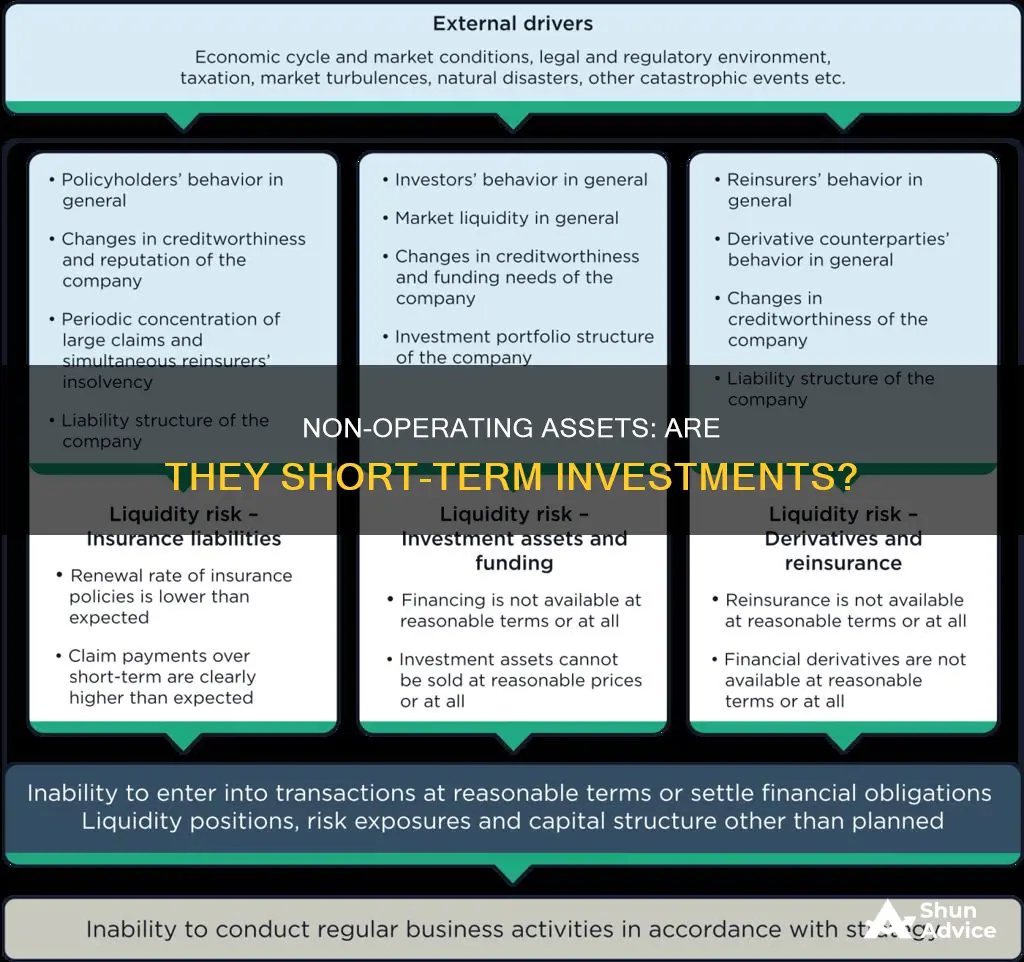

Non-operating assets are a crucial aspect of a company's financial health, and understanding their classification as short-term investments is essential for investors and analysts. These assets, which include items like marketable securities, derivatives, and other financial instruments, play a significant role in a company's liquidity and financial strategy. The question of whether non-operating assets are considered short-term investments is a complex one, as it depends on various factors such as the company's financial policies, industry standards, and regulatory guidelines. This paragraph aims to explore this topic, examining the criteria that determine the short-term nature of these assets and their impact on a company's financial statements and overall investment strategy.

What You'll Learn

- Definition of Non-Operating Assets: These are assets not directly involved in a company's core operations

- Classification as Short-Term: Non-operating assets are often classified as short-term investments if they are easily convertible to cash within a year

- Marketable Securities: This includes stocks, bonds, and other financial instruments that can be quickly sold for cash

- Investments in Affiliates: Non-operating assets can be investments in related companies, which may be considered short-term

- Tax Implications: Short-term investments in non-operating assets may have different tax treatments than long-term holdings

Definition of Non-Operating Assets: These are assets not directly involved in a company's core operations

Non-operating assets are a crucial concept in understanding a company's financial health and investment strategies. These assets are not directly tied to the company's primary business operations and are often considered a separate category in financial reporting. The definition of non-operating assets is straightforward: they are resources or possessions that a company owns but does not use in its core business activities. This classification is essential for investors and analysts as it provides insights into a company's financial structure and potential risks.

In the context of short-term investments, non-operating assets play a unique role. These assets are typically held for a relatively short period, often with the intention of generating quick returns or liquidity. Examples of non-operating assets include marketable securities, such as stocks, bonds, and other financial instruments, which are easily convertible into cash within a short timeframe. Additionally, cash and cash equivalents, such as treasury bills and short-term deposits, also fall into this category, as they are highly liquid and can be quickly accessed without significant impact on the company's operations.

The consideration of non-operating assets as short-term investments is crucial for several reasons. Firstly, it allows investors to assess the company's ability to quickly access and utilize its assets for operational needs or strategic opportunities. For instance, a company with substantial non-operating assets in the form of marketable securities can quickly liquidate these assets to fund expansion projects or manage short-term financial obligations. Secondly, it provides a clearer picture of the company's financial flexibility and risk management strategies.

Furthermore, the classification of non-operating assets as short-term investments can impact a company's financial ratios and metrics. These assets are often excluded from long-term financial analysis, as they are not integral to the core business operations. However, they can significantly influence short-term financial performance and liquidity. For instance, a high level of non-operating assets in the form of cash equivalents can improve a company's short-term liquidity ratio, indicating its ability to meet immediate financial demands.

In summary, non-operating assets are a distinct category of resources that are not directly involved in a company's core operations. When considering short-term investments, these assets become crucial as they represent quick and easily accessible resources. Understanding the nature of non-operating assets and their potential impact on short-term financial strategies is essential for investors and analysts to make informed decisions regarding a company's financial health and investment opportunities.

Long-Term Investments: Separating Fact from Fiction

You may want to see also

Classification as Short-Term: Non-operating assets are often classified as short-term investments if they are easily convertible to cash within a year

Non-operating assets, by definition, are not directly related to a company's core business operations. However, when it comes to their classification as short-term investments, the focus shifts to their liquidity and the ease with which they can be converted into cash. This is a crucial distinction in financial reporting and analysis.

The key criterion for classifying non-operating assets as short-term investments is their ability to be quickly liquidated without significant loss of value. This means that these assets should be readily convertible into cash within a relatively short period, typically one year or less. For example, marketable securities, such as treasury bills or short-term government bonds, are often considered short-term investments because they can be sold quickly and with minimal impact on their market value. Similarly, highly liquid assets like cash, cash equivalents, and short-term investments in marketable securities fall into this category.

The classification of non-operating assets as short-term investments is essential for several reasons. Firstly, it provides a clear picture of a company's liquidity and its ability to meet short-term financial obligations. Investors and creditors often analyze this aspect to assess the financial health and stability of a business. Secondly, this classification allows for better management of cash flow, as these assets can be readily utilized to meet operational needs or unexpected financial demands.

In financial statements, non-operating assets that meet the short-term investment criteria are typically reported in the current assets section, which includes cash, accounts receivable, and other highly liquid assets. This presentation ensures that stakeholders have a comprehensive understanding of the company's short-term financial position and the potential sources of quick cash.

In summary, non-operating assets are considered short-term investments when they possess the characteristic of high liquidity, enabling them to be converted into cash within a year. This classification is vital for financial reporting, as it provides insights into a company's liquidity, cash management, and overall financial health. Understanding this concept is essential for investors, creditors, and financial analysts to make informed decisions regarding a company's short-term financial stability and risk assessment.

Are NFTs a Long-Term Investment? Exploring the Future of Digital Art

You may want to see also

Marketable Securities: This includes stocks, bonds, and other financial instruments that can be quickly sold for cash

Marketable securities are a crucial component of a company's financial portfolio, representing highly liquid assets that can be readily converted into cash. These securities are typically classified as short-term investments because they can be quickly sold without significant loss of value. The term "marketable" refers to the ease with which these assets can be bought or sold in the financial markets.

In the context of a company's balance sheet, marketable securities are often listed as current assets, indicating their short-term nature. This classification is essential for financial reporting and analysis, as it provides a clear picture of the company's liquidity and ability to meet its short-term financial obligations. These securities are an integral part of a company's cash management strategy, allowing businesses to maintain a healthy cash flow while also generating returns on their investments.

Stocks, for instance, represent ownership in a company and can be easily bought or sold on stock exchanges. Bonds, on the other hand, are debt instruments issued by governments or corporations, offering a fixed return to investors over a specified period. Other marketable securities may include money market funds, treasury bills, and commercial paper, each providing a relatively low-risk investment opportunity.

The key characteristic that sets marketable securities apart is their high liquidity. These assets can be quickly converted into cash with minimal impact on their market value. This liquidity is crucial for companies, especially during times of financial stress or when they need to access funds for operational purposes. By holding marketable securities, businesses can ensure they have a readily available source of cash without compromising their investment goals.

In summary, marketable securities are an essential tool for companies to manage their short-term financial needs while also seeking potential returns. Their classification as current assets highlights their role in maintaining liquidity and facilitating efficient cash management. Understanding the nature of these investments is vital for financial analysts, investors, and company management alike, as it provides valuable insights into a company's financial health and strategy.

Unraveling ETFs: Are They Short-Term Investments?

You may want to see also

Investments in Affiliates: Non-operating assets can be investments in related companies, which may be considered short-term

Non-operating assets are indeed a crucial aspect of financial reporting, and their classification as short-term investments can be a complex topic. When it comes to investments in affiliates, the nature of these assets and their treatment in financial statements can vary. Here's a detailed exploration of this concept:

Investments in related companies, often referred to as affiliates, can be categorized as non-operating assets. These investments are typically made by a parent company in its subsidiaries or associated entities. The key characteristic that distinguishes these investments is their lack of direct operational involvement. Non-operating assets are not part of the company's primary business activities but are still significant financial holdings. In the context of short-term investments, these related-party investments can be considered for several reasons. Firstly, the nature of affiliate relationships often allows for quick and flexible transactions. These companies may have a close business relationship, enabling frequent and rapid exchanges of goods, services, or financial assets. As a result, the investments in affiliates might be more readily convertible into cash or easily liquidated, making them suitable for short-term investment strategies.

The classification of these investments as short-term can also depend on the company's financial policies and strategies. Some businesses may hold these investments with the intention of selling them in the near future, especially if they are deemed non-core or if the company is undergoing a restructuring process. In such cases, the investments in affiliates could be considered short-term assets, reflecting the company's plan to realize the financial gains or losses associated with these holdings. Additionally, the liquidity and marketability of these investments play a role. If the affiliate companies have active trading markets or if the investments can be easily sold without significant loss, they are more likely to be classified as short-term.

However, it's important to note that the treatment of non-operating assets, including investments in affiliates, may vary depending on accounting standards and regulations. For instance, the International Financial Reporting Standards (IFRS) provide specific guidelines for the classification of financial assets, which can influence how these investments are categorized. Under IFRS, financial assets are classified based on their intended holding period and the company's business model, which can lead to different interpretations of short-term investments.

In summary, investments in affiliates can be considered non-operating assets and may be classified as short-term investments due to the nature of affiliate relationships, the potential for quick transactions, and the company's financial strategies. Understanding the nuances of these classifications is essential for accurate financial reporting and analysis, especially when assessing a company's overall financial health and investment portfolio.

Afs Investments: Long-Term Strategy or Short-Term Gamble?

You may want to see also

Tax Implications: Short-term investments in non-operating assets may have different tax treatments than long-term holdings

The classification of non-operating assets as short-term investments can have significant tax implications for investors and businesses. When an asset is considered non-operating, it typically refers to an asset that is not directly related to the company's core business operations. These assets can include real estate, intellectual property, or even financial investments that are not part of the company's regular business activities. The tax treatment of these non-operating assets can vary depending on whether they are held as short-term or long-term investments.

In many tax jurisdictions, short-term investments are generally taxed at a higher rate compared to long-term holdings. This is because short-term capital gains are often treated as ordinary income, which may result in a higher tax burden. For example, if a company sells a non-operating asset within a short period, the profit made from the sale might be taxed at the company's regular income tax rate, which could be higher than the long-term capital gains tax rate. This difference in tax treatment can significantly impact the overall profitability and financial planning of the business.

On the other hand, long-term investments in non-operating assets may offer more favorable tax consequences. Long-term capital gains are often taxed at a lower rate, providing an incentive for investors to hold these assets for an extended period. For instance, if a company decides to hold a non-operating asset for several years before selling it, the capital gain realized could be taxed at a reduced rate, potentially resulting in significant tax savings.

Understanding the tax implications is crucial for effective financial management. Investors and businesses should carefully consider the holding period of non-operating assets to determine the most advantageous tax strategy. Proper planning can help minimize tax liabilities and optimize the financial performance of the investment. It is recommended to consult with tax professionals or financial advisors to navigate the complex tax regulations surrounding non-operating assets and short-term investments.

In summary, the classification of non-operating assets as short-term or long-term investments has a direct impact on tax obligations. Short-term investments may face higher tax rates, while long-term holdings can provide tax advantages. Being aware of these tax implications is essential for making informed financial decisions and ensuring compliance with tax laws.

Understanding Long-Term Investments: A Deep Dive into Balance Sheet Strategies

You may want to see also

Frequently asked questions

Non-operating assets are assets that a company owns but does not use in its primary business operations. These assets are typically not directly related to the company's core business activities and are often considered as investments or financial items. Examples include cash, marketable securities, and other short-term investments.

In financial reporting, non-operating assets are usually classified as current assets or long-term investments. Current assets are those that are expected to be converted into cash or used up within one year or one operating cycle, whichever is longer. Long-term investments are assets that the company intends to hold for an extended period, typically beyond one year.

Yes, non-operating assets can be considered short-term investments, especially when they are classified as current assets. Short-term investments are typically low-risk, highly liquid assets that can be quickly converted into cash without significant loss of value. Examples include treasury bills, certificates of deposit, and short-term government bonds.

Operating assets are those directly involved in the company's core business operations and generate revenue or contribute to the production process. These include property, plant, and equipment, inventory, and accounts receivable. Non-operating assets, on the other hand, are not directly tied to the company's primary business activities and are often used for financial management or investment purposes.