Deciding how to invest your 401(k) can be challenging, especially for those new to investing. A 401(k) is a tax-advantaged retirement account offered by many employers, and it often represents the largest chunk of an individual's retirement nest egg. When it comes to investing your 401(k), there are several factors to consider, such as your risk tolerance, investment options, fees, and diversification.

One of the simplest options for investing your 401(k) is to choose a target-date fund, which automatically adjusts its asset allocation over time, becoming more conservative as you approach retirement. However, if you prefer a more tailored approach, you can build your own portfolio by selecting from the investment options offered by your plan. It is important to understand the different types of investments available, such as stocks, bonds, and cash, and how they fit into your overall investment strategy.

Additionally, it is crucial to consider the fees associated with different investment options, as high fees can eat into your returns over time. By carefully considering your investment goals, risk tolerance, and the available options, you can make informed decisions about how to invest your 401(k) to work towards a comfortable retirement.

| Characteristics | Values |

|---|---|

| Risk | Depends on age and personal risk tolerance |

| Returns | Historical data suggests large-cap growth funds have higher returns than large-cap blend funds |

| Safety | Large-cap growth funds are safer than large-cap blend funds |

| Investment approach | Individualized investment approach tailored to your particular goals and life situation |

| Management | Professionally managed or self-managed |

| Time horizon | Depends on the investor's age and retirement plans |

| Fees | Large-cap funds have higher fees than other funds |

What You'll Learn

Risk tolerance and age

When deciding whether to invest in large-cap 401(k) funds, it's important to consider your risk tolerance and age. These two factors will help determine the appropriate level of risk and the allocation of your investments across different asset classes.

Risk tolerance refers to how comfortable you are with taking on investment risk. If you have a high risk tolerance, you may be willing to invest a larger portion of your portfolio in riskier assets, such as stocks. On the other hand, if you have a low risk tolerance, you may prefer to allocate more of your portfolio to less risky assets, such as bonds or cash. It's important to note that your risk tolerance can change over time and may be influenced by factors such as your financial situation, investment goals, and personal preferences. Younger investors tend to have a higher risk tolerance since they have a longer time horizon to recover from potential losses.

Age is another crucial factor in determining your investment strategy. A common rule of thumb is that the percentage of your portfolio invested in stocks should equal 100 minus your age. For example, a 30-year-old investor might allocate 70% of their portfolio to stocks and the remaining 30% to bonds. However, with increasing life expectancies, some experts suggest using 110 or 120 instead of 100 in this calculation. This would result in a higher allocation to stocks for older investors. As you approach retirement age, it is generally advisable to gradually reduce your holdings in riskier assets and shift towards more conservative investments.

It's important to note that while risk tolerance and age are important considerations, they are not the only factors in investment decision-making. Other factors to consider include your financial goals, time horizon, and the overall market environment. Additionally, it's crucial to diversify your investments across different asset classes and industry sectors to mitigate risk.

By considering your risk tolerance and age, you can make more informed decisions about investing in large-cap 401(k) funds and create an investment strategy that aligns with your financial goals and comfort level with risk.

Vanguard Funds: Choosing the Right Investment for You

You may want to see also

Asset allocation

The right asset allocation for you will depend on your age, risk tolerance, and financial goals. A common rule of thumb is that younger investors can take on more risk by investing a greater percentage of their portfolio in stocks, while older investors should shift their allocation towards bonds as they approach retirement. However, this also depends on your risk tolerance, which is how comfortable you are with market volatility and the potential for losses. If you are comfortable with more risk, you may want to allocate more to stocks, while if you prefer a more conservative approach, you might favour bonds.

It's important to diversify your investments across different asset classes to reduce risk and increase the chances of meeting your retirement goals. Diversification means that if one type of asset performs poorly, your losses may be offset by gains in another type of asset.

When deciding on your asset allocation, it's essential to consider your 401(k) plan in the context of your overall investment portfolio. This includes any other retirement accounts, such as an individual retirement account (IRA), and taxable accounts, such as savings or stock accounts. You want to ensure that your 401(k) allocation aligns with your overall investment strategy and doesn't result in too much exposure to a particular market sector.

Additionally, it's crucial to understand the fees associated with different investment options. Mutual funds and exchange-traded funds (ETFs) typically charge expense ratios, which are fees expressed as a percentage of the amount invested. These fees can vary widely, and even small differences can significantly impact your returns over time. Therefore, it's generally advisable to choose lower-cost options, such as index funds, whenever possible.

Finally, once you've determined your asset allocation, it's important to periodically review and rebalance your portfolio to ensure it aligns with your desired allocation and financial goals.

Maximizing Your Roth IRA: Smart Investment Strategies

You may want to see also

Diversification

- Asset Allocation: Diversification starts with determining your asset allocation, which refers to how much you invest in stocks, bonds, and cash. This allocation should be based on your time horizon (how long until you retire) and risk tolerance (how comfortable you are with market volatility). A common rule of thumb is to subtract your age from 110 or 100 to determine the percentage of your portfolio that should be in stocks, with the rest in bonds. However, you can adjust this based on your risk tolerance.

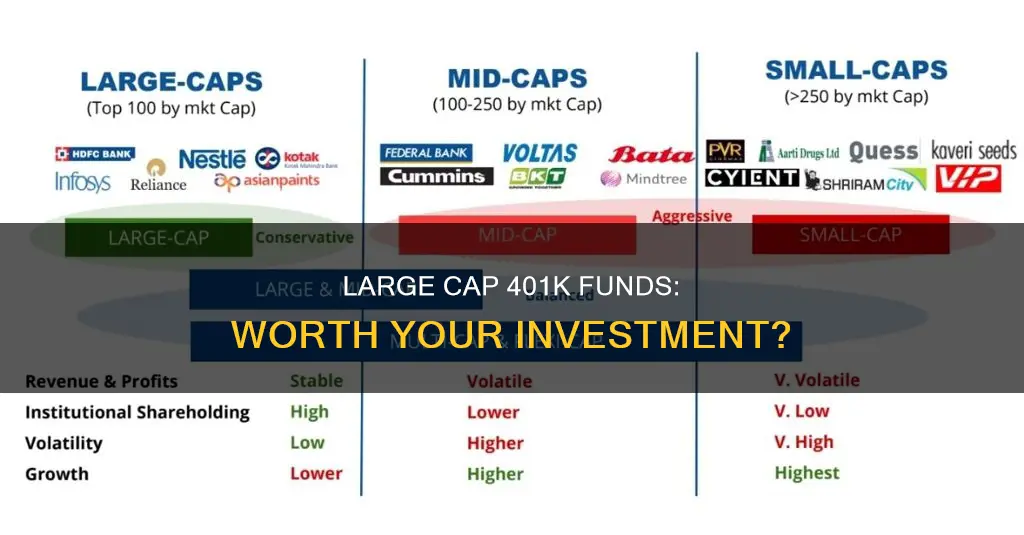

- Stock Diversification: When investing in stocks, it is important to diversify across different types of stocks, such as large-cap, mid-cap, small-cap, international, and emerging markets. Large-cap stocks are generally considered less risky than small-cap stocks, and growth stocks are typically less risky than value stocks. By diversifying across these types of stocks, you can reduce the impact of any single stock or sector on your portfolio.

- Bond Diversification: In terms of bonds, you may consider intermediate, inflation-protected, and short-term bonds. Diversifying across different types of bonds can help reduce the impact of interest rate changes on your portfolio.

- Consider Your Risk Tolerance: It is important to carefully assess your risk tolerance when deciding how to diversify your 401(k) investments. If you are comfortable with market volatility and have a long time horizon, you may want to allocate a larger portion of your portfolio to stocks. On the other hand, if market dips make you uncomfortable, you may want to hold more bonds or other less volatile investments.

- Review and Rebalance: Remember to periodically review your asset allocation and make adjustments as needed. Over time, the performance of different investments can cause your portfolio to deviate from your desired allocation. By rebalancing, you can ensure that your portfolio remains aligned with your risk tolerance and investment goals.

- Seek Professional Advice: If you are unsure about how to diversify your 401(k) investments, consider seeking advice from a financial advisor or investment expert. They can help you assess your risk tolerance, provide guidance on asset allocation, and recommend specific investments to meet your goals.

Proof of Funds: Investment Account Letter Requirements

You may want to see also

Expense ratios

When considering investing in large-cap 401(k) funds, it is important to understand the associated expense ratios. These fees cover the costs of managing your investments and are calculated by dividing a fund's operating expenses by the average value of its net assets. While these fees are typically charged annually, they may appear on your account on a monthly basis, depending on the fund.

When investing in 401(k) funds, it is common to encounter fees, with expense ratios being one of the most prevalent. These fees are used to cover the costs associated with managing your investments, such as administrative fees, legal services, marketing, and distribution costs. The expense ratio is the total of all these fees charged by the fund.

It is important to understand that expense ratios can vary among 401(k) providers. Generally, a good expense ratio for a 401(k) plan should be no higher than 2% and is typically in the range of 1.0% to 1.5%. If you find yourself paying more than 1%, it may be a good idea to consult your plan administrator to discuss ways to reduce these costs.

To reduce your 401(k) expense ratios, you can consider the following strategies:

- Calculate your current expense ratio using your 401(k) statement and participant fee disclosure notice.

- Compare plans using websites like BrightScope to find plans with lower fees.

- Approach your employer's plan administrator, as they have a responsibility to offer competitive plans.

- Choose investments with lower base costs or consider investing outside your 401(k) plan.

- Opt for investments with lower management fees, such as index funds, institutional funds, or target-date funds.

Additionally, it is worth noting that large-cap funds are typically less expensive than small-cap funds, which may be a factor when considering your investment options.

International Equity Funds: Smart Investment or Risky Business?

You may want to see also

Active vs passive investment strategies

When it comes to investing in large-cap 401(k) funds, there are two main approaches: active and passive investment strategies. Both have their own advantages and disadvantages, and the best choice for an investor depends on their financial goals, risk tolerance, and level of involvement in the market. Here is an overview of the two strategies:

Active Investment Strategies:

The active investment strategy involves a hands-on approach, where a portfolio manager or investor actively buys and sells investments based on their short-term performance. The goal of active investing is to beat the average returns of the stock market and capitalise on short-term price fluctuations. This strategy requires a deep analysis of investments and expertise in knowing when to enter or exit a particular stock, bond, or asset. Active investment funds are run by human portfolio managers who may specialise in picking individual stocks or focus on investing in sectors or industries they believe will perform well.

Advantages of Active Investing:

- Flexibility: Active managers can buy "diamond in the rough" stocks that they believe have high growth potential.

- Hedging: Active managers can use techniques like short sales or put options to hedge their bets and reduce risk.

- Tax Management: Active managers can employ tax management strategies tailored to individual investors, such as selling losing investments to offset taxes on winning investments.

- Risk Management: Active managers can get out of specific holdings or market sectors when risks become too large.

Disadvantages of Active Investing:

- Expensive: Actively managed equity funds have higher expense ratios, often around 0.68% compared to 0.06% for passive funds, due to the cost of research and analyst teams.

- Active Risk: Active managers have the freedom to buy any investment that meets their criteria, which may lead to costly mistakes.

- Management Risk: Fund managers are human and can make costly investing errors.

- Underperformance: Many active funds fail to beat the market due to their higher fees, and it can be challenging to find managers who consistently outperform their benchmarks.

Passive Investment Strategies:

Passive investing, on the other hand, involves holding investments over the long term and limiting the amount of buying and selling within a portfolio. This strategy is often associated with buying indexed mutual funds or exchange-traded funds (ETFs) that aim to match the performance of a specific market index, like the S&P 500 or Dow Jones Industrial Average.

Advantages of Passive Investing:

- Ultra-low fees: Passive funds have minimal oversight costs since they simply follow a benchmark index.

- Transparency: It is clear which assets are included in an index fund.

- Tax efficiency: The buy-and-hold strategy of passive investing typically results in lower capital gains tax.

- Strong long-term performance: Historically, passive investments have earned more money than active investments over time, even during market upheavals.

Disadvantages of Passive Investing:

- Limited: Passive funds are restricted to a specific index or set of investments, providing less flexibility in response to market changes.

- Small returns: Passive funds rarely beat the market and are limited to tracking its performance, resulting in smaller returns compared to the significant returns sought by active managers.

- Reliance on fund managers: Passive investors rely on fund managers to make investment decisions and may not have a say in their specific holdings.

Both active and passive investment strategies have their merits, and many investment advisors advocate for a blend of the two to minimise risk and maximise returns. Passive investing is generally more prevalent and has earned higher returns over the long term. However, active investing can be appealing during volatile market periods and for investors who want more flexibility and the potential for higher returns. Ultimately, the choice between active and passive investing depends on an investor's financial goals, risk tolerance, and level of involvement in the market.

Best Investment Fund Options: Where to Invest Money?

You may want to see also

Frequently asked questions

Large-cap funds are a type of mutual fund or exchange-traded fund (ETF) that focuses on investing in well-established, large companies with a market capitalisation above a certain threshold. These companies are typically industry leaders with a strong track record of performance and are seen as less risky investments than small-cap or growth funds.

The choice of 401(k) funds depends on your financial goals, risk tolerance, and time horizon until retirement. It's important to consider your overall asset allocation, including any individual retirement accounts or taxable accounts you may have, to ensure you are not too heavily invested in one market sector. Diversification across different types of assets and industries is key to managing risk.

Large-cap funds offer exposure to well-known, established companies, which are generally seen as a safer investment than smaller or newer companies. Large-cap funds can provide a more stable foundation for your portfolio while still offering the potential for growth.

While large-cap funds are considered less risky than small-cap or growth funds, they still carry market risk. The performance of individual large-cap stocks can vary, and the overall large-cap market may underperform compared to other sectors at certain times. Additionally, investing in only one type of fund may limit your diversification and potential returns.

When assessing the risk of large-cap funds, consider both your own risk tolerance and the specific characteristics of the fund. Look at the fund's historical performance, expense ratios, and the types of companies it invests in. Remember that past performance does not guarantee future results, but it can give you an idea of the fund's volatility and potential returns.