The Franklin India Prima Fund is an open-ended mid-cap equity scheme that has been in operation since 1993. It is a high-risk investment option that seeks to provide medium to long-term capital appreciation as its primary objective, with income as a secondary objective. The fund has delivered 19.97% returns since its inception and currently holds assets under management worth 12,529.29 crore rupees as of July 31, 2024. The expense ratio of the fund is 1.76% for the regular plan, and it has a minimum investment requirement of 5,000 rupees. The fund is suitable for investors who are looking to invest for at least 3-4 years and are comfortable with the possibility of moderate losses.

What You'll Learn

Risk and return

The Franklin India Prima Fund is an open-ended mid-cap equity scheme that falls under the Franklin Templeton Mutual Fund House. It was launched in December 1993 and has since delivered a 19.97% return. The fund has a very high-risk rating according to SEBI's Riskometer, and investors are warned not to invest if they need to redeem their investment in under seven years. The fund has a high expense ratio of 1.76% (the category average is 1.34%), and an exit load of 1% if redeemed within one year. The fund size is Rs. 12,529.29 Cr, with a minimum investment of Rs 5000, a minimum additional investment of Rs 1000, and a minimum SIP investment of Rs 500.

The fund's primary objective is medium to long-term capital appreciation, with income as a secondary objective. It has a portfolio split between different types of investments, with 96.84% in equities, 0.0% in debts, and 3.16% in cash and cash equivalents as of July 31, 2024. The top holdings include stocks in the mid-cap category, ranked between 100 and 250 by size (market capitalization). The fund has 8.89% to 8.9% investment in large-cap stocks, 46.09% to 46.5% in mid-cap stocks, and 19% to 19.14% in small-cap stocks.

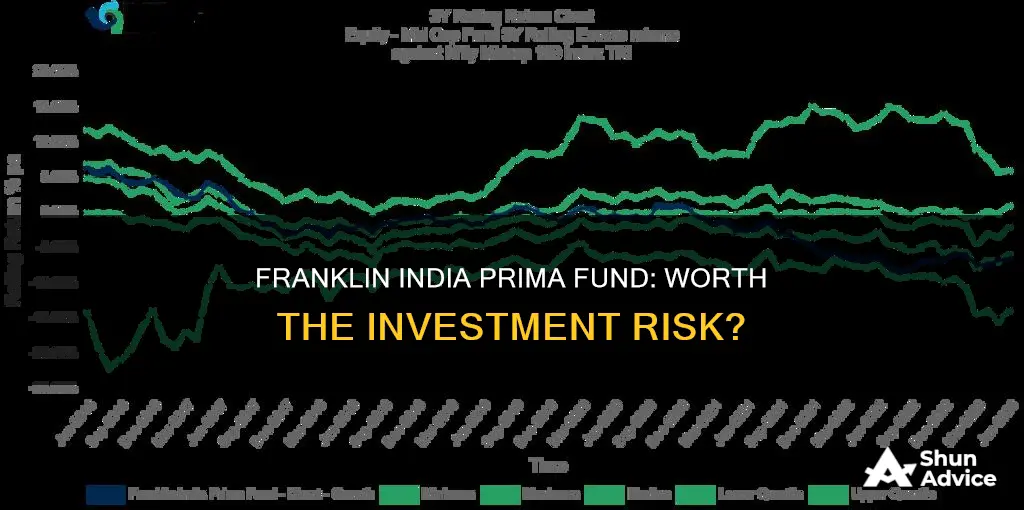

The fund's trailing returns over different time periods are: 52.87% (1yr), 23.31% (3yr), 24.73% (5yr), and 19.97% (since launch). The category returns for the same time periods are: 50.88% (1yr), 24.99% (3yr), and 28.55% (5yr). The fund has underperformed compared to other funds in its category and has average performance among its peers.

The fund has a high standard deviation value, indicating that its returns have been volatile in the past three years. Its beta value is also high, suggesting that its performance has been more volatile compared to similar funds in the market. The fund has poor risk-adjusted returns, as indicated by its Sharpe ratio, Treynor ratio, and Alpha.

Overall, the Franklin India Prima Fund offers potentially high returns but carries a very high risk. Investors should carefully consider their risk tolerance and investment horizon before investing in this fund.

Cion REIT: A Smart Investment Fund Move?

You may want to see also

Tax implications

If you invest in the Franklin India Prima Fund, there are several tax implications to consider. Firstly, if you sell your mutual fund units within one year of the investment date, short-term capital gain tax will be applied. The current tax rate for this is 20%. On the other hand, if you sell your mutual fund units after one year from the date of investment, long-term capital gain tax will be applicable. The current tax rate for this is 12.5% if your total long-term capital gain exceeds 1.25 lakh.

Additionally, dividends are added to the income of the investors and taxed according to their respective tax slabs. If an investor's dividend income exceeds Rs. 5,000 in a financial year, the fund house also deducts a TDS (Tax Deducted at Source) of 10% before distributing the dividend.

It is important to note that the tax rates mentioned above may not include cess or surcharge, and these additional charges may apply.

Furthermore, the Franklin India Prima Fund shall attract an exit load of 1% if the units are redeemed within one year of investment.

Mutual Funds Philippines: Best Time to Invest

You may want to see also

Investment objective

The Franklin India Prima Fund is an open-ended growth scheme with a primary objective of providing medium to long-term capital appreciation and a secondary objective of generating income. The fund has been in operation since December 1993 and is considered a high-risk investment option.

The fund's investment objective is to focus on medium-sized companies, which tend to offer higher returns over the long term but also come with more severe fluctuations in the short term. As such, investors are advised not to invest in this fund if they intend to redeem their investment in under seven years. The fund is mandated to invest at least 65% of its assets in mid-cap stocks at all times.

The fund has delivered returns of 19.97% since its inception and has a current Net Asset Value (NAV) of ₹2,688.3161 as of 18 August 2024. The expense ratio for the fund is 1.76%, and it has an exit load of 1% if redeemed within one year.

In terms of tax implications, short-term capital gains tax (STCG) of 15% is applicable if units are redeemed within one year of investment. For long-term capital gains, gains of up to Rs. 1 lakh are exempt from tax, while gains exceeding this amount are taxed at 10%. Dividend income is taxed according to the investor's tax slab, and a TDS of 10% is deducted if dividend income exceeds Rs. 5,000 in a financial year.

A Guide to Investing in 401(k) Mutual Funds

You may want to see also

Fund size and performance

As of 31 July 2024, the fund size of Franklin India Prima Fund was Rs. 12,529 Cr, representing 3.21% (or 3.25% and 3.31% according to other sources) of investment in its category. The fund's Net Asset Value (NAV) as of 18 August 2024 was Rs. 2,688.3161. The fund has delivered a return of 19.97% since its inception 30 years and 8 months ago. Its trailing returns over different time periods are: 52.87% (1yr), 23.31% (3yr), 24.73% (5yr) and 19.97% (since launch). The expense ratio of the fund is 1.76% for the Regular plan as of 31 July 2024. The fund has an exit load of 1% if redeemed within 1 year. The minimum investment required is Rs. 5,000, the minimum additional investment is Rs. 1,000, and the minimum SIP investment is Rs. 500.

The fund has an average performance among its peers. It has a very high risk according to SEBI's Riskometer. The fund has a suggested investment horizon of >3 years. The fund has 96.84% investment in domestic equities, with a breakdown of 8.89%-8.9% in Large Cap stocks, 46.09%-46.5% in Mid Cap stocks, and 19%-19.14% in Small Cap stocks. The top holdings of the fund include Prestige Estates Projects Ltd, Persistent Systems Ltd, Crompton Greaves Consumer Electricals Ltd, and Coromandel International Ltd.

A Green Guide to Index Fund Investing

You may want to see also

Portfolio allocation

The Franklin India Prima Fund is an open-ended Mid Cap Equity scheme that falls under the Franklin Templeton Mutual Fund House. It is a high-risk fund that has been in operation since December 1993. The fund's objective is to provide medium to long-term capital appreciation as a primary objective and income as a secondary objective.

As of July 31, 2024, the fund's asset allocation was approximately 96.84% in equities, 0% in debts, and 3.16% in cash and cash equivalents. The fund does not appear to have any investments in giant or large-cap companies, with 0% allocation in these categories. Instead, it focuses on mid-cap and small-cap companies, although the exact allocation percentages for these categories are not available.

The fund's top 10 equity holdings constitute around 24.65% of its assets, while the top 3 sectors make up about 39.16%. The Federal Bank is the company with the highest exposure in the fund, ranging from 3.45% to 3.77% over time. The top 3 sectors are Consumer Discretionary, Prestige Estates Projects, and Crompton Greaves Con. Electricals.

The fund has a minimum investment requirement of Rs. 5000, with a minimum additional investment of Rs. 1000 and a minimum SIP investment of Rs. 500. It also has an exit load of 1% if redeemed within 1 year.

Mutual Funds: Active Management Advantage Over Index Funds

You may want to see also

Frequently asked questions

Franklin India Prima Fund is an open-ended mid-cap equity scheme that aims to provide medium to long-term capital appreciation as its primary objective and income as a secondary objective.

As per SEBI's latest guidelines, investment in the Franklin India Prima Fund is considered Very High Risk.

Franklin India Prima Fund belongs to the Equity: Mid Cap category of funds.

The suggested investment horizon for Franklin India Prima Fund is more than 3 years. This is the minimum time required to reduce downside risk and make returns more predictable.

Mutual funds can be bought directly from the fund house's website. For example, Franklin India Prima Fund can be purchased from the Franklin Templeton Mutual Fund website. You can also buy mutual funds through platforms like MF Central and MF Utility.