Long-term bond funds are a type of investment vehicle that focuses on purchasing bonds with maturities of 10 years or more. These funds offer investors steady income and capital appreciation over extended periods. When considering investing in long-term bond funds, it is essential to understand the underlying bonds' interest rate sensitivity, also known as duration. Additionally, investors should be aware of the risks associated with bond investing, such as interest rate risk, credit risk, and liquidity risk. While long-term bond funds provide diversification and stable returns, they are also more sensitive to changes in interest rates compared to shorter-term bond funds. As of 2024, some of the best-performing long-term bond funds include Vanguard Long-Term Corporate Bond ETF and iShares 20+ Year Treasury Bond ETF.

| Characteristics | Values |

|---|---|

| Bond type | Long-term bond funds |

| Bond portfolio | Invest primarily in investment-grade U.S. fixed-income issues, including government, corporate, and securitized debt |

| Bond duration | Above 125% of the three-year average of the effective duration of the Morningstar Core Bond Index |

| Bond prices | Fluctuate in the secondary market; fall when interest rates rise and vice versa |

| Bond term | More than 10 years |

| Bond ratings | Issued by major rating agencies like Moody's Investors Service and Standard & Poor's |

| Bond yields | High enough to be appealing to investors |

| Bond funds | Actively managed funds that help investors diversify their bond exposure and target specific goals |

What You'll Learn

How long-term bond funds can help diversify your portfolio

Long-term bond funds can be a great way to diversify your portfolio. Bonds are loans made to a government, government agency, or corporation, which they use to finance projects and other needs. The bond issuer agrees to repay the bondholder at a fixed interest rate by a specified date, or maturity.

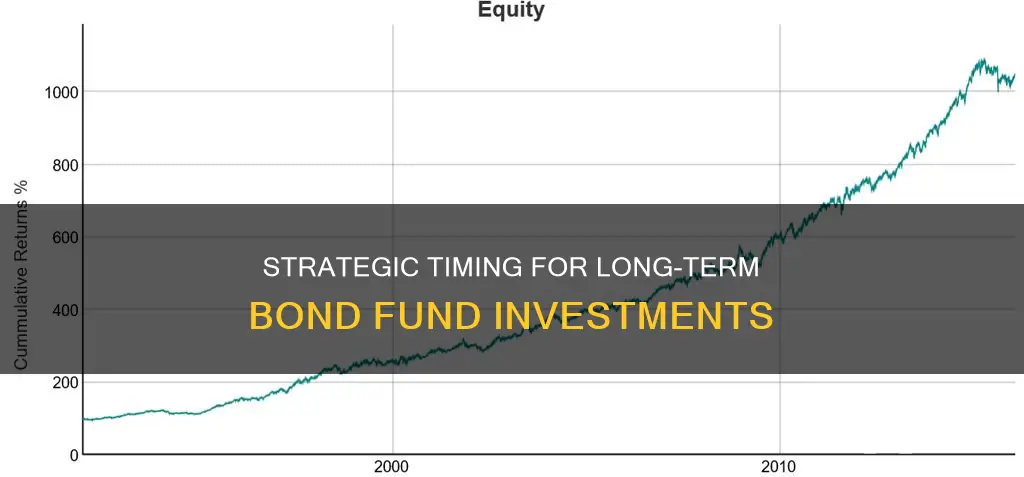

Bonds are a good way to balance the potential volatility of higher-risk investments, such as equities. While bonds have not historically kept pace with stock market returns, they typically experience less short-term price volatility. This makes them a good option for investors looking to smooth out the ups and downs of the market.

There are several types of long-term bond funds that can help diversify your portfolio:

- Government bonds: These are issued by stable governments from developing economies, such as the US, Germany, Japan, and Canada. US government bonds, or Treasury bonds, are considered a "safe haven" investment and have never defaulted.

- Municipal bonds: Also called "muni bonds," these are backed by taxes and revenues from state and local jurisdictions. Yields on municipal bonds are typically lower than yields on comparable Treasury or corporate bonds, but the interest paid is generally exempt from federal income taxation.

- Agency bonds: These are issued by government-sponsored enterprises such as Fannie Mae and Freddie Mac. They are now fully backed by the US government, so they carry credit quality similar to Treasury debt. The interest on these bonds is taxable.

- Corporate bonds: These are issued by corporations and tend to generate higher yields than government or municipal bonds. The interest paid is treated as taxable income. When investing in corporate bonds, look for well-established companies with diversified product offerings and a long track record of financial stability and success.

- Mortgage-backed securities (MBS): These are secured by commercial or residential property mortgages and can be a good choice for bond portfolio diversification. MBS with higher-quality ratings tend to benefit from their focus on borrowers with a strong ability to make timely mortgage payments.

When investing in long-term bond funds, it's important to assess the interest rate environment and consider the impact of interest rate changes on bond prices. Longer-maturity bonds are more sensitive to interest rate changes and may experience more downward price pressure when rates rise.

Additionally, it's crucial to focus on high-quality bonds and assess the credit quality of the bond issuer. Investment-grade bonds have lower risks of default and are rated above BAA by Moody's or BBB by Standard & Poor's or Fitch.

By investing in a variety of long-term bond funds, you can diversify your portfolio, reduce risk, and potentially achieve more consistent investment performance over time.

Best Vanguard Funds to Maximize Your 401(k) Returns

You may want to see also

The role of interest rates in long-term bond investments

Long-term bond funds primarily invest in investment-grade fixed-income securities, including government, corporate, and securitized debt. These bonds have maturities of 10 years or more, and their interest rates are a key consideration for investors.

Interest rates play a crucial role in the performance of long-term bond investments. When interest rates rise, bond prices tend to fall, and vice versa. This inverse relationship between bond prices and yields is essential to understand when investing in long-term bonds.

Long-term bond funds are more sensitive to changes in interest rates due to their longer durations. The duration of a bond measures its sensitivity to interest rate changes and is typically quoted as a percentage. For example, a duration of 125% means that for every 1% change in interest rates, the bond's price will change by 1.25%. As a result, long-term bond funds can experience greater price volatility when interest rates fluctuate.

When interest rates increase, existing bonds become less attractive to investors since they offer lower yields compared to newly issued bonds with higher interest rates. This leads to a decrease in the price of existing bonds as investors sell them to invest in higher-yielding alternatives. Consequently, the value of long-term bond funds may decline during periods of rising interest rates.

On the other hand, when interest rates decrease, the prices of existing bonds tend to increase. This is because investors are willing to pay more for the higher coupon rates offered by these bonds compared to the lower yields available in the market. As a result, long-term bond funds can benefit from capital gains during periods of falling interest rates.

It's important to note that high-quality bonds, such as those offered by governments and large corporations, tend to be less volatile than riskier assets. They provide predictable and consistent coupon income, making them attractive for investors seeking diversification and stable returns.

In summary, interest rates have a significant impact on long-term bond investments. Investors should carefully consider the interest rate environment and their expectations for future rate changes before investing in long-term bonds. While long-term bonds offer steady income and capital appreciation, their prices can be volatile due to changes in interest rates. Therefore, monitoring interest rate movements and understanding the duration of the bond fund is crucial for making informed investment decisions.

Vanguard Funds: Best UK Investment Options

You may want to see also

The benefits of investing in long-term bond funds

Long-term bond funds are a great way to diversify your investment portfolio and can offer several benefits to investors. Here are some advantages of investing in long-term bond funds:

Diversification

Long-term bond funds provide investors with exposure to a diverse range of bonds with maturities of 10 years or more. By investing in longer-term bonds, investors can spread their risk across different issuers and industries, reducing the overall risk of their investment portfolio.

Steady Income

Long-term bonds offer steady income in the form of coupon payments, which are typically made semiannually, annually, or quarterly. These payments provide a reliable source of income for investors, especially those seeking consistent cash flows.

Capital Appreciation

Long-term bond funds offer the potential for capital appreciation over the long term. As interest rates fall, bond prices tend to rise, leading to an increase in the market value of the bonds. This can result in capital gains for investors who buy bonds when interest rates are high and sell when rates decline.

Reduced Risk

High-quality, investment-grade bonds tend to have a lower risk of default compared to other types of bonds. They also have lower volatility than stocks, making them a less risky investment option. Additionally, bonds have an increasing tendency to rise when stocks fall, helping to reduce the overall risk of an investment portfolio.

Tax Advantages

Some types of long-term bonds, such as municipal bonds, offer tax advantages. Interest earned on municipal bonds is often exempt from federal, state, and local income taxes, providing tax benefits to investors.

Professional Management

Investing in long-term bond funds through mutual funds or exchange-traded funds (ETFs) offers the benefit of professional management. Fund managers conduct extensive research and analysis to make informed decisions about which bonds to buy and sell, helping investors navigate the complex bond market.

Who Should Invest in Mutual Funds?

You may want to see also

The risks of investing in long-term bond funds

Long-term bond funds are a good investment option for those looking to balance their portfolio and are an appealing option when interest rates are high. However, there are several risks associated with investing in long-term bond funds that investors should be aware of.

Firstly, long-term bond funds are subject to greater interest rate risk than short-term bond funds. When interest rates rise, bond prices fall, and vice versa. This is because there is a greater probability that interest rates will rise within a longer time period, negatively affecting the bond's market price. As a result, investors who attempt to sell their long-term bonds before maturity may face a discounted market price. In contrast, short-term bonds are less likely to be significantly impacted by interest rate changes and are easier to hold until maturity, reducing the concern of interest rate-driven price changes.

Secondly, long-term bonds have a longer duration, which is a measure of their interest rate sensitivity. A longer duration means that a given interest rate change will have a more significant impact on the bond's price. For example, a bond with a duration of 2.0 years will decrease by 2% for every 1% increase in interest rates. Thus, long-term bonds with longer durations are more sensitive to interest rate fluctuations and will experience larger price drops when interest rates rise.

Thirdly, investors in long-term bond funds take on significant interest rate and inflation risk. As interest rates and inflation rise, the purchasing power of the bond's returns decreases over time. This can result in a substantial loss of purchasing power by the time the long-term bond matures. In contrast, shorter-term bonds provide better risk-adjusted returns, as they allow for frequent reinvestment of principal at potentially higher rates, helping to maintain portfolio liquidity and flexibility.

Additionally, long-term bond funds are more sensitive to changes in interest rates due to their longer durations. This can lead to price volatility, as existing bonds may decrease in price when interest rates rise. While falling interest rates can increase bond prices, the potential for price volatility remains due to the longer duration of these funds.

Lastly, while long-term bond funds offer diversification benefits, they may not provide the same level of portfolio risk reduction as shorter-term bonds. The longer duration of these funds increases the potential for price fluctuations, which can impact the overall risk profile of an investor's portfolio.

Bond Funds: Where to Invest Now?

You may want to see also

How to buy long-term bond funds

Long-term bond funds are a great way to diversify your investment portfolio. They are also known as bond mutual funds or exchange-traded funds (ETFs) and primarily invest in investment-grade U.S. fixed-income issues, including government, corporate, and securitized debt.

- Understand the types of bonds: Long-term bonds have maturities of 10 years or more. There are various types of bonds, including Treasury bonds, corporate bonds, municipal bonds, and mortgage-backed securities. Treasury bonds are issued by the U.S. government and are considered low risk, while corporate bonds are issued by companies and carry a higher default risk. Municipal bonds are issued by local governments and fund public projects, and mortgage-backed securities are backed by income streams from mortgages.

- Consider the risks: Bond investing carries several risks, including interest rate risk, credit risk, downgrade risk, inflation risk, liquidity risk, and currency risk. Interest rate risk is the possibility of a bond's value falling when interest rates rise. Credit risk is the potential for default if the issuer fails to make payments. Inflation risk refers to the chance of losing purchasing power if inflation increases, and liquidity risk measures how easily a bond can be sold without incurring high costs.

- Choose a platform: You can purchase long-term bond funds through a bank or broker, such as Charles Schwab, over the phone or via an online brokerage account. Alternatively, you can buy government bonds directly from the U.S. Department of the Treasury.

- Research and select funds: Research and compare different long-term bond funds based on their performance, fees, and risk profile. Consider factors such as the fund's historical returns, expense ratios, credit ratings, and diversification. Diversification is essential to balance risk and return.

- Purchase the funds: Once you have selected the long-term bond funds that align with your investment goals and risk tolerance, you can proceed to purchase them through your chosen platform. Remember to consider the fees and minimum investment requirements associated with the funds.

- Monitor and rebalance: After investing in long-term bond funds, regularly monitor their performance and adjust your portfolio as needed. Diversification and rebalancing are essential to managing risk and optimizing returns over time.

Some examples of long-term bond funds include the Vanguard Long-Term Investment Grade Fund, PIMCO Long-Term Credit Bond Fund, and iShares US Long Credit Bond Index Fund. Remember to consult with a qualified financial advisor to ensure that your investment decisions align with your specific circumstances and goals.

Navigating Investment Funds: Knowing When to Change for Success

You may want to see also

Frequently asked questions

Long-term bond funds are exchange-traded funds that hold diversified portfolios of bonds with maturities of 10 years or longer.

Long-term bond funds offer steady income and decent capital appreciation over extended periods of time. They also provide great diversification and greater liquidity compared to individual bonds.

Long-term bond funds are more sensitive to changes in interest rates than other types of bond funds due to their longer durations. When interest rates rise, the prices of existing bonds may decrease, leading to price volatility.

Long-term bond funds can be a good investment for those looking for steady income and capital appreciation while also diversifying their portfolio. However, it's important to consider the risks associated with interest rate changes and ensure that you are comfortable with the level of risk.

You can invest in long-term bond funds by purchasing shares of a bond mutual fund or exchange-traded fund (ETF). These funds hold a wide range of individual bonds, making them a good option for diversification. You can also buy individual bonds directly from the U.S. Department of the Treasury or through a bank or broker.