Target date funds (TDFs) are a long-term investment account that automatically adjusts over the years as the investor approaches a specific milestone, such as retirement. They are designed to take the guesswork out of saving for retirement by offering a diversified mix of equities and fixed income that changes over time. TDFs are managed by professionals and are a set it and forget it option, removing the need for investors to decide on a mix of assets and rebalance those investments over time. While TDFs have many benefits, there are also some downsides to consider, such as potentially high fees and a lack of customisation.

| Characteristics | Values |

|---|---|

| Purpose | Retirement savings |

| How it works | A fund's portfolio managers use a "glide path" to adjust the underlying mix of investments that make up the fund over time. |

| Risk | In the early years, target-date funds invest heavily in riskier growth stocks to rack up gains while the investor has plenty of time to recover from any short-term losses. As the target date approaches, the fund shifts towards more conservative, lower-risk investments. |

| Management | Target-date funds are managed by professionals, who conduct research to inform the creation of the "glide path" strategy that the fund will use. |

| Diversification | Target-date funds provide investors with a diversified mix of equities and fixed income that changes over time. |

| Rebalancing | Target-date funds handle the challenging task of optimising your asset allocation and rebalancing your investment holdings. |

| Simplicity | Target-date funds are a "set it and forget it" retirement savings option. All you need to understand is the year you want to retire. |

| Cost | Target-date funds can be expensive in terms of fees. They are a fund of funds, so you have to pay the expense ratios of the underlying assets as well as the fees of the target-date fund. However, fees have been decreasing, and many target-date index funds have low expense ratios. |

| Suitability | Target-date funds may not be suitable for everyone. They can be too broad and too conservative, and there is no guarantee that the fund will generate a certain amount of income or gains. |

What You'll Learn

Target date funds: what are they?

Target-date funds (TDFs) are a type of investment fund designed to provide a "set it and forget it" retirement savings option. They are designed to automatically adjust their asset allocation over time, becoming more conservative as the investor approaches retirement age. This makes them ideal for those who want a hands-off approach to investing for retirement.

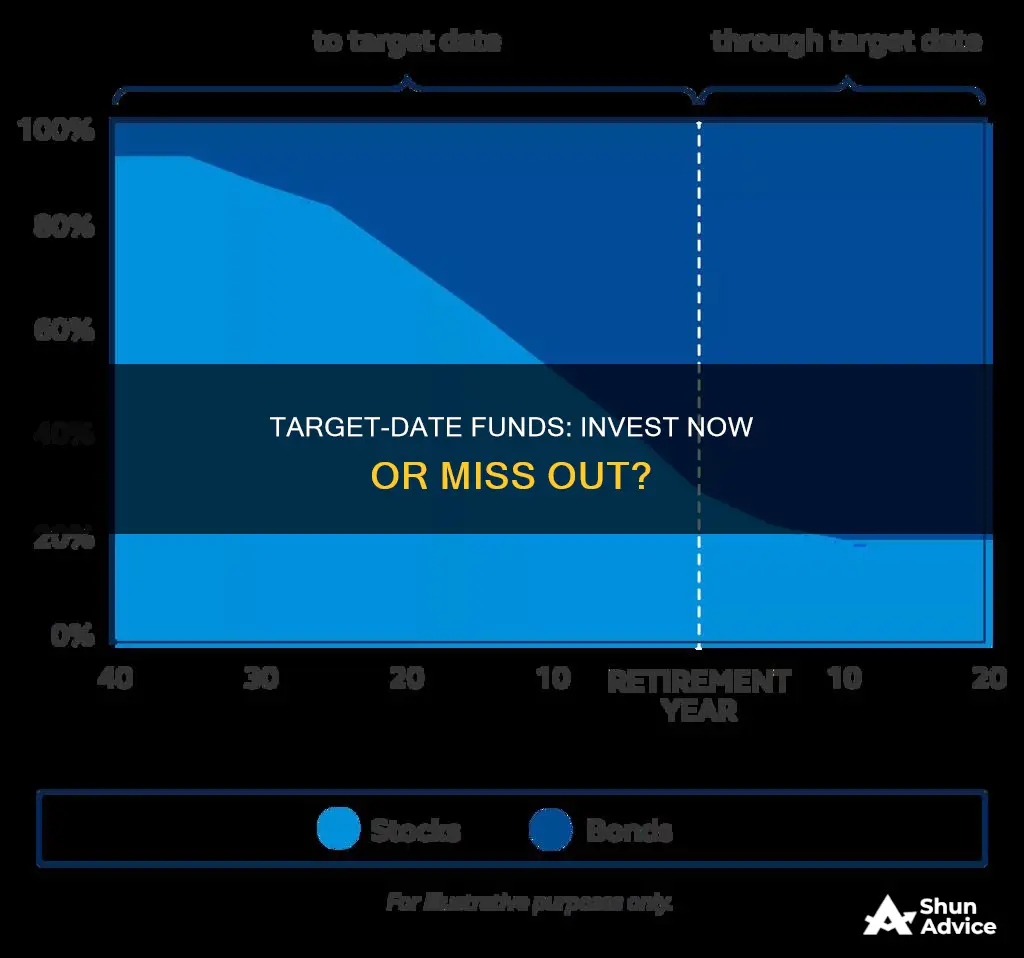

TDFs typically invest in a mix of stocks, bonds, and other types of investments, with the specific mix depending on the investor's age and risk tolerance. When an investor is young, TDFs tend to be heavily weighted towards stocks, as there is a longer time horizon to weather any short-term losses. As the investor gets older, the fund gradually shifts towards more conservative investments, such as bonds, to preserve gains.

The asset allocation of a TDF is based on a "glide path", which outlines how the fund's asset mix will change over time. The glide path is designed to ensure that the fund becomes more conservative as the target retirement date approaches. This is typically done by reducing the allocation of stocks and increasing the allocation of bonds and other lower-risk investments.

TDFs are often used as the default investment option in employer-backed retirement plans, such as 401(k) accounts. They are popular due to their simplicity and the fact that they remove the need for the investor to actively manage their portfolio. However, it's important to note that TDFs may not be suitable for everyone, as they may not always provide the optimal asset allocation for an individual's specific needs and goals.

Bond Fund Strategies: Dynamic Investing for Maximum Returns

You may want to see also

Pros and cons of investing in target date funds

Pros of investing in target date funds:

- They are a "set it and forget it" option, removing the need for investors to decide on an asset mix and rebalance their portfolio over time.

- They are simple and convenient, especially for younger investors who are just starting out.

- They are a good option for those who don't have the time or inclination to review their fund's holdings and revise their investment strategy.

- They provide easy diversification, offering a diversified mix of equities and fixed income that changes over time.

- They handle rebalancing for investors, ensuring their portfolio suits their needs as their risk tolerance typically decreases with age.

- They are associated with good outcomes for investors, helping to ensure they enjoy healthy returns.

Cons of investing in target date funds:

- They may be too broad, with most offerings being off-the-shelf and not tailored to individual needs.

- They may become too conservative too early, with some research indicating that target date funds start becoming too conservative for most people around the age of 50.

- They may charge high fees, with some funds having expense ratios of over 0.5%.

- They may not suit an individual's changing goals and needs, especially if retirement plans change.

- They may not provide a suitable asset mix for long-term investors.

Best Vanguard Index Funds to Invest $1000 Minimum

You may want to see also

How do target date funds work?

Target-date funds are a "set it and forget it" retirement savings option. They are designed to invest heavily in riskier growth stocks in the early years to rack up gains while the investor has plenty of time to recover from any short-term losses.

A target-date fund's portfolio managers use a predetermined time horizon to fashion their investment strategy according to a standard long-term asset allocation strategy. This strategy relies on riskier stocks in the early years, moving gradually toward fixed-income investments like bonds in later years.

The fund managers use the target date to determine the degree of risk currently appropriate for the investor. Target-date portfolio managers typically readjust portfolio risk levels annually.

The funds are named in five-year increments, so investors choose the provider with a fund name nearest their planned retirement date. For example, a 40-year-old planning to retire at 65 would choose a fund with a name closest to 2040 or 2045.

The asset allocation of a target-date fund gradually shifts to more conservative investment choices, reducing the risk of losses as the target date approaches. This is known as the fund's "glide path".

Target-date funds are often used as an investor's single portfolio when investing for retirement. They are a common default option for many providers of employer-backed retirement plans such as 401(k) accounts.

Investing in Your 20s: Target Date Funds Explained

You may want to see also

How to choose a target date fund

When choosing a target date fund, it is important to consider the following:

Annual Fees

Target date funds charge an annual fee, known as an expense ratio, which is a percentage of your investment. The average target-date fund had an expense ratio of 0.52% in 2020, according to Morningstar. However, fees can range from as low as 0.1% to more than 1.5%. The difference in price often depends on whether the fund uses cheaper passive investing strategies or more expensive actively managed accounts.

Investment Philosophy

It is important to understand the fund's investing philosophy and whether it aligns with your risk tolerance. Two identically named 2050 funds, for example, could have very different strategies for adjusting the mix of equities and bonds as you age.

Glide Path

The glide path refers to how the funds shift from a high ratio of riskier equity funds to safer investments like bonds as the target date approaches. Some target-date funds, known as "through" funds, will continue the glide path for 10 years or more past the retirement date, while others, known as "to funds," cease modifications to asset allocation once the target date is reached.

Diversification

Target-date funds are designed to provide a diversified portfolio by investing in multiple types of assets, including stocks, bonds, and other investments. However, it is important to ensure that the fund's portfolio of assets fits your comfort level and appetite for risk.

Performance

While the set-and-forget nature of target-date funds is a key feature, experts advise reviewing your fund's performance at least once a year to ensure it still aligns with your goals and risk tolerance.

Other Investments

It is important to consider how the target-date fund fits with any other investments you may have. Combining multiple funds may result in overlapping exposures and reduce the benefits of diversification.

Age and Retirement Plans

Target-date funds are geared towards retirement and take into account the investor's age and the number of years until their expected retirement. The fund's asset allocation will become more conservative as the investor gets closer to retirement, with a heavier focus on fixed-income investments. Therefore, it is important to choose a fund with a target date that aligns with your retirement plans.

Invest in Your Seventies: Vanguard Mutual Fund Strategies

You may want to see also

Target date funds vs other investment options

Target-date funds are a popular choice for investors, especially those saving for retirement. They are designed to be a "set it and forget it" investment option, removing the need for investors to decide on a mix of assets and rebalance those investments over time.

However, there are other investment options available that offer more control over your portfolio. Here is a comparison of target-date funds with some of these other options:

Target-Date Funds vs. Mixed Portfolio

With target-date funds, investors pick the year they plan to retire, and the fund management company handles the rest. This makes target-date funds a simple and convenient option, especially for those who want a hands-off approach to their investments.

In contrast, a mixed portfolio allows investors to take a more active role in managing their investments. With a mixed portfolio, investors can choose to invest a portion of their retirement savings in a target-date fund while also actively managing other types of investments with the help of a financial institution or advisor. This option provides more flexibility and control over your investment choices but requires more time and effort.

Target-Date Funds vs. Index Funds

Index funds are not actively managed, meaning securities are not bought and sold by a portfolio manager. Instead, index funds aim to replicate the performance of a specific stock market index, such as the S&P 500.

While target-date funds automatically rebalance and adjust the mix of investments over time, index funds do not. Investors in index funds are responsible for making their own adjustments, which may appeal to those who want more control over their investments. However, target-date funds may be preferable for those who want a more passive approach and do not want to actively manage their portfolio.

Target-Date Funds vs. Risk Management Strategies

At the beginning of an investor's career, they may choose to invest in a higher percentage of higher-risk stocks. As they get closer to retirement, they can reallocate their investments to fixed-rate options, such as bonds, to preserve wealth.

Target-date funds automate this process by gradually shifting from riskier investments to more conservative ones as the target retirement date approaches. This takes the guesswork out of managing investments but may not allow for the same level of customization as actively managing risk allocations.

Target-Date Funds vs. Other Retirement Accounts

Target-date funds are commonly used in 401(k) plans and can be a good option for those who want a simple, automated investment strategy. However, retirees may also rely on other accounts, such as IRAs, Social Security, and savings to generate retirement income.

While target-date funds can be a valuable component of a retirement plan, they are not the only option. Investors can also choose to build a diversified portfolio using other types of investment accounts and vehicles.

Large Cap 401k Funds: Worth Your Investment?

You may want to see also

Frequently asked questions

Target date funds (TDFs) are long-term investment accounts that automatically adjust over the years as the investor approaches a specific milestone, such as retirement. They are designed to invest heavily in riskier growth stocks in the early years to rack up gains while the investor has plenty of time to recover from any short-term losses. In later years, the investment choices lean towards more conservative choices to consolidate gains and avoid untimely losses.

The biggest advantage of target date funds is that they handle the challenging task of optimising your asset allocation and rebalancing your investment holdings. They are a "set it and forget it" retirement savings option that removes the headache of deciding on a mix of assets and rebalancing those investments over time. They are also a good option for young workers as they have a very long investment horizon and own mostly stocks, which provide a great foundation for growing returns over the long term.

Target date funds may be too broad and too conservative. Research has shown that long-term investors may end up with an asset mix that's not suitable for their needs. They may also charge high fees.

You can invest in target date funds through a brokerage account with a fund manager or online broker, or directly from a fund provider like Vanguard, Fidelity or T. Rowe Price.