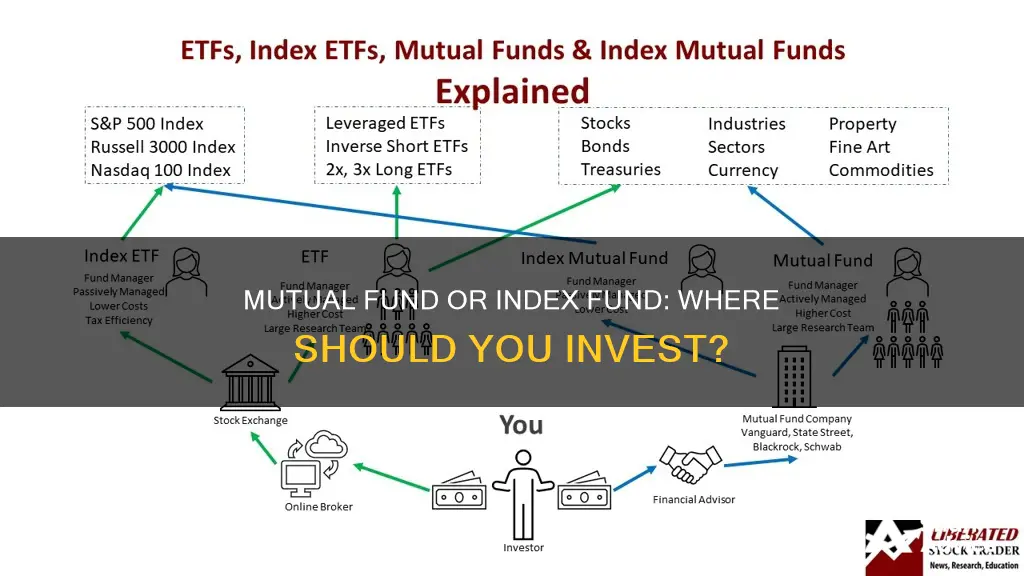

Index funds and mutual funds are both investment vehicles that pool money from investors to purchase a portfolio of stocks, bonds, or other assets. However, they differ in their investment strategies and management styles. Index funds are passive investments that aim to mirror the performance of a specific market index, such as the S&P 500, by holding the same stocks or bonds. On the other hand, mutual funds are actively managed, meaning a fund manager or team selects investments based on the fund's objectives to try and outperform the market. This distinction leads to several differences in costs, diversification, risk, and performance, which are crucial for investors to understand when deciding which type of fund to invest in.

| Characteristics | Values | |

|---|---|---|

| Investment type | Mutual funds pool money from investors to buy a portfolio of stocks, bonds or other assets. Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500. | |

| Management style | Actively managed by professionals. | Passively managed. |

| Investment objective | To beat the performance of index funds. | To mirror the performance of a market index. |

| Costs | Higher fees than index funds. | Lower fees than mutual funds. |

| Diversification | Varying levels of diversification. | Instant diversification. |

| Risk | Higher market risk. | Lower market risk. |

What You'll Learn

Index funds vs mutual funds: differences and similarities

Index funds and mutual funds are both investment vehicles that pool money from investors to purchase a portfolio of stocks, bonds, or other assets. However, there are several differences between the two:

Management Style

Index funds are passively managed, meaning they aim to mirror the performance of a specific market index, such as the S&P 500 or the Nasdaq Composite. The holdings of an index fund automatically track the index, and no one actively manages the portfolio. This passive investing strategy keeps costs low.

On the other hand, mutual funds are actively managed by professional fund managers who aim to outperform the market. These managers have the freedom to shop for investments across multiple indexes and various investment types. They choose which stocks to buy or sell from the portfolio based on the fund's objectives.

Investment Objective

The sole objective of an index fund is to replicate the performance of its underlying index. This means that when the index increases or decreases in value, the value of the fund will closely follow those gains and losses.

Mutual funds, on the other hand, aim to beat the performance of index funds. They seek to generate higher returns than the overall market by strategically selecting and actively trading stocks, bonds, or other assets.

Cost

Index funds typically have lower costs and fees compared to mutual funds due to their passive management style, which involves less frequent trading and lower administrative expenses. Actively managed mutual funds incur higher fees due to active trading, research, and management. These fees include expense ratios, sales loads, and transaction fees.

Diversification

Index funds offer instant diversification by holding a high number of securities in the same proportions as the index they track. This approach ensures broad market exposure and reduces specific risks associated with individual stocks or sectors.

The diversification strategies of mutual funds, especially actively managed ones, can vary. While some mutual funds might hold a diversified portfolio, others might focus on specific sectors or niches, leading to varying levels of diversification.

Risk

Index funds carry market risk, exposing investors to fluctuations in the overall market. However, this risk is spread across a diversified portfolio, reducing individual stock risk.

Mutual funds may bear market risk and specific risks tied to the fund's investment strategy or the manager's decisions. Actively managed mutual funds may also have higher expense ratios, leading to potential underperformance against the market.

PNC Bank, Investments, and Funds: What's the Difference?

You may want to see also

Pros and cons of investing in index funds

Index funds are a popular investment choice as they offer the potential for more stable returns over time, a diversified portfolio of holdings, and low fees. Here are some pros and cons of investing in index funds:

Pros:

- Low fees: Index funds are passively managed, meaning fund managers take a hands-off approach and invest passively in companies in the market index it follows. As a result, management fees tend to be lower than those of actively managed funds.

- Diversification: Index funds provide access to a large collection of stocks, bonds, or other securities, reducing the risk of significant harm to your portfolio due to the poor performance of a single stock.

- Long-term performance: Index funds tend to provide more stable and predictable returns over the long term, making them a good choice for retirement accounts.

- Simplicity and broad market exposure: Index funds are straightforward investment options that provide broad market exposure by aiming to mirror the performance of a specific index, such as the S&P 500 or the Dow Jones Industrial Average.

- Historical performance: Over the long term, many index funds have outperformed actively managed funds, especially after accounting for fees and expenses.

- Tax efficiency: Lower turnover rates in index funds usually result in fewer capital gains distributions, making them more tax-efficient than actively managed funds.

Cons:

- Lack of downside protection: Index funds do not provide protection from market downturns and will follow the market's performance.

- Lack of reactivity: Index funds do not allow for advantageous behaviour. If a stock becomes overvalued, it carries more weight in the index, which is the opposite of what astute investors would want.

- Lack of control: Indexes are set portfolios, and investors have no control over the individual holdings. This may be undesirable if you have specific companies or industries you want to invest in or avoid.

- Limited exposure to different strategies: Index investing may not provide access to successful investing strategies, and diversification can also be achieved with a smaller number of stocks.

- Dampened personal satisfaction: Index investing can still be stressful, and you may find yourself constantly checking the market's performance, just like with individual stocks.

Mutual Fund Investment: Strategies for Profiting

You may want to see also

Pros and cons of investing in mutual funds

Pros of Investing in Mutual Funds:

Mutual funds are a popular investment option that pools money from multiple investors. They offer a relatively easy and diverse way to invest in a variety of securities with a single investment. Here are some pros of investing in mutual funds:

- Diversification: Mutual funds typically invest in a wide range of stocks or bonds, reducing investment risk. If certain fund assets lose value, gains in other areas can offset those losses.

- Potential for high returns: Actively managed mutual funds use active trading strategies to try and beat the market, which could result in competitive returns.

- Professional management: Actively managed funds involve a fund manager or team that researches investment options and makes trades on your behalf. Passively managed funds, on the other hand, track a stock market index to match its returns and are often recommended for long-term investing.

- Convenience: Investors can select a mutual fund with dozens or hundreds of investments within a single packaged security, saving time and resources.

- Compound interest: Mutual funds can enable compound growth by reinvesting dividends and interest, using them to buy more shares of the fund.

Cons of Investing in Mutual Funds:

While mutual funds offer potential benefits, they also come with certain drawbacks. Here are some cons of investing in mutual funds:

- No guaranteed returns: Mutual funds, especially actively managed ones, might not always beat the market. Over a five-year period ending in June 2022, very few actively managed funds outperformed the market, according to the S&P Dow Jones Indices.

- High fees and costs: Mutual funds often have various fees, including load fees, operating expense ratios, and 12b-1 fees. These fees can eat into your investment returns.

- High minimum investment: The minimum investment for a mutual fund can range from $500 to $3,000, which may be a barrier for some investors.

- Tax inefficiency: Mutual funds distribute capital gains and dividends that are taxable, and they may also have tax implications due to frequent trading.

- Possibly too hands-off: Some investors prefer being actively involved in trades and investment decisions, which mutual funds may not allow. Passive index funds, in particular, might feel restrictive for self-directed investors.

In summary, mutual funds offer benefits such as diversification and professional management but also come with potential drawbacks like high fees and tax inefficiency. Whether mutual funds are a suitable investment depends on your investment timeline, financial position, and goals.

High-Speed Trading Funds: Strategies for Smart Investing

You may want to see also

How to choose between index and mutual funds

Index funds and mutual funds are both investment vehicles that pool money from investors to purchase a portfolio of stocks, bonds, or other assets. However, there are some key differences to consider when choosing between the two:

Management Style:

Index funds are passively managed, meaning they aim to mirror the performance of a specific market index such as the S&P 500. The holdings of an index fund automatically track the index, and there is no need for human oversight on buying and selling decisions. On the other hand, mutual funds are actively managed by fund managers who actively trade securities to try to outperform the market.

Investment Objective:

The sole objective of an index fund is to replicate the performance of its underlying index. In contrast, the objective of an actively managed mutual fund is to beat the market and generate higher returns by having experts pick investments they believe will perform better.

Cost:

Index funds typically have lower costs and fees compared to actively managed mutual funds. This is because index funds involve less frequent trading and have lower administrative expenses. The higher fees of actively managed mutual funds include expense ratios, sales loads, and transaction fees.

Diversification:

Index funds offer instant diversification by holding a high number of securities in the same proportions as the index they track. This provides broad market exposure and reduces specific risks associated with individual stocks or sectors. Mutual funds, especially actively managed ones, vary in their diversification strategies, with some funds focusing on specific sectors or niches.

Tax Efficiency:

Index funds are generally more tax-efficient than actively managed mutual funds due to their lower turnover rates. Index funds tend to buy and hold securities, resulting in fewer capital gains distributions, which are taxable to investors. Actively managed mutual funds may experience higher turnover, triggering more taxable events.

When deciding between index funds and mutual funds, consider your financial goals, risk tolerance, and investment objectives. Index funds are a good choice for those seeking passive, low-cost diversification and consistent returns. Mutual funds are better suited for those who want the potential for higher returns and are willing to pay higher fees for active management strategies.

Vanguard Funds: Best UK Investment Options

You may want to see also

Costs and fees of index funds vs mutual funds

Index funds and mutual funds have different costs and fees, which can be a critical factor when choosing between the two.

Index funds are passively managed, meaning they aim to replicate the performance of a specific market index, such as the S&P 500. This passive investing strategy involves trading as little as possible to keep costs low. Index funds have lower expenses and fees than actively managed mutual funds. They do not require research analysts or frequent trades, resulting in reduced transaction fees and commissions. As a result, index funds can charge lower expense ratios, often as low as 0.04%.

On the other hand, mutual funds are actively managed, meaning a fund manager or team makes investment decisions with the goal of outperforming the market. This active management comes at a higher cost, including investment manager salaries, bonuses, employee benefits, office space, and marketing materials. These costs are bundled into the mutual fund expense ratio, which is typically higher than that of index funds, ranging from 0.44% to over 1.00%.

Additionally, mutual funds may include various fees such as management fees, 12b-1 fees (for marketing and employee bonuses), account fees, redemption fees, exchange fees, and purchase fees. Mutual funds may also charge a load fee of up to 8.5% paid to the broker selling the shares. In contrast, exchange-traded funds (ETFs), which can be a type of index fund, are typically "no-load," meaning there is no purchase fee, and they do not charge annual 12b-1 fees.

It is important to note that the fees and expenses associated with index funds and mutual funds can impact investment returns. Higher fees can reduce the returns received by investors, potentially leading to underperformance compared to index funds.

When considering costs and fees, it is advisable to review and compare the expense ratios, trading costs, investment minimums, and potential tax implications of different funds before making investment decisions.

NIIF Master Fund: A Guide to Investing in India's Future

You may want to see also

Frequently asked questions

An index fund is a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. Index funds are passively managed and have lower fees compared to actively managed funds.

A mutual fund is a financial product that pools money from investors to purchase a diversified portfolio of stocks, bonds, or other securities. Mutual funds can be actively or passively managed. Actively managed mutual funds employ fund managers who actively trade securities to try to outperform the market.

The main differences lie in their management style, investment objective, and cost. Index funds are passively managed, aiming to mirror the performance of a market index, while actively managed mutual funds seek to outperform the market. Index funds generally have lower fees and are more tax-efficient than actively managed mutual funds.

The choice between index funds and actively managed mutual funds depends on your investment goals, risk tolerance, and preferences. If you prioritize broad market exposure, low costs, and consistent returns, index funds may be more suitable. On the other hand, if you seek potential outperformance and active management strategies, actively managed mutual funds could be a better option.