Investing in the S&P 500 from Dubai is a popular choice for investors seeking exposure to the US equities market and the performance of the US economy as a whole. The S&P 500 is a renowned stock market index that tracks the performance of 500 large-cap US companies, including Apple, Microsoft, and Amazon. While investing in each of these 500 companies separately would be costly and inefficient, Exchange-Traded Funds (ETFs) offer a practical solution by providing a single investment vehicle representing the entire index's performance.

To invest in the S&P 500 from Dubai, individuals can follow these steps:

1. Pick an ETF that tracks the S&P 500: Choose an ETF such as SPY, VOO, or SPDR S&P 500 ETF Trust, which offer competitive management fees and are listed on multiple exchanges in different currencies.

2. Choose a suitable broker: Select a reliable broker that offers access to S&P 500 ETFs and is regulated by the Securities and Commodities Authority (SCA) in the UAE. Examples include eToro, Sarwa, and Interactive Brokers.

3. Open an account and deposit funds: Complete the registration and verification process with your chosen broker, fund your account, and select your desired currency.

4. Place a Buy Order: Search for the desired S&P 500 ETF on the broker's platform, specify the amount you wish to invest, and submit your Buy Order.

It is important to note that investing in US-domiciled ETFs may have tax implications, so it is advisable to consider European-domiciled ETFs as well. Additionally, individuals should carefully research the fees, minimum deposit requirements, and range of available ETFs when selecting a broker.

| Characteristics | Values |

|---|---|

| Index | S&P 500 |

| Number of companies tracked | 500 |

| Companies included | Apple, Microsoft, Amazon, Tesla, Nvidia, Alphabet |

| Stock exchanges included | NYSE, Nasdaq, CBOE |

| Launched | 1957 |

| Launched by | Credit rating agency Standard and Poor's |

| Investment options | Exchange-Traded Funds (ETFs), Contracts for Difference (CFDs) |

| Example ETFs | SPDR S&P 500 ETF Trust, Vanguard S&P 500 ETF, iShares Core S&P 500 ETF |

| Example brokers | eToro, Sarwa, Saxo Bank, Interactive Brokers, amana |

What You'll Learn

- Choose a platform: e.g. eToro, Baraka, Wealthface, Saxo Bank

- Understand the fees: e.g. deposit fees, withdrawal fees, spreads, transaction fees

- Diversify your portfolio: e.g. bond funds, international indices, non-US indexes

- Pick an S&P 500 ETF: e.g. SPDR, Vanguard, iShares Core, Invesco

- Register and fund your account: choose AED as your currency

Choose a platform: e.g. eToro, Baraka, Wealthface, Saxo Bank

Choose a Platform: eToro, Baraka, Wealthface, Saxo Bank

There are several platforms available for investors in Dubai to access S&P 500 index funds. Here are some options:

- EToro: eToro is a popular platform that offers a range of ETFs tracking the S&P 500. They provide a user-friendly interface and allow you to invest in US-domiciled ETFs as well as European-domiciled ETFs, which may have tax advantages for non-US residents. eToro offers a variety of tools and resources to help you make informed investment decisions.

- Baraka: Baraka offers the S&P 500 Sharia Industry Exclusions ETF (SPUS), which seeks to track the performance of the S&P 500 Sharia Industry Exclusions Index. This ETF is composed according to AAOIFI guidelines and provides value-conscious exposure to the S&P 500.

- Wealthface: Wealthface is an online investment company that provides affordable, high-quality investment products and services. They offer access to various S&P 500 index funds, such as Vanguard 500 Index and SPDR S&P 500. Wealthface is regulated by the FSRA and SEC, ensuring transparency and security for investors.

- Saxo Bank: Saxo Bank is a well-known platform that provides access to a diverse range of products for trading the S&P 500. They offer options such as SPX, XSP, SPY, ES (S&P 500 futures options), and MES (S&P 500 micro futures options). Saxo Bank provides detailed information about each product, allowing you to make informed decisions based on your capital, strategy, and risk tolerance.

When choosing a platform, it's important to consider factors such as fees, minimum deposit requirements, the range of available ETFs, and the platform's ease of use. Each platform has its own unique features and offerings, so be sure to review them carefully before making a decision.

A Beginner's Guide to Mutual Fund Investing with Fidelity 401(k)

You may want to see also

Understand the fees: e.g. deposit fees, withdrawal fees, spreads, transaction fees

When investing in the S&P 500 from Dubai, it's important to understand the various fees involved to make informed decisions. Here's a detailed breakdown of the common fees you may encounter:

Deposit Fees

When funding your investment account, you may be charged a deposit fee. This fee varies depending on the platform and payment method you choose. For example, eToro, a popular platform for UAE investors, is known for its low deposit fees, especially when using United Arab Emirates Dirham (AED). Some banks in the UAE, such as HSBC, also offer international transfers with lower fees, which can be beneficial when depositing funds.

Withdrawal Fees

Just like deposit fees, withdrawal fees may apply when you want to withdraw money from your investment account. These fees can vary across different platforms, so it's important to review the fee structure of your chosen platform before committing.

Spreads

The spread refers to the difference between the buying and selling prices of an investment product, such as an ETF. When investing in S&P 500 ETFs, you may encounter this fee, which can vary depending on the platform and the specific ETF. For example, eToro often offers spreads below 0.15%, making it a cost-effective option for UAE investors.

Transaction Fees

Transaction fees, or trading commissions, are charged when you buy or sell an investment product. These fees can vary depending on the platform and the type of product you are trading. Some platforms may offer low or even zero transaction fees, so it's worth comparing fees across different platforms before making a decision.

It's important to note that these fees can significantly impact your overall investment returns, so reviewing and understanding the fee structure of your chosen platform is crucial. Additionally, some platforms may have other types of fees, such as account maintenance or management fees, so make sure to read the fine print and ask for clarification if needed.

Lastly, when investing in S&P 500 ETFs from Dubai, it's advisable to consider the tax implications, especially when investing in US-domiciled ETFs, as they may be subject to withholding tax on dividends and estate tax. Exploring alternatives such as Irish-domiciled ETFs can offer significant tax advantages, reducing the dividend withholding tax to 15%.

Unlocking Tax Lien Investments: Funding Strategies Revealed

You may want to see also

Diversify your portfolio: e.g. bond funds, international indices, non-US indexes

When investing in the S&P 500 from Dubai, it is important to consider diversifying your portfolio beyond this index fund. Diversification is a key strategy to manage risk and maximise returns. Here are some options to diversify your portfolio:

Bond Funds

Bond funds offer exposure to the bond market, which typically includes government and corporate bonds. These funds are managed by professionals who invest in a diverse range of bonds with different maturities and from various issuers. This helps to reduce the impact of any single bond's performance and provides a more stable income stream. Bond funds also offer the advantage of professional management, liquidity, and the potential for tax-free income through municipal bond funds. However, it's important to consider the fees associated with these funds, such as operating expenses and sales charges.

International Indices

Investing in international indices or non-US indexes can provide exposure to different countries and regions, helping to diversify your portfolio geographically. For example, you could consider investing in the Nasdaq-100 Index, which includes large domestic and international non-financial securities, or explore ETFs based in Europe, such as Irish-domiciled ETFs, to take advantage of favourable tax treaties.

Other Non-US Indexes

In addition to international indices, you can also consider investing in specific sectors or asset classes within non-US markets. For instance, the PHLX Semiconductor (SOX) index tracks companies involved in the semiconductor industry, while the Nasdaq Technology Dividend Index focuses on technology and telecommunications companies that pay regular dividends.

By including bond funds, international indices, and non-US indexes in your portfolio, you can reduce the concentration of US equities and the S&P 500 index fund in your investments. This diversification strategy can help manage risk and provide exposure to different sectors, regions, and asset classes, potentially maximising returns over the long term.

Investing in Amazon: Top Funds to Consider

You may want to see also

Pick an S&P 500 ETF: e.g. SPDR, Vanguard, iShares Core, Invesco

When it comes to investing in the S&P 500 from Dubai, Exchange-Traded Funds (ETFs) are a practical option. Here's a detailed guide on selecting an S&P 500 ETF from renowned providers like SPDR, Vanguard, iShares Core, and Invesco:

SPDR S&P 500 ETF:

SPDR, known for its diverse investment opportunities, offers the SPDR S&P 500 ETF Trust. This ETF provides exposure to the performance of 500 large-cap US companies, including tech giants like Apple, Microsoft, and Amazon. By investing in this ETF, you gain access to a broad range of sectors in the US equity market. SPDR's ETF is listed on the New York Stock Exchange and can be traded in USD.

Vanguard S&P 500 ETF:

Vanguard's S&P 500 ETF is another option for investors in Dubai. This ETF tracks the S&P 500 index, providing exposure to the largest US companies across various sectors. Vanguard's ETF has the advantage of being available in multiple currencies, helping you avoid potential broker-related Forex fees. It is important to note that US-domiciled ETFs like Vanguard's may have tax implications for non-US residents.

IShares Core S&P 500 ETF:

IShares Core offers an S&P 500 ETF that seeks to track the investment results of an index composed of large-capitalization US equities. This ETF provides efficient diversification with a low management fee. iShares Core's ETF has received a Gold medal from Morningstar, indicating its high level of conviction. The ETF is designed to be used as a core holding in your portfolio for long-term growth.

Invesco S&P 500 Equal Weight ETF:

Invesco's S&P 500 Equal Weight ETF takes a unique approach by equally weighting the stocks in the S&P 500 Index. This reduces concentration risk relative to market cap-weighted indexes. The fund invests at least 90% of its total assets in securities that comprise the S&P 500 Equal Weight Index, tilting exposure towards smaller companies. Invesco's ETF is rebalanced quarterly and has a low management fee of 0.20%.

When choosing an S&P 500 ETF, consider factors such as fees, replication method (physical vs. synthetic), distribution policy (accumulating vs. distributing), fund size, and domicile. Additionally, evaluate the tax implications, especially when investing in US-domiciled ETFs. Remember to consult a financial professional for personalized advice before making any investment decisions.

Fidelity Mutual Funds: Investing in Corporate Debt

You may want to see also

Register and fund your account: choose AED as your currency

To register and fund your account, you will need to choose a suitable investment platform or brokerage account that offers access to major exchanges such as the NYSE and provides tools for DIY investing. Some popular options include eToro, Baraka, and Wealthface. These platforms offer a user-friendly interface and comprehensive market data and insights to guide your investments.

When registering, you will need to provide personal information and complete a verification process. During the registration process, or shortly after, you will also need to select AED as your preferred currency.

Once you have registered and verified your account, it's time to fund it. Go to the "Deposit Funds" option, typically found at the bottom left of the platform's interface. Here, you will select 'AED' as your currency and choose a suitable payment method. You can then transfer funds from your bank in the UAE.

Some platforms, such as Baraka, offer a unique feature of automatic investments. This allows you to set up recurring deposits at intervals that suit your preferences, which are then automatically invested according to your preset choices. This feature streamlines the investment process and encourages disciplined investing by eliminating the need to constantly monitor market movements.

By choosing AED as your currency and funding your account, you are taking the necessary steps to start your investment journey in the S&P 500 from Dubai.

Cytonn Money Market Fund: Your Guide to Investing

You may want to see also

Frequently asked questions

The S&P 500 Index, also known as the Standard & Poor's 500 Index, is a market-capitalization-weighted index comprising 500 leading publicly traded companies in the United States, such as Amazon, Tesla, Microsoft, Apple, Nvidia, and Alphabet. It is widely regarded as one of the best indicators of the performance of prominent American equities and the overall stock market.

There are a few ways to invest in the S&P 500 from Dubai. One way is to use a broker or financial advisor who offers access to global markets, such as eToro, Wealthface, or Sarwa. Another option is to invest in exchange-traded funds (ETFs) that track the S&P 500, as directly investing in each of the 500 companies would be costly and inefficient. Examples of such ETFs include SPDR S&P 500 ETF (SPY) and Vanguard S&P 500 ETF (VOO).

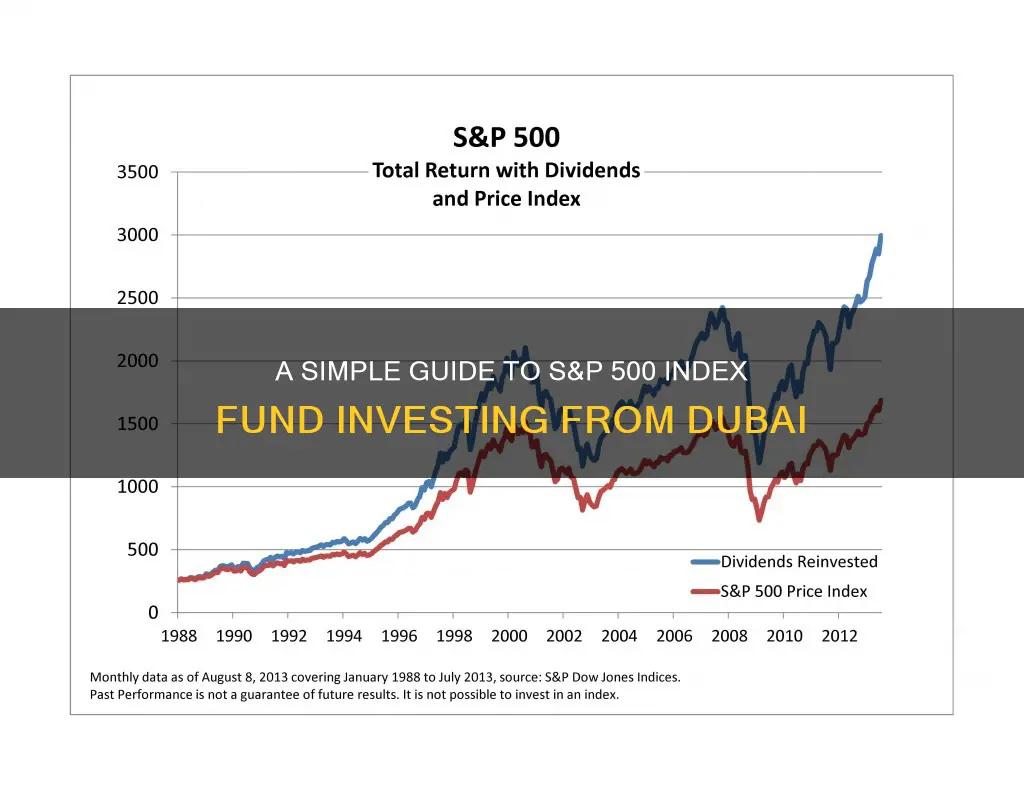

Investing in the S&P 500 offers a way to gain diversified exposure to the US stock market and benefit from its growth. The index includes a broad range of companies across various sectors, providing a good representation of the US equity market. Additionally, S&P 500 index funds are known for their tax efficiency and lower risk exposure compared to other investments.