track and that your capital is protected.

One of the primary risks in long-term investing is market volatility. The financial markets can be unpredictable, and prices of assets can fluctuate significantly over time. To manage this risk, investors should consider diversifying their portfolios. Diversification involves spreading your investments across various asset classes such as stocks, bonds, real estate, and commodities. By diversifying, you reduce the impact of any single investment's performance on your overall portfolio. For example, if one stock in your portfolio underperforms, a well-diversified portfolio can help offset potential losses with gains from other investments.

Another risk management strategy is to maintain a long-term perspective and avoid making impulsive decisions based on short-term market movements. Short-term market volatility can be influenced by various factors, including economic news, geopolitical events, and investor sentiment. While it's natural to feel anxious during market downturns, long-term investors should remember that these fluctuations are often temporary. History has shown that markets tend to recover over the long term, and staying invested through these periods can lead to significant gains.

Additionally, investors should consider implementing risk-control techniques such as setting stop-loss orders. A stop-loss order is an instruction to sell an asset when it reaches a certain price, which helps limit potential losses. This strategy is particularly useful for investors who want to protect their capital and manage risk proactively. By setting a stop-loss level, you can automatically sell an investment if it drops to a predetermined point, ensuring that you don't incur substantial losses.

Furthermore, regular portfolio reviews are essential for effective risk management. Long-term investors should periodically assess their investment choices to ensure they align with their risk tolerance and financial goals. This review process allows investors to make necessary adjustments, rebalance their portfolios, and stay on track with their long-term investment strategy. It's also an opportunity to identify and address any potential risks or vulnerabilities in your investment plan.

In summary, long-term investors should embrace risk management as a fundamental aspect of their investment approach. By diversifying portfolios, maintaining a long-term perspective, utilizing risk-control tools, and conducting regular reviews, investors can effectively protect their capital and increase the likelihood of achieving their financial objectives. Remember, successful long-term investing is not just about the potential for high returns but also about safeguarding your investments through prudent risk management practices.

Quantitative Strategies: Unlocking Long-Term Investment Potential

You may want to see also

Frequently asked questions

VXUS, or the Vanguard FTSE Emerging Markets UCITS ETF, is an exchange-traded fund (ETF) that tracks the FTSE Emerging Markets Index. It is designed to provide investors with exposure to a diverse range of companies across emerging markets, primarily in Asia, Latin America, and Africa. This ETF is considered a long-term investment strategy because it aims to capture the growth potential of these developing economies over an extended period, offering investors a way to benefit from the long-term economic growth and market development in these regions.

VXUS stands out from other emerging market funds due to its focus on a broad range of companies and its low-cost structure. It includes a wide array of sectors and industries, providing a more diversified approach compared to funds that may concentrate on specific sectors or regions. Additionally, VXUS has a lower expense ratio, making it an affordable option for investors who want to invest in emerging markets without incurring high fees.

Investing in VXUS carries certain risks that investors should be aware of. Emerging markets are generally more volatile and less liquid than developed markets, which can lead to price fluctuations. Currency fluctuations in the local currencies of these emerging markets can impact the fund's performance. Additionally, political and economic instability in these regions may pose risks to the long-term stability of the investment. Diversification within the fund can help mitigate some of these risks.

While VXUS is primarily designed for long-term investment strategies, it can also be considered for short-term gains. The ETF's broad exposure to emerging markets can provide opportunities for capital appreciation in the short term, especially during periods of market growth. However, short-term trading strategies may require more frequent monitoring and adjustments due to the inherent volatility of emerging markets.

VXUS has historically outperformed traditional developed market indices over the long term. Emerging markets have shown significant growth potential, often providing higher returns compared to developed markets. However, it's important to note that this performance can vary over different time periods, and investors should consider their risk tolerance and investment goals before making any decisions.