Trading debt investments can be a short-term strategy for investors looking to capitalize on market fluctuations and potential gains. These investments, which include bonds, notes, and other fixed-income securities, offer a way to generate income through interest payments and potential capital appreciation. However, the short-term nature of trading debt investments can also introduce risks, such as increased volatility and the potential for losses if market conditions change rapidly. Understanding the dynamics of these investments is crucial for investors who aim to navigate the market effectively and manage their risk exposure.

What You'll Learn

- Debt vs. Equity: Trading debt is a short-term strategy, unlike equity investments, which can be long-term

- Liquidity: Debt investments are typically more liquid, allowing for quicker trading compared to long-term debt

- Risk Management: Short-term debt trading involves managing risk through quick buy/sell decisions

- Market Timing: Timing the market is crucial for short-term debt investments, requiring constant monitoring

- Interest Rates: Fluctuations in interest rates impact short-term debt, affecting investment returns

Debt vs. Equity: Trading debt is a short-term strategy, unlike equity investments, which can be long-term

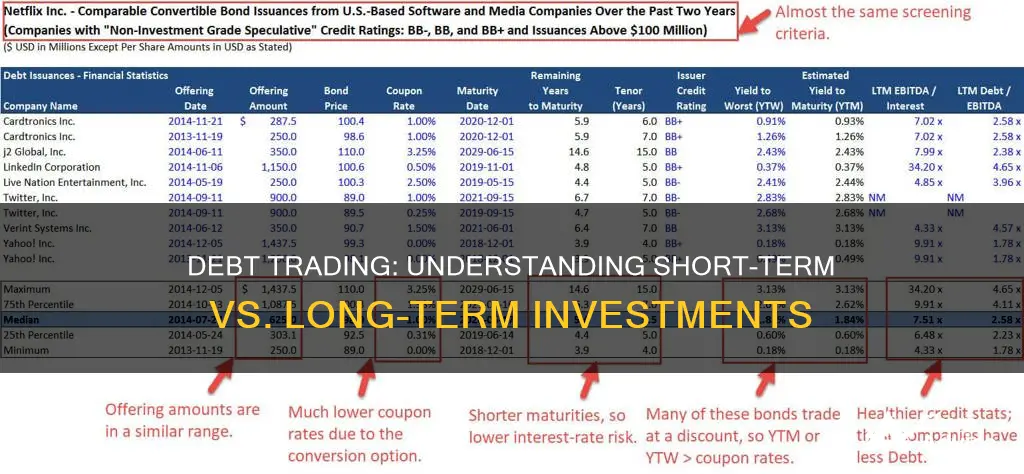

When considering investment strategies, understanding the nature of debt and equity investments is crucial, especially regarding their short-term or long-term nature. Debt investments, such as bonds or short-term debt securities, are typically classified as short-term strategies. These investments are designed to mature within a relatively short period, often ranging from a few days to a few years. The primary focus of debt trading is to capitalize on the interest earned from these short-term loans, providing a steady income stream for investors. This approach is particularly attractive to those seeking a more conservative investment strategy with lower risk.

In contrast, equity investments, such as stocks or shares, are generally considered long-term plays. Equity trading involves purchasing ownership in a company, which can hold for an extended period, sometimes even indefinitely. Long-term equity investments are based on the belief that the value of the company will appreciate over time, leading to potential capital gains for investors. This strategy often requires a higher level of risk tolerance and a longer-term perspective.

The key difference lies in the maturity and risk associated with each type of investment. Debt investments offer a more predictable and stable return, making them suitable for short-term goals or risk-averse investors. On the other hand, equity investments carry a higher risk but also offer the potential for significant long-term gains. Short-term debt trading allows investors to quickly access their capital and generate income, while long-term equity investments focus on the growth and potential dividends associated with owning a company's stock.

Understanding this distinction is essential for investors to make informed decisions about their portfolios. By recognizing the short-term nature of debt investments and the long-term potential of equity investments, investors can strategically allocate their resources to align with their financial goals and risk preferences. This knowledge empowers investors to navigate the financial markets with a clear understanding of the risks and rewards associated with different investment vehicles.

In summary, debt investments are indeed short-term strategies, providing a stable income stream through short-term loans. Conversely, equity investments are long-term plays, focusing on company growth and potential capital appreciation. Recognizing these differences is vital for investors to make strategic choices, ensuring their investment decisions are tailored to their specific financial objectives and risk tolerance.

Long-Term Investments vs. Long-Term Debt: Understanding the Difference

You may want to see also

Liquidity: Debt investments are typically more liquid, allowing for quicker trading compared to long-term debt

Debt investments, such as corporate bonds and government securities, are generally considered more liquid assets compared to long-term debt instruments. Liquidity refers to the ease and speed with which an investment can be converted into cash without significantly impacting its market price. When it comes to trading, liquidity is a crucial factor as it directly influences the efficiency and speed of transactions.

In the context of debt investments, being more liquid means that investors can quickly buy or sell these assets in the market without incurring substantial losses. This is particularly important for investors who may need to access their funds promptly or adjust their portfolios based on changing market conditions. For example, if an investor holds a corporate bond and needs immediate cash, they can typically sell it on the open market, often within a few days, and receive a relatively close approximation of its face value.

The higher liquidity of debt investments is primarily due to the established secondary markets for these securities. These markets facilitate the trading of debt instruments, providing investors with a platform to buy and sell bonds, notes, and other debt securities. As a result, there is always a demand for these assets, ensuring that investors can find buyers and sellers, even during market fluctuations.

In contrast, long-term debt investments, such as mortgage-backed securities or certain types of private debt, may have less liquidity. These instruments often have longer maturity periods and may not have an active trading market, making it more challenging and time-consuming to buy or sell them. As a result, investors might experience delays or incur higher transaction costs when converting these long-term debt holdings into cash.

Understanding the liquidity of debt investments is essential for investors as it impacts their ability to manage their portfolios effectively. More liquid debt instruments provide investors with greater flexibility and control over their investments, allowing them to respond swiftly to market opportunities or unforeseen financial needs. This aspect of liquidity is a key consideration for investors seeking to balance risk and accessibility in their debt investment strategies.

Long-Term Investments: Assets or Liabilities? Unlocking the True Value

You may want to see also

Risk Management: Short-term debt trading involves managing risk through quick buy/sell decisions

In the realm of short-term debt trading, effective risk management is paramount. This involves a dynamic approach to decision-making, where traders must act swiftly to capitalize on opportunities while mitigating potential pitfalls. The essence of this strategy lies in the ability to make rapid-fire buy and sell decisions, often within a short time frame, to navigate the volatile nature of short-term debt markets.

Risk management in this context is a delicate balance between seizing profitable opportunities and avoiding potential losses. Traders must possess a keen understanding of market dynamics, including interest rate fluctuations, economic indicators, and credit risk associated with various debt instruments. A comprehensive risk assessment is crucial, as it enables traders to make informed choices, especially when dealing with short-term securities that are more susceptible to market shifts.

One key aspect of risk management is the implementation of stop-loss orders. These orders automatically trigger a sell action when a predetermined price level is reached, limiting potential losses. Traders often use stop-loss strategies to protect their capital, especially in volatile markets where short-term debt prices can fluctuate rapidly. By setting these limits, traders can ensure that their positions do not result in significant financial setbacks.

Additionally, diversification plays a vital role in risk management. Traders should not concentrate their investments in a single debt instrument or sector. Instead, spreading investments across various short-term debt securities, such as treasury bills, commercial paper, or money market funds, can reduce overall risk. Diversification ensures that potential losses in one area are offset by gains in others, providing a more stable trading environment.

Successful short-term debt trading requires a combination of technical analysis, market knowledge, and disciplined risk management techniques. Traders must stay informed about market trends, employ appropriate risk mitigation strategies, and make timely decisions to adapt to the ever-changing financial landscape. By mastering these aspects, traders can navigate the challenges of short-term debt investments and potentially generate consistent returns while minimizing risks.

Understanding Short-Term Investments: Expense or Asset?

You may want to see also

Market Timing: Timing the market is crucial for short-term debt investments, requiring constant monitoring

Market timing is a critical aspect of short-term debt investments, as it involves making strategic decisions to buy or sell securities based on anticipated market movements. This strategy is particularly important for short-term investments, where the goal is often to capitalize on price fluctuations within a relatively brief period. Effective market timing requires a deep understanding of market dynamics, economic indicators, and the specific characteristics of the debt instruments being traded.

For short-term debt investments, such as treasury bills, commercial paper, or money market funds, timing the market is essential because these instruments typically have shorter maturity dates. This means that their prices can be more volatile, and market conditions can significantly impact their value. Investors must stay informed about market trends, interest rate changes, and economic news to make timely decisions. For instance, if central banks are expected to raise interest rates, short-term debt instruments might become less attractive, leading to potential price declines.

The process of market timing involves constant monitoring of financial markets and staying updated on various factors that can influence debt investment prices. This includes keeping track of economic data releases, such as GDP growth, inflation rates, and employment reports, as they can provide insights into the overall health of the economy. Additionally, investors should monitor the actions of central banks, as their policies and statements can have a direct impact on short-term interest rates and, consequently, debt investment values.

A successful market timing strategy often requires a combination of technical analysis and fundamental analysis. Technical analysis involves studying historical price and volume data to identify patterns and trends that can predict future price movements. On the other hand, fundamental analysis focuses on evaluating the economic and financial health of the underlying assets, considering factors like credit ratings, industry performance, and company-specific news. By integrating both approaches, investors can make more informed decisions and potentially time the market effectively.

In summary, short-term debt investments demand a proactive and vigilant approach to market timing. Investors must be prepared to react swiftly to changing market conditions, making use of a variety of tools and techniques to identify profitable opportunities. While market timing can be challenging, it is a crucial skill for those seeking to maximize returns in the short-term debt investment space. Staying informed, analyzing market trends, and making timely decisions are key components of a successful strategy in this dynamic investment environment.

Maximize Your Short-Term Cash: Top Investment Strategies

You may want to see also

Interest Rates: Fluctuations in interest rates impact short-term debt, affecting investment returns

The relationship between interest rates and short-term debt investments is a critical aspect of financial markets, especially for investors seeking to optimize their returns. When interest rates fluctuate, it directly influences the value and profitability of short-term debt instruments, making it an essential consideration for traders and investors alike.

Short-term debt investments, such as treasury bills, certificates of deposit, and commercial paper, are typically characterized by their maturity periods of less than one year. These investments are highly sensitive to changes in interest rates because they represent a specific period of borrowing or lending. When interest rates rise, the cost of borrowing increases, which can negatively impact the returns on short-term debt investments. Conversely, falling interest rates can lead to higher returns as the cost of borrowing decreases, making these investments more attractive.

The impact of interest rate fluctuations is twofold. Firstly, for investors, higher interest rates can lead to increased yields on short-term debt. When rates rise, the demand for these investments may increase, causing their prices to appreciate. This is particularly beneficial for investors seeking fixed returns in a short period. However, it also means that investors might need to pay more for these investments, potentially reducing their overall returns. Secondly, for borrowers, rising interest rates can make short-term debt more expensive, potentially impacting their ability to service debt and affecting their creditworthiness.

Understanding the dynamics of interest rates is crucial for traders and investors to make informed decisions. During periods of rising interest rates, short-term debt investments may become less attractive as their yields might not keep up with the increasing borrowing costs. Conversely, in a low-interest-rate environment, these investments could offer more competitive returns. Market participants should also consider the duration of their investments, as longer-term debt is generally more sensitive to interest rate changes.

In summary, interest rate fluctuations have a direct and significant impact on short-term debt investments. Traders and investors must stay informed about interest rate trends to make strategic decisions regarding their portfolios. Being aware of these relationships allows for better risk management and the potential to maximize returns in a dynamic interest rate environment.

Mastering Short-Term Investing: Strategies for Quick Profits

You may want to see also

Frequently asked questions

Trading debt investments, often referred to as fixed-income securities, are typically considered a long-term investment strategy. These investments include bonds, debentures, and other debt instruments. They offer a steady income stream through regular interest payments and are generally less volatile than stocks. Short-term investments, on the other hand, are those with a maturity period of less than a year, such as money market funds, certificates of deposit (CDs), and treasury bills. Short-term investments are more liquid and carry lower risk but offer lower returns compared to long-term debt investments.

Trading debt investments can be a strategic move to manage risk. These investments are generally considered less risky than stocks because they provide a fixed return and are less susceptible to market volatility. However, the risk can vary depending on the creditworthiness of the issuer. High-quality debt investments from stable governments or corporations are considered low-risk, while those from riskier entities may offer higher returns but also carry more risk. Diversifying debt investments across different credit ratings can help manage risk effectively.

Yes, tax considerations are essential when dealing with debt investments. Interest income from these investments is typically taxable, and the tax treatment may vary depending on the jurisdiction and the type of debt instrument. For example, in some countries, interest earned from government bonds may be exempt from tax, while corporate bonds might be subject to different tax rates. Additionally, short-term trades of debt investments may be taxed differently, often as ordinary income, which can impact the overall tax liability of an investor.

Absolutely, trading debt investments can be a profitable short-term strategy for those who actively manage their portfolios. Short-term traders often focus on taking advantage of price fluctuations in the bond market, buying and selling debt instruments within a short period. This strategy requires a deep understanding of market dynamics, interest rate movements, and economic indicators. Profitable short-term trades can be achieved by anticipating market shifts and making informed decisions, but it also carries higher risks due to the potential for rapid price changes.

Risk management is crucial in trading debt investments, especially for short-term traders. Here are some strategies:

- Diversification: Spread investments across different credit ratings, sectors, and maturities to reduce concentration risk.

- Duration Management: Adjust the duration of debt investments to match an investor's risk tolerance and market conditions. Longer-duration bonds are more sensitive to interest rate changes.

- Credit Analysis: Thoroughly assess the creditworthiness of issuers to minimize default risk.

- Regular Review: Continuously monitor the portfolio and market trends to make timely adjustments.