Investing during residency is a great way to build wealth over time. While it can feel like you don't have enough money to invest, there are several ways to get started.

One option is to open an individual retirement account (IRA). There are two main types: traditional IRAs, which offer a tax deduction on contributions, and Roth IRAs, which allow tax-free withdrawals in retirement. During residency, a Roth IRA can be a good choice due to income limitations on contributions.

Another option is to utilise your employer's retirement plan, if available. This can be a tax-efficient way to invest, especially if your employer offers a matching contribution.

Additionally, consider building good financial habits by investing small amounts regularly. This can include using taxable investment accounts or apps that facilitate micro-investments.

Remember, even small contributions can make a significant impact over time, and it's important to get started early to take advantage of compound returns.

| Characteristics | Values |

|---|---|

| Salary | $64,200 |

| Average Salary | $64,000 |

| Max Roth IRA Contribution | $6,500 |

| Average Salary During Residency | $64,200 |

| Average Salary During Residency (Years 6-8) | $70,300 |

| Employer Matching | Yes |

| Employer Match | Yes |

| Employer Match Percentage | 50% |

| Employer Match Percentage | 50% |

| Employer Contribution | 5% |

What You'll Learn

The importance of investing early

Investing early for retirement is an important step towards achieving financial security and comfort in your later years. Here are some key reasons why starting early is crucial:

Compound Interest:

Compound interest is often referred to as "the miracle of compounding earnings." The earlier you start saving, the more time your money has to grow exponentially. Even a small amount saved during residency can make a significant difference over time due to the power of compound interest. This allows your savings to grow faster and accumulate a larger sum for retirement.

Time in the Market:

Time in the market is crucial for investment success. The longer your investments are in the market, the more they benefit from compound growth. Starting early gives your investments a longer timeframe to weather market volatility and ride out any short-term downturns. This long-term approach increases the likelihood of achieving higher returns.

Tax Benefits:

Retirement plans often come with tax advantages. By investing early, you can maximize these benefits over a longer period. For example, contributing to a Roth IRA during residency allows your investments to grow tax-free. Additionally, you may be eligible for tax deductions or credits, further enhancing your savings.

Building a Savings Habit:

Starting early helps establish a habit of saving and investing. It becomes easier to continue saving as your career progresses and your income increases. By prioritizing savings from the beginning, you develop a disciplined approach to financial management, which will benefit you throughout your life.

Reaching Financial Goals:

Retirement planning is about more than just saving; it's about accumulating enough to maintain your desired lifestyle after you stop working. Starting early gives you a better chance of reaching your financial goals. This includes ensuring you have sufficient funds to cover expenses, maintain your standard of living, and achieve the retirement you envision.

In conclusion, investing early for retirement is crucial. It allows your savings to grow through compound interest, maximizes the time your investments are in the market, and provides tax benefits. Additionally, it establishes a strong foundation for your financial future and increases the likelihood of achieving your retirement goals. The earlier you start, the better positioned you'll be to enjoy a comfortable and secure retirement.

Young Investors: Emulate Warren Buffett's Strategy

You may want to see also

Retirement plans for residents

Retirement planning is an important aspect of financial management, especially for those in residency. While it may seem challenging to set aside funds for the future, there are various strategies and investment options available to residents that can help build wealth over time. Here are some guidelines and recommendations for retirement planning during residency:

Understanding Your Financial Situation

It is essential to assess your financial circumstances, including your income, expenses, and debt obligations. The average resident earns around $64,000 per year, but this can vary depending on the year of residency. Understanding your cash flow will help determine how much you can allocate towards retirement savings.

Prioritize Debt Repayment

Before investing, it is advisable to focus on minimising high-interest debt, such as credit card balances. Additionally, if you have student loans, consider enrolling in an income-driven repayment plan or exploring loan forgiveness programs like Public Service Loan Forgiveness (PSLF). Lowering your debt burden will provide more financial flexibility for retirement planning.

Take Advantage of Employer-Sponsored Plans

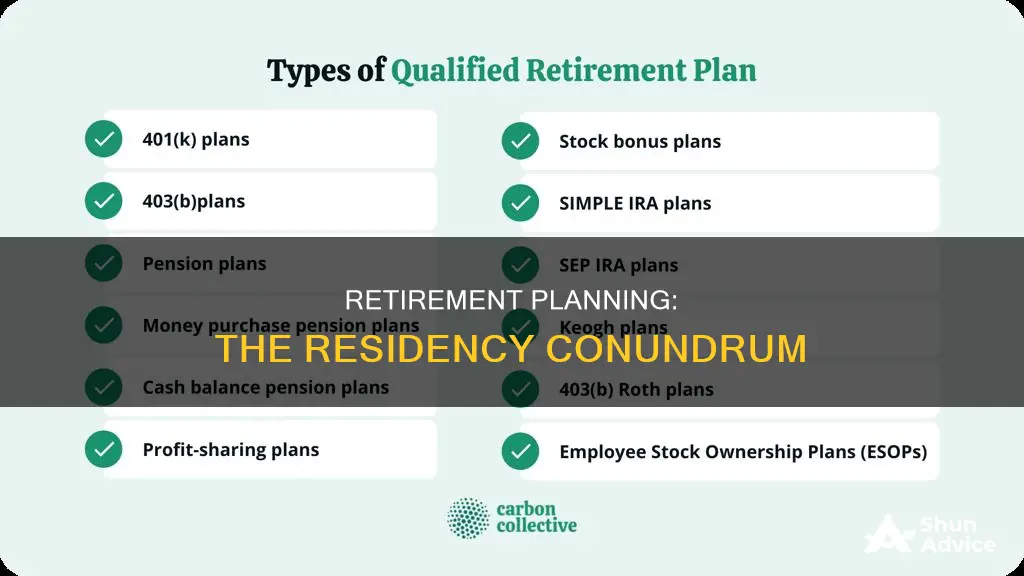

If your residency program offers a retirement plan, such as a 403(b) or 401(k), it is generally advisable to contribute, especially if your employer provides matching contributions. These plans often include tax advantages and can help you save for retirement while reducing your taxable income.

Individual Retirement Accounts (IRAs)

IRAs are a popular option for residents. There are two main types: Traditional IRAs offer tax deductions on contributions, lowering your tax liability now. Roth IRAs allow tax-free growth and withdrawals in retirement but are funded with after-tax dollars. The annual contribution limit for IRAs is $6,500 as of 2023, and contributing to a Roth IRA may be more suitable if you anticipate being in a higher tax bracket later in your career.

Other Investment Options

In addition to employer-sponsored plans and IRAs, you can explore other investment avenues. Taxable brokerage accounts, for example, offer flexibility in investment choices and can be a good supplementary option if you've maxed out your contributions to other retirement accounts.

Develop Good Financial Habits

Building good financial habits during residency is crucial. This includes living within your means, maintaining an emergency fund, and prioritising saving and investing over excessive spending. These habits will benefit you not only during residency but also throughout your financial journey.

Moonlighting for Extra Income

If your schedule and energy levels permit, consider moonlighting to boost your income. This additional income can be directed towards retirement savings, debt repayment, or other financial goals.

Seek Professional Guidance

Retirement planning can be complex, and it's beneficial to seek guidance from a qualified financial advisor or planner. They can help you navigate the various investment options, tax considerations, and strategies tailored to your specific circumstances.

Millionaires' Investment Strategies

You may want to see also

Tax advantages of investing in residency

Retirement plans offer significant tax advantages and other incentives for both employers and employees. Here are some of the key tax benefits:

Lower tax bill

Making contributions to a tax-deferred retirement account, such as a Traditional IRA, allows you to lower your current tax bill. The money you contribute is typically deductible now, and you only pay taxes on the money you withdraw in retirement. This is a powerful financial tool, especially for those in higher tax brackets.

Compounding potential

Tax-deferred accounts allow you to invest funds before paying taxes on them, increasing the potential for compounding returns. Compounding is a basic principle of investing, where earnings generate their own earnings over time.

Long-term tax savings

If your income drops during retirement, your tax bracket may also decrease. In this case, you could end up paying less in taxes overall since withdrawals in retirement are taxed at a lower rate than when you were working.

Eliminate taxes on investment gains

Within a tax-deferred account, you can buy and sell assets without triggering any capital gains taxes. This gives you the freedom to make investment moves without worrying about the tax implications on your current tax situation.

Discipline for savings

Withdrawing money from a Traditional IRA or employer-sponsored plan before the age of 59½ typically comes with a 10% early withdrawal penalty. This acts as an incentive to leave the money in the account, helping you build your retirement savings and avoid the temptation to spend it early.

Tax credits

Retirement plans may also come with tax credits and other benefits that can help reduce costs. For example, the saver's credit may be available to some employees, and employer contributions are often tax-deductible.

Reduced taxable income

Employee contributions to retirement plans can reduce their current taxable income. Contributions and investment gains are not taxed until they are distributed, which is typically during retirement.

Tax advantages for specific plans

Certain retirement plans offer unique tax advantages. For instance, with a Roth IRA, you contribute post-tax dollars, but you never pay taxes again on the money you withdraw in retirement. Additionally, contributions to Health Savings Accounts (HSAs) are made with pre-tax money, and withdrawals are tax-free when used for qualified medical expenses.

In summary, investing in retirement plans during residency can provide significant tax advantages, helping to minimize taxes and maximize the growth of your savings. These benefits can have a substantial impact on your financial future, making it a wise decision to consider.

The Retirement Mortgage Dilemma: Pay Off or Invest?

You may want to see also

How to save for retirement

Retirement planning is an important aspect of personal finance, and there are various options available to help you save for your retirement. Here are some steps and strategies to consider:

Set your retirement savings goal

The first step is to estimate how much you need to save for retirement. This can be challenging due to the many variables involved, such as vacation costs, medical expenses, desired retirement age, and life expectancy. A common recommendation is to aim to save at least 10% to 15% of your pretax income annually. You can use online retirement calculators to get a more personalised estimate.

Open a retirement account

There are two main types of retirement accounts: employer-sponsored retirement accounts and individual retirement accounts (IRAs). Employer-sponsored plans, such as 401(k)s, 403(b)s, and 457(b)s, often include tax benefits and may offer employer contributions or matching programs. IRAs come in two main types: traditional IRAs and Roth IRAs. Traditional IRAs allow you to contribute pre-tax income, which can lower your taxable income, while Roth IRAs are funded with after-tax dollars, and withdrawals in retirement are tax-free.

Choose your investments

When deciding how to invest your retirement savings, consider mutual funds, index funds, and exchange-traded funds (ETFs) as they are generally considered suitable for long-term retirement savings. Index funds, in particular, offer instant diversification and have historically outperformed actively managed funds. You can also consider target-date funds or robo-advisors, which provide pre-mixed retirement portfolios that adjust automatically as you age.

Make regular contributions

Setting up automatic recurring deposits into your retirement accounts is a recommended way to save consistently. If you have access to an employer-sponsored plan with payroll deductions, this can be a convenient way to save without having to manually transfer funds each time.

Increase your savings rate over time

You may not be able to save 15% of your income right away, but you can start with a smaller amount and gradually increase your contributions over time. Aim to increase your retirement savings by 1% each year until you reach at least 15%. You can also allocate a portion of any raises, bonuses, or windfalls towards your retirement savings.

Consider multiple retirement accounts

There are benefits to having more than one retirement account. For example, if your employer-sponsored plan has high fees or limited investment options, you might want to open an additional account, such as a traditional or Roth IRA. Additionally, if you've reached the contribution limit on your main account, opening another account can provide you with more flexibility and continue building your retirement savings.

Maintain perspective during market fluctuations

Remember that retirement investing is a long-term game. The stock market will have its ups and downs, but historically, it has always recovered from periods of negative performance. Don't get too caught up in the short-term performance of your retirement portfolio; focus on the long-term growth and adjust your holdings as needed.

Lucrative Investment Opportunities: Exploring the Highest-Paying Ventures

You may want to see also

Investing strategies for residents

Residents are often burdened with heavy student loan debts, and investing during residency can seem daunting. However, investing early is crucial to take advantage of compound interest. Starting early means that you will have a head start and will be able to accumulate more wealth over time.

Where Should Residents Invest?

- Roth IRA: A Roth IRA is a retirement account that allows you to contribute after-tax dollars. The benefit of a Roth IRA is that you can withdraw your contributions at any time without penalties, and the earnings in the account grow tax-free. The maximum contribution limit for 2023 is $6,500, and this option is suitable for residents who expect their tax rate to be higher during retirement than it is during residency.

- Traditional IRA: With a traditional IRA, you contribute pre-tax dollars, which lowers your taxable income. The earnings in the account grow tax-deferred, and you pay taxes when you withdraw the money during retirement. This option may be preferable if you anticipate being in a lower tax bracket during retirement.

- Employer-Sponsored Retirement Plans: Many employers offer retirement plans such as 401(k), 403(b), or 457(b) plans. These plans often come with matching contributions from the employer, which is essentially free money for residents. Additionally, contributing to these plans can lower your taxable income and help reduce your student loan payments.

- Taxable Investment Accounts: If you are unable to max out an IRA or contribute to an employer-sponsored plan, you can consider using a taxable investment account. Apps like Stash, Acorns, or Robinhood allow you to invest with small amounts, and you can gradually increase your contributions over time.

Tips for Residents:

- Maximize Roth IRA Contributions: If possible, try to max out your Roth IRA contributions each year. Even if you can't max it out, contributing what you can will help build a solid financial foundation for the future.

- Take Advantage of Employer Matching: If your employer offers a retirement plan with matching contributions, take advantage of it. This is essentially free money that can grow over time.

- Live Within Your Means: Keep your expenses reasonable, especially when it comes to housing costs. Try to ensure that housing takes up no more than one-third of your income during residency.

- Moonlighting for Extra Income: Consider moonlighting to earn extra money, which you can then use to boost your investments or pay off debts.

- Focus on Building Good Financial Habits: Investing during residency is about more than just the money you contribute; it's also about building good financial habits that will benefit you in the long run. Get used to setting aside a portion of your income for investing, and you'll find it easier to continue doing so even when your income increases.

The Great Debate: Paying Off Student Loans vs. Investing — Which Should You Choose?

You may want to see also

Frequently asked questions

Yes, you should invest in retirement plans in residency. The earlier you start investing for your future, the more your money will be able to compound, and these tax advantages can help you amass money even more quickly because you won’t have the extra drag from taxes.

Investing in retirement plans in residency helps you take advantage of compound interest and maximize your earnings over time. It also enables you to benefit from tax advantages and employer matching contributions, boosting your savings further. Additionally, establishing good financial habits early on will set you up for financial success later in life.

Residents can invest in various retirement plans, including 401(k), 403(b), 457(b), Traditional IRA, Roth IRA, and employer-sponsored plans. Each plan has its own contribution limits, tax advantages, and investment options.

It is recommended to contribute as much as possible, with a general goal of maximizing your retirement plan contributions. For example, aim to contribute at least enough to receive the full employer match if one is offered. Additionally, consider contributing to a Roth IRA, as the tax benefits may be more advantageous for residents compared to attending physicians.

To maximize your retirement plan contributions during residency, consider the following strategies:

- Live within your means and keep your expenses reasonable, especially housing costs.

- Minimize debt and focus on paying off high-interest loans.

- Take advantage of any employer matching contributions.

- Automate your investments by scheduling regular contributions from your paycheck.

- Consider moonlighting or taking on extra shifts to boost your income.