Investing in mutual funds is a popular choice, especially for those who want to benefit from the stock market's high average annual returns without picking individual investments. Mutual funds are also a good option for those who want a relatively hands-off investment that provides exposure to a variety of assets. However, there is a lot to consider when deciding whether to invest in multiple mutual fund companies.

The consensus is that a well-balanced portfolio should contain 20-30 stocks to diversify away the maximum amount of unsystematic risk. However, since a single mutual fund often contains five times that number of stocks, investing in multiple mutual funds could lead to over-diversification, which can prevent you from making good gains.

On the other hand, investing in more than one mutual fund company can provide exposure to international investments and different types of funds, such as large-cap, mid-cap, and small-cap funds, which can help you achieve your desired asset allocation.

So, should you invest in more than one mutual fund company? The answer depends on your financial goals, risk tolerance, and the level of diversification you want to achieve.

| Characteristics | Values |

|---|---|

| Number of mutual funds | 20-30 stocks are enough to diversify away the maximum amount of unsystematic risk |

| Type of funds | Active or passive funds |

| Investment budget | Choose an amount you're comfortable with |

| Investment goals | Choose funds that match your goals |

| Brokerage account | Choose a brokerage account with low fees and a broad selection of funds |

| Rebalancing | Consider rebalancing your portfolio once a year to keep it in line with your diversification plan |

| Diversification | Diversify your portfolio across various asset classes and within the same asset class |

| Risk | Different types of mutual funds have different levels of risk and potential returns |

What You'll Learn

Pros and cons of diversification

Diversification is a key principle of investment. By spreading your investments across various asset classes and within the same asset class, you can reduce the risk of sudden losses. However, it is possible to over-diversify, which can prevent you from making good gains.

Pros of Diversification

The primary benefit of diversification is risk reduction. By investing in multiple mutual funds, you can gain exposure to a variety of different markets, sectors, and asset classes. This helps to reduce the overall risk of your portfolio and ensures that the failure of one company or industry does not wipe away a significant portion of your money.

Another advantage of diversification is access to professional management. Mutual funds are managed by experienced fund managers who have years of experience in selecting investments and adjusting portfolios to ensure optimal performance. By investing in multiple mutual funds, you can benefit from the expertise of a number of different fund managers.

Diversification can also reduce volatility. Investing in a single fund is more volatile than investing in several funds. By investing in multiple mutual funds, you can spread out the risk associated with any one fund and reduce overall volatility.

Cons of Diversification

Despite the benefits of diversification, there is a potential for over-diversification when investing in multiple mutual funds. If you spread your investments too thinly, each individual investment may not be able to generate sufficient returns to offset the costs of the fund.

Another potential drawback of diversification is the complexity it can add to your portfolio. With multiple funds, you have to keep track of all the different investments you own, as well as the performance of each fund. This can be difficult and time-consuming to manage, especially if you have a large number of funds.

Additionally, investing in multiple mutual funds can result in higher transaction costs. Each time you buy or sell a fund, you will incur trading fees, which can add up over time and eat into your returns. Some funds may also require additional fees, such as annual maintenance or redemption fees.

In conclusion, diversification can be a smart move for investors who want to reduce risk and gain access to professional asset management. However, it is important to be mindful of the potential drawbacks, such as over-diversification and higher costs. The decision to invest in multiple mutual funds should be made on a case-by-case basis, depending on your individual needs and goals.

Pension Funds: Why Real Estate is a Smart Investment

You may want to see also

Mutual fund types

There are several types of mutual funds, and they are classified based on their investment strategy, holdings, and risk. Here is an overview of some of the most common types:

Equity Mutual Funds

These funds primarily invest in stocks and other equity-related instruments. They aim for high returns by capitalizing on the growth potential of companies. Equity mutual funds can be further categorized into:

- Large-cap funds: These funds invest in well-established, large companies with a market capitalization above $10 billion. Examples include companies like Reliance, TCS, and Infosys.

- Mid-cap funds: Mid-cap funds invest in companies with a market capitalization between $5000 crore and $20,000 crore. These companies have higher growth potential but also carry more risk.

- Small-cap funds: Small-cap funds focus on smaller companies with a market capitalization of less than $5000 crore. They offer high growth potential but come with significant risk.

- Large and mid-cap funds: These funds diversify their investments across large and mid-cap stocks, aiming for higher returns than large-cap funds while maintaining lower risk than pure mid or small-cap funds.

Debt Mutual Funds

Debt mutual funds invest in fixed-income instruments, such as bonds, government securities, and money market instruments. They aim to provide stable returns and preserve capital. Examples include:

- Liquid mutual funds: These funds invest in short-term debt instruments with maturities of up to 91 days.

- Overnight mutual funds: Similar to liquid funds, but with a maturity period of just 24 hours.

- Ultra-short-duration funds: These funds invest in short-term securities and money market instruments with maturities between 90 and 180 days.

Hybrid Mutual Funds

Hybrid funds combine investments in both equity and debt instruments, providing a balance between growth and stability. Examples include:

- Conservative hybrid funds: These funds allocate 75-90% of their assets to debt instruments and the remaining in stocks.

- Balanced hybrid funds: Balanced funds invest in a defined ratio of equity and debt, typically ranging from 40-60% in each.

- Multi-asset allocation funds: These funds diversify across multiple asset classes, such as equity, debt, real estate, and gold.

Solution-Oriented Mutual Funds

These funds are designed for specific financial goals, such as retirement planning and children's education. They often have a long-term investment horizon and come with a lock-in period. Examples include retirement funds and children's mutual funds.

Index Funds

Index funds aim to replicate the performance of a specific market index, such as the S&P 500 or the Nifty. They are passively managed, meaning they invest in the same securities as the index without actively changing their portfolio composition.

Other Types

There are also sector-specific funds, international and global funds, dividend yield funds, and many more specialized types of mutual funds tailored to different investment objectives and risk tolerances.

Hedge Funds: Investment Firms or Something Different?

You may want to see also

How many funds are too many?

Diversifying your portfolio is a good way to spread risk. However, it is possible to over-diversify, which can prevent you from making good gains.

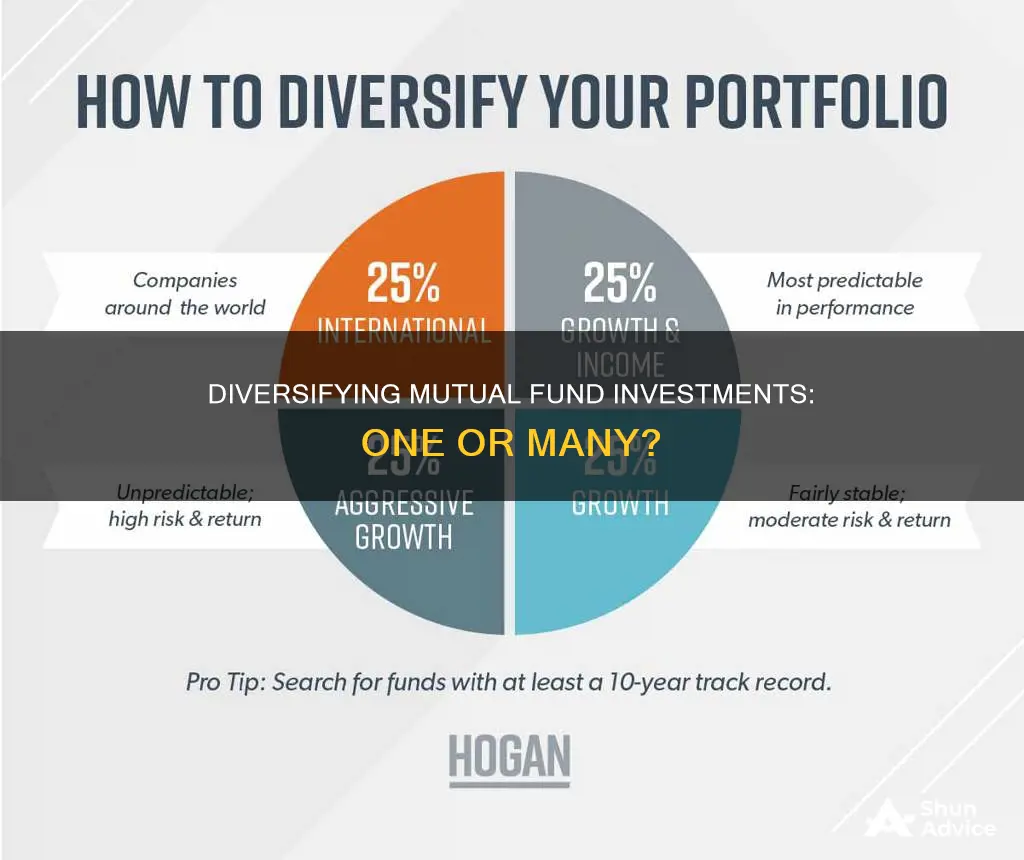

A well-balanced portfolio should contain approximately 20 to 30 stocks to diversify away the maximum amount of unsystematic risk. A single mutual fund often contains five times that number of stocks, so one fund may be enough. However, a single fund may not provide adequate exposure to international investments.

If you want to build your own portfolio, you can take steps to limit the number of funds while still feeling comfortable with your holdings. First, consider your objectives. If income is your primary goal, an international fund may not be necessary. If capital preservation is your objective, a small-cap fund may not be needed.

Compare the underlying holdings of the funds you're considering. If two or more funds have significant overlap in holdings, some can be eliminated. There's no point in having multiple funds that hold the same underlying stocks.

Next, look at the expense ratios. When two funds have similar holdings, go with the less expensive choice and eliminate the other fund. If you're working with an existing portfolio, eliminate funds that have balances that are too small to make an impact on overall performance. If you have three large-cap funds, for example, consider moving the money to a single fund. The amount spent on management-related expenses will likely decrease, and your level of diversification will remain the same.

As a general rule of thumb, you could invest in the ratio of 40%, 30%, and 30% of your equity allocation in large-cap, mid-cap, and small-cap categories, respectively. This would mean investing in around eight mutual funds, give or take two. However, this number is by no means a rule, and you can choose to own significantly more or less provided your decision is well-informed.

A Beginner's Guide to Investing in Funding Circle

You may want to see also

Active vs passive funds

When deciding whether to invest in more than one mutual fund company, it is important to understand the difference between active and passive funds.

Active vs. Passive Funds

Active investors are those who buy stocks or other investments regularly. They closely research and follow companies, and buy and sell stocks based on their performance and their predictions about the future. Active investors take a hands-on approach and may act as their own portfolio managers, or they may hire a professional portfolio manager to do this for them. Active investing requires a deeper analysis of investments and the expertise to know when to pivot into or out of a particular stock, bond, or asset. It also requires familiarity with fundamental analysis, such as analyzing company financial statements. Active investing aims to beat the stock market's average returns and take advantage of short-term price fluctuations.

Passive investors, on the other hand, rarely buy individual investments. Instead, they hold investments over a long period or purchase shares of a mutual or exchange-traded fund. Passive investors tend to rely on fund managers to ensure the investments held in the funds are performing well and expect them to replace declining holdings. Passive investing involves less buying and selling and often results in investors buying indexed or other mutual funds. This approach requires a long-term mindset that disregards the market's daily fluctuations. Passive investors have a buy-and-hold mentality, selecting stocks or funds and resisting the temptation to react to the market's movements.

Advantages and Disadvantages

Passive Investing Advantages

- Ultra-low fees: Passive funds do not require stock pickers, so oversight is much cheaper.

- Transparency: It is always clear which assets are in a passive fund.

- Tax efficiency: The buy-and-hold strategy does not typically result in a large capital gains tax for the year.

Passive Investing Disadvantages

- Too limited: Passive funds are limited to a specific index or set of investments, so investors are locked into those holdings regardless of market changes.

- Small returns: Passive funds will rarely beat the market and will only occasionally outperform during times of turmoil.

- Reliance on others: Passive investors rely on fund managers to make decisions and do not have a say in their specific investments.

Active Investing Advantages

- Flexibility: Active managers are not required to follow a specific index and can buy stocks they believe will perform well.

- Hedging: Active managers can hedge their bets using techniques like short sales or put options and can exit specific stocks or sectors when the risks become too big.

- Tax management: Advisors can tailor tax management strategies to individual investors, such as by selling investments that are losing money to offset taxes on winning investments.

Active Investing Disadvantages

- Very expensive: Actively managed equity funds have high expense ratios, and all the buying and selling triggers transaction costs. These fees can kill returns over time.

- Active risk: Active managers are free to buy any investment they believe meets their criteria, which can lead to costly mistakes.

- Management risk: Fund managers are human and can make mistakes that negatively impact the fund's performance.

While both strategies have their advantages and disadvantages, passive investing has become the strategy of choice for millions of investors. Passive investing tends to deliver better overall returns and is quicker and easier than active investing. Passive funds also tend to be cheaper than active funds, as they buy and sell stocks mechanically, and investors are not paying for a high-priced professional. Passive funds that follow the S&P 500, for example, will earn investors close to the market's long-term average return of about 10% annually. Even billionaire investor Warren Buffett recommends buying low-cost S&P 500 index funds regularly.

However, active investing may be preferable for investors who want more flexibility and the potential for higher returns. Additionally, active investing may be better suited for certain niche markets, such as emerging-market and small-company stocks, where assets are less liquid and fewer people are watching.

Ultimately, the decision to invest in more than one mutual fund company depends on your investment goals, risk tolerance, and personal preferences. Both active and passive funds can be a good choice, depending on your specific situation.

A Guide to Investing IRA Funds in Taxable Accounts

You may want to see also

Mutual fund fees

Shareholder fees, on the other hand, are sales commissions and other one-time costs incurred when buying or selling mutual fund shares. These fees include sales loads, redemption fees, exchange fees, account fees, and purchase fees.

Sales loads are commissions paid to third-party brokers when buying or selling shares. There are two types of sales loads: front-end loads, which are paid when purchasing shares, and back-end loads, which are paid when redeeming shares. Some funds may also have contingent deferred sales loads, where investors are charged a fee if they sell their shares before a specified time period.

Redemption fees are charged by some funds if an investor sells their shares within a short period after purchasing them. Exchange fees are charged by funds when shareholders transfer their shares to another fund offered by the same investment company. Account fees are maintenance fees, often charged when an account balance falls below a specified minimum investment amount. Purchase fees are charged by some funds when shareholders buy their shares.

It's important to carefully review and compare the fees associated with different mutual funds before investing. These fees can significantly impact your overall investment returns. Additionally, it's worth noting that diversification is important, but overdiversification can prevent you from making good gains. Therefore, it's recommended to hold a few shares from most industries and consider your investment goals, risk tolerance, and the overlap of underlying holdings when building your mutual fund portfolio.

A Smart Guide to Investing in DFA Funds

You may want to see also

Frequently asked questions

The consensus is that a well-balanced portfolio with approximately 20 to 30 stocks diversifies away the maximum amount of unsystematic risk. However, there is no magical "right" number of mutual funds for your portfolio. The answer depends on your risk profile and how well you know the market.

Investing in multiple mutual funds allows you to diversify your portfolio and reduce the risk of losing your money should something happen to one company or industry. Mutual funds are also a good investment option because they are highly liquid, meaning they are easy to buy or sell.

Investing in too many mutual funds can prevent you from making good gains. This is because having too many funds negates the impact that any single fund can have on performance, while the expense ratios of multiple funds generally add up to a number that is greater than average.