Term deposits are a type of savings account that offers a fixed interest rate for a predetermined period, typically ranging from a few months to several years. They are a low-risk investment option, making them attractive to those seeking a secure way to grow their savings. With term deposits, you can expect a guaranteed return, which can be particularly appealing to risk-averse investors. However, it's important to consider the potential trade-offs, such as limited access to funds during the term and the possibility of lower returns compared to other investment options. This introduction aims to explore the pros and cons of term deposits to help you decide if they are the right choice for your investment strategy.

What You'll Learn

- Risk and Returns: Understand the low-risk nature of term deposits and their competitive interest rates

- Liquidity and Flexibility: Term deposits offer fixed-term savings with limited early withdrawal options

- Comparison with Other Investments: Compare term deposits to stocks, bonds, and savings accounts

- Tax Implications: Learn how term deposits may be taxed differently depending on your jurisdiction

- Long-Term Financial Planning: Term deposits can be a stable component of a diversified investment strategy

Risk and Returns: Understand the low-risk nature of term deposits and their competitive interest rates

Term deposits are a low-risk investment option that can provide a sense of security for those seeking a safe place to park their money. They are essentially a type of savings account with a fixed term, offering a competitive interest rate that is typically higher than what you might find in a traditional savings account. This makes them an attractive choice for investors who prioritize capital preservation and are willing to sacrifice some liquidity for potentially higher returns.

The low-risk nature of term deposits is a key advantage for risk-averse investors. When you invest in a term deposit, you are essentially lending your money to a financial institution for a specified period. This is similar to opening a fixed-term savings account, where the bank guarantees the return of your principal amount at maturity. The bank cannot access your funds during the term, ensuring that your investment is protected from market volatility and potential losses associated with other investment vehicles.

One of the primary benefits of term deposits is the competitive interest rates they offer. Financial institutions often provide higher interest rates on term deposits to encourage investors to commit their funds for a fixed period. These rates can be significantly higher than those offered on regular savings accounts, providing an opportunity for investors to grow their wealth over time. The interest earned on term deposits is typically calculated on a simple interest basis, meaning you earn interest on both the principal and the accumulated interest.

Understanding the risk associated with term deposits is crucial. As mentioned, they are low-risk investments, but it's important to remember that they do not offer the same level of liquidity as other investment options. When you invest in a term deposit, you are locking up your money for a specific period, typically ranging from a few months to several years. During this time, you cannot access your funds without incurring penalties, which can be a drawback if you need immediate access to your money.

Despite the lack of liquidity, the competitive interest rates and low-risk nature of term deposits make them an attractive option for investors seeking a safe and potentially profitable investment strategy. It is essential to carefully consider your financial goals, risk tolerance, and the time horizon you are comfortable with before deciding to invest in term deposits. By understanding the risks and rewards, you can make an informed decision about whether this investment vehicle aligns with your financial objectives.

Unlocking Long-Term Wealth: The Power of Share Investing

You may want to see also

Liquidity and Flexibility: Term deposits offer fixed-term savings with limited early withdrawal options

When considering term deposits as an investment option, it's important to understand the concept of liquidity and flexibility. Term deposits are a type of savings account that typically offers a fixed interest rate for a predetermined period, often ranging from a few months to several years. One of the key characteristics of term deposits is that they provide a structured and secure way to grow your savings over time. However, this structure also means that they come with certain limitations in terms of accessibility and flexibility.

Liquidity refers to the ease with which you can access and withdraw your funds. With term deposits, you generally commit your money for a specific period, and early withdrawals are usually not permitted. This lack of early withdrawal flexibility is a trade-off for the higher interest rates that term deposits often offer compared to regular savings accounts. The fixed-term nature of these deposits ensures that your money is protected and grows according to the agreed-upon terms, but it also means you may not have immediate access to your funds if you need them before the maturity date.

For investors seeking more liquidity, this can be a significant consideration. If you anticipate the need for quick access to your funds, term deposits might not be the best fit. However, for those who can commit their savings for a fixed period, term deposits can provide a safe and reliable way to earn interest without the risk of market volatility. It's essential to evaluate your financial goals and the time horizon for your investments to determine if the limited liquidity is acceptable.

In summary, term deposits offer a structured and secure investment option with higher interest rates, but they come with limited early withdrawal options. This lack of flexibility in liquidity might be a trade-off for those seeking immediate access to their funds. Understanding your financial needs and the potential trade-offs will help you decide if term deposits align with your investment strategy. It's always advisable to carefully consider the terms and conditions of any investment product before committing your money.

Mastering Investment Terms: A Structured Approach to Success

You may want to see also

Comparison with Other Investments: Compare term deposits to stocks, bonds, and savings accounts

When considering investment options, term deposits are often seen as a safe and stable choice, but it's important to understand how they stack up against other common investment vehicles. Here's a comparison with stocks, bonds, and savings accounts to help you decide if term deposits are the right fit for your financial goals.

Stocks:

Investing in stocks means purchasing shares of a company, which can offer significant growth potential over time. Stocks are known for their volatility, meaning their value can fluctuate dramatically based on market conditions and the company's performance. While this can lead to substantial gains, it also means your investment is at risk of losing value. Term deposits, on the other hand, offer a fixed rate of return, providing a predictable income stream. This predictability makes term deposits less risky compared to stocks, especially for those seeking a more conservative approach.

Bonds:

Bonds are essentially loans made to governments or corporations. When you buy a bond, you're lending money to the issuer, who promises to pay you back with interest over a specified period. Bonds are generally considered less risky than stocks, as they provide a steady income stream and the principal amount is usually guaranteed. However, the interest rates on bonds can be lower than those offered by term deposits, especially for longer-term investments. Term deposits often provide higher interest rates, making them an attractive option for those seeking a stable income without the higher risk associated with bonds.

Savings Accounts:

Savings accounts are a type of deposit account offered by banks, providing a safe place to store your money while earning a modest interest rate. They are highly liquid, allowing you to access your funds whenever needed without penalty. While savings accounts offer some level of security, their interest rates are typically lower than those of term deposits, especially for long-term investments. Term deposits, therefore, can provide a more attractive return on your investment, making them a better choice if you're looking to grow your money over time.

In summary, term deposits offer a balanced approach to investing, providing a fixed income stream with relatively low risk. They are an excellent option for those seeking stability and predictability in their investments. When compared to stocks, bonds, and savings accounts, term deposits shine in their ability to offer a competitive interest rate while maintaining a low-risk profile, making them a valuable tool in a well-diversified investment portfolio.

Understanding NAV: The Key to Investment Clarity

You may want to see also

Tax Implications: Learn how term deposits may be taxed differently depending on your jurisdiction

When considering term deposits as an investment option, it's crucial to understand the tax implications that vary depending on your location. Tax laws and regulations can significantly impact the overall returns on your term deposit investments, so being well-informed is essential. In many countries, term deposits are generally considered a low-risk investment, and the tax treatment often reflects this.

In some jurisdictions, term deposits are typically not subject to income tax. This means that the interest earned from these deposits is not taxed as regular income. Instead, the interest may be treated as a form of savings or investment income, which could be exempt or taxed at a lower rate. For example, in certain countries, the interest earned on term deposits might be tax-free, allowing investors to grow their savings without incurring additional tax liabilities.

However, the tax treatment can differ significantly across regions. In some countries, term deposits may be taxed as ordinary income, meaning the interest earned is subject to the standard income tax rate. This can result in a higher tax burden for investors, reducing the net returns on their investments. Additionally, the frequency of taxation can vary; some countries may tax term deposit interest annually, while others might require quarterly or even monthly tax payments.

Understanding the specific tax rules in your country or region is vital. For instance, if you are a resident of a country with a progressive tax system, the tax rate on term deposit interest might increase as the interest earned rises. This could potentially impact your investment decisions, especially if you are comparing term deposits with other investment options that have different tax consequences.

Furthermore, certain jurisdictions may offer tax incentives or deductions for specific types of term deposits. For example, some countries provide tax benefits for long-term term deposits or those held in specific retirement savings accounts. These incentives can make term deposits more attractive from a tax perspective, potentially increasing their overall appeal as an investment strategy. Being aware of these variations in tax treatment can help investors make more informed choices when considering term deposits as part of their financial portfolio.

Unveiling the Secrets: How Short-Term Investments Are Manipulated

You may want to see also

Long-Term Financial Planning: Term deposits can be a stable component of a diversified investment strategy

When considering long-term financial planning, term deposits can be a valuable addition to your investment portfolio, offering a stable and secure way to grow your wealth over time. This investment strategy is particularly appealing to those seeking a more conservative approach, as it provides a predictable and reliable return, making it an excellent choice for risk-averse investors.

Term deposits, also known as fixed deposits, are essentially loans given by you to a financial institution, typically a bank or credit union, for a specified period. During this term, you agree to keep your money in the account without accessing it, and in return, you earn a fixed interest rate. The beauty of this arrangement is the security it offers. Unlike some other investment options, term deposits guarantee a known return, providing a sense of certainty in an often-volatile financial market. This predictability is especially beneficial for long-term goals, such as retirement planning or funding a child's education.

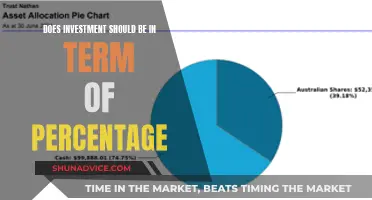

In a diversified investment strategy, term deposits can serve as a pillar of stability. Diversification is a key principle in managing risk, and by including term deposits, you're adding a low-risk, fixed-income component to your portfolio. This helps to balance out potential losses from more volatile investments like stocks or mutual funds. For instance, if you're planning for a 10-year goal, such as a down payment on a house, you can allocate a portion of your savings to a 10-year term deposit, ensuring a steady growth rate and a guaranteed return.

The interest rates on term deposits can vary depending on the financial institution and the term length. Longer-term deposits generally offer higher interest rates, providing an incentive to commit your funds for an extended period. This strategy allows you to take advantage of compound interest, where your earnings earn interest, leading to exponential growth over time. It's a simple yet effective way to watch your money grow, especially when combined with other investment vehicles in a well-rounded financial plan.

In summary, term deposits are a practical tool for long-term financial planning, offering stability and predictability in an otherwise uncertain market. By incorporating them into a diversified investment strategy, you can achieve your financial goals with a reduced risk profile. This approach ensures that your money works harder for you, providing a solid foundation for building wealth over the long haul. Remember, when making investment decisions, it's essential to consider your risk tolerance and financial objectives to create a tailored plan that suits your needs.

Debt Trading: Understanding Short-Term vs. Long-Term Investments

You may want to see also

Frequently asked questions

Term deposits are a type of investment vehicle offered by banks and financial institutions. They are essentially a savings account with a fixed term, typically ranging from a few months to several years. When you deposit money into a term deposit, you agree to keep your funds locked in for the specified period, and in return, you earn a fixed interest rate.

Term deposits offer higher interest rates compared to regular savings accounts, especially for longer-term deposits. However, the trade-off is that your money is tied up for a fixed period, and early withdrawals may incur penalties. Regular savings accounts provide more flexibility, allowing you to withdraw funds at any time without penalties, but the interest rates are generally lower.

Term deposits are a safe and secure investment option, especially for risk-averse investors. They offer a guaranteed return, and the interest is typically calculated and paid out at maturity. This makes term deposits an attractive choice for those seeking a stable and predictable return on their investment. Additionally, term deposits often have higher interest rates than other savings options, providing an opportunity to grow your money over time.

While term deposits are generally considered low-risk, there are a few potential drawbacks. The main risk is the loss of flexibility, as your money is committed for a fixed period. If you need to access your funds early, you may face penalties, which can reduce your overall returns. Additionally, if interest rates drop during the term, you might not benefit from higher rates elsewhere in the market. It's important to consider your financial goals and the time horizon before committing to a term deposit.

When selecting a term deposit, consider your investment goals, risk tolerance, and financial needs. Evaluate the interest rates offered by different financial institutions and compare the terms and conditions. Longer-term deposits typically offer higher interest but with a longer commitment. Decide whether you are comfortable with locking up your funds for an extended period and if you can afford any potential early withdrawal penalties. It's also a good idea to review the bank's reputation and the security measures they have in place to protect your investment.