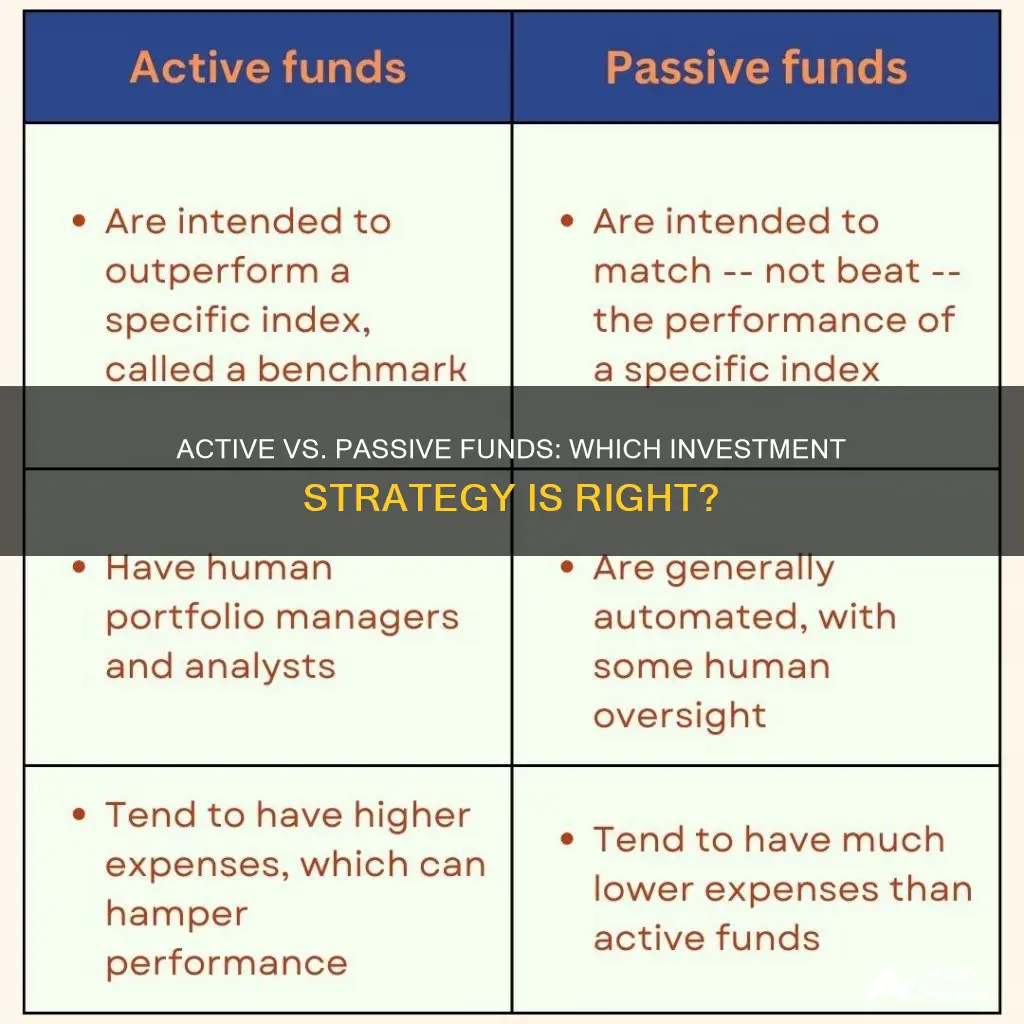

The debate between active and passive investing has divided the investment world for years. Active investing involves frequent trading with the goal of beating average index returns. It requires a high level of market analysis and expertise to determine the best time to buy or sell. Passive investing, on the other hand, is a long-term strategy centred on buying and holding assets. It aims to duplicate the performance of market indexes rather than trying to outperform them. While active investing offers more flexibility and trading options, passive investing tends to be quicker, easier, and delivers better overall returns with lower fees.

What You'll Learn

Active investing: pros and cons

Active investing involves investing in funds that are managed by portfolio managers who choose investments based on their expected performance. The goal of an actively managed fund is to "beat the market" or a certain benchmark, like the S&P 500. Active investors try to buy and sell investments in response to new information, market changes, or economic conditions to generate higher returns or limit losses.

Pros of Active Investing

- Opportunity to outperform the market: Active investing allows portfolio managers to use different strategies to select attractive investments, potentially leading to higher-than-average market returns.

- More choices: There are more actively managed funds available, providing investors with greater access to different investments.

- Flexibility: Active investors can adjust their portfolios in response to market fluctuations, such as a market crash or economic recession. They have the freedom to buy "diamond in the rough" stocks and are not restricted to a specific index.

- Hedging: Active managers can use short sales, put options, and other strategies to insure against losses and exit specific stocks or sectors when risks become too high.

- Tax management: Active managers can tailor tax strategies to individual investors, such as selling losing investments to offset taxes on winning investments.

Cons of Active Investing

- Higher expenses: Actively managed funds often have higher fees due to the need to pay research analysts and portfolio managers, as well as additional costs from frequent trading.

- Potential for below-market returns: When expenses are considered, many active managers fail to beat their benchmarks, resulting in lower returns.

- Lower tax efficiency: Frequent trading within actively managed funds can lead to higher capital gains taxes.

- Active risk: Active managers have the freedom to buy any investment they believe meets their criteria, which can introduce risk.

- Management risk: Fund managers are human and can make costly investment mistakes.

A Beginner's Guide to Mutual Funds on Vanguard

You may want to see also

Passive investing: pros and cons

Passive investing is a more hands-off approach to investing, where investors buy and hold securities over a long period, with the goal of achieving gradual wealth growth. This strategy is particularly popular among retail investors. It is also known as index investing, where investors purchase securities in a representative benchmark, such as the S&P 500 index, and hold them for a long time.

Pros of passive investing

- Lower fees: Passive investing involves lower fees compared to active investing, as there is no need to pay for research analysts and portfolio managers. The average expense ratio for a passive equity fund is 0.06%, while an actively managed equity fund is 0.68%.

- Tax efficiency: The buy-and-hold strategy of passive investing results in lower capital gains tax.

- Transparency: Investors know exactly which assets are in an index fund at all times.

- Simplicity: Passive investing is easier to implement and understand than active investing, which requires constant research and adjustments.

- Diversification: Passive investing enables investors to achieve diversification by holding a broad market index or indices.

- Long-term performance: Passive investing has consistently outperformed active investing over the medium to long term.

Cons of passive investing

- Limited flexibility: Passive investors are locked into a specific index or set of investments and are not able to make changes based on market conditions.

- Smaller returns: Passive funds rarely beat the market and tend to have smaller returns compared to active funds.

- Reliance on the market: Passive investors are dependent on the performance of the market and do not have the same opportunities to capitalize on short-term price fluctuations.

- Lack of control: Passive investors rely on fund managers to make decisions and do not have a say in the specific investments they are holding.

- Downward market risk: While passive investing offers greater potential for gradual growth, it does not protect investors from downward market slides.

Overall, passive investing is a good option for those seeking a hands-off, long-term approach with lower fees and greater tax efficiency. However, it is important to consider the limitations in terms of flexibility and potential returns when deciding between passive and active investing strategies.

A Guide to Investing IRA Funds in Taxable Accounts

You may want to see also

Active vs passive investing: which is better?

There are two primary methods of investing: active and passive. Active investing involves a fund manager who actively picks and chooses investments, whereas passive investing tracks an existing group of investments called an index. Passive investing strategies tend to perform better and are more cost-effective. However, active investing has its advantages and may be more suitable for certain investors.

Active Investing

Active investing requires a hands-on approach, typically by a portfolio manager, and involves frequent trading with the goal of beating average market returns. It requires a high level of market analysis and expertise to determine the best times to buy or sell investments. Active investors can use various strategies, such as hedging and shorting stocks, to increase their chances of beating the market. Additionally, active investing offers more flexibility, especially in volatile markets, and can be used for tax management strategies.

However, active investing also comes with higher fees due to the extensive research and frequent trading involved. It also carries increased risk, as one wrong move can cause significant losses.

Passive Investing

Passive investing, on the other hand, is a more hands-off approach where investors buy a basket of stocks and hold them for the long term, regardless of market fluctuations. This strategy is often done through index funds or exchange-traded funds (ETFs) that aim to replicate the performance of a specific market index. Passive investing is generally more cost-effective due to lower transaction costs and expense ratios.

Another advantage of passive investing is decreased risk. By investing in a diverse range of stocks and bonds, the impact of a single investment failing is minimised. Passive investing also offers transparency, as investors always know which assets are in their index fund.

However, a disadvantage of passive investing is that it may not be suitable for investors who want to actively preserve their wealth or require more tailored tax management strategies.

Both active and passive investing have their advantages and disadvantages. Passive investing tends to deliver better overall returns and is more cost-effective, making it a popular choice for many investors. However, active investing offers more flexibility and can be useful for investors who want to actively manage their portfolio and have the time and expertise to make frequent trading decisions.

Ultimately, the best strategy may be a blend of both active and passive investing, allowing investors to take advantage of the strengths of each approach and diversify their portfolio.

Smart Ways to Invest Your Rainy Day Fund

You may want to see also

Active and passive blending

For example, investors with large cash positions may actively seek out opportunities to invest in ETFs just after the market has pulled back. Retirees who prioritise income may actively select specific stocks that offer dividend growth while maintaining a buy-and-hold mentality.

Additionally, blending can help manage risk-adjusted returns. Controlling the allocation of funds across different sectors or companies during periods of rapid change can protect the investor. For instance, investors can be active traders of passive funds, betting on the rise and fall of the market rather than adopting a true passive approach. Conversely, passive investors can hold active funds, expecting their fund manager to outperform the market.

Many professionals advocate for a blended strategy, arguing that it offers the best of both worlds. However, some investors have strong opinions and may not be convinced of the merits of combining the two approaches. Ultimately, the decision to blend active and passive investing depends on an investor's personal priorities, timelines, and goals.

Target Maturity Funds: A Guide to Investing Wisely

You may want to see also

Active and passive funds: what are the differences?

There are two main investment strategies: active and passive. Both have their own advantages and disadvantages, and investors are often divided on which is the better strategy.

Active Investing

Active investing involves a fund manager picking and choosing investments based on an independent assessment of their worth. The goal of active managers is to "beat the market" or outperform certain benchmarks. For example, an active US equity investor may aim to achieve better returns than the S&P 500 or Russell 3000. Active investing requires a hands-on approach and a deeper analysis of investments, and it can be more expensive due to the need to pay for research analysts, portfolio managers, and other costs associated with frequent trading.

Advantages of Active Investing

- Flexibility: Active managers can buy stocks they believe are "diamonds in the rough" and are not required to follow a specific index.

- Hedging: Active managers can use various techniques such as short sales or put options to hedge their bets and can exit specific stocks or sectors when risks become too big.

- Tax management: Active investing allows for tailored tax management strategies, such as selling investments that are losing money to offset taxes on winning investments.

Disadvantages of Active Investing

- Higher fees: Actively managed equity funds have higher expense ratios due to the research and trading involved.

- Increased risk: Active investing can lead to catastrophic losses if investments do not perform as expected, especially if borrowed money is used.

- Trend exposure: It is easy for active investors to follow trends, such as meme stocks or pandemic-related fads, which may not have long-term growth potential.

Passive Investing

Passive investing, on the other hand, involves buying a basket of stocks and buying or selling regularly, regardless of market performance. This strategy is often associated with index funds, which aim to match the performance of a specific market index rather than trying to outperform it. Passive investing requires a long-term mindset, disregarding short-term market fluctuations. It is also less expensive since there is no need to pay for extensive research and analysis.

Advantages of Passive Investing

- Lower fees: Passive funds simply follow an index, so oversight is much cheaper.

- Transparency: It is clear which assets are in a passive fund as they follow a specific index.

- Tax efficiency: The buy-and-hold strategy of passive investing typically does not result in a large capital gains tax bill.

- Lower risk: Passive investing provides easy diversification, reducing the risk of significant losses from a single investment.

- Higher average returns: Passive funds tend to outperform active funds over the long term, as they are not trying to beat the market but rather match its performance.

Disadvantages of Passive Investing

- Limited: Passive funds are limited to a specific index or set of investments, and investors are locked into those holdings regardless of market changes.

- Small returns: Passive funds rarely beat the market and are limited by their core holdings, so they may not provide significant returns.

- Reliance on fund managers: Passive investors rely on fund managers to make decisions and do not have a say in their specific investments.

- No exit strategy in severe bear markets: Passive investing is a long-term strategy and may not provide an off-ramp during severe market downturns.

Both active and passive investing strategies have their merits, and some investors choose to blend the two approaches to take advantage of the strengths of each. When deciding between the two, it is essential to consider factors such as fees, risk tolerance, investment goals, and the level of involvement desired in managing investments.

Bond Funds: A Beginner's Guide to Investing Wisely

You may want to see also

Frequently asked questions

Active investing involves buying and selling investments based on their short-term performance, with the goal of beating the average market returns. Active investors take a hands-on approach and frequently trade to capitalize on short-term price fluctuations.

Passive investing is a long-term strategy that involves buying and holding a diverse range of investments, aiming to duplicate the performance of the market rather than trying to outperform it. Passive investors typically buy shares of index funds or ETFs that track major market indexes.

Active investing offers flexibility, expanded trading options, and the potential for higher returns during favourable market conditions. However, it also carries higher fees, increased risk, and requires a significant amount of time and expertise to be successful.

Passive investing is known for its low costs, decreased risk due to diversification, and higher average returns over the long term. On the other hand, it may not offer an exit strategy during severe market downturns and may not provide the same level of excitement as active investing.