Mutual funds are a great way to invest your money, but they can come with a variety of fees that chip away at your returns. One such fee is the load fee, which is a sales commission or charge that not all mutual funds have. Load fees are usually based on a percentage of the total invested amount, though they can also be a flat fee. There are three types of load fees: front-end, back-end, and level. Front-end load fees are charged when you open the fund, back-end load fees are charged when you exit the investment, and level load fees are annual fees charged for as long as you hold the fund. These fees are used to compensate sales intermediaries such as brokers, financial planners, or investment advisors. Mutual funds that don't have load fees are called no-load funds, but they may still have other fees. When deciding whether to invest in a loaded fee mutual fund, it's important to consider the potential impact of these fees on your returns and whether the benefits of the fund outweigh the costs.

| Characteristics | Values |

|---|---|

| Type of fee | Load fee, sales charge or commission |

| Who pays the load fee | The fund investor |

| Who the load fee is paid to | Sales intermediary, such as a broker, financial planner or investment advisor |

| When the load fee is paid | Upfront at time of purchase (front-end load), when shares are sold (back-end load), or as long as the fund is held (level-load) |

| Load fee amount | Usually a percentage of the total invested amount, but can also be a flat fee |

| Load fee percentage | Typically between 2% and 5% of total investment |

| Load fee amount for flat fee | For example, $50 regardless of amount invested |

| Load fee alternatives | No-load funds, which don't charge a sales fee or commission |

Front-end load fees

When considering front-end load funds, it's crucial to evaluate the fund's performance and potential returns to determine if the load fee is justified. Additionally, investors should be aware that mutual funds may charge other fees in addition to the front-end load, such as management fees, 12b-1 fees, and account fees.

It's worth noting that front-end load fees are just one type of load fee structure. There are also back-end load fees (Class B shares) and level load fees (Class C shares), which are charged when investors redeem their investment or on an ongoing basis, respectively.

Real Estate Fund Investing: What You Need to Know

You may want to see also

Back-end load fees

It is important to note that back-end load fees can significantly impact an investor's returns, especially if the investment is held for a shorter period. Therefore, investors should carefully consider the potential impact of these fees on their overall investment strategy.

Additionally, mutual funds may charge other fees, such as 12b-1 fees, which cover marketing costs and shareholder services. These fees can increase investment costs over time, and it is essential for investors to be aware of all associated fees when making investment decisions.

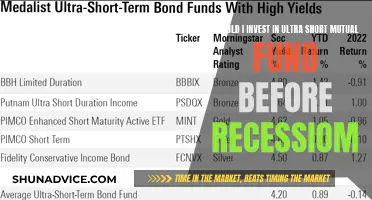

Bond Funds: Where to Invest Now?

You may want to see also

Level load fees

Unlike front-end and back-end loads, level loads are not paid out to the selling broker and broker-dealer as a commission. Instead, they are paid to compensate a sales intermediary, such as a broker, financial planner, or investment advisor, for their time and expertise in selecting an appropriate fund for the investor.

Level load funds can be contrasted with no-load funds, which do not carry a sales charge. While investors may assume that no-load funds are the better choice, fees on load funds go towards paying the investor or fund manager who does research and makes investment decisions on the client's behalf. This can help investors make smart investment decisions that they may not have the knowledge or skill to make on their own.

However, it's important to note that level load fees can cause a significant opportunity cost from lost compounding over time. Investors should carefully consider the potential impact of these fees on their investment returns.

S&P Mutual Funds: A Smart Investment Strategy

You may want to see also

No-load funds

While no-load funds do not charge sales fees, they may still charge other fees such as an expense ratio or 12b-1 fees for marketing and distribution. It is important to carefully review the fund's prospectus to understand all the fees associated with a particular no-load fund.

However, it is important to note that the absence of commission charges in no-load funds should be weighed against other factors such as the fund's overall expense ratio, performance history, investment style, and risk tolerance. Additionally, no-load funds may be less likely to be recommended by financial advisors or brokers who receive commissions from load funds.

In summary, no-load funds offer investors a way to minimize fees and maximize their returns, but it is important to carefully consider all the fees and factors associated with the fund before making an investment decision.

Key Factors to Consider Before Investing in Mutual Funds

You may want to see also

Shareholder fees

Mutual fund fees generally fall into two categories: annual fund operating expenses and shareholder fees. Shareholder fees are sales commissions and other one-time costs when you buy or sell mutual fund shares. These fees are charged by load funds, which are mutual funds that come with a sales charge or commission. The fund investor pays the load, which compensates a sales intermediary such as a broker, financial planner, or investment advisor for their time and expertise in selecting an appropriate fund for the investor.

There are three types of load fees: front-load, back-load, and level load. Front-load funds charge the load fee when you open the fund, using part of your investment as a commission. Back-load funds charge the load fee when you exit the investment, based on your initial investment. Level-load funds charge an annual load fee for as long as you hold the fund.

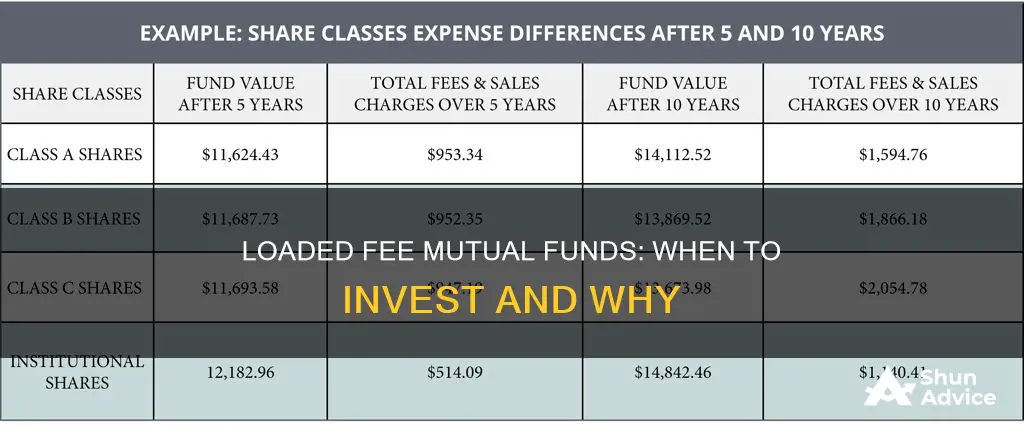

Load fund share classes are generally divided into three types: Class A, Class B, and Class C shares. Class A shares are front-end load funds, which require load fees to be paid from the initial capital. Class B shares are typically back-end load funds but often offer decreasing load fees the longer you hold the investment. Class C shares are typically level-load funds that have indefinite level loads.

Load funds are different from no-load funds, which do not carry a sales charge. No-load funds will still charge an expense ratio, so investors should be aware of those and try to keep them as low as possible. In addition, some no-load funds may impose a lock-in period where early redemptions may be limited, prohibited altogether, or allowed if a penalty is paid.

Roth Funds: Where to Invest and Why

You may want to see also