The SBI Emerging Businesses Fund, now known as the SBI Focused Equity Fund, is a flexi-cap fund that provides investors with the opportunity for long-term capital appreciation. The fund has a proven track record of nearly 15 years, with an average annual return of 20.62%. It has outperformed its category and benchmark since its formation, with impressive returns of 13.49% and 18.73% over the last three and five years, respectively. The fund has a moderate risk level and is suitable for investors seeking higher returns through a focused investment approach. The fund's portfolio is diversified across market capitalisation and sectors, with the maximum allocation in financial services, accounting for over 31% of total assets as of January 2019. The SBI Emerging Businesses Fund is one of the must-have schemes for investors' portfolios, offering substantial returns and the potential for high growth.

What You'll Learn

SBI Focused Equity Fund's investment strategy

The SBI Focused Equity Fund, previously known as the SBI Emerging Businesses Fund, is an open-ended equity fund that concentrates its investments in small and mid-cap companies. The fund identifies potentially promising companies in the mid and small-cap segments and invests in them while they are still emerging. This strategy allows for huge growth potential as the fund invests in companies before they become highly successful.

The fund is classified as a focused fund and follows a focused investment strategy, limiting its portfolio to a maximum of 30 stocks. It is also a multi-cap fund, investing across all market capitalisations. The fund has an actively managed portfolio with a high degree of equity share diversification, particularly towards mid and small-cap funds.

The fund is suitable for investors seeking long-term growth in their investments and looking to invest in emerging, export-oriented, and globally competitive companies with outsourcing opportunities. It is also suitable for investors with a moderate to high-risk appetite.

The fund has a proven track record, generating impressive returns over the last three and five years, and an average return of 20.62% since its inception in October 2004. The fund's performance has been better than the category average, with a 10-year annualised return of 2.22% higher than the category average.

The expense ratio of the fund is 0.74%, and it has an exit load of 1% if redeemed within a year. The minimum SIP investment is ₹500, and the minimum lumpsum investment is ₹5,000.

Amana Funds: Smart Investment Strategies for Beginners

You may want to see also

SBI Emerging Businesses Fund's performance

SBI Emerging Businesses Fund, now known as the SBI Focused Equity Fund, is an open-ended equity fund that has been in operation since October 2004. The fund primarily focuses on investing in small and mid-cap companies, identifying those with high growth potential before they become highly successful. This strategy allows for huge growth potential.

The fund is classified as a focused fund, investing in a maximum of 30 stocks. It is considered a multi-cap fund as it invests across all market capitalisations. As of 31 May 2019, the fund featured Assets Under Management (AUM) of Rs. 4642.18 Cr. The fund has a diversified portfolio, actively managed, with a high degree of equity share diversification, particularly in mid and small-cap funds.

The fund has a relatively aggressive investment strategy, with a focus on emerging businesses that can offer higher growth. As of January 2019, the fund had large-cap holdings of 50.11%, with investments of 13.30% and 22.17% in mid and small-cap companies, respectively. The fund also maintains liquidity at 14.42% of its portfolio.

The SBI Emerging Businesses Fund has demonstrated strong performance, outperforming its category and benchmark since its formation. The fund has generated returns of 13.49% and 18.73% over the last three and five years, respectively, with an average return of 20.62% since its inception. The fund has an impressive track record of close to 15 years.

The fund's portfolio is diversified across market capitalisations and sectors, with the maximum sector-wise allocation in financial services, accounting for over 31% of total assets as of January 2019. The fund's aggressive investment strategy is reflected in its asset allocation, with higher weightage given to consumption-driven sectors.

The SBI Emerging Businesses Fund is suitable for investors seeking higher returns through a focused investment approach with a moderate risk level. The fund has provided attractive returns, outperforming its benchmark over the last five years.

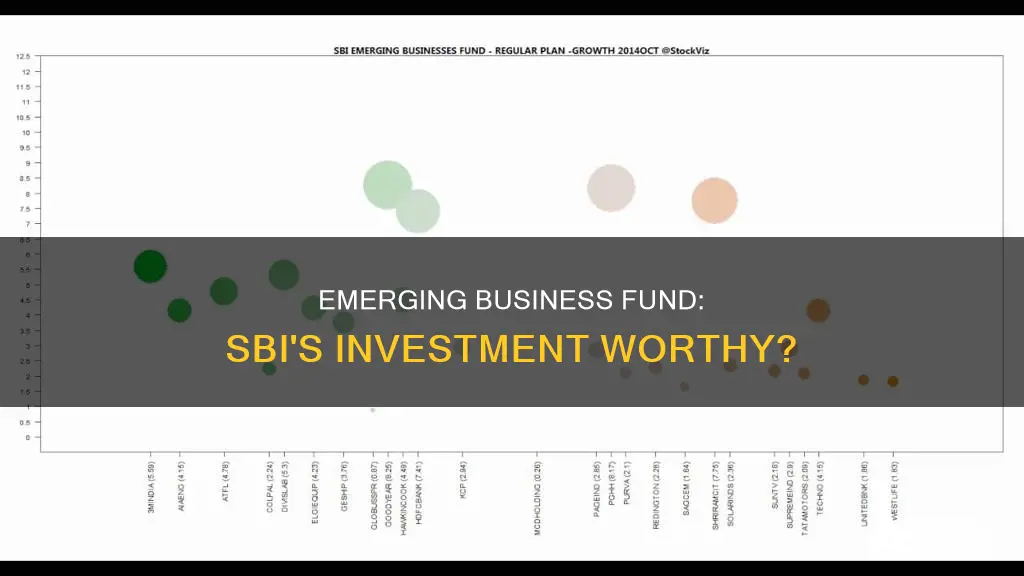

The top holdings of the fund as of January 2019 include Proctor & Gamble Hygiene and Health Care, Solar Industries India, HDFC Bank, Divi's Laboratories, and Great Eastern Shipping Company. These companies are top performers in their respective industries, offering significant returns to investors.

Overall, the SBI Emerging Businesses Fund is a notable scheme with a strong market position and a growth-oriented investment nature. It is a recommended addition to an investment portfolio for those with a considerable risk appetite and a focus on long-term financial goals.

Loaded Fee Mutual Funds: When to Invest and Why

You may want to see also

SBI Emerging Businesses Fund's suitability for investors

SBI Emerging Businesses Fund, now known as the SBI Focused Equity Fund, is suitable for investors with a moderately high-risk appetite. The fund is designed for investors seeking long-term growth in their investments, specifically in emerging companies, export-oriented businesses, and those with global outsourcing opportunities.

The fund has a proven track record of nearly 15 years, with an average annual return of 20.62%. It has outperformed its category and benchmark since its formation, generating impressive returns of 13.49% and 18.73% over the last three and five years, respectively. The fund's performance is considered better than the category average, and it has a consistency rating that indicates it generates average returns with exceptional consistency.

The SBI Focused Equity Fund is an open-ended equity fund that primarily invests in small and mid-cap companies. It follows a focused investment strategy, limiting its portfolio to a maximum of 30 stocks. The fund is flexible, investing across different market capitalisations, and has a diversified portfolio across sectors, with the maximum allocation in financial services (over 31% as of January 2019).

The fund is suitable for investors who are comfortable with a moderate risk level and are seeking higher returns through a focused investment approach. It is one of the schemes that can be added to an investor's portfolio to achieve long-term financial goals.

Hedge Funds: Pooled Investment Vehicles Explained

You may want to see also

SBI Emerging Businesses Fund's top holdings

The SBI Emerging Businesses Fund, now known as the SBI Focused Equity Fund, is an open-ended equity fund that focuses on investing in small and mid-cap companies. The fund has a diversified portfolio that is actively managed and is known for its aggressive investment strategy.

- Proctor & Gamble Hygiene and Health Care

- Solar Industries India

- HDFC Bank

- Divi's Laboratories

- Great Eastern Shipping Company

Other notable equity holdings include P&G Hygiene and Health Care, Muthoot Finance, ICICI Bank, State Bank of India, and Bharti Airtel.

Invest in SBI Magnum Midcap: A Guide to Get Started

You may want to see also

How to invest in SBI Emerging Businesses Fund

How to invest in the SBI Emerging Businesses Fund

The SBI Emerging Businesses Fund, now known as the SBI Focused Equity Fund, is an open-ended growth plan that can be purchased directly from the SBI Mutual Fund website. The fund has a minimum SIP amount of Rs 500 and a minimum lumpsum investment of Rs 5,000.

To invest in the SBI Focused Equity Fund, you will need to fill out an application form for a mutual fund account and provide proof of identity and address. You can also invest through platforms like MF Central and MF Utility, or seek help from a mutual fund distributor, such as a bank.

The fund has a diversified portfolio, investing in companies of different sizes, depending on where the fund management team expects maximum gains. The fund has a large proportion of its holdings in large-cap stocks and debt instruments, but also invests in mid-cap and small-cap companies.

The SBI Focused Equity Fund has a proven track record, outperforming its category and benchmark since its formation in October 2004. It has generated impressive returns of 13.49% and 18.73% over the last three and five years, respectively. The fund has a moderate risk level and is suitable for investors seeking higher returns through a focused investment approach.

Documents Required for SBI Emerging Businesses Fund

- Application form for a mutual fund account

- Proof of identity: PAN with photograph, passport, Voter's ID, Driving licence, etc.

- Proof of address: Aadhaar, Driving licence, Passport, Voter’s ID, Ration card, Utility bills, bank account statement, etc.

- A cheque for SIP or lump sum amount

- Third-party declaration, in case the applicant is a minor

Angel Investment Fund: Getting Started as a Beginner

You may want to see also

Frequently asked questions

The SBI Emerging Business Fund, now known as the SBI Focused Equity Fund, is an open-ended equity fund that primarily invests in small and mid-cap companies. The fund has a diversified portfolio and follows a focused investment strategy, investing in a maximum of 30 stocks.

The fund offers the opportunity for long-term capital appreciation by investing in emerging businesses with high growth potential. It has generated impressive returns, outperforming its category and benchmark since its formation. The fund has a proven track record, with an average return of 20.62% since inception.

You can invest in the SBI Emerging Business Fund directly from the website of the fund house, SBI Mutual Fund. You can also invest through platforms like MF Central or MF Utility. Alternatively, you can seek the help of a mutual fund distributor or connect with your bank for assistance.